- >News

- >The Twitter Dogecoin Logo and Elon Musk’s $258 Billion Class-Action Lawsuit

The Twitter Dogecoin Logo and Elon Musk’s $258 Billion Class-Action Lawsuit

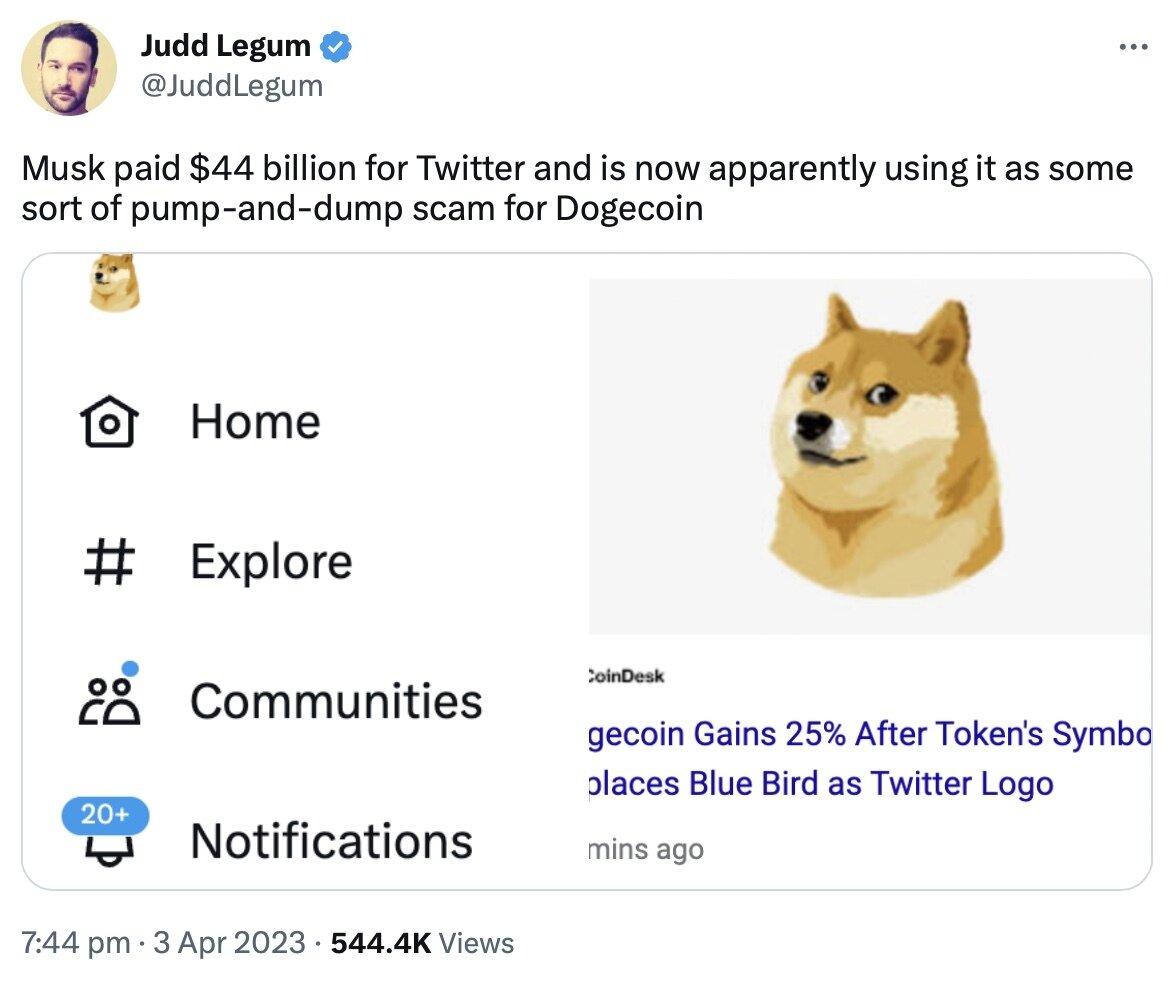

Barely a week passes without Elon Musk producing some veiled — or not so veiled — reference to Dogecoin, and this week is no different. This time, the Twitter owner has seen fit to change the social network’s logo from the familiar blue-and-white bird to a picture of a Shiba Inu dog, which is Dogecoin’s mascot. The price of DOGE has rocketed in response, surging from $0.076980 before the tweet on April 3 to a five-month high of $0.102349 (a 33% gain). And once again, the Dogecoin community are singing the praises of the mercurial Musk, who alone seems to be the only person supporting the meme token’s price at the moment.

Yet as a handful of more dispassionate owners were quick to point out, it seems that something else is going on under the surface of this latest piece of vaguely titillating news. Elon Musk has asked a federal judge to dismiss a class-action lawsuit filed against him, with his request being submitted the very day before Twitter’s logo received its makeover. Interestingly, this class-action lawsuit — originally filed in June 2022 — alleges that Musk has intentionally pumped the price of DOGE only to then dump it on retail investors, with the plaintiffs accordingly seeking $258 billion in damages.

