- >News

- >Social Media Data Indicates Retail Investors Coming Back to Bitcoin, Crypto

Social Media Data Indicates Retail Investors Coming Back to Bitcoin, Crypto

You may be almost tired of hearing how institutional and corporate investors are flocking to bitcoin in droves at the moment, and that they’re the big factor in the current bull market. There’s little doubt that such assertions are largely true, yet new data from crypto analysts The TIE also indicates that retail investors are now coming back to bitcoin and cryptocurrency in growing numbers.

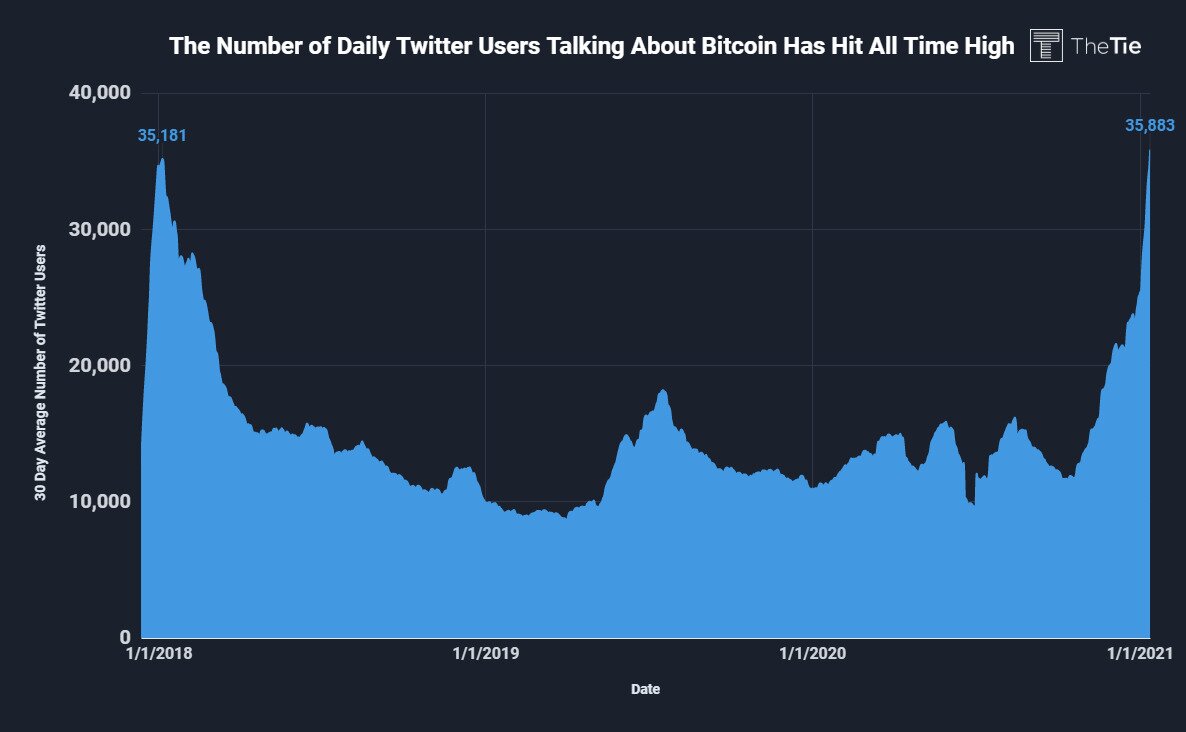

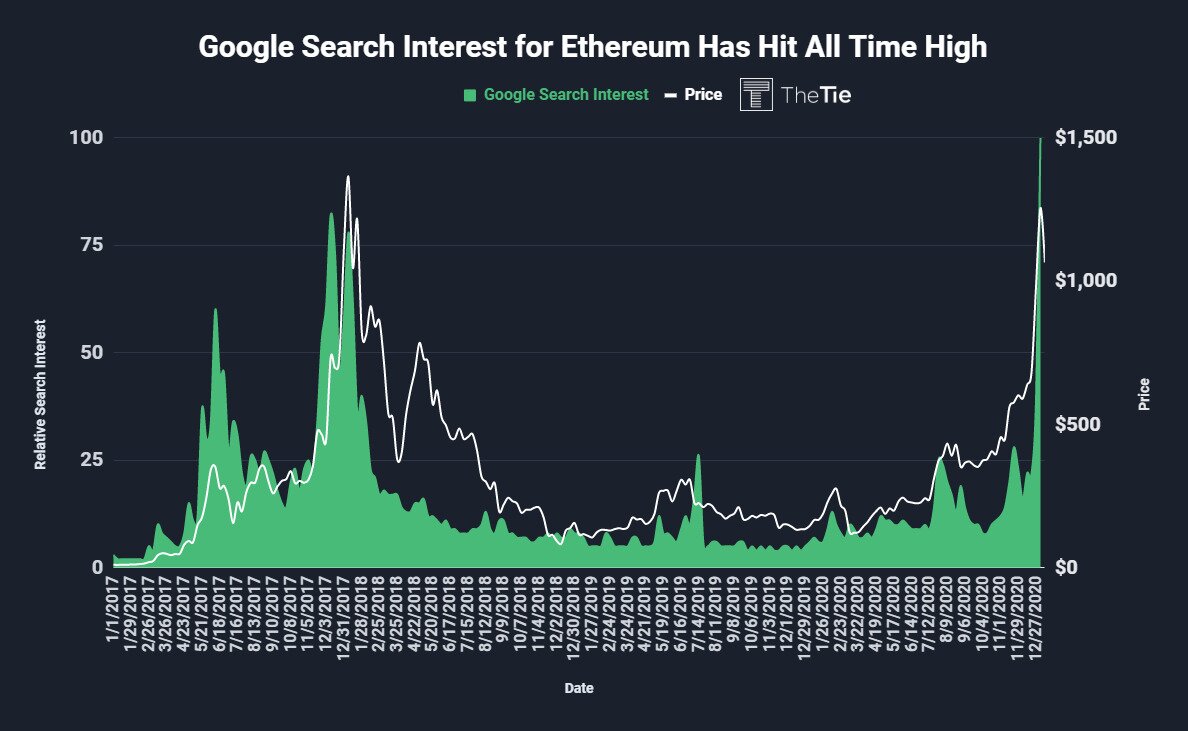

Writing in its latest update, the TIE found that the average number of Twitter users posting daily about bitcoin has reached a new all-time high, of 35,883. At the same time, Google search interest for Ethereum has also broken records, indicating that rising public interest isn’t exclusive to bitcoin.

However, while a growth in layperson interest is vital if more companies like PayPal are to begin offering cryptocurrency services, it may come with noticeable drawbacks at the current