- >News

- >The 5 Biggest Trades in Crypto History (That We Know About)

The 5 Biggest Trades in Crypto History (That We Know About)

Nearly every investor who’s dipped their toes in the cryptocurrency market has been warned of its infamous volatility. Yet the more positive flipside of this volatility is that, every once in a while, investors make huge trades that land them oversized profits. This article attempts to shine a light on such successes by running through the five biggest trades in crypto history.

While there’s no official source of data that provides a definitive account of the top trades in cryptocurrency history, we’ve meticulously combed a decade of reports, posts and transfers to provide an authoritative rundown. This list provides the all-important rates of return for the five biggest trades ever, while it also explains the circumstances and context for each trade, unpacking just how and why certain investors found themselves lucky enough to be sitting on enviable profits.

On the other hand, this article will also show that some of the traders who made humongous returns in theory weren’t able to realize them in practice, due to the illiquid nature of certain altcoin markets.

April 2013: The Winklevoss’ Twins Buy 120,000 Bitcoin

Two of the biggest known holders of Bitcoin are Cameron and Tyler Winklevoss, who were famously immortalized in The Social Network, a film which dramatized their involvement in the early days of Facebook.

A falling out – and legal battle – with Mark Zuckerberg over who really founded the social media site led to them receiving a settlement of $65 million in 2008. And in April 2013, they revealed that they’d spent a large portion of this sum on Bitcoin, with reports suggesting that they purchased 120,000 BTC at a time when the cryptocurrency was priced at $10.

While it’s clear that the Winklevoss twins would’ve had to have sold slices of their Bitcoin fortune at various times since 2013 (e.g. to fund the launch of their US-based Gemini exchange), it would have been worth $8.3 billion when BTC hit its record high of $69,044 in November 2021. Not bad work if you can get it.

