- >News

- >Report: Crypto Job Market Strong Despite Bear Market, Layoffs

Report: Crypto Job Market Strong Despite Bear Market, Layoffs

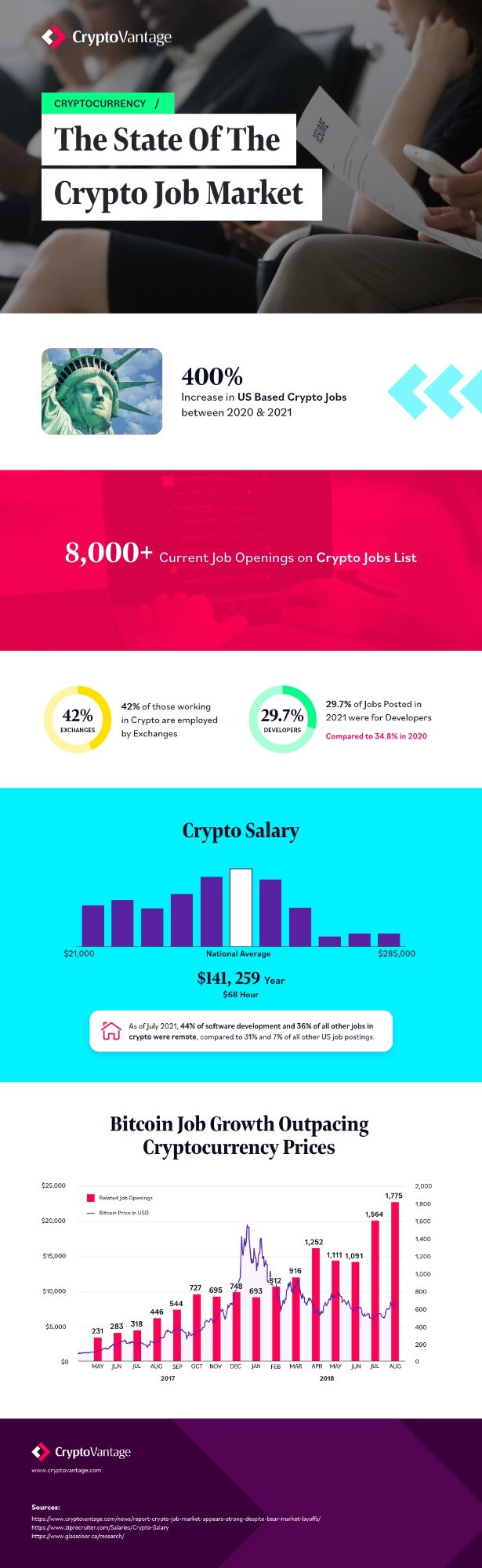

The past few years have been a boom period for the cryptocurrency industry, with a market-wide rise in prices driving an expansion in the sector as a whole. Nowhere is this more evident than with jobs, with LinkedIn postings for professional roles in crypto exploding by nearly 400% between 2020 and 2021.

The bearish conditions the market has experienced in 2022 has unsurprisingly put the brakes on such growth. Many prominent crypto-related firms have announced layoffs, including Coinbase, Crypto.com and BlockFi, while the industry witnessed the loss of 1,700 jobs in the month of June alone.

However, even with recent losses, the crypto job market remains healthy as a whole. Some large firms — including Kraken, Binance and FTX — have actually ramped up their hiring efforts in recent months, as they seek to plan for a return to future expansion. This means that anyone looking to gain themselves a job in the cryptocurrency industry still has a very good chance of doing so.

How Has the Crypto Job Market Expanded Over Time?

May 3, 2014 is the closest the industry has to an official birth date for the crypto job market. It marked the first ever Bitcoin Job Fair, which hosted 34 startups and 400 attendees in Sunnyvale, California. However, as an indication of how small the industry was and how slowly it was growing, next year’s edition of the job fair welcomed only 20 startups and 300 attendees.