moment in time, when the bitcoin and crypto markets are still relatively immature. Because as we saw with BTC’s sudden crash back down to $30,000, retail investors may be more impulsive and rash than longer term institutions.

Retail Is Falling in Love with Crypto Again

Having been at subdued levels for much of the period between Q2 2018 and Q3 2020, retail interest in bitcoin has shot up precipitously over the past month or so.

Source: The TIE

What the above graph shows is that there are more people on Twitter talking about bitcoin than at any point in the cryptocurrency’s short history. As the TIE writes in its report, “This is huge, as this shows that retail investors are here and excited about Bitcoin.”

Other data collected by BitInfoCharts supports this optimism, with the total number of tweets about bitcoin hitting its second-highest total ever on January 2, at around 141,000 (compared to 151,000 on December 7, 2017).

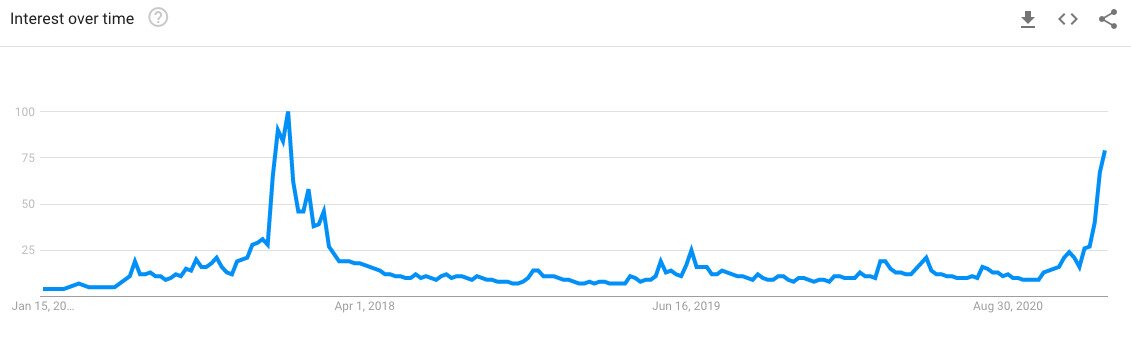

Looking beyond social media, Google Trends data also indicates that retail investors and the general public are turning once again to bitcoin.

