- >News

- >What Happens if Cryptocurrencies Like ETH Are Classified as Securities?

What Happens if Cryptocurrencies Like ETH Are Classified as Securities?

Most cryptocurrencies are securities. This, at least, is the view of Gary Gensler, the Chairman of the Securities and Exchange Commission. In numerous interviews and during numerous speeches, Gensler has reiterated his — and his agency’s — view that “most crypto tokens are investment contracts under the Howey Test.” This means they are securities, and if their issuers do not register them as such, then the SEC could very easily take legal action.

In fact, this has already happened on more than one occasion, with the SEC having taken action in recent years against Ripple, Telegram and LBRY, as well as against several trading platforms (such as Nexo, Paxos and Gemini). And if the ongoing case between the SEC and Ripple ends with the presiding judge ruling in favor of the regulator, then there could be a spate of such actions in the coming years.

Indeed, a victory for the SEC against Ripple may provide confirmation that most cryptocurrencies, including Ethereum (ETH), should be classified as securities under American law. As such, it may result in a shrinkage of the US cryptocurrency industry as platforms and projects shift to registering with the SEC, although it could end up inadvertently benefitting Bitcoin, which the SEC doesn’t regard as a security.

Why the SEC Already Classifieds Cryptocurrencies Like ETH As Securities

While written law and legal precedent still remains somewhat murky in terms of classifying cryptocurrencies as securities (or not), there’s a mounting body of speech and evidence that the SEC does believe most are very much securities.

Take the speech given by Gary Gensler at the Penn Law Capital Markets Association Annual Conference in April 2022. Here’s one of the most revealing statements:

“The fact is, most crypto tokens involve a group of entrepreneurs raising money from the public in anticipation of profits — the hallmark of an investment contract or a security under our jurisdiction. Some, probably only a few, are like digital gold; they may not be securities.”

Gensler has echoed this line of reasoning elsewhere, doing so as recently as a February 2023 interview with New York Magazine’s Intelligencer. In this particular piece, he comes out as suggesting that Bitcoin isn’t a security, although it isn’t entirely clear if this is the SEC’s official stance.

“Everything other than bitcoin, you can find a website, you can find a group of entrepreneurs, they might set up their legal entities in a tax haven offshore, they might have a foundation […] They might drop their tokens overseas at first and contend or pretend that it’s going to take six months before they come back to the US […] But at the core,these tokens are securities because there’s a group in the middle and the public is anticipating profits based on that group.”

This position is fairly clear. The SEC views most cryptocurrencies as securities, and it has acted in accordance with this view, taking legal action where it has found it possible and consequential to do so. This likely includes coins such as Ethereum, particularly in light of the latter’s move to a proof-of-stake consensus mechanism.

What Will Happen If Ripple Loses Its Case Against the SEC

However, things could become significantly worse for crypto if the SEC ends up winning its case with Ripple. As Ripple’s CEO Brad Garlinghouse has said recently in interviews, this case’s result is “going to be pivotal for the whole industry,” insofar as it will set a precedent that could result in other cryptocurrency projects and companies facing legal action.

In fact, Ripple’s Chief Legal Officer Stuart Alderoty has already advised crypto companies in the US to set up overseas, given how uncertain the law currently is. A victory for the regulator will only make this situation much worse, in that it will provide the SEC’s views with legal confirmation, while also emboldening the regulator to pursue other firms.

Source: Twitter

Assuming an SEC victory, the biggest loser may end up being the US, in that its cryptocurrency sector may flee to friendlier shores. However, for any firms and exchanges that remain within American jurisdiction, the effects will likely be chilling.

Any US-based exchanges would be at risk of violating securities laws. They may have to do what Coinbase did in December 2020, when it delisted XRP in response to the SEC’s action against Ripple. This would leave them with very few cryptocurrencies to legally list, perhaps reducing its supported coins down to Bitcoin and its forks (e.g. Litecoin, Bitcoin Cash), as well as a small smattering of genuinely decentralized, community-founded tokens.

