- >News

- >Kraken Quietly Lowers Withdrawal Fees for Bitcoin, Will Others Follow?

Kraken Quietly Lowers Withdrawal Fees for Bitcoin, Will Others Follow?

The bull rally of the past few months has, unsurprisingly enough, brought higher bitcoin and cryptocurrency prices. While the seemingly endless bull run finally experienced a sharp correction this week it’s important to remember that Bitcoin was trading for $10,000 as recently as September so regardless of a 10-20% drop, it goes without saying that BTC has experienced exponential growth over the last six months. While the holders among us can all celebrate the resulting increase in our personal fortunes, some of us may have noticed that most cryptocurrency exchanges haven’t responded by lowering their bitcoin withdrawal fees.

Among the major exchanges which charge a flat bitcoin withdrawal fee, Kraken is the one exception to this trend. It quietly lowered its bitcoin withdrawal fee from 0.0005 BTC to 0.00015 BTC at some point in early February, given that 0.0005 BTC is now worth the non-negligible sum of $27.50.

However, its move has highlighted the failure of other major exchanges to follow suit. What this means is that, at a time when many exchanges are already letting their customers down by suffering outages during trading peaks, they are effectively imposing a fee increase on these users at the same time. There is arguably a reason for this though, which is that the recent increase in bitcoin transaction fees makes cutting withdrawal fees uneconomic.

Bitcoin Withdrawal Fees

If anyone has bitcoin on an exchange but is considering withdrawing it to their own wallet, they’ll already know about withdrawal fees. These are what exchanges charge to cover the costs of requesting a bitcoin transaction (and to make a small profit for themselves), and they’re also something that makes frequent withdrawals expensive for investors.

With some exchanges, withdrawal fees vary according to average (or median) transaction fees. Others charge a flat fee, including Kraken, Binance, Bitstamp, Bitfinex, and Bittrex.

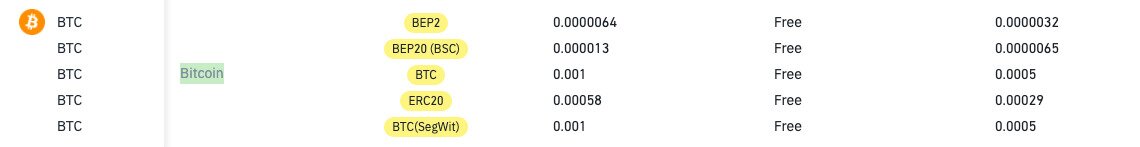

Binance’s bitcoin withdrawal fees are displayed in the right-hand column. Source: Binance

For example, Binance’s bitcoin withdrawal fees currently stand at 0.0005 BTC for transactions using the Bitcoin Core blockchain or Bitcoin Core with SegWit compatibility (the others are either for Binance’s own chain or Ethereum). As the following list shows, this is more or less the market rate:

-

Bitstamp: 0.0005 BTC

-

Bitfinex: 0.0004 BTC

-

Bittrex: 0.0005 BTC

-

Bitpanda: 0.00049680 BTC

-

Kucoin: 0.0005 BTC

- Crypto.com: 0.0004 BTC

-

eToro: 0.0005 BTC

-

Gate.io: 0.0005 BTC

This isn’t anywhere near an exhaustive list of exchange withdrawal fees, while some exchanges — such as Coinbase and BitMex — charge a variable (rather than flat) fee intended only to cover transaction costs (which themselves are variable according to network traffic).

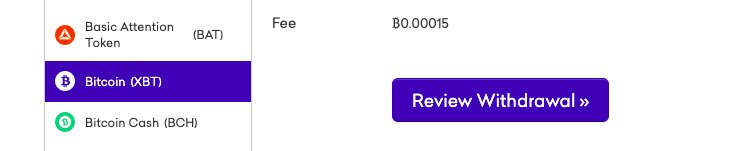

As mentioned above, one other exchange that lists a flat withdrawal fee is Kraken. Up until early February, it also charged 0.0005 BTC to withdraw bitcoin to another exchange or an external wallet. It still actually lists this on its official fees page, but this page also clearly states that these “values can change without notice and may not always be current. Please login to your Kraken account to see the most current information listed on each withdrawal page.” If you take this advice and login to Kraken you’ll see that the current withdrawal fee for bitcoin is now actually 0.00015 BTC.

Source: Kraken

At today’s prices (approx. $55,000), this 0.00015 BTC fees works out at roughly $8.25. That’s not too bad, particularly if you’re withdrawing a larger amount of bitcoin. However, 0.0005 BTC translates to around $27.50, which kind of seems like a slightly high price to pay to gain access to and control over your own money.