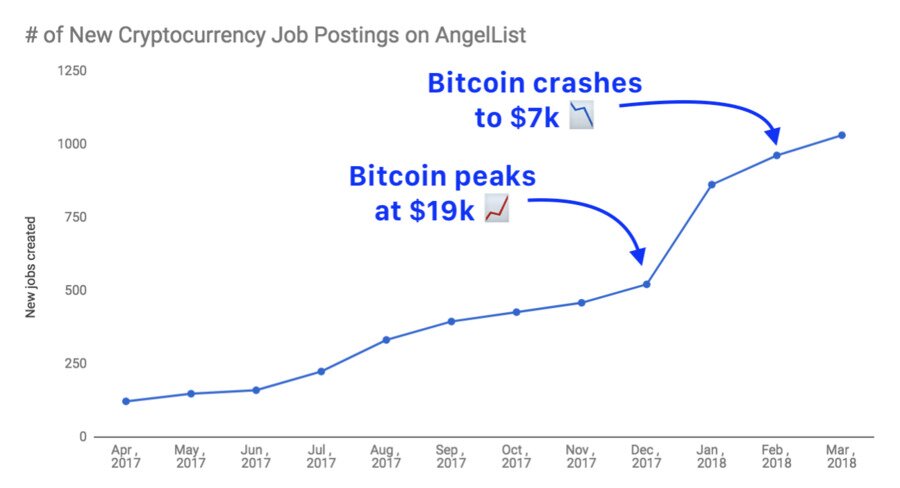

The scale of the crypto job market began to widen only with the 2017-18 bull market, which saw the price of bitcoin reach a then-record of $19,783 in December 2017. During this period, startup job site AngelList published a newsletter in April 2018 reporting that new crypto job listings had doubled in the previous three months alone.

Source: AngelList

Interestingly, the observed rise in crypto jobs wasn’t affected by the climbdown the market suffered from January 2018 onwards. It’s possible that the industry remained large enough that, despite price losses, companies were still able to invest in future growth, encouraged by the memory of bullishly the market had risen in late 2017.

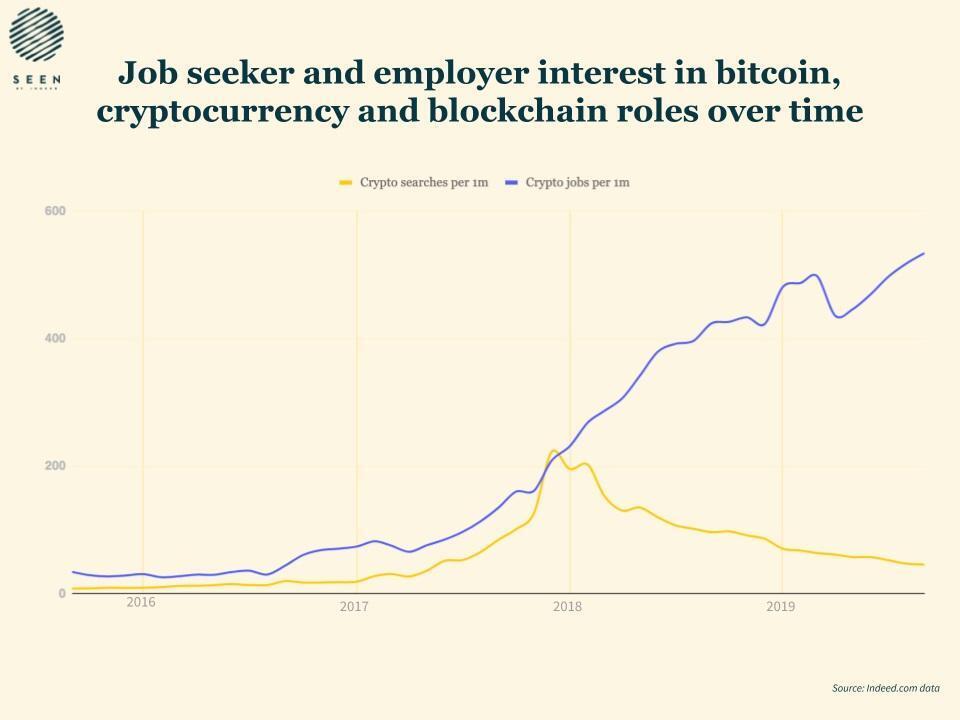

In fact, by the time November 2019 rolled around, with BTC still languishing at roughly $9,000, the crypto job market was still ballooning. Vacancy platform Indeed published a study that same month which found that the share of crypto jobs (per every million on its site) had risen by 1,457% in the previous four years.

