- >News

- >Why the Current Climate is Poised to Bring a New Crypto Bull Market

Why the Current Climate is Poised to Bring a New Crypto Bull Market

There’s no question that the past year has been a decidedly challenging period for crypto and investors alike. The market’s total capitalization has plummeted significantly since the start of the year, with major cryptocurrencies like bitcoin and ethereum each experiencing steep declines from their all-time highs. These price drops have triggered a series of dramatic collapses, as several prominent platforms and companies within the industry declared bankruptcy, sending shockwaves through the broader market and leaving a lasting impact on the ecosystem.

Despite the turbulence and setbacks of the past year, there are signs that the coming months could bring a much-needed recovery. Prices appear to have stabilized near their lowest points, and many of the economic pressures that weighed heavily on markets are beginning to ease, hinting at a potential turnaround. Additionally, the challenges and upheavals of the past year are likely to reshape the cryptocurrency landscape, elevating the importance and prominence of certain sectors within the ecosystem.

Technical Indicators and Macros Suggest a Turnaround in 2023

Looking solely at the charts, technical indicators would suggest that a new crypto bull market is overdue. Indeed, the longer 2023 puts a new bull run off, the likelier it will become.

Source: TradingView

In the five-year bitcoin price chart above, the most important indicator is the relative strength index (purple), which signals when an asset (in this case BTC) is overbought or oversold. In this particular chart, bitcoin’s RSI fell below 30 in July, and has more or less remained under 40 ever since. This means that it’s oversold and is selling at a discount.

Looking at the previous time BTC’s RSI fell below 30 (towards the end of 2018), the cryptocurrency’s price staged a recovery in the following months, rising from just over $3,000 in early 2019 to close to $13,000 by the middle of the same year. Other falls in the RSI (especially around April 2020) also came before rallies, suggesting that something similar could happen in 2023.

In Bloomberg Intelligence’s 2023 Cryptos Outlook report, analyst Mike McGlone noted that for “as long as a Bitcoin 100-week moving average could be calculated, the crypto has never been at a deeper discount than at the end of November [2022].” He then predicted that “it could be a matter of time” before “the nascent fundamental value of the world’s most significant decentralized digital asset prevails” this year.

Looking at what has largely caused 2022’s bear market — rising inflation and rising interest rates — both have started to come down towards the end of this year. US inflation fell in October and again in November, suggesting a downwards trend that will continue into 2023. Correspondingly, the Federal Reserve has softened its stance on rate hikes, which will peak in 2023 before falling again.

Also, while the war in Ukraine will celebrate its first birthday in February, Ukraine itself has been able to recapture key territory in recent months, while the United States — one of the major backers of Ukraine’s effort — has recently said it’s prepared to talk with Russian President Vladimir Putin regarding bringing the conflict to an end.

Trials, Launches and Adoption Continue Despite Bear Market

2022 may have been a disappointment as far as price action was concerned, but it’s worth pointing out that, even with ongoing selloffs, a steady number of financial institutions and businesses increased their involvement with crypto.

Banks including BNY Mellon, BNP Paribas, Société Générale, DZ Bank and Nomura launched cryptocurrency services this year (joining the ranks of institutions that had already done so in 2021), as did a range of digital banks and finance apps such as N26, Plum and Nubank (which will also be launching its own virtual currency).

What this shows is that the potential size of the cryptocurrency market continues to grow, with its infrastructure and ecosystem expanding even within a bear market. This impression is reinforced further by the number of brands and businesses that have begun dabbling in NFTs, Web3 and the metaverse this year. This includes an exceedingly large number of fashion houses (e.g. Gucci, Balmain, Adidas, Tag Heuer, Hndsm, 10KTF, Timex and Prada), as well as a wide variety of sports teams and franchises, and not to mention in the arts and in music.

Combined with ongoing plans at various central banks to launch or pilot CBDCs, 2022 continued to witness growing exploration of and experimentation with blockchain technology and cryptocurrencies. As such, even if the macroeconomic conditions aren’t favorable right now, the groundwork for an even bigger bull market next time around continues to be laid.

Next Year’s Winners Among Platforms and Cryptocurrencies

Given that a growing number of pieces are in place for a bigger rally in the not-too distant future, it’s worth considering which platforms and blockchains/cryptocurrencies are set to benefit the most.

Well, given the continued interest in NFTs and Web3, there’s little doubt that Ethereum is one of the best-placed layer-one smart contract platforms in the ecosystem right now. It already accounts for 58.8% of the total value locked in of the entire cryptocurrency ecosystem, and with the Merge successfully completed in September, it’s set to cement its position further.

