- >News

- >What’s Behind Chainlink, Cardano’s Exponential Growth in 2020?

What’s Behind Chainlink, Cardano’s Exponential Growth in 2020?

Bitcoin and Ethereum may continue to receive most of the attention in crypto, but other, newer cryptocurrencies have performed extremely well this year. The two most notable of these are Chainlink (LINK) and Cardano (ADA), which have risen in price (over the year to date) by over 900% and 300%, respectively.

What has driven such growth? As with most price rises and falls in crypto, the answer to this question isn’t simple. However, a number of factors can be identified for each cryptocurrency.

With Chainlink, hype surrounding its core value proposition — its ability to feed external data to smart contracts and blockchains — caused an initial surge which has steamrolled thanks to FOMO (fear of missing out) and the rise of decentralized finance (DeFi). And with Cardano, a similar surge has been triggered by a core update that will let users stake their ADA in order to earn a passive income.

Both cryptocurrencies have grown in tandem with DeFi, which has also witnessed bullish growth this year. But as is usually the case in crypto, investors need to be aware that much of this rise could be the product of a bubble, which may pop in the near future.

Why Chainlink Has Risen By Almost 1,000% Since January

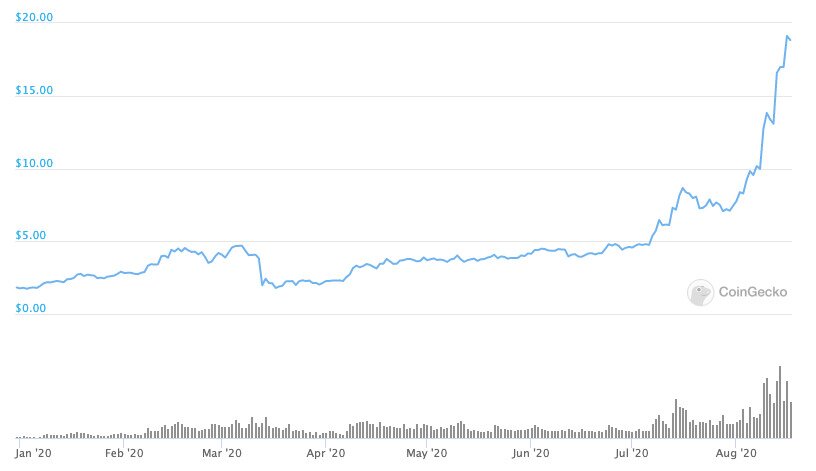

Chainlink is undoubtedly one of this year’s best performers. On January 1, one LINK would have cost you roughly $1.76. Earlier this week Chainlink hit an all-time high of nearly $20, a rise of 981.8%.

Source: Chainlink

The price of Chainlink has since pulled back slightly but it’s still trading at around $17 at the time of writing, which is impressive.

For those who aren’t aware, Chainlink functions as a decentralized oracle network. In plainer English, it collects external data from non-blockchain sources and feeds this data to other blockchains. It’s said that this function will have particular utility for smart contracts, which would need external data to execute its own actions.

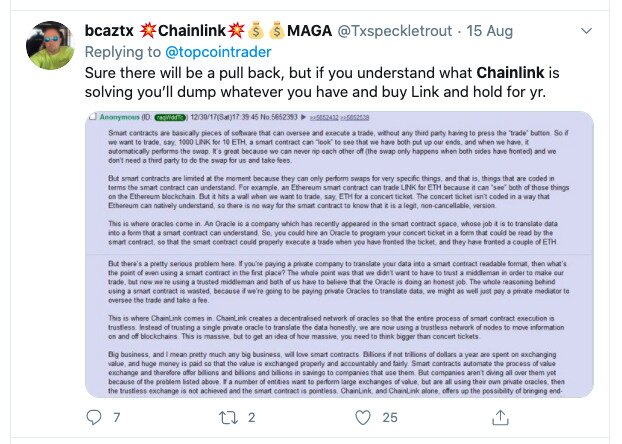

Chainlink has generated additional hype because it appears to solve a problem that had previously troubled oracle networks. It collects external data in a decentralized way, using multiple nodes to come to an agreement on the accuracy of the collected data.

This promise has already led to Chainlink being used or integrated with Synthetix, Aave, InstaDapp, KyberSwap, and other DeFi platforms. Based on such integrations and partnerships, and based on Chainlink’s value proposition, a growing number of traders believe it will become one of the big cryptocurrencies and platforms.

Source: Twitter

The growing belief in Chainlink has also been driven by a growing belief in DeFi. Because Chainlink works with so many DeFi platforms (usually to feed them price data), Chainlink appears to have grown in parallel with DeFi.

At the start of June, some $1 billion in total value was locked into DeFi platforms. As of writing, this figure now stands at $6.34 billion. This is a 534% surge in a couple of months, over which time LINK has also risen by around 360% (according to CoinGecko prices).

Make no mistake, the staggering rise in Chainlink price isn’t (only) about the market ‘rationally’ determining that the blockchain will be a fundamental part of the future economy. It’s also about hype and FOMO, two things which continue to loom large in crypto.

For example, the price of Dogecoin was recently boosted by the social media platform TikTok, where the cryptocurrency went viral after a video urged users to buy it because it was so cheap. It’s therefore interesting to note that the #chainlink hashtag on TikTok has garnered around 2.7 million views.