One significant piece of info revealed by Indeed’s study was that, while crypto job postings had steadily risen during the ‘crypto winter’ of 2018-19, searches for such postings had fallen.

Source: Venturebeat/Indeed

What this suggests is that market downturns may actually be a good time to get a job in the cryptocurrency industry, with the supply of positions significantly outpacing demand for them.

Indeed’s research also shed light on the nature of crypto jobs, which were predominantly technical during this period. In other words, they were for programmers who had familiarity with cryptography, peer-to-peer networks and coding languages such as C++, Java, Python or JavaScript, as well as newer blockchain development languages such as Solidity. Such coders would primarily be tasked with building smart contracts, designing user interfaces, and developing decentralized applications.

For the most part, people taking crypto jobs during this period would be working at crypto-exchanges, with trading platforms accounting for 42% of all blockchain industry jobs as of October 2019. Significant employers at this time were chip manufacturer Bitmain, as well as Coinbase, Huobi and OKEx (now OKX). Figures from Glassdoor also show that ConsenSys, IBM, Coinbase, Figure, Oracle, Kraken, Circle, Accenture and JPMorgan were among the top US-based crypto employers at this time.

Also of note is the fact that, geographically speaking, crypto jobs tended to be concentrated in two main regions: the United States and Asia. According to data from Indeed, particular Asian nations that ranked high for crypto jobs included Australia, India, Singapore and Malaysia.