August 2020: Trader Buys More Than 30 Trillion Shiba Inu

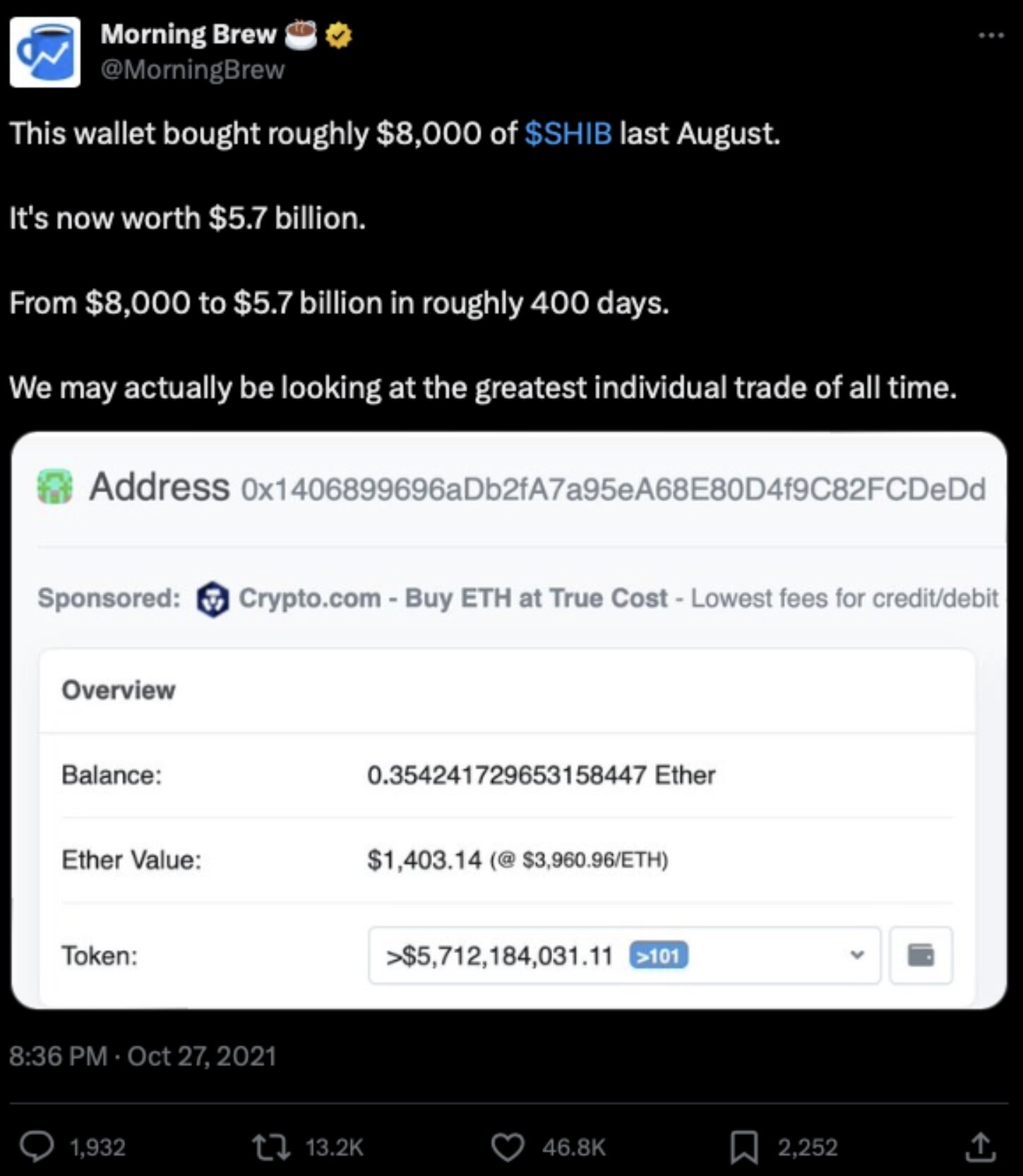

Crypto’s biggest trade of all-time was made by one unidentified investor who spent $8,000 in August 2020 to buy somewhere in the region of 30 trillion Shiba Inu (SHIB). At the time, SHIB was a new Dogecoin-wannabe meme token worth $0.000000000265, and most serious people in crypto would have laughed at you if you’d suggested it would become one of the next big altcoins in the market.

Fast forward roughly a year and a couple of months, and SHIB had indeed become a big coin, rising to an all-time high of $0.00008616 (which is still its record high). Compared to its price in August of the previous year, this made for a return of 32,513,107%, with the trader in question booking an unrealized profit of around $5.7 billion.

Source: Twitter

The thing is, SHIB’s market was so illiquid and so small that selling the above quantity of the token all at once would have cratered its price. Yet an inspection of the trader’s address would suggest that, over time, they were able to siphon off their holdings over time, with their last SHIB outgoing happening in July of this year.

Of course, SHIB’s price had descended to roughly $0.0000075 by this time, representing a fall of 91% from its ATH. As such, the lucky trader – who presumably took a lucky and early guess that SHIB would moon – was able to realize only a fraction of their highest unrealized profit, although this would have still been comfortably above the $8,000 they originally invested.

2020: MicroStrategy Buys 70,000 BTC

IT and software consultancy MicroStrategy famously began accumulating Bitcoin from August 2020, when it made an initial purchase of 21,454 BTC, worth $250 million.

It quickly followed this up with another purchase worth $175 million in October of that same year, taking its tally up to 38,250 BTC. By the end of 2020, it had around 70,000 BTC.

Source: Twitter

While MicroStrategy continued to accumulate Bitcoin through bad times and good, the BTC it purchased in 2020 was worth $1 billion by the close of that year, rising to $4.9 billion by the time the cryptocurrency hit its all-time high of $69,044 in November 2021.

BTC’s price has since fallen since this record high, but with MicroStrategy now sitting on a store of just over 158,000 BTC, it could be in for a massive profit in the not-too distant future.

January 2021: Tesla Buys $1.5 Billion in BTC

Possibly the most famous cryptocurrency trade of all-time was revealed in February 2021, when it emerged that electric vehicle manufacturer Tesla had purchased $1.5 billion in Bitcoin.

Tesla owner Elon Musk had previously been known as an avid admirer of Dogecoin, yet his company’s purchase of Bitcoin really helped kickstart the 2021 bull market. It was estimated that Tesla bought around 46,500 BTC at the time, a quantity which rose in value to $3.2 billion by November of that same year.

Sadly, this profit went unrealized for Tesla, who held onto its BTC during the bull market and sold only later, when prices had already fallen. According to an SEC filing, it lost $140 million on its BTC holdings in 2022, after selling all but $184 million worth of its supply.

June 2014: Tim Draper Buys 30,000 BTC in Federal Auction

Noted entrepreneur and investor Tim Draper was the winner of nearly 30,000 BTC in a June 2014 auction held by US Marshals Service, which had seized as much as 144,000 BTC from the infamous Silk Road marketplace in 2013.

Draper spent roughly $18 million for his haul of BTC, and reports suggest he hasn’t yet sold even a fraction of his holdings. In fact, he has given interviews in which he declares that he continues to steadily accumulate more of the cryptocurrency.

What this means is that the 30,000 BTC he acquired back in 2014 is now worth approx. $1 billion at current prices, although it was worth $2 billion in November 2021, when the cryptocurrency hit its record high.