- >News

- >What is Grayscale Bitcoin Trust, And How Might It Be Pushing Up BTC Prices?

What is Grayscale Bitcoin Trust, And How Might It Be Pushing Up BTC Prices?

Bitcoin price is booming, yet a number of important issues remain regarding its ongoing year-end rally. The first is that the supply of Tether expanded by over 350% in the year-to-date, raising suspicions (at least among Bitcoin’s critics) that a significant part of the rally results from some kind of stablecoin-induced pumping.

The second question mark has received somewhat less attention: the Grayscale Bitcoin Trust. This is a trust which buys up bitcoin and then sells shares, which nominally track the market price of the cryptocurrency but tend to be sold at a significant premium.

On the face of it, the Grayscale Bitcoin Trust simply lets investors gain exposure to bitcoin’s price movements without having to actually buy and hold the cryptocurrency. However, by purchasing bitcoin, selling shares which track BTC at a premium, and then buying up yet more bitcoin, the trust may be caught in a vicious circle that’s inflating the bitcoin price.

The Grayscale Bitcoin Trust: What Is It and What Does It Do?

Founded in 2013 by a subsidiary of the Digital Currency Group (which also owns CoinDesk), the Grayscale Bitcoin Trust is an investment vehicle for bitcoin that has publicly listed shares (GBTC), which investors can buy through OTCQX, an over-the-counter market. Accredited investors can also privately buy these shares from Grayscale when they’re first issued.

The trust is the first crypto investment vehicle to qualify as an SEC reporting company, doing so in January 2020. Given that all it does as a company is buy bitcoin, the value of its shares closely tracks the price of the cryptocurrency