The State of the Crypto Job Market Today

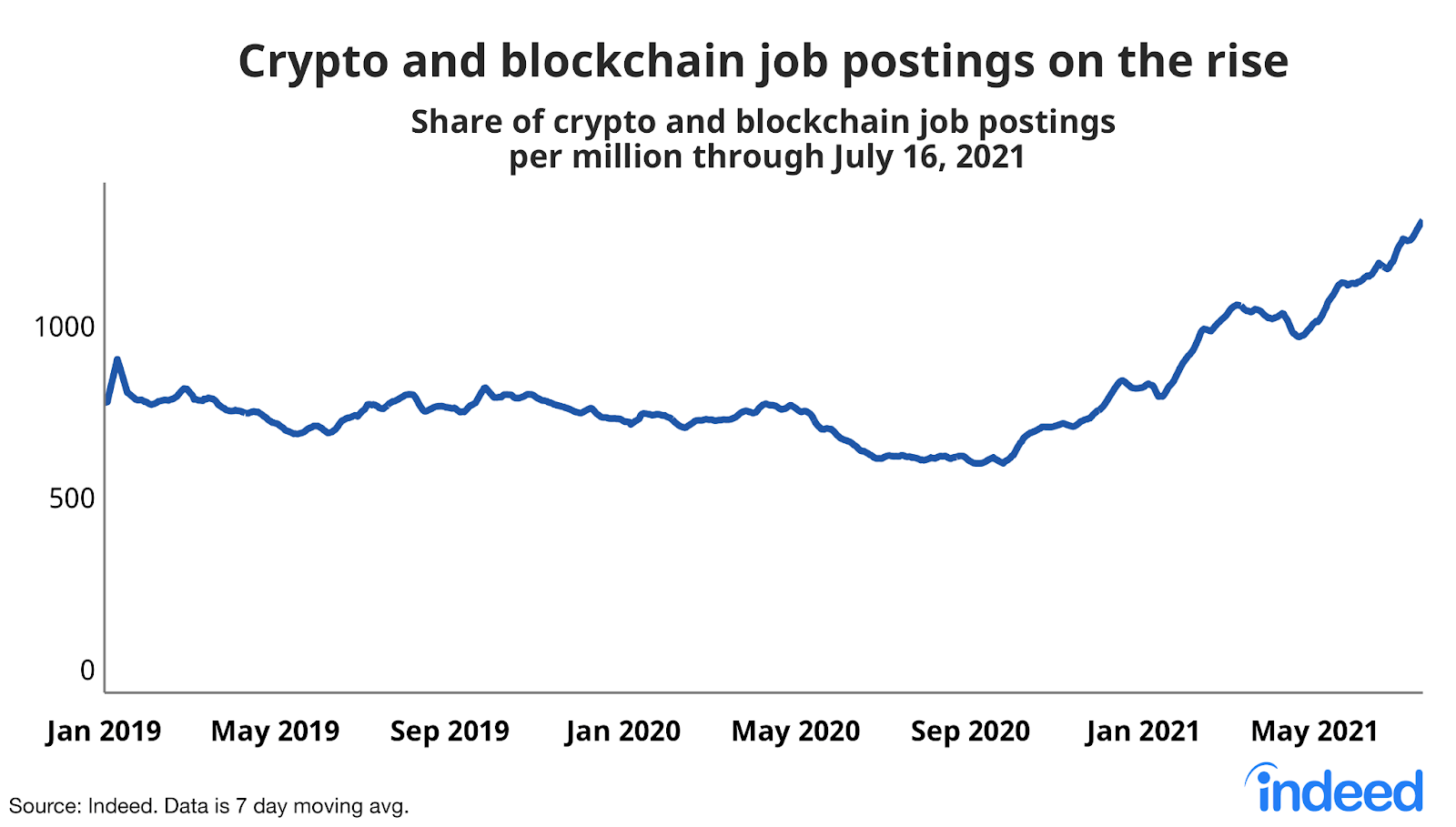

Looking at the industry from 2020 to the present day, it’s clear there has been an explosion in positions and roles, driven by a new bull market that saw bitcoin reach an all-time high of $69,044 in November 2021.

Further data from Indeed showed a big 118% increase in crypto job postings in the US between September 2020 and July 2021, with the industry’s share of postings per million rising from 599.6 to 1,307.8.

Source: Indeed

According to the above data (which represents Indeed’s latest release), the crypto industry accounted for 0.13% of the entire job market. This is likely to be higher at the moment, and in the future, as we’ll explain further below.

