- >News

- >How to Pick the Next Big Cryptocurrency Before It Gets Big

How to Pick the Next Big Cryptocurrency Before It Gets Big

It’s every trader’s dream to buy a cryptocurrency before it experiences substantial growth, before it transitions from being a small cryptocurrency to a big one. Of course, in a market with just over 10,000 different coins and a reputation for uncertainty, it’s more than a little difficult to identify a coin that will rise noticeably in price before it actually does rise.

Short of throwing darts at a long list of the top 100, 200 or 300 cryptocurrencies, how do you do it? Well, there’s obviously no guaranteed way of picking the next big cryptocurrency before it gets big, but there are two primary things you can do to increase your chances of narrowing in on a future riser.

The first is to check price data to see big one-hour, one-day or one-week movers before small rallies turn into long bull markets, while coupling such data with other technical indicators. The second is to complement this focus on price with research into the fundamentals of coins that have begun moving, in order to confirm whether they really have good longer term potential.

How Early Price Movements Can Give Away the Next Big Cryptocurrency

As we move into 2022, some newer (and more experienced) traders may feel that the likes of bitcoin and ethereum have become too valuable and too established for their liking. Their prices seem too high, and their days of truly eye-watering growth may (or may not) be over. So assuming you want to enjoy something like double-digit (or even triple-digit) returns in a year, what do you do?

The first thing you can do is scour price data for breakout rallies. Sites such as CoinGecko and CoinMarketCap list every major and minor cryptocurrency in existence right now, including their latest price movements and other market info.