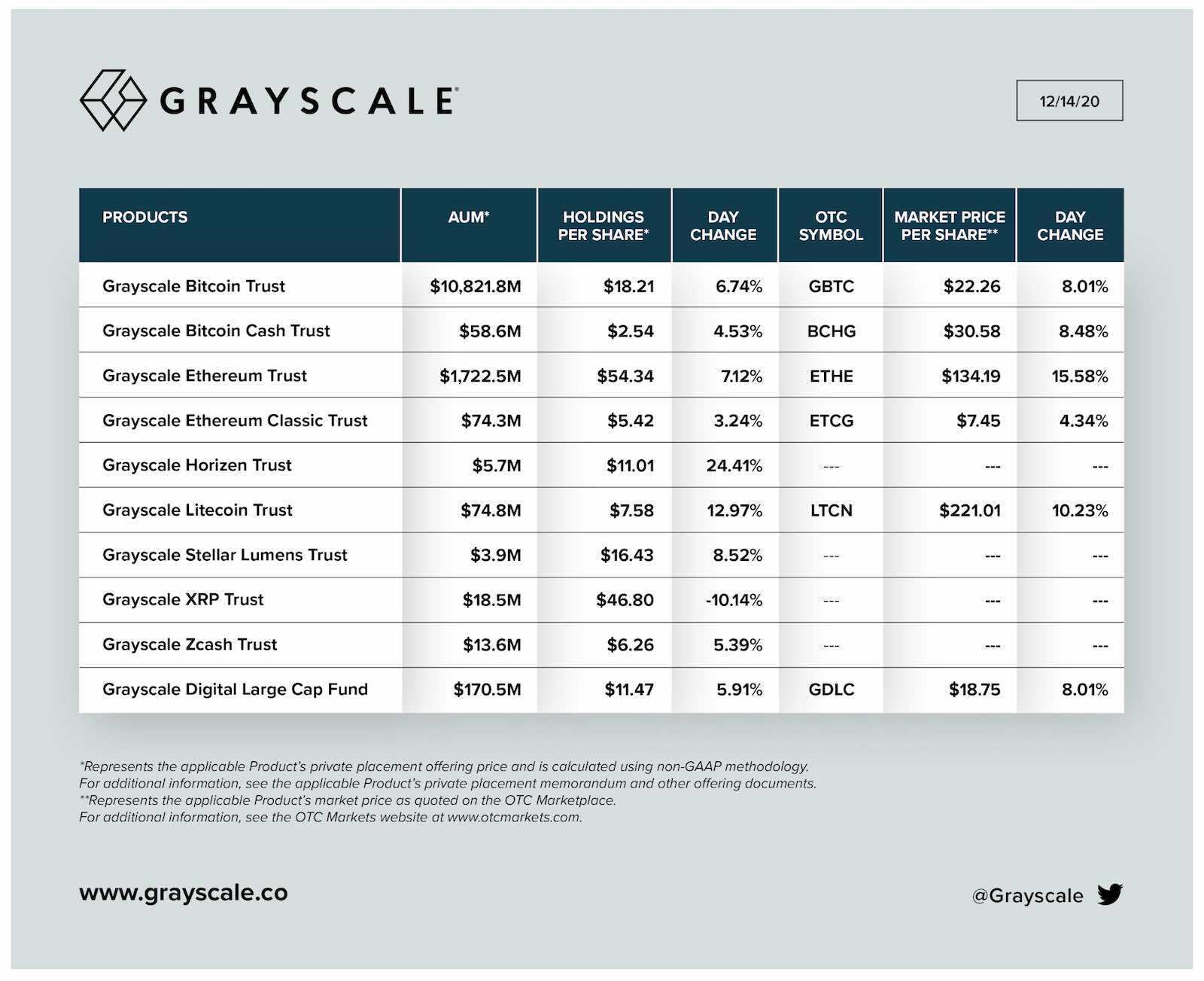

As of December 14, the Grayscale Bitcoin Trust boasts an impressive $10.8 billion in assets under management, while Grayscale as a whole has around $13 billion AUM (which also includes other cryptocurrencies).

Source: Twitter/Grayscale

This $10.8 billion figure is particularly impressive, given that the Grayscale Bitcoin Trust had only $1.9 billion in AUM as of October 8, 2019. This makes for an increase of 468.4%, compared to a 134.1% increase for bitcoin’s price over exactly the same period.

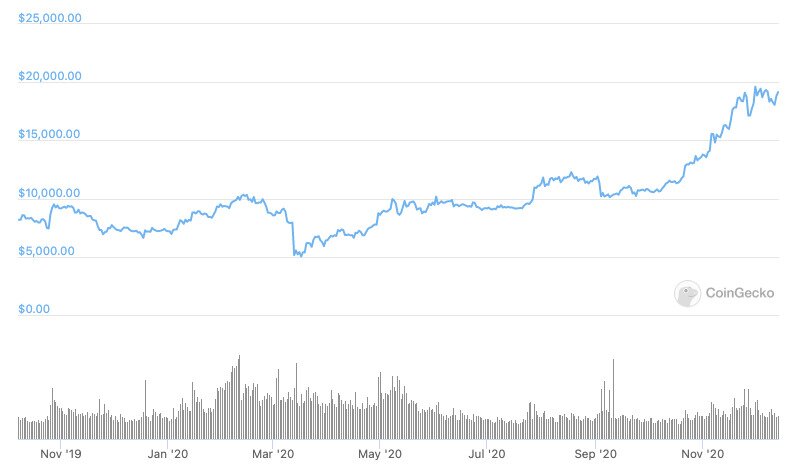

Source: CoinGecko

What this disparity between the two increases means is that the Grayscale Bitcoin Trust has indeed been buying up extra bitcoin between October 2019 and December 2020. If the increase in its AUM had been derived solely from an increase in bitcoin’s price, this increase would have risen by exactly the same as the price of BTC had risen.