Google Trends search data for “bitcoin”. Source: Google

The above chart shows that, in the week between January 10 and 16, the relative popularity of the term “bitcoin” hit 79. Its highest level (indicated by a score of 100) was reached in the week between December 10 and 16, 2017.

Searches for “bitcoin” may not be at their highest level, but it’s clear that current levels are much, much higher than they were in previous months and years. This shows that significant retail interest is returning to bitcoin, and that it may only grow further still if the price of bitcoin continues reaching new all-time highs in 2021.

Another important metric for Bitcoin and its popularity among the general public is the number of subscribers to its sub-Reddit. The current level is just shy of two million, at 1.93 million. Back in April 2020, it was 1.36 million, while in April 2018, it was 793,000.

It’s not just Bitcoin either. The TIE also found that Google search interest for Ethereum has hit an all-time high.

Source: The TIE

The Good, The Bad and The Ugly

This influx of new retail investors into bitcoin and crypto has its upsides and downsides. Firstly, if you look at the charts above, you’ll see that the recent peaks in retail interest come towards the end of December and beginning of January, coinciding with bitcoin’s rally beyond $20,000 and up to its current all-time high of $41,000 (January 8).

It’s likely that retail investors played a part in this huge rise, even if it’s still the case that institutions and whales are driving the overall direction of travel. At the same time, the arrival of greater numbers of retail investors will draw more financial and payment companies (like PayPal) to launch cryptocurrency services, which in turn will drive greater investment into the market.

For example, American Express invested in crypto-trading platform FalconX in December, with the platform stating that it aims to develop a crypto-based payment service in the future. That same month, the ETC Group launched a new bitcoin-based exchange-traded product (ETP) on the Swiss SIX Exchange, expanding the number of regulated cryptocurrency investment vehicles accessible to the general public.

On the other hand, an explosion in new retail investors coming to the bitcoin and cryptocurrency markets while they’re still under-regulated and immature may carry various dangers.

As with the dizzying rise up to $41,000, bitcoin was extremely quick to fall back down to $30,000. It’s likely that retail investors may be partly to blame for just how quick and big this fall was, in that, after an initial dip, they were more easily panicked into selling than institutional investors or experienced traders accustomed to HODLing.

Source: Twitter

With retail investors accounting for a growing proportion of overall investment activity, we may continue to witness similar volatility while bitcoin and crypto attract more institutional investors. In other words, it’s possible that we could see a few other flash crashes over the course of 2021, as bitcoin gradually jumps from one plateau to another.

Another drawback of increased retail investment at the current moment in time is that regulators and other authorities may become more inclined to involve themselves in crypto. They generally view their job as protecting the ‘naive’ consumer, so when larger such consumers start buying up crypto, they may feel the need to issue investment warnings or even introduce new guidelines.

In fact, this happened only a few days ago, when the UK’s Financial Conduct Authority published a statement declaring that cryptocurrency investment is “high-risk” and that investors “should be prepared to lose all their money.” It’s interesting to note that the FCA’s last statement along these lines was issued in November 2017, the first time the UK saw a big jump in retail interest.

On their own, such warnings may be benign, but they may also result in a hurried push for regulation that could end up harming the evolution of crypto. The FCA, for example, introduced a ban on the sale of crypto-derivatives to retail investors this month, while a financial advisor in the UK has just launched a petition to ban all cryptocurrency transactions in Britain.

This petition is unlikely to be successful, but the point remains that massive retail investment in crypto — at this stage in crypto’s evolution — may be a double-edged sword. Still, it is likely to help legitimate and popularize cryptocurrencies, so it may only help crypto in the long-term.