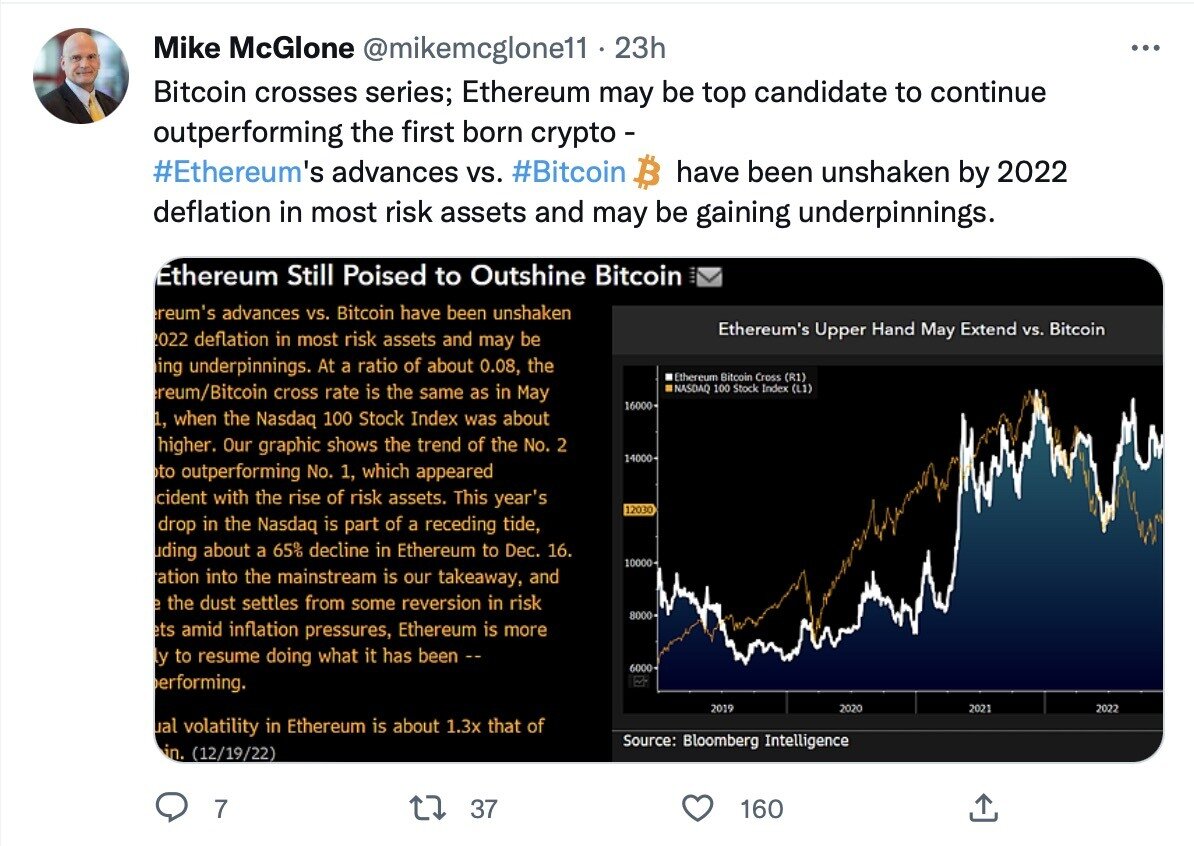

Source: Twitter

And given Ethereum’s continued dominance, investors should also expect the biggest layer-two scaling solutions to do well next year. This includes Polygon, Loopring and Arbitrum, all of which serve to provide cheaper Ethereum-based transactions during periods of high demand.

Such solutions are used often in the DeFi space, and this is one particular area that is set to grow considerably in 2023. This is largely because of the fallout surrounding the collapses of centralized finance platforms such as BlockFi and Celsius, which have fatally undermined trust in CeFi providers.

Similarly, expect self-custody to become much bigger in 2023, meaning hardware wallets such as Ledger and Trezor, as well as software alternatives such as Exodus and Trust Wallet. Again, this is because the failure of big exchanges such as FTX has made greater numbers of investors wary about leaving their cryptocurrency funds with centralized trading platforms.

That said, with retail investors needing fiat-to-crypto on-and-off ramps, it should also be expected that the biggest remaining centralized exchanges, such as Binance, Coinbase, OKX, Huobi and Kraken, will further consolidate their positions. Such consolidation may go against crypto’s spirit of decentralization, but for the new retail investors who will likely drive the next bull market, recognized names such as these will prove increasingly indispensable.

Of course, one of the exciting (if frustrating) things about crypto is that it’s unpredictable. While the above provides a good general overview of what’s likely to happen in the sector (based on current trends), you can almost certainly bet your bottom dollar that 2023 will also throw up more than a few surprises.