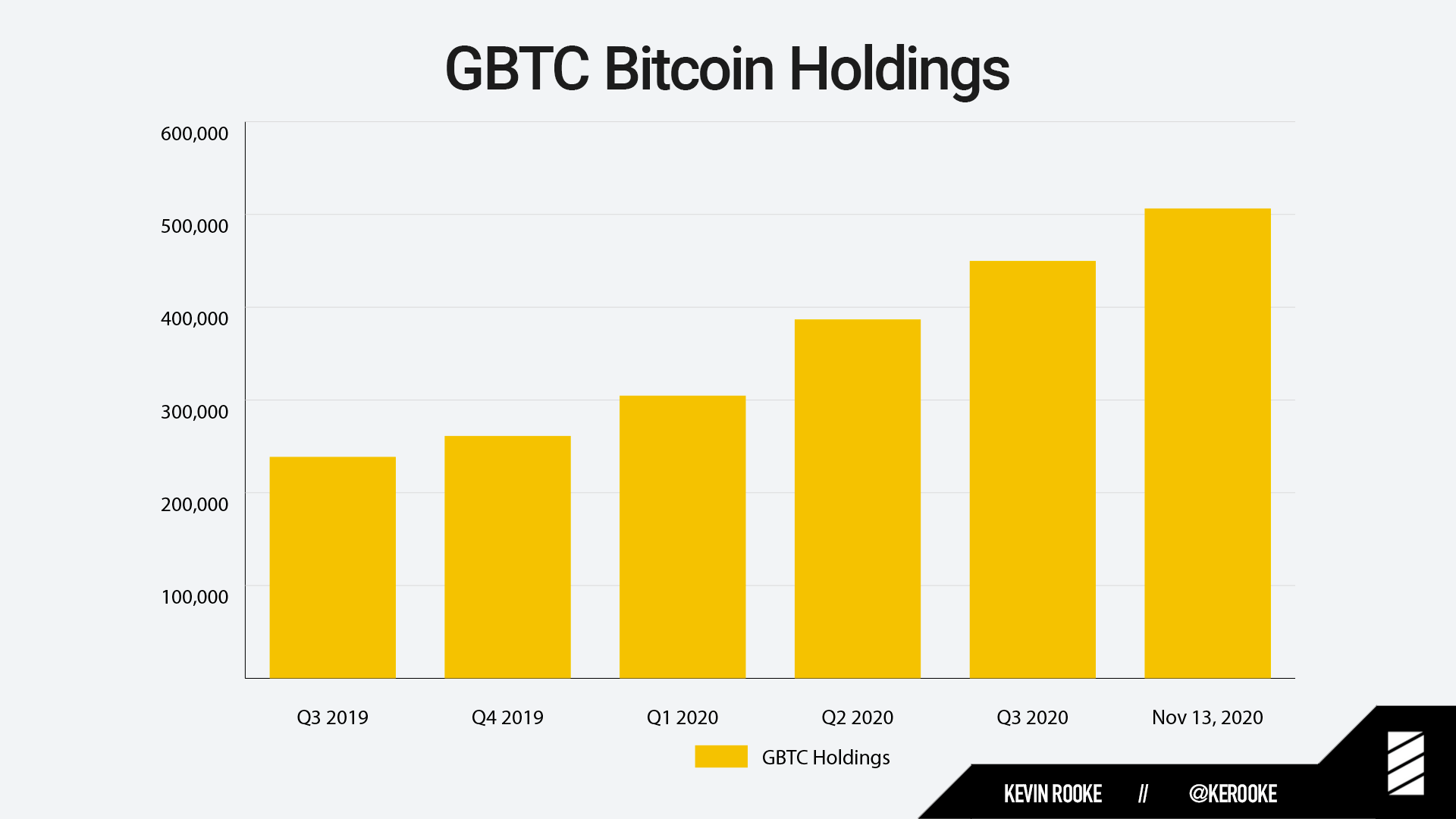

But it hasn’t, and data shows that it acquired over 100,000 BTC between June and November 13, and has doubled its bitcoin holdings since the end of Q3 2019.

Source: Twitter/Kevin Rooke

Premiums = Bubbles?

The Grayscale Bitcoin Trust now owns close to 3.5% of the liquid bitcoin supply, which CoinMetrics currently puts at 14.49 million bitcoins. It’s a big part of the market and becoming bigger by the month, and some people seem to think that its expanding role is inflating the price of bitcoin.

