- >News

- >What to Make of Bitcoin Dominance Trends? Is 50% Dominance Here to Stay?

What to Make of Bitcoin Dominance Trends? Is 50% Dominance Here to Stay?

One of the most interesting metrics in all of crypto is the bitcoin dominance ratio. As tracked by such aggregators as CoinMarketCap, it expresses bitcoin’s market cap as a percentage of the cap of the entire cryptocurrency market. It therefore provides a useful snapshot of how the original cryptocurrency is faring relative to altcoins (and vice versa), while also providing some key insights into the state of the overall market, as well as into investor sentiment.

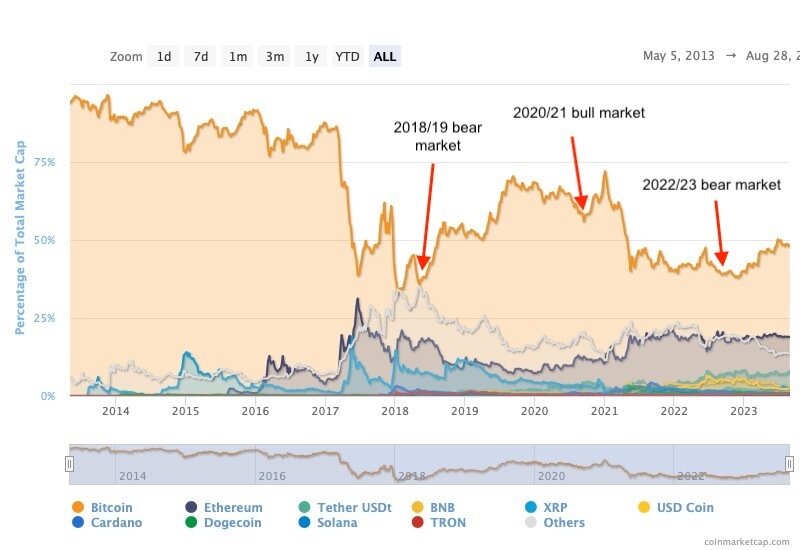

And ever since the end of 2022, something relatively interesting has been happening to the bitcoin dominance ratio: it has been rising again. While it has hardly recaptured the 90% and 80% levels witnessed between 2013 and 2017 (when there were only a handful of altcoins), it has recovered steadily from the four-year low of 37.80% it fell to in November 2022.

In reaching as high as 50% in recent months, the bitcoin dominance level reveals some important truths about where crypto and its investors are at the moment. It suggests that regulatory fears regarding altcoins have made BTC seem like a relatively low-risk bet in an uncertain market, while it also suggests that recent fears over inflation, bank stability and the wider global economy have also heightened its status as a ‘safe haven.’

History Shows That Bitcoin Dominance Rises In Bear Markets

While the cryptocurrency market remains very young in the grander scheme of things, it does appear that Bitcoin dominance trends have already developed cyclical patterns. And in particular, what its cycles tend to show is that BTC’s dominance rises during bear markets (and the initial phases of bull markets), and then falls during bull markets.

Bitcoin’s dominance since the middle of 2013. Source: CoinMarketCap

There are two basic reasons for this. Firstly, bear markets tend to make investors much more cautious and risk-averse. This means that many take flight from newer and riskier altcoins, and (if they don’t simply flee to cash) revert to bitcoin, which as the oldest and most established cryptocurrency remains arguably the most stable.

Secondly, bull markets generally have the effect of making riskier, more speculative cryptocurrencies more attractive to investors. The latter may have excess profits from BTC that they want to reinvest in some other tokens which show more growth potential, and so more floods into altcoins during the peaks of bull markets. And so on.

This is the basic pattern of Bitcoin dominance trends. However, as we’ll explore below, the rise in BTC’s dominance this year has arguably been caused by a different mix of factors than in previous years and cycles.