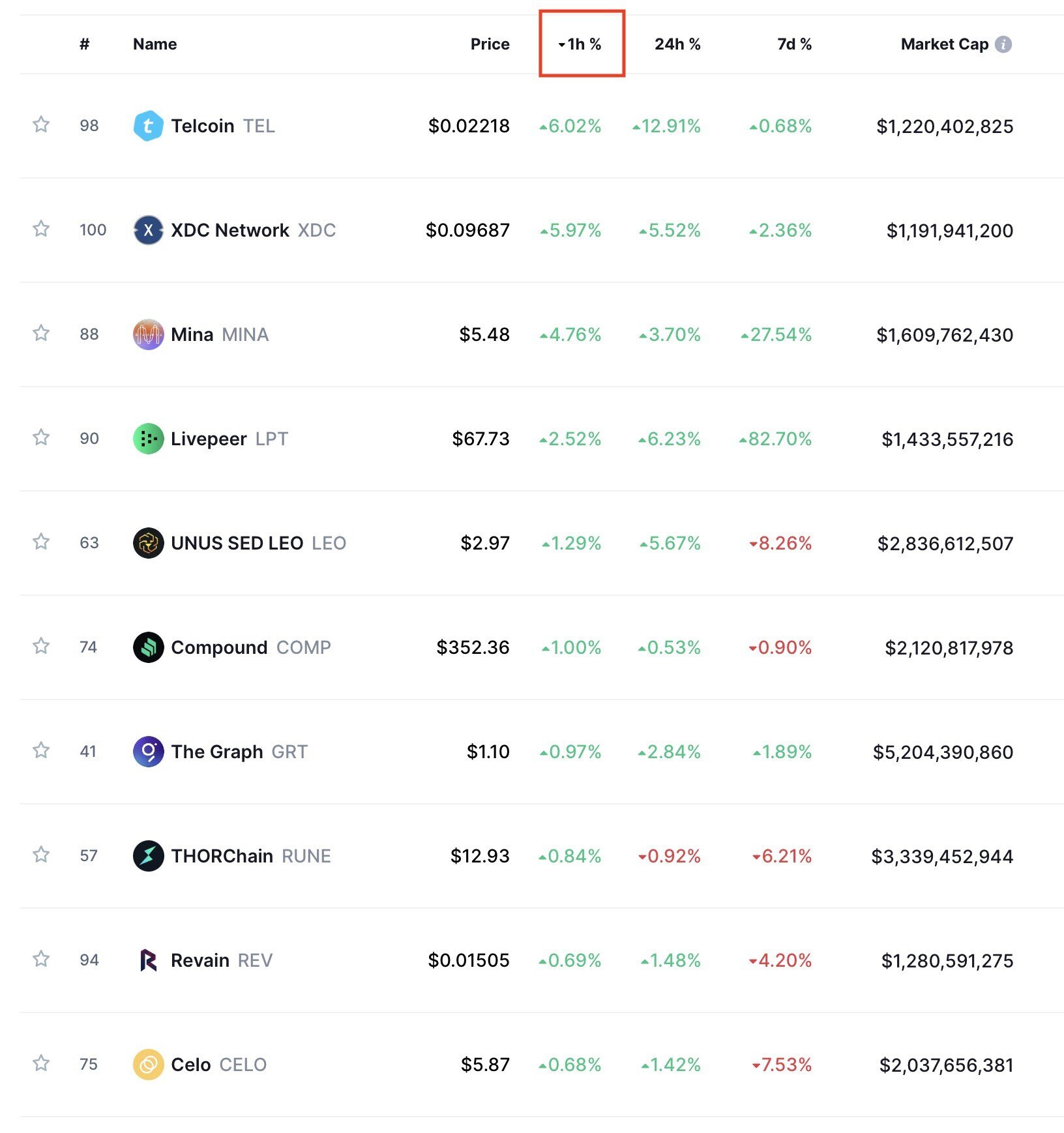

What’s particularly helpful about these sites is that, by clicking the top of the “1h”, “24h” and “7d” percentage columns, you can order the top 100 cryptocurrencies according to which has risen the most in the last hour, 24 hours or seven days. This lets you check whether something has only really just begun rallying, with big one-hour or 24-hour percentage increases suggesting a possible breakout (particularly if these are bigger than percentage increases over the past week or month).

Importantly, CoinGecko and CoinMarketCap don’t let you check only the top-1oo cryptocurrencies (by market cap) to see which have been moving the fastest in the past hour, day and so on. By scrolling to the bottom and clicking the next page, you can also check the top-200, top-300, etc. Doing this lets you see newer, smaller coins, potentially increasing the chances you’ll catch something early.

Clicking on the “1h” column as shown above lets you see the hour’s biggest risers. Source: CoinMarketCap

As the image above shows, doing this will bring up a number of cryptocurrencies you’ve probably never even heard of before (particularly if you go to subsequent pages and check the top-200/300/400 coins). It’s therefore a very good resource for finding out about cryptocurrencies before they’re reported in the media, by which time it may possibly be a little too late.

It may seem odd or counterintuitive to go to price data first to identify a coin with significant fundamental potential for long-term growth. However, there are now so many cryptocurrencies in existence that it would be far too time consuming to search the Web checking out and reading up on every single one of them. The market — which is essentially a mechanism for conveying information — is therefore a good way of filtering out coins with good potential from those with little/no potential. That is, prices and rises should be taken as a signal that the market has decided that certain coins are likely good one.

In addition to prices, it’s also a good idea to check other technical data, if available.

For example, both CoinGecko and CoinMarketCap provide one useful metric for certain coins with total value locked in (i.e. that let you stake coins on their platforms). This is the market cap-to-total value locked ratio, which basically tells you whether a cryptocurrency is overpriced (or underpriced) relative to the total value it has locked in on its native network. As of writing, fast-rising layer-two cryptocurrency Loopring (LRC) has a market cap-to-total value locked ratio of 7.75, while Polygon (MATIC) has a ratio of 1.15. This would suggest that, while it has had a breakout rally recently, LRC is overvalued relative to the value of its network/platform.

Another similar metric to check, if you can find it for newer coins, is the NVT ratio. This is similar to the market cap-to-TVL ratio, in that it compares a coin’s market cap to the transfer volume of its native platform. Again, high ratios suggest that something is already overvalued, and that it may be too late to buy it before it rallies strongly.

