- >News

- >Record-Low Volatility, Declining Liquidity Points to Huge Move for Crypto Prices

Record-Low Volatility, Declining Liquidity Points to Huge Move for Crypto Prices

The cryptocurrency market continues to teeter between minor gains and reversals, yet data is now emerging which increasingly suggests it’s on the brink of a major move. A new report from K33 Research shows bitcoin’s implied volatility reaching an all-time low, while a similar analysis from Kaiko has revealed a big drop in exchange liquidity since the beginning of the year. When coupled with the fact that BTC’s realized price is on the brink of passing the long-term holder realized price, these metrics signal an imminent — and big — move.

It’s arguable that such a move is long overdue, given that the market as a whole remains down by 62% since reaching a total cap of around $3 trillion in November 2021. This means that the next few months may provide the last opportunity to buy certain cryptocurrencies at relatively discounted prices, before a catalyst comes along to trigger the market. However, with crypto still awaiting the end of the Ripple-SEC case, and with the industry still facing a regulatory onslaught in the United States, there also remains a real chance that the next big move could actually be downwards.

Indicators Reveal Bitcoin and Crypto Market is ‘Ripe for a Move’

Writing in its latest market update, K33 Research noted that bitcoin’s “realized and implied volatility have fallen into deep depths.” In fact, the cryptocurrency’s “3-month implied volatility reached an all-time low on Monday [May 15],” with low levels of volatility historically serving as an indicator of incoming price movements.

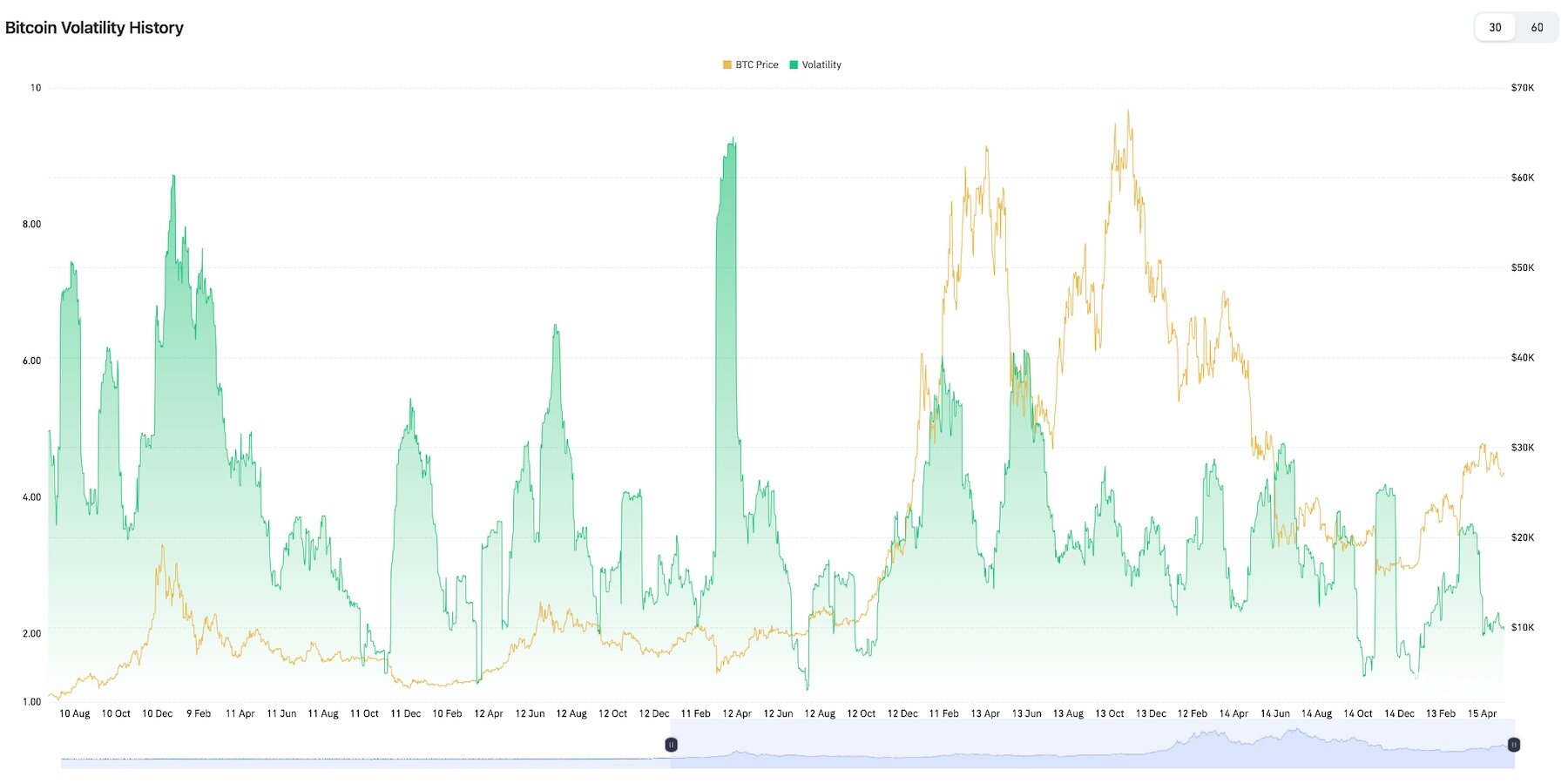

Bitcoin price (yellow) set against its realized volatility (green) since 2017. Source: CoinGlass

As the chart above indicates, the lowest volatility levels often precede big rises, whereas pronounced increases in volatility tend to go with significant price falls. For this reason, it’s tempting to suggest that something may happen with bitcoin and the wider cryptocurrency market in the coming weeks, with K33 Research using its latest bulletin to declare that the market is “ripe for a move.”

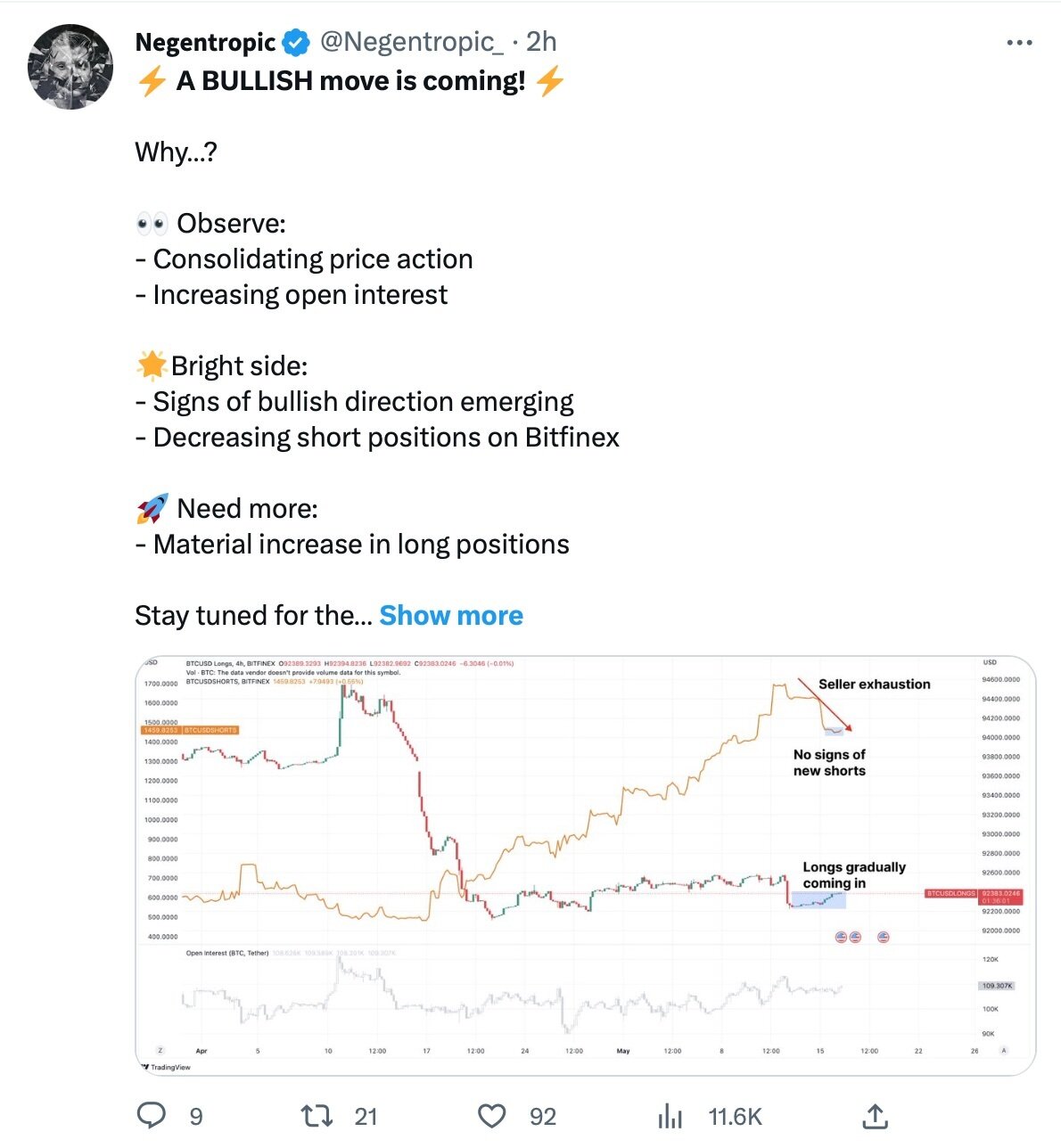

Other analysts have started to think the same thing, with glassnode co-founder Negentropic tweeting this week that “a bullish move is coming.” The basis for this claim includes an increase in open interest and long positions, and a corresponding decline in shorts. Negentropic also notes “consolidating price action” and that BTC has “held the $26.8k support level” for the best part of a week, implying that it probably isn’t falling any further at the moment.

Source: Twitter

Other analysts are also noting that liquidity on exchanges has dried up over the past months, caused to a large extent (at least in the United States) by regulatory issues and the demise of FTX. While this means less people are trading cryptocurrency right now, it also makes the market much more sensitive to price swings. This is because lower liquidity and market depth means that big trades have a disproportionate effect.

Research firm Kaiko noted how lower liquidity amplifies intraday volatility in its own latest market report, in which it wrote that “liquidity has fallen to a one-year low.” It also found that altcoin liquidity alone fell by 17% in the past month, compared to 4% for BTC and 2% for ETH.

Source: Twitter

Again, this raises the suspicion that the cryptocurrency market has moved into a position where big price movements have become increasingly likely. Of course, low liquidity and 3-month implied volatility doesn’t guarantee that prices will move up rather than down, although certain other data does suggest that the general shift is likely to be positive.

Most notably, bitcoin’s realized price — the average price of all bought/sold BTC — is about to overtake the average realized price paid by long-term holders (who have held BTC for at least 155 days). Glassnode tweeted a few days ago that the realized price has just hit a five-month high of $20,135.74, while others have noted that its overtaking the long-term realized price generally precedes a bull market.

Source: Twitter

And speaking of glassnode, the analytics firm has a ‘Recovering from a Bitcoin Bear’ dashboard that tracks eight metrics, which together tend to signal the end of a bear market when they enter positive territory. All eight of its indicators are indeed flashing green at the moment, adding to the sense that something should be changing before long.

Waiting and Warnings

There’s little doubt that investors and the market in general are crying out for a return to more bullish conditions. Crypto has seen something of a mini-recovery since the beginning of the year, with the market’s total cap rising by as much as 61% last month compared to its level on January 1. However, it has since slipped by 13% from this 2023 peak, and continues to behave inconsistently, pulled in opposing directions by rate hikes and regulatory attacks, on the one hand, and by signs of slowing hikes and an improving economy, on the other.

As such, all of the above may come as very welcome news to investors, who may be inclined to take the opportunity to buy low while they still can. The thing is, two important points need to be made.

Firstly, even though all available data may be pointing towards an incoming bull market, it can still take months for such a market to arrive. Yes, many of the technical conditions are there, including low volatility and a high realized bitcoin price. But these conditions need some kind of trigger or catalyst to translate them into market demand and rising prices. Such a trigger could be provided by the Ripple-SEC case, which is due to conclude by the end of the year, according to Ripple CEO Brad Garlinghouse. Or it may have to wait for the next Bitcoin halving, which is scheduled to take place in April or May 2024.

Secondly, even though low volatility and liquidity does make big movements likelier, such movements could just as easily be in a negative direction. Indeed, looking at the volatility-price chart near the top of this article, it also shows a few dips after periods of low volatility. Because of this, investors need to be mindful that the market is still in a position where further falls are possible, especially if Ripple ends up losing its case with the SEC, or if the US imposes stringent cryptocurrency regulations (which is a possibility).

This warning aside, it remains arguable the positive signs currently outweigh the negative signs. The market has weathered a cocktail of very negative factors recently, including collapses, bankruptcies and rising interest rates. It seems like it’s now through the worst of these stresses, and that the end of the year may finally bring some positive action.