- >News

- >The Lightning Network is Growing. Here’s Why That’s Bullish for Bitcoin

The Lightning Network is Growing. Here’s Why That’s Bullish for Bitcoin

Bitcoin may be making its name right now as a store of value and high-growth asset, but it still has its sights firmly set on becoming a viable medium of exchange. Yes, critics continue to dismiss it as a bonafide currency, repeating the mantra that it cannot scale, but there’s one ongoing area of development within Bitcoin that’s getting better at proving such skepticism wrong.

We’re referring to the Lightning Network. While you may be forgiven for assuming that it has been lost in development limbo, it marked a couple of new milestones recently. Its network capacity reached an all-time high of 1,170.5 BTC, while the number of channels it hosts hit its own record high of 40,829. This latter figure surpassed a previous peak set in 2019, indicating that interest in the Lightning Network has been renewed in the wake of bitcoin’s rally over the past few months.

With numerous exchanges adding Lightning Network integration in recent weeks, and with a steady trickle of new apps also harnessing its power, interest in it is indeed growing. And just as rising bitcoin prices are likely to amplify investment into the Lightning Network, so too will the Lightning Network end up driving new investors towards bitcoin.

From Decline to Redevelopment

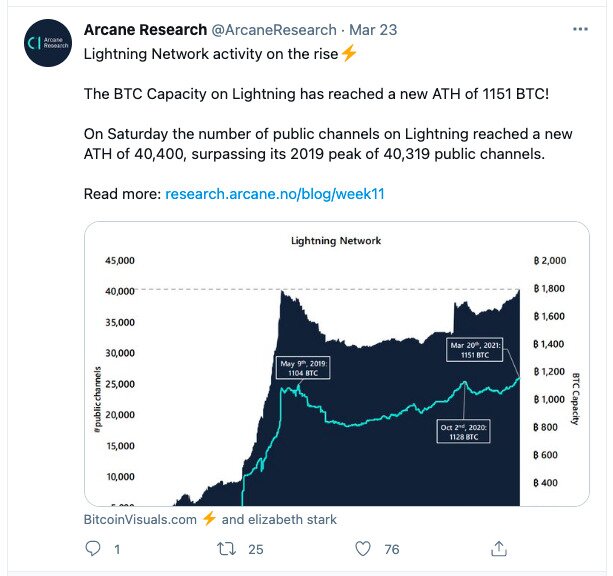

For a while, the Lightning Network appeared to be in trouble. September 2019 and June 2020 brought news of two separate and dangerous vulnerabilities, and these weren’t in fact the only bugs discovered during this period (and after). The cumulative effect of these disclosures was to help reduce activity in the network, which had witnessed an ATH of 40,319 public channels in March 2019, only for this to decline to 31,434 on May 22, 2020.

Clearly, public faith in the Lightning Network had been dampened by the semi-regular revelation of vulnerabilities, lending fuel to Bitcoin skeptics who affirm(ed) that the cryptocurrency would never become a significant medium of exchange.

However, as any coder would probably tell you, the disclosure of bugs is not only commonplace (Apple, Google and Microsoft are releasing updates all the time to patch vulnerabilities), but it’s something that ultimately makes any affected system more robust. This is arguably something which has now happened to the Lightning Network, since in tandem with a vigorously rising bitcoin price, it has grown to record size.

As Arcane Research pointed out in a tweet from March 23, the total value locked into the Lightning Network hit an all-time high of 1,151 BTC (it’s 1,170 BTC as of writing). It also reached an ATH of 40,400 public channels (now 40,829), which are the pathways used to make payments between one Lightning Network user and another.

Source: Twitter

It’s worth pointing out that this represents a growth of 27.4% compared to this time last year, as well as a 10% rise since the start of this year. At the same time, the number of nodes running the Lightning Network software has hit an ATH of 10,140, basically the same as the number of Bitcoin nodes. This figure has risen by 22.9% since the beginning of 2020.

Such growth comes amid a regular stream of updates to the Lightning Network protocol, with Lightning Labs releasing the latest on March 16. Most notably, this version (lnd 0.12.1-beta) introduces Sidecar channels which allow for new users to be onboarded without them having to put up capital, something which may ultimately increase usability and adoption.

Why the Lightning Network is Growing

But why is the Lightning Network experiencing a steady resurgence in growth right now? Perhaps the most significant contribution to its current expansion is that a gradual drip of exchanges are integrating it, letting their users withdraw and deposit using the network.

This includes the likes of Kraken, OKEx, CoinCorner and OKCoin. Their adoption of Lightning has been helped by an August LN update which introduced “Wumbo” channels, enabling users to send transactions over the previous 0.1677 BTC limit.

Yet it’s not only exchanges that are jumping on the bandwagon, but various new apps. Riga- and San Francisco-based startup Lastbit released two separate apps in February which let you send payments in bitcoins and euros using the Lightning Network. The month before, Strike.Global launched its own LN-based app with the highly ambitious aim of providing instant payments for free.

In March, Bitfinex (which integrated with the LN back in late 2019) launched its Bitfinex Pay service, which lets merchants accept payments using bitcoin and the Lightning Network (among other cryptocurrencies).

Such recent releases follow in the footsteps of an already wide variety of Lightning-integrated wallets and apps, as developer Jameson Lopp lists on his website. And as the incrementally climbing channel, BTC and node figures show, the increase in compatible apps is having a noticeable impact on Lightning Network usage.

Modest Beginnings, Immodest Aims

Of course, this all needs to be put in some context: the 1,170 BTC locked into the LN makes up only 0.0278% of the 4.2 million bitcoin currently estimated (by glassnode) to be liquid. That is a tiny fraction, and shows just how far the Lightning Network still has left to go if it wants to transform bitcoin into a medium of exchange.

Still, after its usage and capacity suffered a dip in 2020, it’s heartening to see that it’s now in a situation where it’s consistently topping all-time highs with each passing week. As LN-based payment service Bitrefill noted on Twitter on March 24, its Lightning Network volume in Q1 2021 will more than double the previous record set the previous quarter.

Source: Twitter

Integration with the Lightning Network threatens to initiate a virtuous circle that will increase bitcoin adoption (for payments, etc.), and in turn increase bitcoin’s price (since more people will want to use the cryptocurrency).

By improving the ease with which people can pay using bitcoin, and by lowering fees, more of us will eventually be drawn towards the cryptocurrency. And the more of us that are drawn towards bitcoin, the more development and investment the Lightning Network will enjoy, and so on, until bitcoin ends up becoming the significant medium of exchange it was always intended to be.