- >News

- >Is Bitcoin’s Extreme Volatility Holding it Back?

Is Bitcoin’s Extreme Volatility Holding it Back?

One of the biggest criticisms that Bitcoin faces as to why it should be considered a reliable means of exchange is its price volatility. Even though it has proven its weight in digital gold as a reliable store of value in the medium to long term, the violent price fluctuation in every market cycle is a major issue for most people, and possibly why it hasn’t seen higher adoption in regions of hyperinflation or heightened inflation.

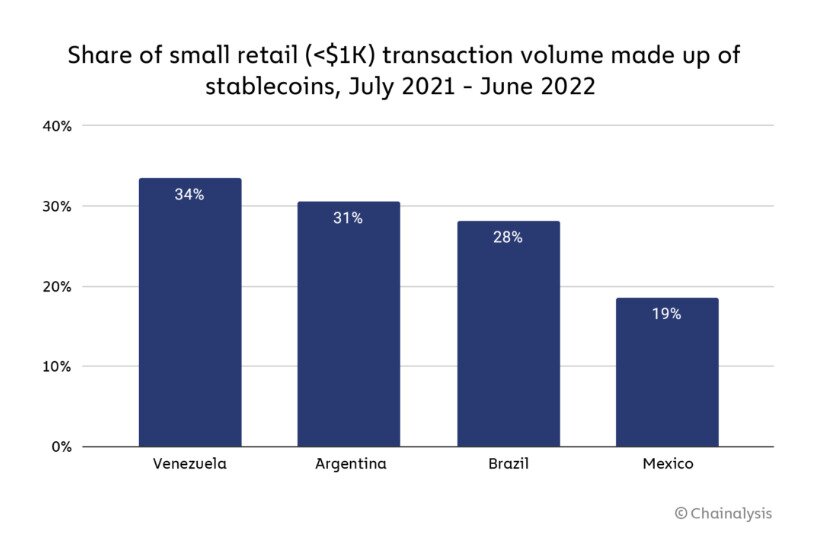

People in those regions are much more likely to take their chances with inflation from exposure to the U.S. dollar through stablecoins in the short term. A Mastercard report in June 2022 revealed that more than half of Latin America was making crypto payments, with 95% reflecting that they planned on doing so in the following year. It is important to understand why Bitcoin’s volatility might make it a less appealing option in these environments by understanding first why it could be a problem to regulate a Bitcoin marketplace.

Bitcoin as a Deflationary Force

Unlike its fiat and stablecoin counterparts, Bitcoin has absolute scarcity built into its architecture. This has an important effect on price over time. Where fiat currencies exist in economies that have targeted annual inflation numbers that introduce large volumes of new currency into their system, bitcoin is engineered to specifically do the opposite.

The result of this phenomenon is that when prices are measured in terms of a currency with an absolute cap that cannot be inflated, prices should fall to the marginal cost of production.

A look at where stablecoins have impressive adoption. Courtesy Chainalysis.

In other words, prices should fall over time when using Bitcoin. If we take the example of when early Bitcoin adopter Laszlo Hanyecz paid Jeremy Sturdivant 10,000 BTC for two large Papa John’s pizzas, we can see just how dramatic this effect can be.

In today’s price of BTC, the bitcoin used to purchase those two pizzas would be worth over $273,000,000 USD. The pizzas were valued at around $25 at the time, meaning that in today’s BTC price, Mr. Hanyecz would be able to afford roughly 21,840,000 pizzas or spend 0.00091575 BTC for two.

Why is Deflation Problematic for Regulation?

If you start measuring price points in terms of Bitcoin when the rest of the world is operating under an inflationary fiat standard, you get a compounding effect. Prices start falling for you while prices rise for everyone else. This can be a double-edged sword and a difficult thing to regulate under the current financial infrastructure.

If we take something that is a better store of value than pizza (sorry, Laszlo), like real estate, the Bitcoin marketplace becomes a regulatory nightmare. It opens up opportunities and potential loopholes for tax evasion down the road, or worse, double payments on lost gains.

Such was the case for billionaire Chamath Palihapitiya when he spent $1.6 million worth of BTC (2,739 BTC) in 2014 to purchase a plot of land near Lake Tahoe. Priced today, the BTC he used would be worth nearly $75,000,000 USD or over $178,000,000 USD if he sold at Bitcoin’s all-time high.

Another way to think about the purchase is that if he were to buy the same plot of land at the same fiat price ($1.6 million) today, he would only need to spend around 58.60 BTC. When valued in BTC, the plot of land has depreciated in value by almost 80%.

Despite the massive loss, if he sold the property priced in BTC, real estate is currently highly regulated and priced primarily in fiat. We know that housing prices have increased across the board since 2014, so not only would Mr. Palihapitiya miss out on the gains from not holding his BTC, but he could also end up owning capital gains on top of the increase in fiat value of the plot of land.

1 Bitcoin = 1 Bitcoin

The examples above are what happens when we use multiple forms of payment methods when establishing value and, ultimately, why a Bitcoin marketplace’s volatility is a regulatory issue. Regulators have previously tried to and failed to regulate Bitcoin as a security.

However, even Gary Gensler has conceded that Bitcoin can and needs to be viewed as a commodity rather than some speculative security asset.

By establishing Bitcoin as a commodity, we can start to imagine what a Bitcoin standard world may look like.

Some regions are already experimenting with what a circular Bitcoin economy may look like. The Bitcoin Beach in El Zonte, El Salvador, has been at the forefront of this movement since 2019. Establishing a sustainable Bitcoin ecosystem where the price in fiat of Bitcoin can be removed, and a circular economy in Bitcoin can exist. In such an economy where everything is priced in BTC alone, an equilibrium of pricing becomes established, and the free market can operate seamlessly.

Final Thoughts

As adoption grows, Bitcoin’s price will eventually begin to stabilize, and its volatility will wane. The more people who are willing to use it as a means of exchange, the stronger its case for being a reserve currency becomes.

However, Bitcoin is still firmly entrenched in a period of price discovery, which probably won’t change any time soon. This period of price discovery is inherently volatile as large market forces enter and leave the space with every cycle.

Yet, if we are to imagine a world where Bitcoin operates as a global reserve currency or if more regions begin to adopt a closed Bitcoin economy, then regulation becomes far easier. A Bitcoin marketplace is then priced against itself with no price manipulation through the inflationary practices experienced in today’s fiat currencies.

While Bitcoin’s volatility currently poses a regulatory issue in today’s Bitcoin marketplace, that will ultimately change with a higher rate of adoption. The more goods and services priced in Bitcoin, the easier a marketplace will be to regulate.