- >News

- >The Merge is Finally Coming, Here’s How to Stake Ethereum Right Now

The Merge is Finally Coming, Here’s How to Stake Ethereum Right Now

It’s only a matter of days before Ethereum completes its much-awaited Merge, whereby it becomes a proof-of-stake blockchain. This shift is likely the biggest thing on the calendar for crypto in 2022, with some observers hoping that it will provide a boost to a market that has been stagnant for more or less the entire year.

While it would be highly risky to predict whether the Merge will result in a new bull market, one thing it will result in is the staking of ethereum. And if the market doesn’t move too dramatically upwards in response to the shift, some ETH holders may begin wondering how they can put their holdings to work.

This article answers the questions such holders may have, offering a rundown on how to stake Ethereum. As the following will show, there are two main ways to do this: 1) through dedicated staking services and/or platforms; and 2) through certain crypto-exchanges.

How Staking Will Work After Ethereum Completes the Merge

When people say that Ethereum will become a proof-of-stake cryptocurrency, they’re referring to one basic fact. That is, rather than using expensive computational work to verify transactions and secure its network, Ethereum will require validators to stake ETH in order to confirm new blocks (and the transactions within them).

The idea behind this system is that it reduces the (vast amounts of) energy needed to perform computational work, while also ensuring the security of the corresponding blockchain network, since validators should (in theory) be reluctant to lose their staked ETH by voting for a bad block.

In Ethereum’s case, would-be validators will need to have at least 32 ETH to qualify. At current prices, this works out to just over $50,000, so it’s not something most people are going to be able to do by themselves.

Once ethereum has been staked, validators can earn more ETH as a reward, at a rate of anything between 3% and 18% of the amount staked. This percentage varies according to how much ETH is taked in total (the more staked, the lower the reward rate), and the means by which someone stakes their ethereum.