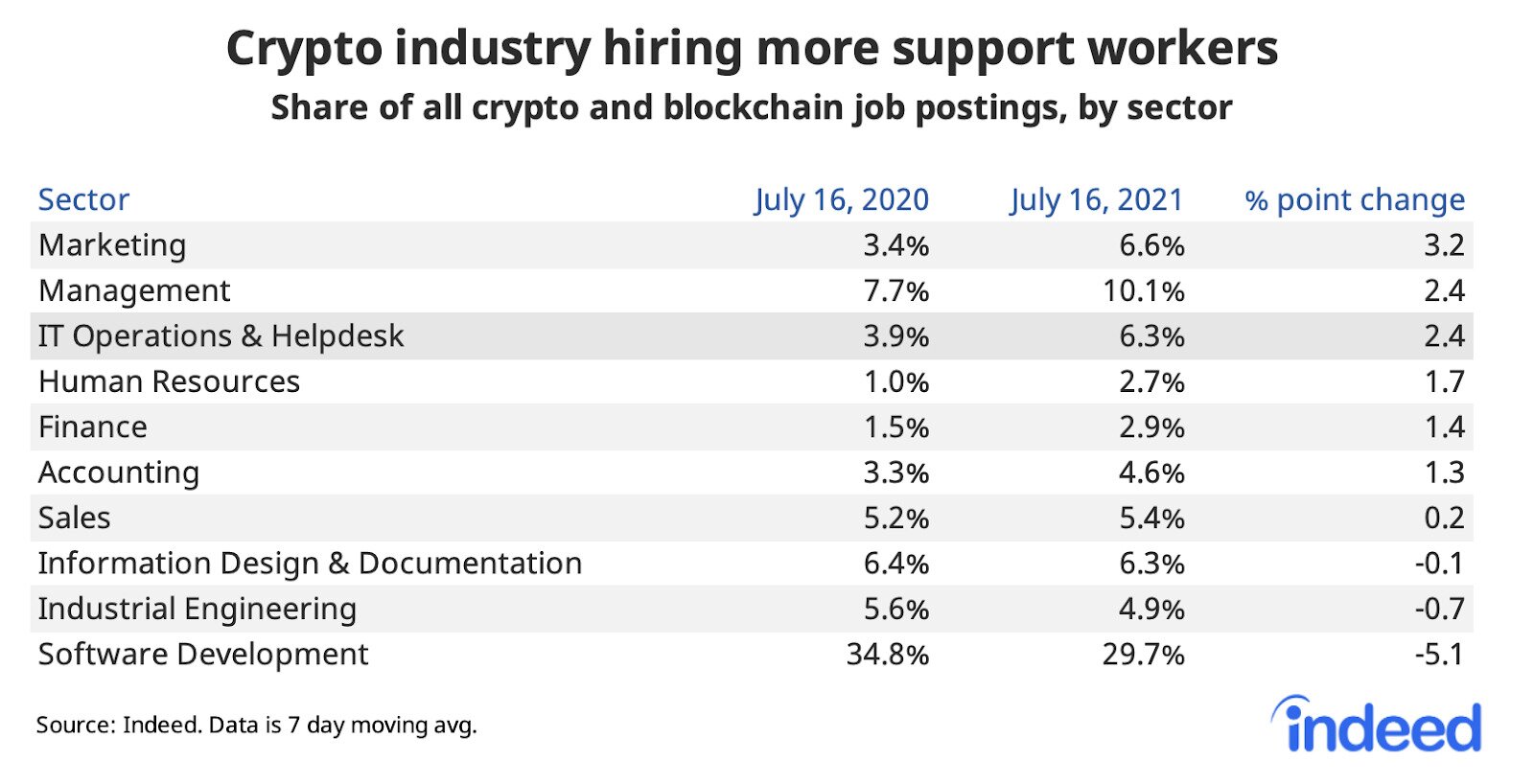

It has been during the current 2020-22 market period that crypto job data has become more granular and informative. For example, Indeed’s latest post includes a breakdown of the crypto job market according to job category. And while software development retains the lion’s share of openings, the industry is now witnessing a growth in ancillary roles, with marketing, sales, human resources, management, IT, accounting and finance making up bigger percentages.

Source: Indeed

This is likely to be a trend that gains strength over time, meaning that you don’t have to be a coder or have studied computer science/cryptography to bag a job in crypto.

While the available job data is often focused solely on the United States, Indeed’s figures show that remote-based work is more common in crypto than in other sectors. As of July 2021, 44% of software development and 36% of all other jobs in crypto were remote, compared to 31% and 7% of all other US job postings.