To put this another way, the vast majority of major exchanges are charging fees that represent a 233.3% increase over Kraken’s fees, which have been reduced to account for a rising bitcoin price. On the face of it, this seems like exchanges are profiteering from bitcoin’s rising price by creaming off a small percentage of the gains enjoyed by their customers.

Explanations

We’ve reached out to Bitstamp, Binance, Bittrex, Bitpanda, eToro and Gate.io for an explanation as to why they haven’t reduced their withdrawal fees to account for bitcoin’s rising price. Three have replied (Bitstamp, Bittrex and eTor), with two of these offering variations on a similar line, which is that they keep fees under review:

Here’s eToro:

“The fees for transferring crypto-assets from the investment platform to the wallet currently remain unchanged. However, we regularly review our fees and will update you if anything changes,” says a spokesperson for eToro.

Likewise, Bitpanda tells us that its fees can go up or down according to Bitcoin traffic.

“In addition to that, we are using different techniques where possible, such as Segregated Witness and transaction batching to further reduce fees for our users. It is important to mention that Bitpanda does not profit from these fees,” says the exchange’s global communications and PR manager, Sara Moric.

As for Bittrex, its PR told us that it “does not have a comment for this story,” so we can’t be sure whether its fees will change in the near future.

When it comes to the other platforms, we also can’t say what their plans are. With the very real prospect of bitcoin rising beyond $50,000 and perhaps to $100,000 or even higher, you’d think they’d sooner or later reduce their withdrawal fees accordingly. For example, if bitcoin did hit the dizzying heights of $100,000, a 0.0005 BTC withdrawal fee would set you back $50. Not a bad racket.

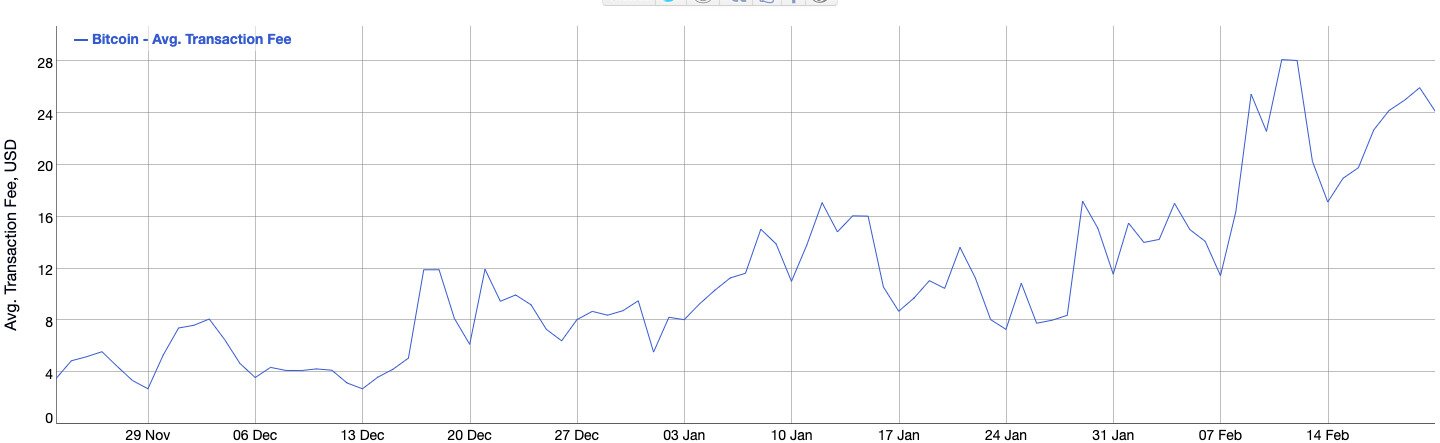

However, given their failure to reduce fees in light of bitcoin’s 433% rise over the past year, it’s possible that at least some exchanges might continue digging their heels in. There’s also the fact that, with average (i.e. mean) and median bitcoin transaction fees hitting new three-year heights recently, it might be economically difficult for exchanges to reduce withdrawal fees substantially.

For instance, the current average transaction fee (as of writing) is equal to $24, which is only a little less than the US dollar value of withdrawal fees costing 0.0005 BTC.

Source: BitInfoCharts

However, assuming that the market stabilizes for a period around a bitcoin price in the $55,000 to $58,000 range, transaction fees will decline, while most exchange withdrawal fees won’t.

This is arguably unfair to the customers of any exchange which doesn’t alter its fees according to network loads and bitcoin prices. And at a time when many exchanges are suffering outages every time there’s a surge in market activity, it means customers are being let down on at least two fronts.