- >News

- >What is Short Selling and How Does It Work in Crypto?

What is Short Selling and How Does It Work in Crypto?

In a bear market, it’s unsurprisingly hard to make money. Every cryptocurrency’s price is dropping, so anyone buying coins and hoping they’ll rise in price is likely to be disappointed in the short-term (hopefully the long-term picture looks better). However, even in a downturn where everything is pretty much falling, there is at least one way of turning a quick(ish) profit: short selling crypto.

Short selling involves borrowing an asset and selling it now at higher prices, before buying it back later so as to settle your debt. The idea is that it will have declined in price at the point where you buy it back, enabling you to pocket the difference between the price at which you sold it and that at which you bought it. This practice of selling assets short has been common for well over a century, and it’s now also a big fixture in crypto, accounting for a little over 30% of all bitcoin options accounts on Binance (as of writing).

Accordingly, this article will explain how to short sell crypto. It will provide step-by-step instructions for shorting cryptocurrencies on a number of major crypto-exchanges, while it will also provide alternatives to direct shorting, such as buying futures contracts and simply selling your own holdings high before buying them back low. On top of this, it will spell out some of the risks of short selling cryptocurrencies, with the possibility of unlimited losses being the most notable.

How to Short Sell Crypto on Exchanges

Not all of the biggest crypto-exchanges let you short sell crypto using margin, which allows you to actually borrow a cryptocurrency to sell it before buying it back later on (to return it). However, here are some of the major exchanges that do let you short cryptocurrencies on margin:

Running through how to short sell crypto (using margin) on all of these exchanges is beyond the scope of this article. However, we’ll run through the process of shorting BTC on both Binance and Kraken, in order to give an example of how it usually works.

With Binance, users will need to open a margin account first. Then they should do the following:

-

Transfer collateral from your spot account to your margin account. For example, with the 3x margin Binance offers, depositing $10,000 (or 10,000 BUSD) will result in your margin account being worth $30,000 (or 30,000 BUSD).

-

On the BTC/USD (or BTC/BUSD) trading page, choose Limit order and select the Cross 3x tab. Then, under Sell BTC, click Borrow.

-

Next, select the amount of BTC you’d like to borrow by inputting the equivalent price. Then click Margin Sell BTC.

-

Assuming that the price of BTC is $10,000, a margin account worth $30,000 would enable you to borrow — and sell — two bitcoins. You would not be able to borrow more (e.g. three bitcoins), because $10,000 needs to be kept as collateral.

-

Having sold two bitcoins, you would have an extra $20,000 in your account. However, you would need to return two BTC at a later date, so hopefully the price of bitcoin would quickly decline to a point where you could buy 2 BTC, return it, and have a nice profit left over.

-

To do this, click the Repay tab under Buy BTC. Set the price and amount (e.g. 2 BTC), and then click Margin Buy BTC. Doing this will close your short position, and hopefully, you’ll have made a profit.

These are the fundamentals of how short-selling works on Binance. However, you need to bear in mind that the exchange will charge a handling fee and interest, with bitcoin having a daily interest fee of 0.02% (equivalent to 7.3% per year). As such, you need to account for additional costs when short selling crypto on margin.