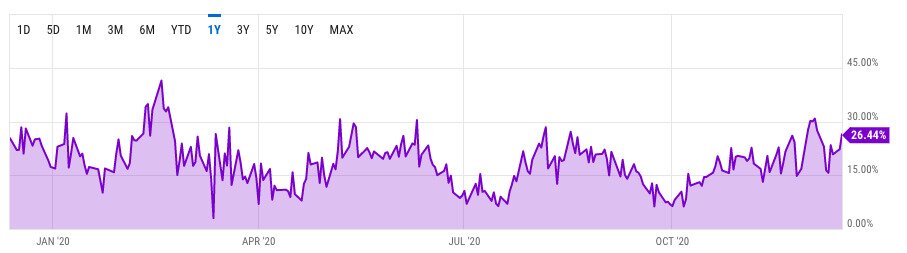

This claim revolves around the premium the Grayscale Bitcoin Trust charges for its shares, which generally trade above the actual price of bitcoins. As of writing, this premium stands at 26.4%, while its average over the past five years is 38.6%.

This chart illustrates how much more expensive GBTC shares are compared to the price of bitcoin. Source: YCharts

According to certain commentators and investors, this premium allows the Grayscale Bitcoin Trust to sell its shares at a profit and then buy up more bitcoin, something which boosts the price of bitcoin further. The rise in bitcoin prices then increases demand for GBTC shares among investors, allowing Grayscale to sell more shares at a premium and then buy even more bitcoin, and so on, until you have a fairly vicious circle of asset inflation.

Noted Bitcoin critic and hedge-fund manager Peter Schiff recently made this very same claim, while adding the extra claim that Grayscale is paying CNBC large sums to run “non-stop ads pumping bitcoin to investors.”

Source: Twitter

Other experienced investors have expressed similar misgivings, and while Schiff’s bias may lead him to exaggerate the effect here, there’s no doubt that the Grayscale Bitcoin Trust has been buying up more bitcoin (remember that its BTC holdings doubled over the past year or so).

This means it has also been selling more shares, as SEC filings indicate that it creates one outstanding share for every bitcoin it holds. And because its shares generally trade at a generous premium to bitcoin, this means Grayscale has been receiving more capital which it can potentially use to buy up more bitcoin (and again, its bitcoin holdings have increased by over 100,000 BTC since June).

Other SEC filings reveal that a growing number of major institutions are investing in the Grayscale Bitcoin Trust, including ARK Investment, Kinetics Investment Group, Rothschild Investment Corporation, Addison Capital, and Corriente Advisor. Many of these firms would rather not hold bitcoin themselves, so they go to Grayscale and are apparently happy to pay a premium for the privilege.

In other words, Grayscale Bitcoin Trust seems to be the first port of call for many of the insitutitions entering bitcoin for the first time. This implies that its premium will remain high, and that Grayscale could potentially continue inflating bitcoin’s price for some time to come. That said, some investors are already shorting GBTC shares and are predicting that its premium will soon turn negative, on the basis of the existence of alternatives (see below).

Maturation

The market effects outlined above don’t really describe any kind of ‘conspiracy’ to manipulate bitcoin prices, but are more a function of the immaturity of the bitcoin market, and of the fact that few investment vehicles exist which allow investors to gain exposure to bitcoin without holding the cryptocurrency.

This state of affairs isn’t likely to last for long, however, with other bitcoin funds coming into existence over the past one or two years, including funds from the ETC Group, 3iQ, CoinShares, and Wisdom Tree. Not only that, but it’s probably only a matter of time before a bitcoin ETF (exchange-traded funded) receives approval, enabling more investors to passively trade bitcoin on regulated stock markets.

Such developments are likely to chip away at Grayscale’s dominance, providing alternatives that will reduce the premium the company currently receives for buying up bitcoin on behalf of investors. And as its premium declines over time, so too will its impact on the bitcoin market, meaning that the cryptocurrency’s price will increasingly grow more organically.