While Musk’s well-documented love for doing things that drive up DOGE’s price may suggest the case has some substance to it, it remains to be seen whether the plaintiffs can sufficiently prove that the Twitter and Tesla owner intended to defraud investors via his actions. Of course, just because the case may end up failing to prove Musk’s guilt doesn’t mean that the average retail investor should invest with confidence in Dogecoin, which arguably has nothing going for it besides Musk’s now-suspect cheerleading.

Musk’s Latest Dogecoin Stunt

It may only be April, but 2023 has already been a fairly busy year as far as Elon Musk and Dogecoin references are concerned. First Musk attended the Super Bowl while wearing a Dogecoin T-shirt (and while sitting next to media tycoon Rupert Murdoch). Then, barely a couple of days later, we had February’s Twitter post in which he posted a picture of the “new CEO of Twitter,” who happened to be his Shiba Inu dog, Floki.

It almost goes without saying that the Dogecoin price rose in response to these two little back-t0-back stunts, gaining by around 11% in a couple of days. The reason? Well, the cynic would be tempted to argue that Dogecoin holders and investors are so starved for any genuine adoption news that they’ll go crazy in response to even the slightest mention of the meme token by Musk.

Dogecoin’s price chart since October 2022. Source: Twitter

On the other hand, a more charitable reading is that the above nods to Dogecoin amount to Musk reaffirming that, sooner or later, he’s going to integrate DOGE payments into Twitter in one form or another.

This possibility has been on the agenda ever since Musk offered to buy the social media company back in April 2022, with the Tesla owner suggesting at the time that he may introduce “an option to pay [for Twitter Blue subscriptions] in DOGE”. It was recently returned to the fore as a result of a report in the Financial Times, which in late January revealed that Musk was pushing Twitter to forge ahead with its plans to bring digital payments to its network.

This also helped to boost Dogecoin’s price, even though the insiders quoted by the Financial Times made no explicit mention of DOGE, and even though they said that digital payments on Twitter would initially involve fiat currencies only. Still, the report’s appearance reinforced hopes that Twitter would use DOGE eventually, and it seems that such hopes flared yet again when the social network changed its logo this week.

Source: Twitter

As a result of this logo change, Dogecoin even briefly flipped Cardano as the market’s eighth-biggest cryptocurrency (by market cap), although it has since returned to ninth in the rankings. Still, it remains up by 30% in a week as of writing, and has been trending widely on Twitter.

Burying a Class-Action Lawsuit

Again, it could be argued that it’s an extremely sad indictment of Dogecoin that all Elon Musk has to do to boost its price is produce some inane Doge-related meme, with investors lapping it up for some bizarre reason. However, what’s interesting about this latest episode is its timing, given that the logo change happened on the very same day news broke of Musk filing to have the aforementioned class-action lawsuit dismissed.

Journalist Seth Abramson suggests that Musk changed the logo to deflect from a class-action lawsuit filed against him. Source: Twitter

Indeed, several observers have claimed that the change was implemented in order to deflect attention away from the lawsuit, in that searches for “Musk” and “Dogecoin” would likely turn up pages related to the logo switch (rather than to the lawsuit).

If this is true, then Musk’s attempts at deflection have been only half-successful. While searches for the above terms mostly yield results related to the Twitter logo, there are still quite a few related to the $258 billion suit. That said, it does seem that more people online are talking about the logo, so Musk may be pleased nonetheless with his latest shenanigans.

As for the suit, Musk’s lawyers have filed to have the case dismissed, on the grounds of a lack of evidence. They’ve referred to the case’s claims as a “fanciful work of fiction,” adding that there’s “nothing unlawful about tweeting words of support for, or funny pictures about, a legitimate cryptocurrency that continues to hold a market cap of nearly $10 billion.”

The case remains at a very early stage, so it would be difficult — if not foolish — to discuss where it might end up. Suffice it to say, Elon Musk’s actions and tweets over the past couple of years have undoubtedly boosted the price of Dogecoin, which has also seen an 87% decline since the all-time high of $0.731578 it set in May 2021 (around the time Musk appeared on Saturday Night Live). It’s also extremely unlikely that Musk isn’t aware that DOGE rises in price on nearly every occasion he mentions it.

Source: Twitter

The case notes that Musk “has been tweeting about Dogecoin since at least April 2, 2019, when he shared a satirical article from The Onion about Bitcoin price volatility and added: ‘Dogecoin value may vary’. Musk followed up with: ‘Dogecoin might be my fav cryptocurrency. It’s pretty cool.’”

Since he posted the above tweet, DOGE has risen in price by roughly 3,266%, and even rose by as much as 25,000% (in terms of its May 2021 record high). It’s arguable that this is all down to the cheerleading of Musk, who has acknowledged that he holds DOGE (and that Tesla owns some).

Ultimately, Dogecoin remains a meme token with little utility beyond other cryptocurrencies. At the moment, its holders are pinning their hopes entirely on the unconfirmed possibility that Twitter will eventually introduce DOGE-based payments. This is far from a certainty, yet what is certain is that investing in the coin remains a risky business, and that investors with a low tolerance for risk may prefer to look towards more useful cryptocurrencies with more going for them than an unreliable billionaire’s endorsement.