- >News

- >Major Banks Have Rolled Out Cryptocurrency Custody Services, But Are Institutions Buying?

Major Banks Have Rolled Out Cryptocurrency Custody Services, But Are Institutions Buying?

If you build it, they will come. This old phrase doesn’t really apply to the cryptocurrency market right now, since while a growing list of international banks and financial institutions have been rolling out custody and brokerage services over the past couple of years, it doesn’t seem to have had a noticeable effect on prices. Just this past week, both BNY Mellon and Mastercard expanded their respective involvements in the cryptocurrency sector, yet the response from the market muted, with its total cap still remaining under $1 trillion.

While it would be foolish to expect an instant influx of institutional and big investors after the rollout of cryptocurrency services from major banks, the latter have been building out their capabilities since at least 2021. As such, institutions have had plenty of time to dip their toes in the market, but there’s little if any public evidence or announcements to the effect that they have been doing just this. At the same time, the fact that crypto remains in a bear market suggests that bank-based digital asset services have had little if any positive impact.

However, digging into the available data suggests that bank cryptocurrency services have received some custom from institutions and/or wealthy investors. And while the figures aren’t dramatic, they lay the foundation for more investment in the future, particularly when macroeconomic conditions improve and a new bull market begins.

More Banks Dipping Toes Into Crypto

There’s a long and growing list of major banks that have begun offering either custody services for digital assets, and/or services whereby their wealth management clients (i.e. ultra wealthy individuals) can gain exposure to crypto (usually via funds). Here’s a rundown of the most notable:

-

Bank of America: began offering wealth management clients with access to bitcoin futures trading from at least July 2021.

-

Credit Suisse: it was revealed in its Q2 2022 financial report that it holds $31 million in cryptocurrencies for its clients.

-

Goldman Sachs: reports from March 2022 indicated that it had begun offering high-net-worth investors exposure to bitcoin and ethereum.

-

Morgan Stanley: began offering its wealth management clients access to bitcoin funds from March 2021 onwards.

-

JPMorgan: gave wealth management clients access to crypto funds from July 2021 onwards.

-

PNC Bank: partnered with Coinbase in August 2021 to provide cryptocurrency trading services to its clients.

-

State Street: launched cryptocurrency fund administration services in July 2021. Also plans to launch its own digital asset custody service in 2023.

-

US Bancorp: launched cryptocurrency custody services for institutional investment managers in October 2021.

-

Wells Fargo: launched services offering exposure to cryptocurrency funds in May 2021.

These are the banks that have already launched some kind of cryptocurrency service, yet others are also planning to follow their example, with BNP Paribas, Deutsche Bank, Citigroup and Société Générale among the biggest names in the process of entering the sector.

But None Are Diving In

Taken together, such a long list of names may create the impression that the world’s major banks have dived into cryptocurrency in a big way. The thing is, while many have taken their first steps into the sector and launched services, these services have received very little in the way of custom or usage.

The financial institutions themselves are saying very little about this: CryptoVantage directly reached out to four big US-based banks that have launched crypto-related services of some kind in the past year or so. Only one — Morgan Stanley — replied, and only to tell us that it declines to comment on just how much revenue its cryptocurrency unit has generated since March 2021.

As such, the curious need to do a little digging to gain a sense of just how much crypto-related business banks are attracting. Again, the available evidence suggests it isn’t much, although some of the available figures do hold out promise for the future.

