- >News

- >What Are Terra, Theta and Why Have They Risen in Value By 14,000%?

What Are Terra, Theta and Why Have They Risen in Value By 14,000%?

Mooning is relative. Yes, bitcoin may have hit an all-time high of $61,711 on March 13, but certain coins have far outperformed the original cryptocurrency in percentage terms. Over recent weeks, months and the past year, the highest performing of these has been Terra (LUNA) and Theta (THETA), two altcoins which launched in 2018 but have only now come to prominence.

Over the past 14 days, LUNA and THETA have risen in price by 99% and 133% respectively, outpacing bitcoin with its 3.9% increase over the same period. Across the past 30 days, LUNA and THETA have surged by 219% and 208%, while bitcoin is currently down by 3.6%. And if that weren’t impressive enough, LUNA has appreciated by a staggering 14,441% across the last 12 months, with THETA hitting the dizzying heights of a 17,657% increase.

These figures make bitcoin’s 827% increase (as of writing) seem fairly modest by comparison. But what are these two cryptocurrencies, and why are they surging so drastically? Well, aside from the wider bull market helping things along, Theta has benefited from the growing interest in NFTs, while Terra has been boosted on the back of a similarly rising interest in stablecoins, as well as by the fact that its burns LUNA to mint its own stablecoins.

Theta, A Brief History

Theta is a decentralized video-streaming platform, with its platform being used mostly to stream eSports. It was launched by the Seoul-based Theta Labs in 2018 as an Ethereum-based network, with THETA originally being ERC-20 token. However, in March 2019 it launched its very own mainnet, converting its ERC-20 tokens into its own native THETA and TFUEL tokens (with the latter being used to pay for transactions).

At this time, THETA was worth about $0.13, with the Theta platform boasting partnerships with the likes of SLIVER.tv, MBN, and Samsung VR. In the months which followed, it announced new partnerships with MGM Studios, COS.tv, and Google Cloud, while it was also backed by Sony Innovation Fund and gumi Cryptos.

In other words, it has accumulated a steady stream of interest, which seems to have accelerated in recent months. This is likely because it launched its own non-fungible token (NFT) capability in January 2021, just in time for it to ride the NFT craze that would follow a couple of months later. It followed up this roll out by announcing fresh partnerships that positioned it to take advantage of NFT interest, with its February deal with film studio Lionsgate being the most prominent.

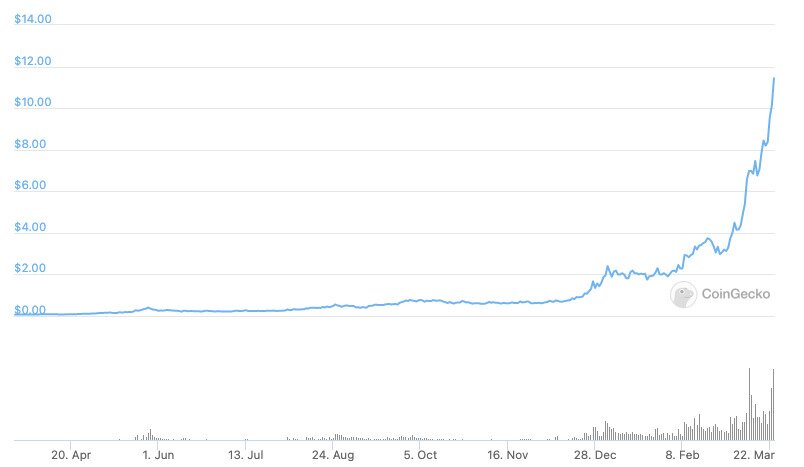

THETA price over the past 12 months. Source: CoinGecko

Basically, Theta has amassed the backing, partnerships and network infrastructure to make it a big player, and it now seems that a growing proportion of the market is willing to place bets with it. THETA has accordingly become the top cryptocurrency by market cap in the NFT category, according to CoinMarketCap. And it’s top by quite some margin, with its current cap of $11.4 billion dwarfing that of its nearest rival, Chiliz (CHZ), which has a cap of $2.9 billion.

Terra, A Brief History

It’s a similar story with Terra, which also happens to be based in South Korea. As with Theta, Terra launched in 2018, backed by $32 million in seed funding from Binance, OKEx, Huobi, Upbit, as well as from VC firms such as Polychain Capital and FBG Capital.

Terra’s platform mints stablecoins, yet what sets it apart from the crowd was that it planned from the start to integrate with a variety of eCommerce firms that would use its stablecoins to avoid traditional payment processing costs. At the same time, users would receive discounts for paying for goods via Terra. Accordingly, 15 (South Korea-based) eCommerce partners were already signed up at launch, including Woowa Brothers, Qoo10, Carousell, Pomelo, and Tiki, which together accounted for over $25 billion in annual revenue.

Terra launched its mainnet on April 23, 2019, at a time when its native token — LUNA — was worth around $3. It partnered with newly launched mobile payment service CHAI in June 2019, with CHAI now serving over 1.9 million users in South Korea. It also partnered with Mongolia (the country) that same year, launching MemePay in the Asian country and enabling instant stablecoin payments at cabs, gas stations and department stores.

Terra issues a family of stablecoins pegged to various fiat currencies, with its KRT stablecoin (pegged to the Korean won) being the first, and its UST (pegged to the dollar) being the biggest. In contrast to other stablecoins, its pegging mechanism is a little different, with Terra burning its native token — LUNA — whenever it mints new stablecoins.

This arguably makes Terra’s stablecoins more secure than rivals, yet it also limits the supply of LUNA, thereby squeezing its price ever higher.

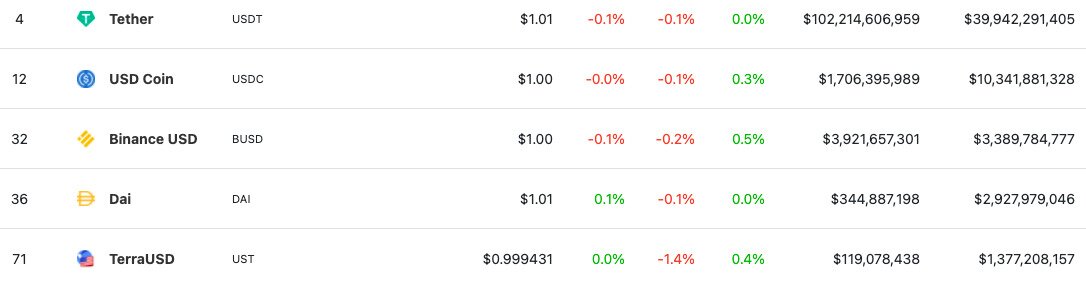

This largely accounts for why LUNA hit an all-time high of $22 on March 22. Of course, the burning of LUNA is being driven by a growing demand for stablecoins, with TerraUSD (UST) now the fifth biggest stablecoin by market cap.

Source: CoinGecko

To put this simply, the more Terra and its stablecoins are used, the more it will have to burn LUNA. That means: price goes up.

Bull Markets

While it’s hardly a secret, it also needs to be pointed out that we’re still in throes of a major bull market. Not only are bitcoin, ethereum and other big coins hitting ATHs, but investors are looking for the ‘next big thing,’ in particular small-cap coins which show great potential to rise significantly.

THETA and LUNA arguably fit this bill better than any other relatively small altcoins in the market. Both are underpinned by platforms with good business models, good backing, good infrastructure, and the good luck of having jumped on major bandwagons (e.g. non-fungible tokens and stablecoins).

Their platforms have shown promising growth in recent months, and the market has begun rewarding this by buying them up in ever larger numbers. It could possibly be time to swoop in before they get too big.