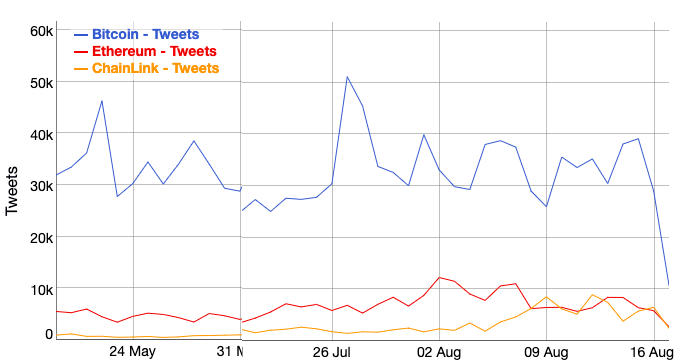

Likewise, Chainlink has enjoyed more Twitter posts than Ethereum at various points since the beginning of August, indicating that it’s often the second-most talked about cryptocurrency at the moment after Bitcoin.

Source: BitInfoCharts

Why Cardano Has Risen By Over 300% Since January

Next up is Cardano. It arguably doesn’t provide a ‘game-changing’ new platform like Chainlink, yet the proof-of-stake blockchain still has a fundamental draw that has attracted investors.

On July 29, Cardano began rolling out Shelley, its mainnet that will let users delegate their ADA to staking pools and earn staking rewards, which Cardano claims are around 4.6%. This has attracted investors who want to earn an income from their stores of crypto, while claims that Shelley will make Cardano “50-100 times more decentralized than other large blockchain networks” have also impressed traders.

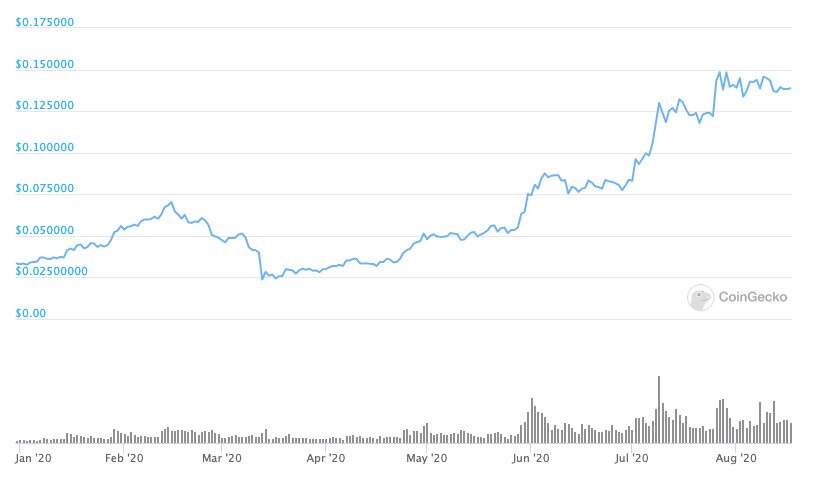

This upgrade set the ball rolling for Cardano, which was worth $0.03340385 on January 1, and is now worth $0.133046, providing an increase of over 300%. Much of this rise has happened since May 28, when the price was only $0.055132.

Source: CoinGecko

Since the end of May, ADA has risen by around 159.5%, as more traders have grown excited by the prospect of staking their coins and earning an income.

Source: Twitter

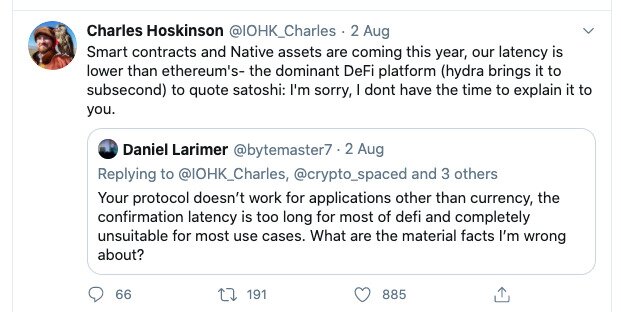

Again, decentralized finance plays a role in Cardano’s rise, even if it’s not quite as significant. The organization behind it — IOHK — are planning to push it further into the DeFi space, and are claiming it’s even better suited than Ethereum at handling DeFi applications.

Source: Twitter

It’s possible that traders expect Cardano to increasingly ride the DeFi wave in the future, even if it currently occupies a negligible space within DeFi right now. One blockchain auditing firm, Quanstamp, believes it will become the second biggest DeFi platform after Ethereum.

As with Chainlink, we also can’t discount hype, FOMO and herd behavior when trying to account for Cardano’s rise. It’s significant that ADA enjoyed much of its recent rise at a time when Bitcoin — and much of the crypto market overall — was largely flat, indicating that some of investors may have turned to Cardano for lack of other investment opportunities elsewhere.

Caveats for Chainlink, Cardano

It’s hard to say how much of the rise of Chainlink and Cardano is down to their actual fundamentals, and how much is down to FOMO and hype. One market analyst firm, Zeus Capital, has even claimed that Chainlink is “a massive pump-and-dump scheme”, and has written a detailed report outlining various problems it has claimed to have found. Others have rebutted that Zeus may have a large short position on LINK, and may be incentivized to talk it down.

Either way, it’s important investors conduct thorough research before investing in any cryptocurrency. Chainlink and Cardano may seem very promising right now, but their utility and sustainability have yet to be fully proven or realized. As the old saying goes, only invest what you can afford to lose.