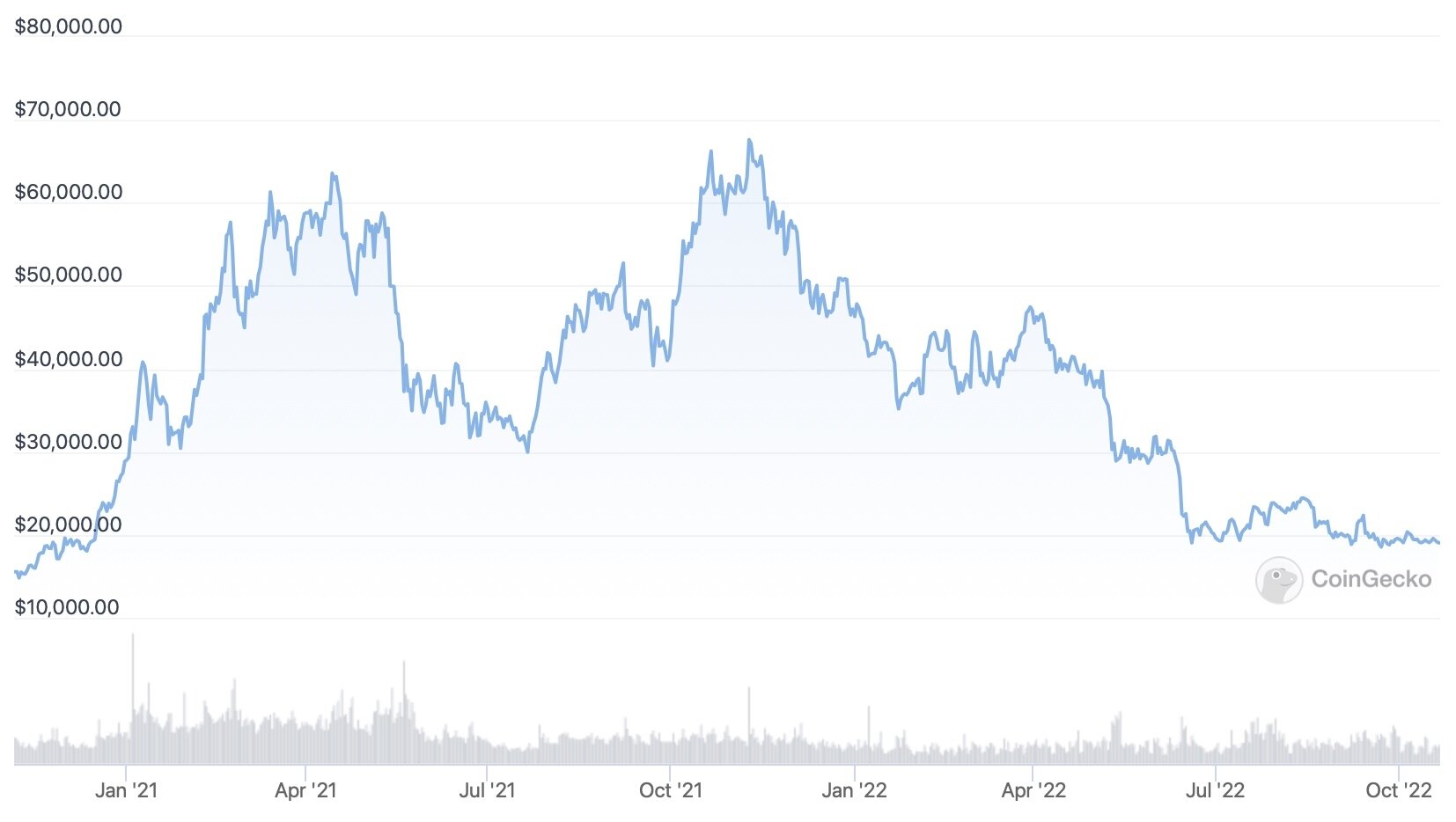

Most simply, the mere fact that the cryptocurrency market remains in a downturn suggests that banks have been unsuccessful in attracting significant numbers of institutions and high-worth individuals. Given just how large these banks are, they could potentially shepherd billions upon billions of dollars into the cryptocurrency market, but the chart below — illustrating the bitcoin price since the end of 2020 — suggests that such sums haven’t really flowed into the market.

Bitcoin’s price since December 2020. Source: CoinGecko

It’s also worth looking at balance sheets and filings. In this respect, Credit Suisse’s Q2 2022 financial report (mentioned above) is highly instructive, revealing that the Switzerland-based bank has $31 million in cryptocurrencies that it holds on behalf of its clients. Given that Credit Suisse has total assets of CHF 727.4 billion (about $719.4 billion), this works out at 0.004% of its overall balance sheet.

It’s highly likely that other major banks have similarly small cryptocurrency holdings and/or revenues. Even though no other big bank explicitly shares its cryptocurrency figures in its quarterly filings, a perusal of recent financials often turns up no significant increase in assets under management (when compared to periods before banks launched cryptocurrency custody or brokerage services).

For example, Wells Fargo’s Q3 2022 report shows a 10% drop in wealth and investment management deposits between the third quarter of this year and the same period last year. This undermines any notion that it has attracted significant sums of money for its cryptocurrency service (offering exposure to funds), which it launched last May.

Combined with the mere fact that banks flatly refuse to talk about their cryptocurrency activities, this helps strengthen the suspicion that, despite rolling out crypto-related services, these services haven’t yet attracted many customers.

The Next Bull Market

However, despite the insignificant size of their cryptocurrency activities, it’s arguable that what the banks have been doing in recent months is putting themselves in a position to capitalize when the market returns to growth.

It’s already encouraging that the world’s banks have around €9.4 billion in total exposure to cryptocurrency assets, according to a recent report from the Bank for International Settlements. While this represents only 0.01% of total exposures of all banks (again reinforcing the claim that banks aren’t doing much with their crypto activities), it represents an important stepping stone towards banks gaining more exposure. It also comes during a bear market, suggesting that banks — and their clients — may be willing to gain much more exposure during a bull market.

Of course, with inflation still high and rates still rising, it may be some time before this bull market finally emerges. But when it does, it seems that the world’s banks will be ready.