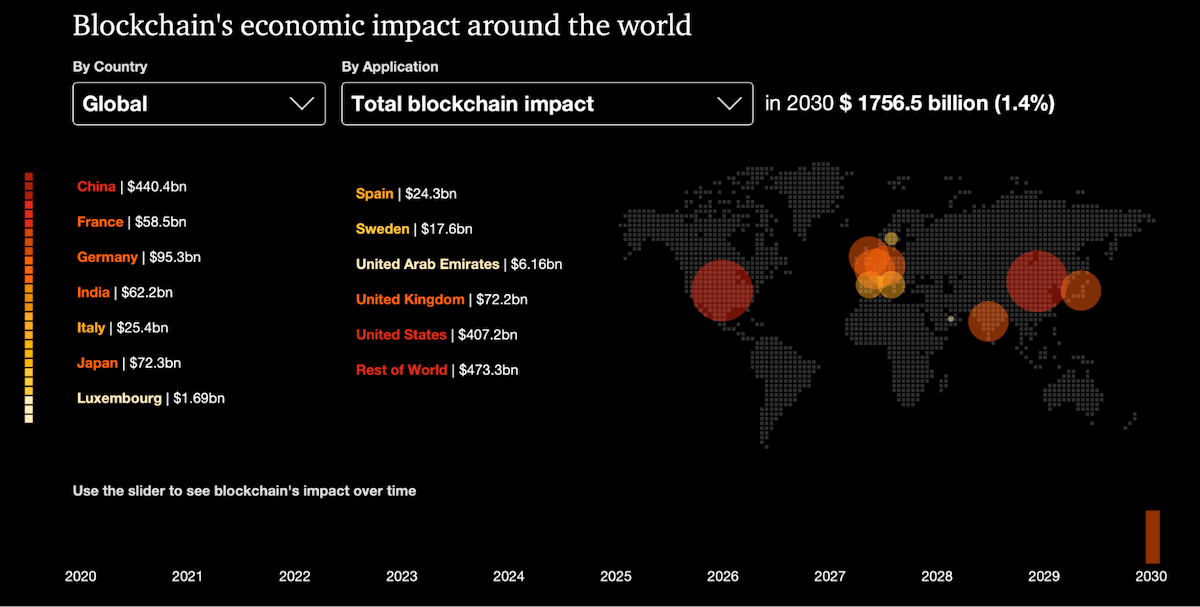

This means you don’t necessarily need to be based in a crypto-industry hotspot to actually find work within the sector. Still, recent data from professional services firm PricewaterhouseCoopers offers a useful global outline of where crypto- and blockchain-related activity is concentrated, and also where it will be concentrated in the future.

Source: PwC

As the above graphic illustrates, the following countries will be of particular interest for anyone hunting for a crypto job in the next decade:

-

China

-

United States

-

Germany

-

Japan

-

United Kingdom

-

India

-

France

-

Italy

-

Spain

-

Sweden

-

United Arab Emirates

-

Luxembourg

PwC’s report shows that the ‘rest of the world’ will also witness significant blockchain-related activity. Indeed, LinkedIn searches reveal significant crypto job numbers for such nations as Singapore, Brazil, Australia, Canada, New Zealand, Malta, Bulgaria, Switzerland, Finland and Lithuania, to name only a few.

Which Companies Are Hiring… and Firing?

Despite LinkedIn data showing a nearly 400% rise in US-based crypto job postings in 2021, 2022 has been marked mostly by a market downturn and headlines related to crypto layoffs.

As of July 2022, here are companies that have had to let go of employees in recent weeks and months:

-

Coinbase (US, exchange)

-

Crypto.com (Singapore, exchange)

-

BlockFi (US, exchange)

-

Bybit (Singapore, exchange)

-

BitOasis (UAE, exchange)

-

Robinhood (US, exchange)

-

Bitso (Mexico, exchange)

-

Gemini (US, exchange)

-

BitMex (Seychelles, exchange)

-

BitPanda (Austria, exchange)

-

Vauld (Singapore, crypto-lending platform)

-

Banxa (Australia, exchange)

-

Huobi (Seychelles, exchange)

-

Rain (Bahrain, exchange)

-

Buenbit (Argentina, exchange)

-

OSL (Hong Kong, exchange)

As the above list makes clear, crypto-exchanges appear to have been the hardest hit by the current downturn, possibly because they expanded more aggressively than other cryptocurrency and blockchain firms during the 2021 bull market. That said, some exchanges have expanded hiring in the past few months, undermining any simple claim that the industry has been wracked by tech layoffs.

Here’s a rundown of the firms that have announced plans to hire more workers:

-

Kraken: announced a “global hiring push” in June, aiming to recruit over 500 new workers worldwide. 90% of Kraken’s staff are remote, with its current openings spanning accounting and finance, business and corporate development, client services, data, legal, marketing, IT, human resources, administration, engineering, and regional and banking operations.

-

Binance: currently looking to fill 2,000 open positions. Roles span business development, customer support, communications and editorial, data and research, engineering, finance, and administration. Most positions are remote.

-

FTX: revealed at the end of June that it’s looking to hire 1,000 more employees, resulting in between a 50% and 100% growth in staff within a year. It has teams in software engineering (Typescript, React, RESTful API, Rust, Javascript, Python), data and analytics, product development, compliance, customer support, marketing, and human resources.

