- >News

- >Why DeFi’s High Interest Rates Aren’t Sustainable

Why DeFi’s High Interest Rates Aren’t Sustainable

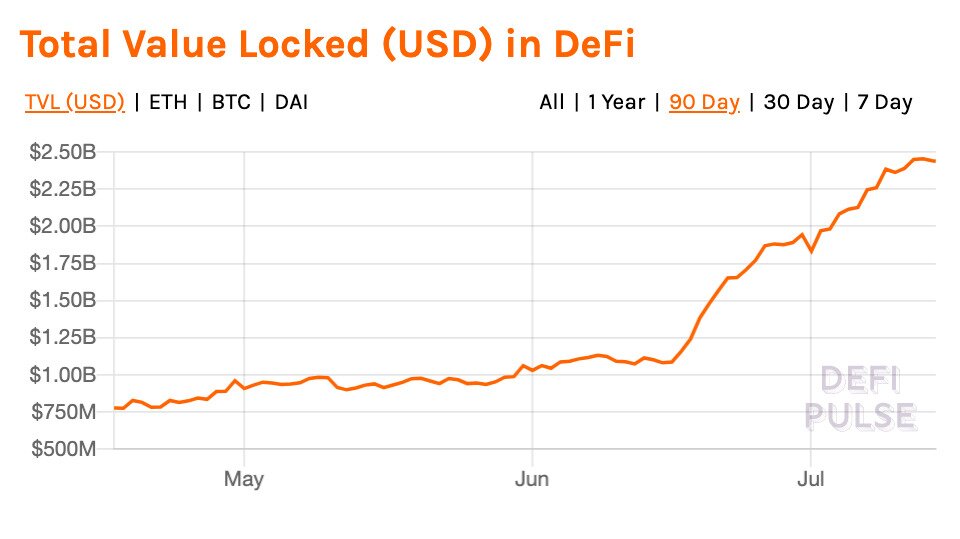

DeFi is blowing up at the moment, as cryptocurrency lending platforms such as Compound offer lenders interest rates as high as 68%. The total value locked into DeFi platforms is nearing $2.5 billion, having doubled between June and early July.

Figures such as these explain why DeFi is the hot topic in cryptocurrency right now. Bitcoin has been surprisingly non-volatile in recent weeks, so investors have been turning to cryptocurrency lending platforms such as Compound, Maker and Aave to get their speculative kicks.

But are the high interest rates offered right now by DeFi cryptocurrency lending platforms sustainable? Well, the answer is simple: no.

DeFi interest rates are determined by supply and demand, so the more investors pump money into platforms for lending, the lower interest rates will go. On top of this, it’s not clear whether the business models of the major lending platforms will enable high rates at larger scales, particularly when more retail users get on board.

DeFi Offering The Interest Rates Of Your Dreams

We may have entered a golden period for DeFi and cryptocurrency lending. According to DeFi Pulse, there is now $2.44 billion locked into various DeFi platforms, most of which offer crypto-lending of one form or another.

This value stood at $1.087 billion as recently as June 16, before doubling to just over $2 billion on July 4.

Source: DeFi Pulse

Cryptocurrency lending platforms account for $1.55 billion — or 63.5% — of the DeFi sector. Of these, Compound is the biggest (and also the biggest within DeFi as a whole), accounting for 44.21% of lending and 28.18% of DeFi.

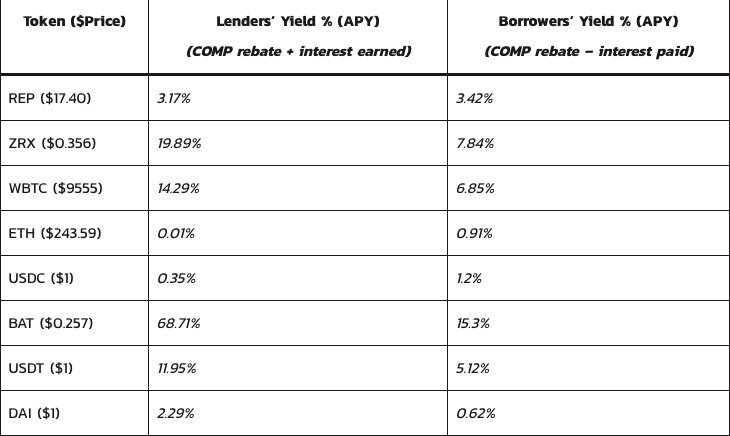

Why is it the biggest? Well, it’s largely because of the interest rates it offers. According to an analysis by CoinMarketCap, it’s highest interest rate (as of June 24) was 68.71%, which it offered to lenders of basic attention tokens (BAT). This figure includes the interest rate for the actual loan amount, as well as the rebates in compound (COMP) that the platform pays out to lenders.

As the table below shows, this isn’t the only high rate Compound offers, with its rates for 0x (ZRX), wrapped bitcoin (wBTC) and tether (USDT) also being better than any rate of return most investors could hope to receive from, say, the stock market.