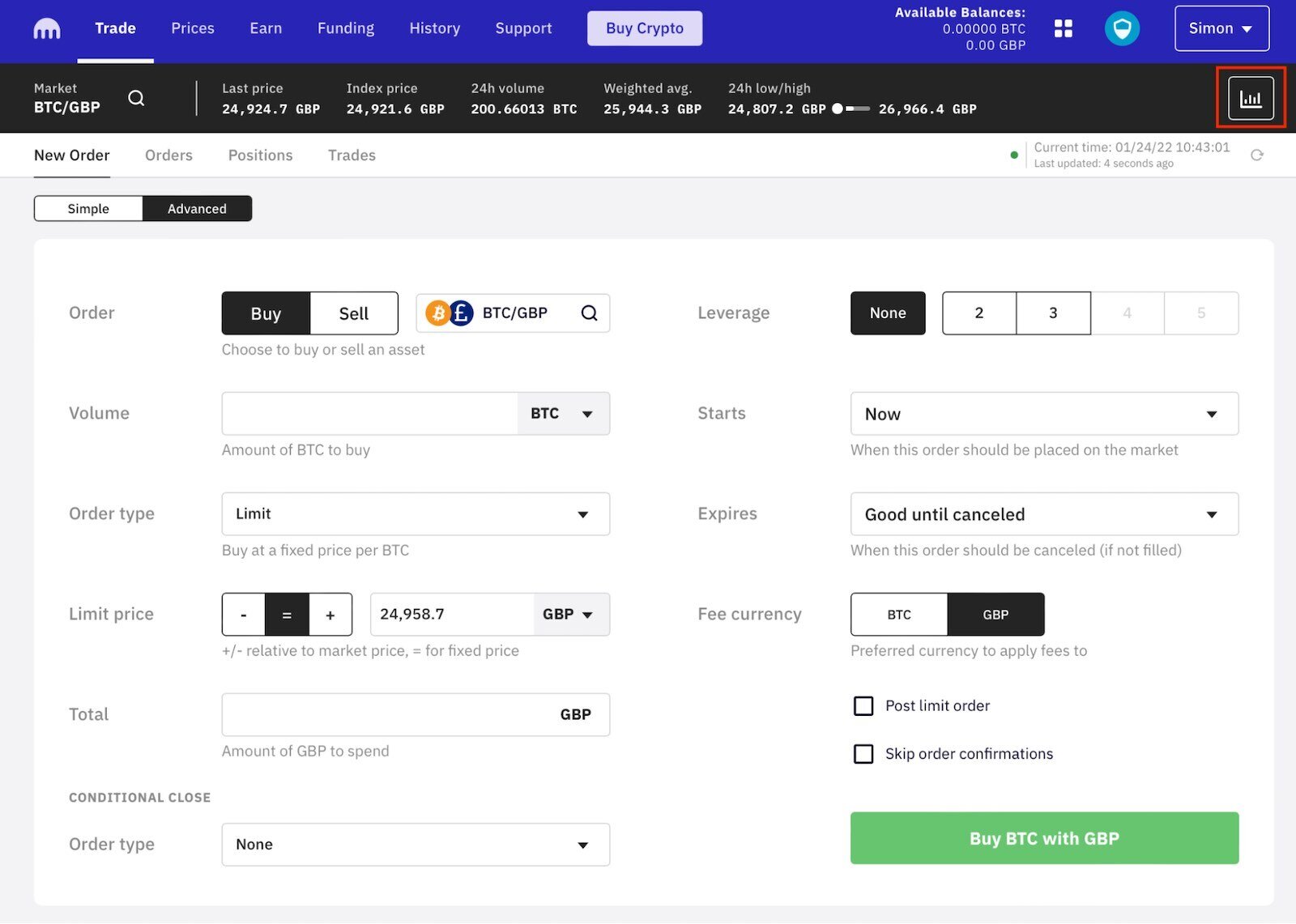

The Kraken Terminal icon is highlighted in red above.

With Kraken, you can do the following to short sell a cryptocurrency (also see Kraken’s support pages for further info):

-

Log into your account and click on the Trade tab. Once in Trade, choose the pair you’d like to short with (e.g. BTC/USD) and then click on the Kraken Terminal icon (it looks like a chart) in the top-right corner.

-

Once in the Kraken Terminal, scroll to the right, to the trading form. At first, this form will likely be grayed out: click Connect to enable it. Then, choose Sell, Limit, and then set your leverage. Also, specify how much BTC you’d like to borrow (and sell) and at what price, and then click Review and Sell.

Quantity specifies the amount of BTC you will borrow and Price specifies the price at which you’ll sell it.

-

Once you’ve clicked Review and Sell, the order will have been made. It may take a minute or two for the order to be met by the market, but once it has, you will receive the proceeds of the sale and will be obligated to close the short position within 365 days.

-

To close a short position on Kraken, you have one of two options: simply deposit BTC into your Kraken account, or simply buy (on Kraken) the quantity of BTC you borrowed.

Margin Calls, Liquidations and Risks

In a bear (or overheated) market, you might be forgiven for assuming that prices are all-but guaranteed to decline. However, while the cryptocurrency market is notoriously volatile, this volatility also means that it can rise dramatically from time to time. This creates massive risk for short sellers.

When short selling, whether on Kraken or any other platform, you have to be wary of margin calls. Basically, your collateral has to maintain a proportionate value (called the ‘margin level’) to the price of the cryptocurrencies you’re shorting. So, if the price of a shorted crypto rises enough, you will have to deposit more funds as collateral in order to maintain your position. If you don’t, the exchange will liquidate your position, meaning you lose your collateral.

In other words, shorting can be very expensive if things don’t go your way. In fact, losses when shorting a potentially unlimited, in that the cryptocurrency you short has no cap on how high its price could rise. So make sure you feel confident it’s going to sink further before shorting it.

Different Ways of Shorting Crypto: Futures and Selling Your Own Holdings

Another common way to short sell cryptocurrency is to sell futures contracts. Through a futures contract, for example, you may agree to sell bitcoin at $10,000. If it falls below $10,000 by the time the contract is settled, you will make a profit.

Various exchanges offer futures trading. Here are some of the most prominent:

-

Binance

-

Kraken

-

Bitfinex

-

BitMEX

-

Bybit

As with short selling on margin, futures contracts will also require maintenance fees if they have been entered into using leverage. Such contracts mostly have fixed termination dates (i.e. dates when they have to be settled), although Binances offer perpetual futures contracts, which continue indefinitely, until the holder of the contract wants to close it.

Similar to selling futures contracts is buying put options. These represent the option — but not the obligation (as with futures) — to sell a given cryptocurrency by or on a particular date. Again, if you think the price of a coin is going to fall, they are another way of shorting it and potentially making a profit.

Lastly, if you already own a cryptocurrency, you can indirectly short sell by selling it at a higher price and buying it back after it has dipped. While technically not short selling, this method can indeed be profitable, particularly if you think the cryptocurrency in question is going to rise again after it has reached the bottom of its dip.

And speaking of dips, bitcoin and the wider cryptocurrency market continues to fall as we write these words. So while short selling may have its risks, it may be the only game in town for the time being.

Disclaimer: CryptoVantage does not offer any investment advice and should be used for educational purposes only. Short selling crypto is exceptionally risky and it can lead to staggering losses.