-

Ripple: the XRP and RippleNet developer revealed in mid-June that it has “hundreds” of open positions. A perusal of its website reveals positions in San Francisco, London (UK), New York, São Paulo, and working remotely.

Similarly, a search of individual websites reveals that the following companies and/or platforms have added new job listings recently:

-

Circle: the company behind the USDC stablecoin has 93 open listings as of writing, in such areas as compliance, data science, engineering, finance, legal, IT, marketing, product development, and security.

-

Square: the payments company has 362 open positions, of which 287 are remote. Not all of these will be related to cryptocurrency, but roles span everything from accounting and administration to design and software/hardware engineering.

-

ConsenSys: the Ethereum developer has over 100 open positions, mostly in software engineering, but also in social media, marketing, and management.

-

Polygon: the layer-two Ethereum developer has around 100 positions, in business, design, marketing and development. Roles are spread between the US, India, South Korea, Spain and remote.

-

Nexo: the crypto-lending platform has more than 50 open positions, largely in software development, but with some administrative, marketing, and legal roles also available. Positions are a mix of remote and in Bulgaria.

-

Chainlink: the external-data network is hiring for around 50 unfilled positions, mostly in software engineering. These are all remote.

-

Aave: the DeFi platform has 10 open positions, in technical and non-technical roles. These are all based in London, UK.

-

Uniswap: the decentralized exchange is looking to fill 15 positions, based in either New York or working remotely.

This is hardly an exhaustive list, but it provides a clear illustration of how the crypto job market remains in good health, despite this year’s selloffs. Recent headlines have suggested that as many as 3,500 jobs have been lost as a result of 2022’s bear market, yet the recruitment drives of Kraken, Binance and FTX alone balance out such losses.

Anecdotal evidence from crypto-recruitment specialists also suggests that the market slump hasn’t substantially affected the crypto jobs market overall, with some recruiters testifying to being “overwhelmed with requests for quality candidates.” Portal CryptoJobsList currently counts just over 6,600 open positions, a highly encouraging number in light of the fact that it doesn’t cover the entire crypto jobs market.

As such, anyone hoping to enter the cryptocurrency industry needn’t be discouraged whenever prices fall. Despite much-publicized crypto layoffs, leading firms are still hiring, and with the market still boasting an overall cap of nearly $1 trillion, there are still plenty of resources left to hire more talent.

What Qualifications Are Needed to Work in Crypto?

As the above overview should make clear, the crypto job market has evolved in recent years from being centered almost exclusively around technical roles. Now, individuals with skills and qualifications in marketing, administration, journalism and content writing, accountancy, legal, compliance, and various other fields have plenty of opportunity to enter the sector.

Given that the cryptocurrency industry remains relatively young and is growing fast, potential candidates may be encouraged to learn that massive amounts of experience aren’t always needed when applying for roles within crypto.

Some software development and engineering roles, for instance, require only one year of experience in blockchain development, coupled with at least two years in more general software engineering. Taking a look at a recent Uniswap posting, for example, requires two years of professional experience working with Solidity-based smart contracts, as well as a degree in either mathematics or computer science. This obviously precludes freshly graduated candidates, but it’s not too exclusive or onerous.

Of course, if you look outside of the technical roles, experience in other areas is required. As another random example, Binance advertised this year for an English-French translator who is fluent in both languages and has at least three years of professional experience in translation.

Senior roles will inevitably require more experience (e.g. Kraken has a Director of Social Content role that requires at least ten years of relevant work), but the fact remains that the cryptocurrency industry is relatively open to candidates.

It needs to be. Because despite the recent contraction, crypto remains one of the fastest-growing sectors in the global economy, with the aforementioned PwC report forecasting that blockchain will add $1.766 trillion to the world’s economy by 2030. And if any job seekers out there want to have a slice of such growth, now is probably as good a time as any to act.

If you’re looking for a job in crypto be sure to check one of the many specialized job boards in the space including the following:

- Pompcryptojobs.com

- Cryptojobslist.com

- Cryptocurrencyjobs.co

- Crypto.jobs

Here’s a graphical look at the expansion of crypto jobs over the last decade: