- >News

- >Why Biden’s SEC Pick Could Pave the Way for a Bitcoin ETF

Why Biden’s SEC Pick Could Pave the Way for a Bitcoin ETF

Trump is out, and Biden is in. This (mostly peaceful) transfer of power has attracted plenty of attention from the crypto community in recent days, not least because Biden’s pick for U.S. Treasury secretary — Janet Yellen — has come out as saying that cryptocurrencies “are a particular concern. I think many are used […] mainly for illicit financing.”

Crypto prices have fallen since this remark, made during Yellen’s confirmation hearing on January 19, with the price of bitcoin dropping from around $37,600 to as low as $29,355 on January 22. It has since returned to the $33,000-mark, although most mainstream commentary would have you believe that things continue to look grim for the crypto market, given the apparent bitcoin-bearishness of the Biden administration.

However, a wider reading of this administration’s initial actions reveals that it’s likely to be a boost for bitcoin in the long run. Not only does Biden’s pick for the chair of the SEC pave the way for a much-anticipated bitcoin ETF, but the introduction of another big stimulus package is likely to strengthen the macroeconomic conditions which made bitcoin more attractive to investors in 2020.

Biden Picks Digital Currency Initiative Advisor As SEC Chair

Yes, the new Treasury Secretary may not have the most favorable view of crypto, but Biden’s pick for the chair of the Security and Exchange Commission (SEC) is much more encouraging, not least because the SEC has more of a direct bearing over the cryptocurrency market than any other U.S. authority.

This pick is Gary Gensler, the former chair of the Commodity and Futures Trading Commission (CFTC), a former partner at Goldman Sachs, and also a senior advisor to MIT’s Digital Currency Initiative.

It’s this latter position which is the most significant. As an advisor to DCI, Gensler has spoken positively of Bitcoin and other cryptocurrencies on numerous occasions. He has referred approvingly to crypto and blockchain as “acting as a catalyst for change,” and he has also argued that the cryptocurrency market needs national regulation in order to grow.

In his view, nationwide regulation is necessary to provide the kinds of consumer protection that would invite more retail investors into the space. This is important, because it reveals that Gensler truly believes that bitcoin and crypto have a place within mainstream finance, and that he wants to help find it a place through regulation.

It’s because he believes such things that some commentators and experts regard his appointment as a sign that a bitcoin exchange-traded fund (ETF) will finally be approved by the SEC under a Biden presidency.

Such an ETF has long been regarded as representing a key milestone in bitcoin’s growth, because in providing a regulated investment vehicle that tracks the price of bitcoin and can be acquired via a traditional broker or exchange, it potentially opens the floodgates to widespread investment.

For example, crypto-specalized lawyer Jake Chervinksy is one person who believes that Gensler’s appointment is significant for bitcoin.

Source: Twitter

Even outside of the crypto industry, specialists suggest that Gensler’s appointment could quite easily herald a bitcoin ETF in the near future.

Publishing on January 22, the Bank of Singapore wrote a report in which it suggested that Gensler’s installation as chair of the SEC indicates that “US regulators may become more favorable to cryptocurrencies.” In particular, the report states that Gensler, due to his involvement with the Digital Currency Initiative, is likely to be “willing to allow broader investment in cryptocurrencies,” meaning an ETF.

“An important milestone here would be if the SEC approved an exchange-traded fund (ETF) for bitcoin or another cryptocurrency. This would offer a trustworthy, reliable investment vehicle, allow fresh participants to enter digital currencies, improve liquidity, lower volatility and help deal with reputational risks,” writes the bank’s chief economist, Mansoor Mohi-uddin.

Macroeconomics of Biden Administration

Another boost for bitcoin and crypto comes from what the Biden administration is likely to do in the fiscal arena.

That is, Biden has already unveiled a $1.9 trillion stimulus package, which would provide personal checks worth $1,400, raise the minimum wage to $15 per hour, and also provide state and local governments with $350 million in extra funding. What’s more, this package would be followed up by a second stimulus (the Build Back Better plan), which will distribute over $2 trillion to caregivers and infrastructure spending.

While the American economy certainly needs some kind of help, this is a considerable amount of spending, so much so that it’s likely to push up inflation and also weaken the U.S. dollar. In other words, it’s likely to make bitcoin even more attractive as a store of value, which is certainly saying something when the likes of MicroStrategy were already buying up bitcoin as an inflation hedge back in August 2020.

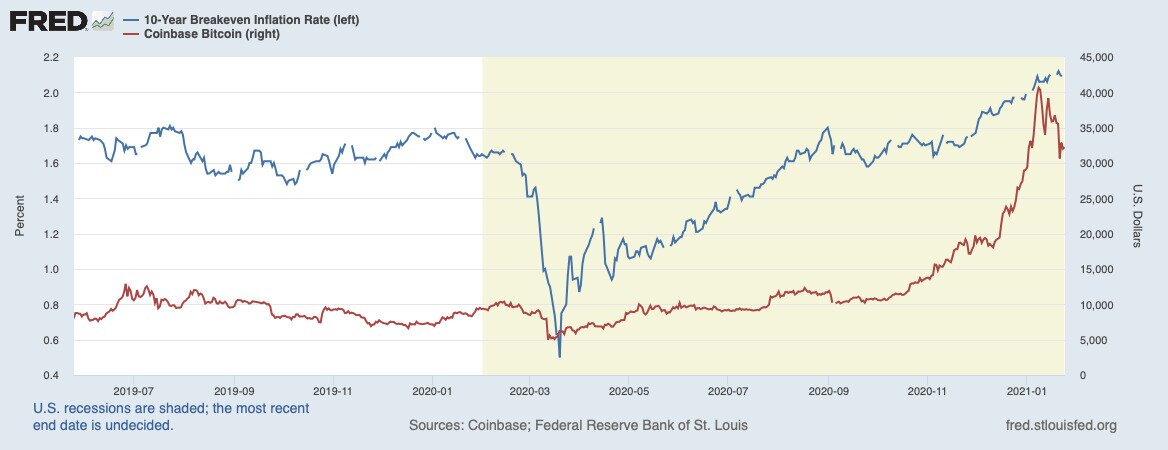

Bitcoin price (red) and 10-year breakeven inflation rate (blue). Source: Federal Reserve Bank of St. Louis

As the chart above shows, bitcoin ballooned to just over $40,000 at the same time that the 10-year inflation rate crossed 2%, having risen by around 20% between the start of 2020 (when it was 1.75%) and January 21, 2021 (when it was 2.10%).

With the Federal Reserve also relaxing its stance towards inflation in August, inflation is likely to rise even higher. Ultimately, this could drive even more institutional investors towards bitcoin.

But What About Yellen?

Of course, this doesn’t change the fact that newly installed Treasury Secretary Janet Yellen said some things about Bitcoin and crypto that seemed highly negative. In particular, she seemed to be pushing for some kind of ‘crackdown’ on the use of bitcoin and other cryptocurrencies.

“And I think we really need to examine ways in which we can curtail their use and make sure that money laundering doesn’t occur through those channels.”

However, this statement needs to be put in context. As the focus of Yellen’s other remarks that same day indicate, she was likely referring solely to illegal activities when she said “curtail their use.” She wasn’t talking about some general crackdown, and in fact, her position is likely not to be very different from Gary Gensler’s, since he too has spoken of the need to curtail the illegal use of cryptocurrencies such as bitcoin.

In a 2019 interview with Underscore VC, for example, Gensler remarked that crypto needs to fit with existing regulatory frameworks.

Speaking of the then-current regulatory approach to crypto, he said, “We don’t really want illicit activity to move to this new technology […] The anti-money laundering and antiterrorist regimes, that you’ve got to keep track of who buys and sells this. I think it’s pretty clear in that space.”

This is basically no different from Yellen’s remarks, even if Yellen focused only on the negatives of crypto and had little to say about its positives. Put differently, Yellen is no more hostile to crypto then Gensler, so crypto shouldn’t be too fearful.

If nothing else, we should expect the Biden administration to weigh up regulatory proposals and approaches carefully before rushing into anything. This is indicated by the fact that one of Biden’s first actions in office was to introduce a regulatory freeze, which will allow for a 60-day delay and 30-day consultation period on pending rules, including the controversial FinCEN reporting rule proposed in December.

Taken with Gensler’s appointment, this shows that unlike Donald Trump — who explicitly denounced bitcoin and crypto — Biden may end up being very good for Bitcoin and crypto.