- >News

- >Swing and a Miss! The Worst Crypto Predictions (So Far)

Swing and a Miss! The Worst Crypto Predictions (So Far)

As fundamental as predictions are to crypto, the sector has known more than its fair share of wildly inaccurate forecasts. From estimates of bitcoin’s price hitting $100,000 in 2018 to the claim that EOS will ‘kill’ Ethereum, many — or most — crypto experts are hardly known for their clairvoyance.

Of course, the purpose of predictions within crypto (and in financial markets in general) isn’t to be right, but to generate buzz, as well as commissions for exchanges or brokerage houses. And in that respect, most crypto predictions have been pretty successful.

Here’s our selection of the four biggest crypto predictions to have been proven wrong (so far).

‘Bitcoin Price Will Hit $100,000 by 2018/2019/2020/…’

Bitcoin price predictions need to be taken with a pinch of salt. While most people working within crypto can probably agree that the long-term trajectory for bitcoin is up, it’s quite frankly a little foolish to assume that you can forecast when exactly BTC will hit $20,000, or $50,000, or higher.

That hasn’t stopped dozens of analysts from trying, of course. Possibly the most notorious and inaccurate bitcoin price predictions came in 2017. At the height of bull-market overconfidence, a number of ‘reputable’ analysts suggested that the price of bitcoin would reach or even pass $100,000 in 2018 or 2019.

Source: Twitter

This was the view of: Anthony “Pomp” Pompliano, Octagon Strategy’s Dave Chapman, Saxo Bank’s Kay Van-Petersen, Smart Valor’s Olga Feldmeier, Investr’s Kerim Derhalli, among others.

Needless to say, their failure to predict the bitcoin price correctly hasn’t stopped others from making similar predictions more recently. Venture capitalist Tim Draper has been predicting since 2018 that bitcoin will hit $250,000 by 2022, something which looks unlikely but still has time to be proven accurate.

And don’t expect optimistic predictions to stop. Forecasts are usually how analysts attract customers to whichever hedge fund or financial institution they work for.

‘EOS Is An Ethereum Killer’

EOS launched in June 2018 to much fanfare, with supporters predicting that it would become an “Ethereum killer”. This was mostly because the platform featured a (delegated) proof-of-stake blockchain, which could handle more transactions than Ethereum’s proof-of-work version.

Things initially looked good for this prediction. EOS hit an all-time high of $21 in April 2018, before its launch. It declined soon after, but partially recovered to about $8 in June 2019, with some predicting its market cap “will soon exceed Ethereum’s” and that it could still “be bigger than Ethereum”.

Unfortunately for EOS, it has largely tailed off in recent months. At its launch in June 2018, it was the fifth most valuable cryptocurrency, with a cap of almost $11.5 billion. It’s now the 12th most valuable, with its valuation at $3.2 billion.

Ethereum has continued to hold the number-two spot among cryptocurrencies, with its recent resurgence helped by the rise of DeFi, which is largely an Ethereum-based phenomenon.

This comparative decline of EOS has attracted more than its fair share of derision online, with analysts wasting no time in mocking it on Twitter.

Source: Twitter

‘Bitcoin Cash/SV to Overtake Bitcoin’

Make no mistake: people involved in smaller cap cryptocurrencies like hyping them up. This was, and is particularly the case with Bitcoin Cash and Bitcoin SV, two forks of Bitcoin that claim superiority to the original cryptocurrency by virtue of having larger block sizes.

Source: Twitter

Back in 2018, Roger “Bitcoin Jesus” Ver claimed that Bitcoin Cash would be bigger than Bitcoin (in terms of market cap) by 2020. He still claims this, as do a number of less prominent figures within crypto.

The same goes for people in the Bitcoin SV camp, with venture capitalist (and SV-booster) Calvin Ayre even suggesting in 2019 that all other cryptocurrencies “will be absorbed” into the Craig Wright-championed coin.

Source: Twitter

If you’ve been following the cryptocurrency market recently, you’ll know that neither Bitcoin Cash nor Bitcoin SV have done particularly well in comparison to Bitcoin. Bitcoin Cash is down by 92% since the bull market of December 2017, falling from around $3,785 to $292. Meanwhile, Bitcoin is down by only 40%, from $19,665 to $11,800 (as of writing).

At 52% down from its all-time peak of $420 (in January 2020), Bitcoin SV is also hardly coming close to overtaking Bitcoin.

‘Blockchains Will Revolutionize the World’

When Bitcoin first started turning a significant number of heads in 2016, a number of otherwise serious people started predicting that “blockchains will change the world”, or something very similar.

The basic idea behind this prediction is that, because blockchains allow data to be shared without a trusted third party (allegedly), they will provide finance, industry and the wider world with greater transparency, accountability, and trust. This will result in a fundamental shift in “the way organizations work”, and will be “life-changing for today’s generation” more generally.

In some ways, blockchain has been life-changing and revolutionary, at least in the field of cryptocurrencies. However, it’s hard to maintain or support the claim that it has (so far) been truly revolutionary outside of crypto.

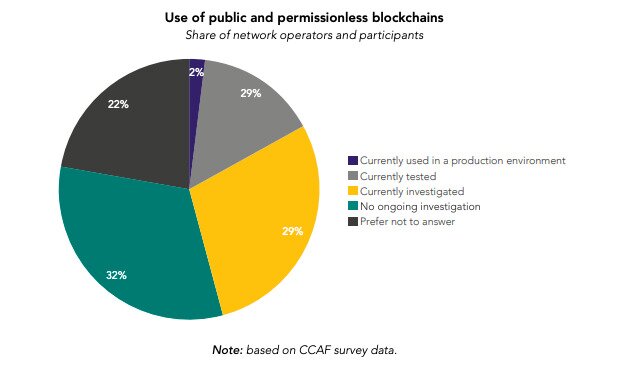

Yes, a growing number of enterprises have implemented some kind of “blockchain” or “distributed ledger”, but in the vast majority of cases these are private databases shared between a few network participants. According to Cambridge University’s Global Enterprise Blockchain Benchmarking Study, only 2% of surveyed companies are using public, permissionless blockchains in any capacity.

Source: University of Cambridge Judge Business School

Those that are using ‘blockchains’ are using private, permissioned ledgers. As of 2020, it’s hard to see the world as having changed in any significant way because of this, and certainly not in any way that ‘revolutionizes’ it. Is the world a better place now because of blockchain?

Still, we’re still very early in the life of cryptocurrency and blockchain. And while many predictions have been wide of the mark, there’s still plenty of time for others to come true.