Fundamental Analysis and Research

Having said that, we all know that the cryptocurrency market has more than its fair share of pumps and dumps and speculative memecoins. For this reason, price data showing new risers needs to be followed up with research into the platform or project behind the corresponding cryptocurrencies.

Assuming you’ve found a new(ish) altcoin that has only just started rising in price. It would be a good idea to start researching it, first by looking up its whitepaper and giving it a read. While few of us are versed in cryptography and computer science, a well-written and detailed whitepaper should help support the idea that you’re dealing with a serious cryptocurrency. It should also give you an idea of the particular area the cryptocurrency is operating, and who its rivals might be.

Related to this, it’s worth checking out the cryptocurrency’s website for more information about its team and mission. Having a team with a good pedigree likely indicates good long-term potential. For instance, early investors in, say, Avalanche (AVAX) may have been impressed by the fact that it was launched by researchers based at Cornell University.

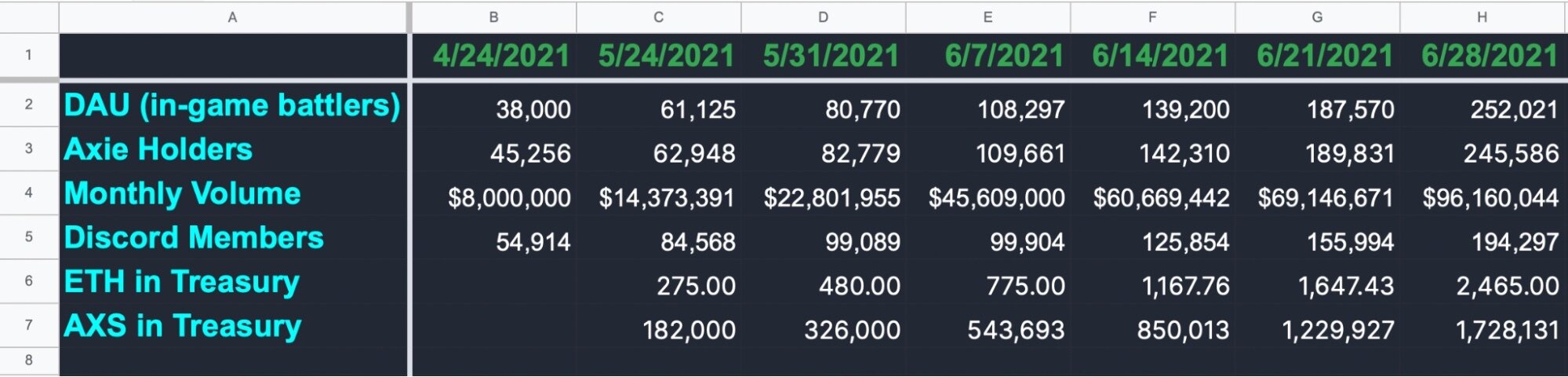

By extension, it’s also a good idea to check for news related to the cryptocurrency and its platform. Has it received investment from venture capital funds (e.g. Sandbox, Avalanche, Internet Computer)? Has it recently celebrated reaching a milestone, such as increasing its number of users or transactions(e.g. Axie Infinity shared a Google Sheets charting its growth in daily active users)? Has it formed partnerships with reputable organizations?

The above chart would have told you as early as June that Axie Infinity (AXS) was going to get bigger. Source: Sky Mavis

If a new coin that has begun rising ticks a number of these boxes, then it may indeed be a good idea to invest in it before it becomes significantly bigger. Needless to say, nothing is guaranteed in crypto, particularly when the markets for so many newer coins are so small and so easily moved by bigger players.

Crypto investors often warn new users to only invest what they can afford to lose. That goes double for small cap coins. However, by taking the steps outlined above, you will at least improve your chances.