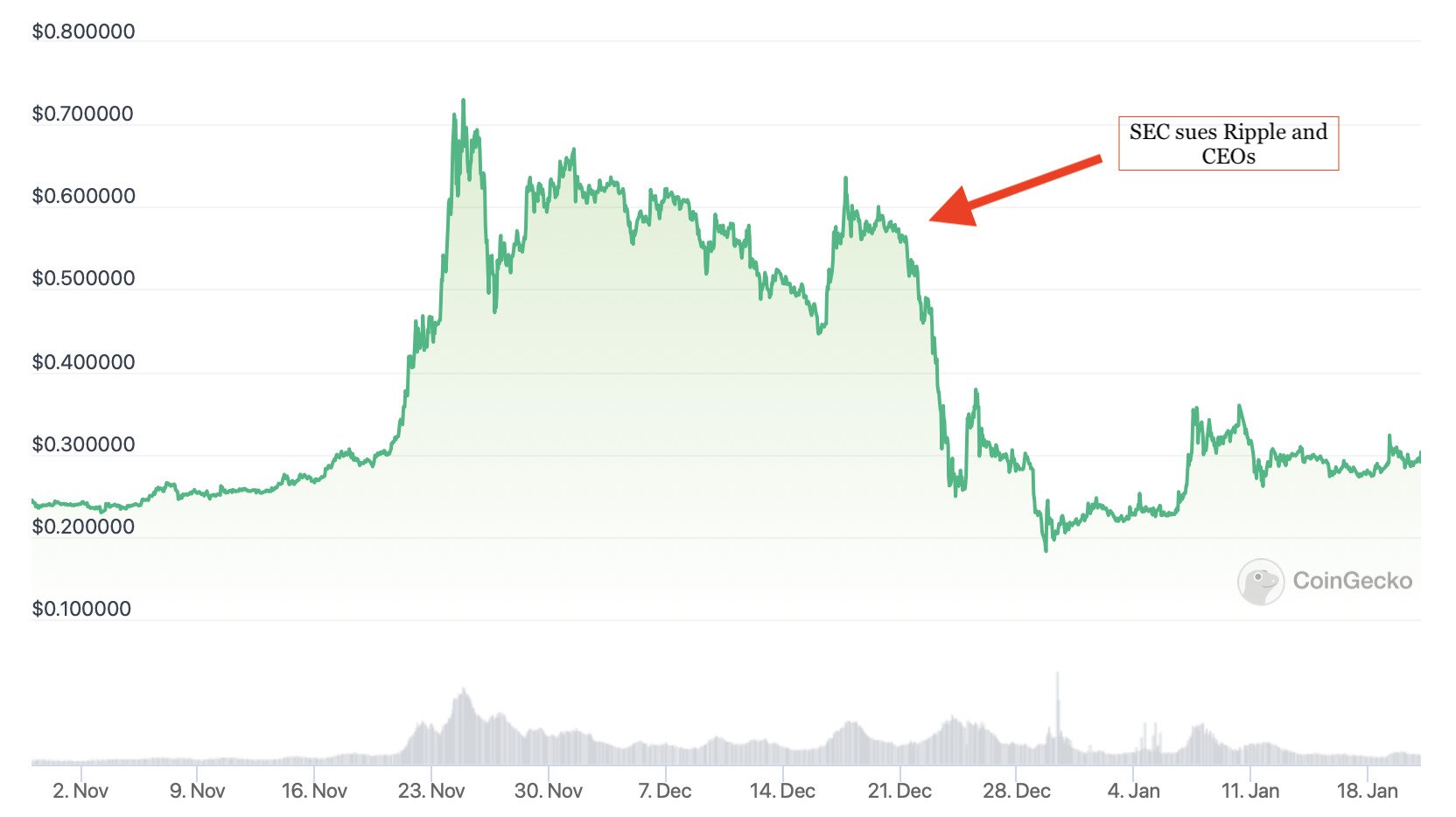

Needless to say, this would be extremely damaging as far as prices are concerned. XRP fell by around 63% within a week after the Coinbase delisting, underlining how negative the loss of US investors and traders could be for demand.

XRP price between November 2020 and January 2021. Source: CoinGecko

On the other hand, it’s entirely arguable that an SEC victory would be extremely bullish for bitcoin and (to a lesser extent) its forks. As Gary Gensler has repeatedly suggested, the securities regulator doesn’t regard bitcoin as a security, so investors and trading platforms in the US would be entirely free to hold and transfer bitcoin. As such, we may see BTC’s dominance of the cryptocurrency market increase substantially, potentially propelling it to new highs.

That said, the LBRY-SEC case raises hope that, even with a negative outcome, US-based exchanges may still be free to list XRP (and by extension, many other cryptocurrencies like it). This is because an appeal hearing found that the third-party sale of LBC tokens does not represent the offering of unregistered securities. This means third-parties — e.g. exchanges — are legally free to continue supporting trades in LBC.

Of course, it remains to be seen whether exchanges in the US feel comfortable enough to relist LBC, or whether they’d feel comfortable enough to list numerous other cryptocurrencies in the event of a decisive Ripple defeat. Still, it remains highly arguable that the prospects of such a defeat are actually pretty low.

As we’ve written numerous times before, Ripple has secured a number of important decisions and rulings in its case up until now. Most recently, the court excluded the opinion of an expert witness called upon by the SEC, who the regulator had hoped would demonstrate that Ripple had created a reasonable expectation of profits among XRP purchasers. This exclusion of the witness supports arguments that the SEC hasn’t sufficiently proven its case in court, and that a settlement could soon arrive, one which enables Ripple to continue its business more or less as before.

Because of this, the market can realistically hope that we won’t enter a scenario where most cryptocurrencies are definitively classified as securities. But only time will tell…