Source: CoinMarketCap

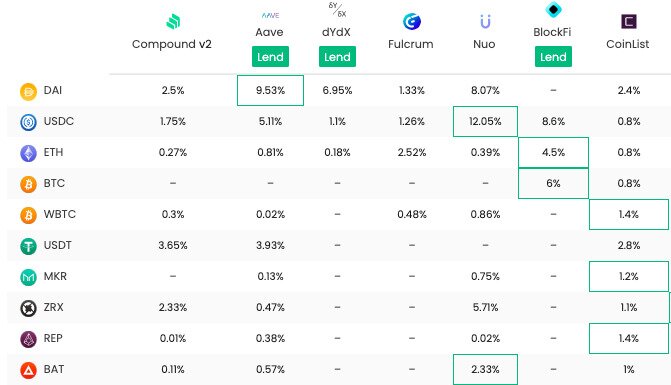

Compound isn’t alone in offering market-beating interest rates. According to DeFi Rate’s regularly updated lending rates, Aave currently offers 9.53% to lenders of DAI and 18.34% to lenders of TrueUSD. Nuo offers 12.05% to lenders of USDC, while BlockFi offers 6% for bitcoin and 8.6% Gemini dollars, to name only a few.

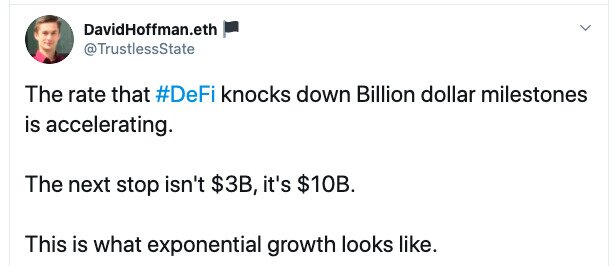

Such rates explain why the DeFi sector is taking off. For RealT COO David Hoffman, it won’t be long at all until crypto worth $10 billion is locked into DeFi platforms.

Source: Twitter

But It’s Not Sustainable

DeFi is certainly giving crypto a welcome shot in the arm. The high interest rates it offers, however, aren’t sustainable over the longer term.

In fact, they aren’t sustainable over the short term. Platforms such as Compound and Aave calculate lending interest rates based on supply and demand. As Compound’s founder Robert Leshner told the Financial Times in December, this means rates decline whenever lending supply rises.

“When demand to borrow an asset is super high, the interest rate is high, and when demand to borrow an asset is low, the interest rate is low.”

Many of the lending rates offered by cryptocurrency lending platforms aren’t that high. DeFi Rate’s data shows that Compound offers only 0.27% for Ethereum lending, while Aave offers only 0.3% for wrapped bitcoin, for example.

Source: DeFi Rate

In other words, despite a few notably high rates, the norm seems to involve more modest returns. And when it comes to the few higher rates, these may decrease as more people flood into DeFi.

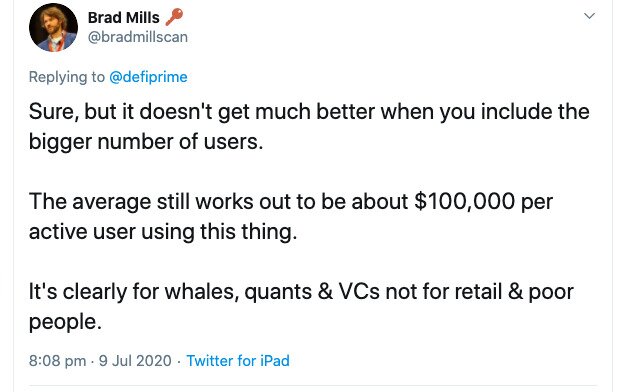

This is particularly the case in view of the fact that, right now, the DeFi space is occupied mostly by bigger investors, as opposed to retail investors. Looking at DappRadar, Compound has around 4,100 users per week and $700.8 million locked in per week. This means the average user has about $170,975 locked in, something which Bitcoiner Brad Mills recently pointed out on Twitter.

Source: Twitter

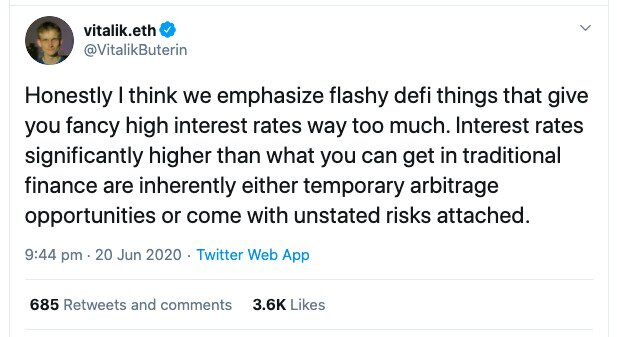

Mills also suggested that the higher rates may be a temporary, loss-leading strategy to bootstrap adoption in the initial phase of DeFi’s existence. This is also something that has been previously expressed to this author by Spartan Capital’s head of research Jason Choi. Likewise, Ethereum founder Vitalik Buterin has himself warned that high yields are either temporary or inherently suspicious.

Source: Twitter

As such, there’s reason to be doubtful of the high interest rates offered by cryptocurrency lending platforms. They aren’t likely to last, being pushed down by growing lending supply and by the market becoming more efficient at detecting arbitrage opportunities. There’s also the possibility that a longer term decline in crypto prices could lower lending rates.

One other factor affecting lending interest rates is cybersecurity. A number of DeFi platforms, including Bisq and bZX, have suffered attacks in recent months. As DeFi gains more adoption, it may need to spend more money on constantly reinforcing its security. As a result, it may take a higher percentage of lending returns as fees.

Still, even if cryptocurrency lending interest rates uniformly come down to less impressive levels, they’re still likely to remain worthwhile to at least a portion of the market. Because with the primary crypto market likely to remain volatile for the near- and medium-term, lending may end up being a less risky way of earning a return.