Bitcoin Dominance Boost #1: The SEC Says All Altcoins Are Securities

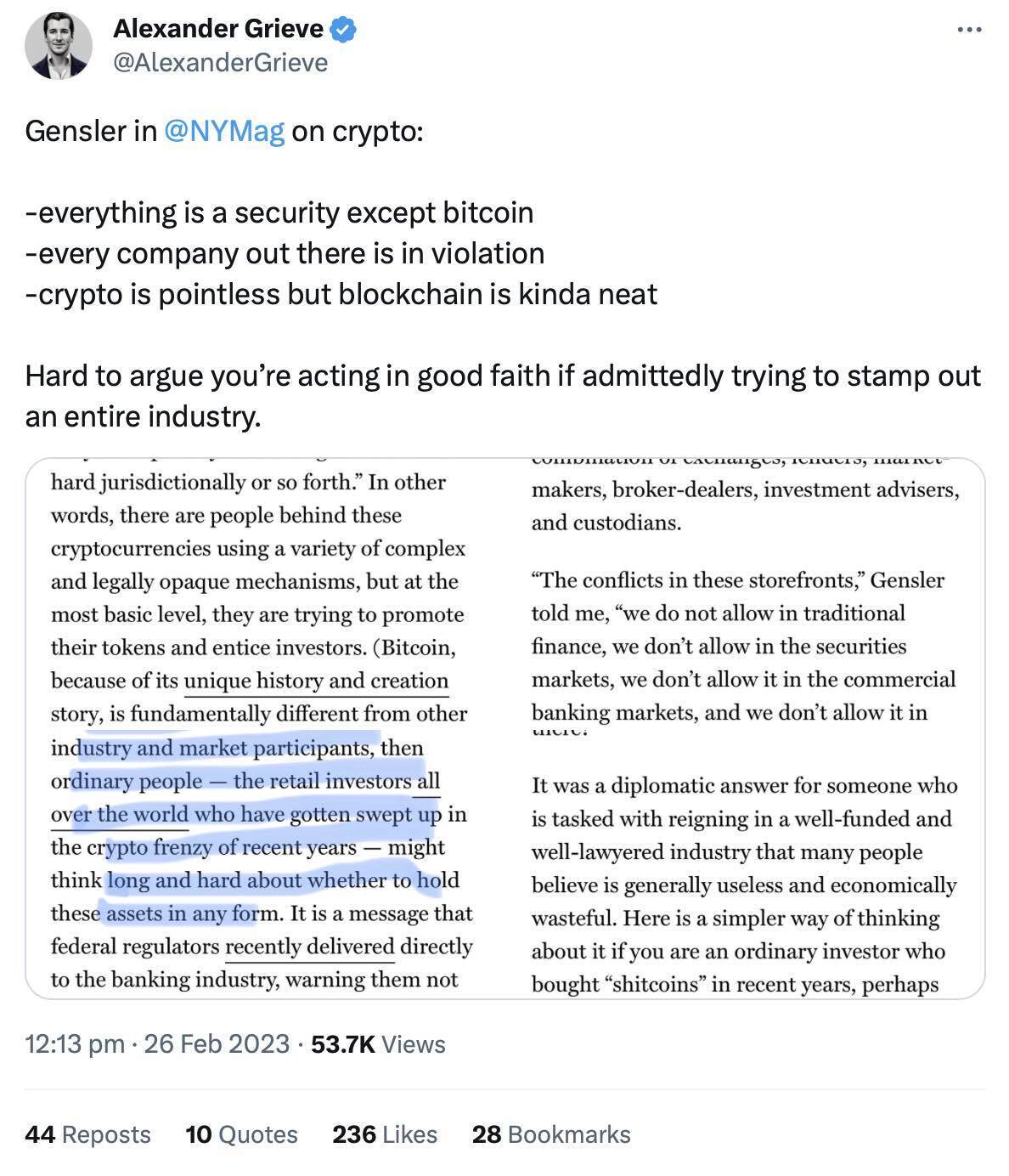

One major factor in the recent rise in Bitcoin dominance has been the US Securities and Exchange Commission, which has been on something of a regulatory crusade against much of the cryptocurrency market for several years now.

This crusade reached a new intensity in 2023, with the regulator beginning legal action against both Binance and Coinbase in early June. Key to these actions was the SEC’s claim that both exchanges had been offering “unregistered securities,” in the form of such altcoins as SOL, ADA, MATIC, FIL, SAND, AXS, CHZ, FLOW, ICP, NEAR, VGX, DASH, and NEXO (as listed in the regulator’s filing against Coinbase).

Yet it gets even worse for altcoins, because it was reported in July that Coinbase CEO Brian Armstrong had said that the SEC tried to force the exchange to delist all cryptocurrencies except BTC. This chimes with previous remarks from SEC Chairman Gary Gensler, who has claimed on more than one occasion that pretty much every cryptocurrency (save for Bitcoin) is an unregistered security.

Source: Twitter

This kind of blanket assault on altcoins has severely undermined the ability of the cryptocurrency market to recover from the bear market it fell into at the end of 2022. And in turn, it has helped to increase bitcoin’s dominance of the market, as investors increasingly come to fear that any other cryptocurrency investment beyond BTC may end up being harmed by the SEC.

Bitcoin Dominance Boost #2: Macroeconomic Instability

The other key reason as to why Bitcoin dominance has been rising in recent months is that economic uncertainty has made the cryptocurrency more attractive to investors as a ‘safe haven.’

A combination of stresses have weakened the attraction of more traditional destinations of the typical investor’s money, with fiat currencies suffering from inflation and with a number of banks collapsing this year. So even if Bitcoin still can’t claim to be an entirely safe store of value, its status as such has been heightened in recent months.

For example, the failures of Silicon Valley Bank, Signature Bank, Silvergate, First Republic and also Credit Suisse happened to precede BTC’s move from around $20,000 (on March 11) to $30,000 roughly a month later. While such collapses are unlikely to account for all of this increase, much commentary at the time argued that they had given the original cryptocurrency a big boost.

Bitcoin’s price since January 2023. Source: CoinGecko

At the same time, inflation continued to undermine the national currencies of multiple economies in 2023, with the US, the UK, the eurozone and many other areas witnessing rates above 5% for much of the year (if not all).

Again, the decline in the spending power of many fiat currencies may have increased the willingness of some savers to move into BTC. And combined with the aforementioned banking fears, periods of bitcoin price growth may have heightened investor appetite even further, even though the cryptocurrency market as a whole remained relatively depressed and volatile.

Bitcoin Dominance Trends: Where Now?

Just because bitcoin’s dominance is now relatively high doesn’t necessarily mean it’s going to stay this way. From a two-year peak of 50% in the middle of June, CoinMarketCap now puts BTC’s dominance at 48.4%. It’s therefore possible, at least in theory, that this could decline further as altcoins outperform BTC.

That said, it’s not entirely certain that alts will be performing BTC anytime soon. Not only does bitcoin tend to lead transitions from bear to bull markets, but the regulatory issues mentioned above could mean that relatively high levels of bitcoin dominance could be here to stay for a while yet.

Of course, such levels will never return to the 90% and 80% they reached back in 2017 and before. However, with Bitcoin being the only cryptocurrency that is definitively safe from the regulatory clutches of the SEC (and with the likelihood of spot BTC ETFs increasing) it remains the securest bet in crypto today.