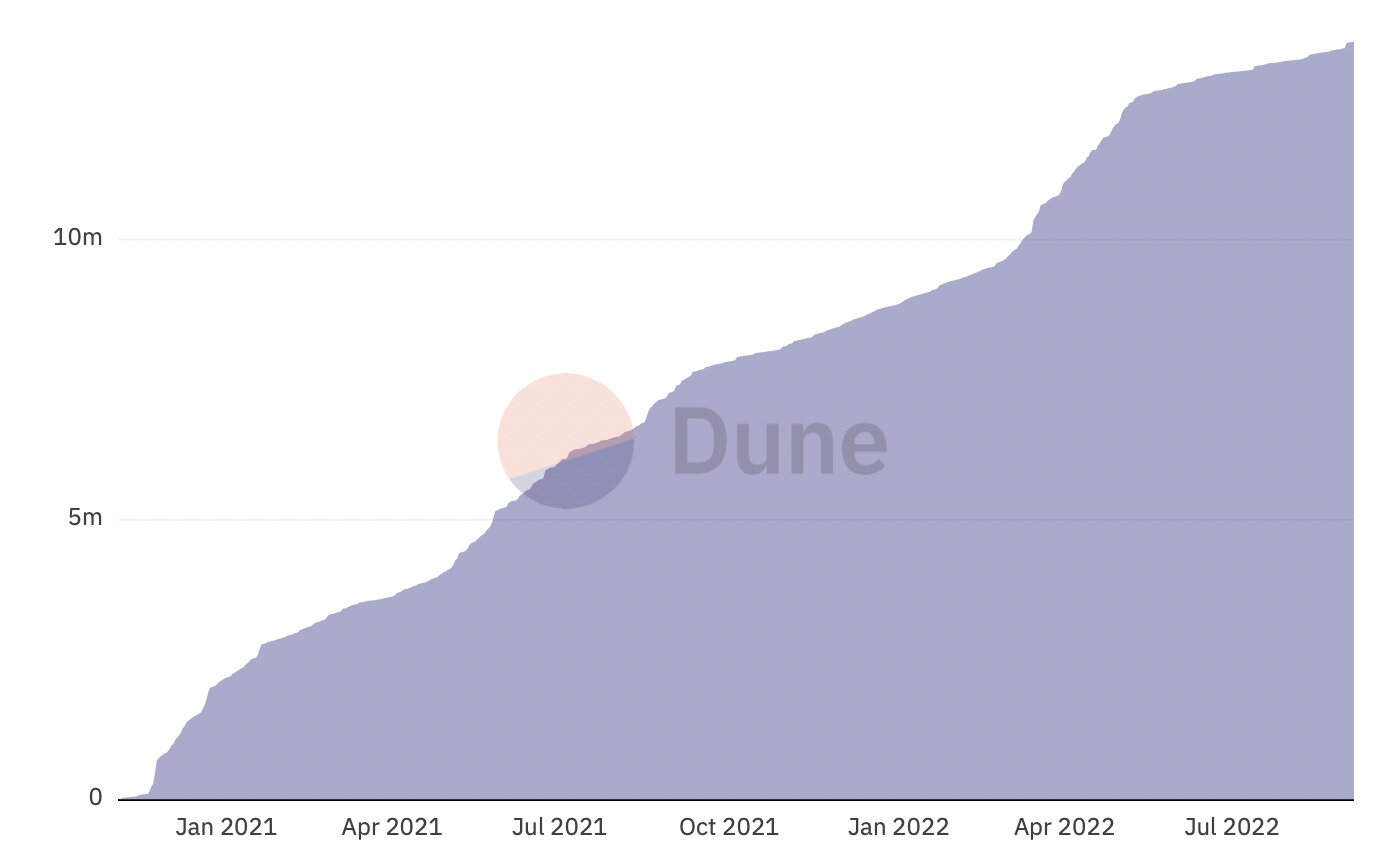

Cumulative total of ETH staked over time. Source: Dune

Staking is in fact live on the new proof-of-stake Beacon Chain, and has been live since November 2020. As of writing, 13.39 million ETH has been staked, representing about 11% of the total circulating supply of the cryptocurrency.

The thing is, even though Ethereum staking is indeed live right now, stakers cannot withdraw their staked ETH, or the daily rewards that are paid out. They won’t be able to do so until the completion of the Shanghai upgrade, which is due at some point after the Merge, which itself is due at any point between September 10 and 20 (according to Vitalik Buterin). There is no specific date for Shanghai, although some websites have vaguely mooted ‘early 2023,’ without any real evidence or backing.

Source: Twitter

As such, would-be stakers need to be a little patient. Although assuming that ETH rallies bigly after the Merge, they may be rewarded handsomely for their patience.

How to Stake Ethereum Following the Merge

There are basically three main ways to stake ethereum now and once the network completes the Merge, as outlined below:

-

Solo staking: this requires stakers to have 32 ETH (roughly $50,000 at time of publication), yet it lets them keep all of their rewards. It also requires either that the validator has enough technical knowledge to run their own Ethereum node and obtain their own validator credentials, or that they use a staking-as-a-service provider (such as BloxStaking, Abyss Finance, Kiln, and Allnodes).

-

Pooled staking: this allows people with less than 32 ETH to deposit whatever ethereum they do have into a validator pool and receive block rewards in proportion to the amount deposited. This includes liquid staking services such as Lido or Rocket Pool.

-

Staking via crypto exchanges: this requires basically no technical knowledge (beyond digital literacy) and can be used with less than 32 ETH. It requires only that a user signs up with a participating exchange.

While a fuller description of solo staking is beyond the scope of this article, more info for the curious can be found on ethereum.org. Instead, we’ll focus on pooled staking and staking on a crypto exchange.

Pooled staking services are provided by a growing range of staking platforms, all of which make the process easy and don’t require a minimum of 32ETH. Here are the most popular:

-

Lido

-

StakeWise

-

Rocket Pool

-

Stakefish

-

StaFi

-

Ankr Staking

Focusing on Lido as an example, it currently accounts for the staking of over 4 million ETH, making it the most popular way of staking the cryptocurrency. According to its own site, it offers an annual return of 3.9% on your staked ETH, providing staked ethereum (stETH) as a token of the ethereum that can be withdrawn once the Shanghai update is complete.

It’s worth pointing out that it also charges a fee of 10% on your received rewards, so don’t expect to keep everything you’re likely to earn from staking Ethereum.

Turning to crypto exchanges, these work in much the same way as pooling services, allowing you to stake any amount of ETH and to receive your rewards in exchange for a fee. They arguably represent the most convenient option, since pretty much all ETH holders will have an account with at least one exchange that offers staking. However, the Ethereum Foundation itself warns that they risk becoming too big, in the process creating “a large centralized target and point of failure, making the network more vulnerable to attack or bugs.”

Nonetheless, here are some of the major exchanges that offer Ethereum staking:

-

Coinbase

-

Binance

-

eToro

-

Kraken

-

BlockFi

-

Uphold

-

Huobi Global

-

OKEx

Expect this list to grow significantly once Ethereum completes the Merge, something which is due in the next couple of weeks. Again, it’s hard to say how the market will react to the successful completion of the shift, but with observers predicting that ETH will become a deflationary cryptocurrency as a result of its supply being locked up, it may be a good time to buy some and start staking yourself.