- >News

- >Will 2023 Bring a Crypto Regulation Crackdown in the United States?

Will 2023 Bring a Crypto Regulation Crackdown in the United States?

If 2022 was about crypto suffering a bear market, then 2023 is shaping up to be a year in which it faces sweeping regulatory action. This at least appears to be the case in the United States, where not only is Ripple awaiting the end of its long-running case against the SEC, but where also Kraken has been forced to stop offering staking services, and where Paxos — the issuer of the BUSD stablecoin — is facing action for allegedly issuing an unregistered security.

When coupled with ongoing efforts in Congress to introduce comprehensive cryptocurrency legislation, such developments indicate that 2023 may finally be the year the industry receives the regulatory framework it has so far lacked. Of course, with the SEC proving very trigger happy in the last few months — and with the White House recently urging lawmakers to focus on ‘protecting’ investors and consumers — it could turn out that such a framework ends up being exceedingly restrictive.

However, while there is a chance that the US could severely limit certain activities and areas within crypto, this article will explain that the country will have to remain mostly open to the industry if it wishes to be competitive within an evolving digital economy. As such, investors and traders shouldn’t start migrating just yet.

The State of US Crypto Regulation

Part of the issue in the United States right now is that the lack of crypto-specific legislation has created a big regulatory vacuum. Because of this, existing agencies and regulators — with the Securities and Exchange Commission (SEC) being the worst offender — are currently rushing to assert jurisdiction over crypto, based on pre-existing laws.

The most obvious example of this is the 1933 Securities Act, which the SEC has used as a ramrod to batter more than a few cryptocurrency firms in recent years. In conjunction with various precedents (such as the ‘Howey test’ from 1946), the regulator has used this piece of legislation to take regulatory action against a long list of companies, including Telegram, LBRY, Ripple, Kraken, and now Paxos (to name only a few).

It nearly goes without saying that the cryptocurrency industry doesn’t appreciate the SEC’s efforts here, with figures long arguing that, in the context of having no clear standalone legislation or framework, the regulator’s actions have created severe uncertainty and ambiguity. And indeed, there is currently no piece of dedicated cryptocurrency legislation passed in the United States.

That said, there are numerous crypto bills currently under debate in Congress and at various stages of progress. This includes the Stablecoin TRUST Act and the Lummis-Gillibrand Responsible Financial Innovation Act, which would classify most cryptocurrencies as commodities and thereby give jurisdiction over them to the CFTC (Commodity Futures Trading Commission).

Is The US Gearing Up for a Cryptocurrency Crackdown?

This background is important, since even though recent moves towards greater regulation could seem like a negative for the cryptocurrency industry, it would actually provide a much-needed corrective to years of uncertainty. And as it stands, it’s not entirely clear that the many of the worst-case scenarios for crypto regulation will actually be realized.

Let’s take one possibility that has been discussed considerably in recent months: that the US will ban stablecoins outright.

The fear that this will happen stems from two things. Firstly, from a draft bill that leaked in late September 2022, a few months after the spectacular Terra collapse. This bill proposes to criminalize “endogenously collateralized stablecoins,” meaning stablecoins backed by other cryptocurrencies created by its own issuer (much like Terra did with LUNA and USTC). Secondly, from the fact that the SEC has charged Paxos with issuing an unregistered security, in the form of the BUSD stablecoin (which is not ‘endogenously’ collateralized).

Together, these two recent developments might create the impression that the US really is gearing up to ban all stablecoins. However, it needs to be noted that the draft bill above (which was leaked to Bloomberg) hasn’t even been formally presented to Congress, let alone debated, amended, passed and written into law.

On top of this, the SEC taking legal action against Paxos because of BUSD does not automatically mean stablecoins will become illegal. Indeed, Paxos declared in its statement that it “categorically disagrees” with the SEC’s assessment on this issue, and that it “will engage with the SEC staff on this issue and are prepared to vigorously litigate if necessary.” So an SEC victory here is hardly a given, let alone a scenario where such a victory leads to a blanket ban on all stablecoins.

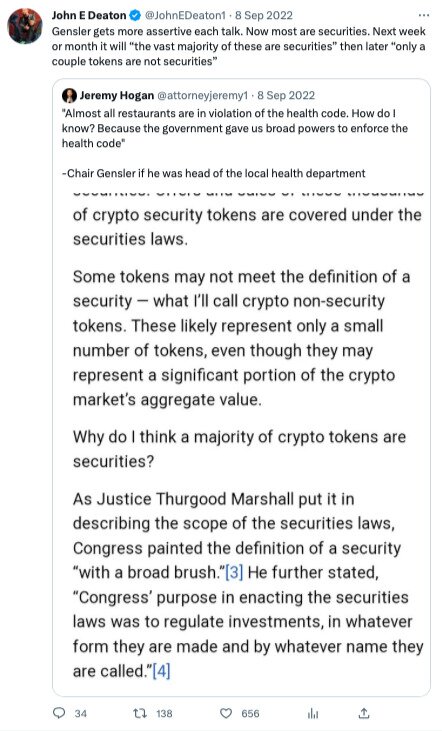

And speaking of the SEC, let’s address another fear: that the US — via its securities regulator — will classify pretty much all cryptocurrencies as securities, except for Bitcoin and maybe Ethereum. This has been fed, for example, by remarks made by SEC Chair Gary Gensler, who has gone on record as saying that the “vast majority” of cryptocurrencies are securities. Such comments have invited real concerns that, effectively, all cryptocurrencies — save for Bitcoin and a few others — will be deemed securities.

Source: Twitter

The thing is, the SEC’s views and the position of US law are two separate entities. It’s clear that the SEC already regards nearly all cryptocurrencies as securities, yet it doesn’t have the power or the resources to go after all of them, while it also lacks the means to ensure that Congress and US legislation takes the same stance. Also, even if Capitol Hill were to come through with legislation that reinforces the SEC’s position and confirms that cryptocurrencies are generally securities, this would not actually ban most tokens. Token issuers would still be able to register their cryptocurrencies with the SEC, although obviously this would necessitate many relatively decentralized networks to behave more like centralized corporations.

This also leads to another anxiety, namely that stringent US legislation and regulations would marginalize the cryptocurrency industry, with American banks refusing to do business with companies in the sector. By extension, these same banks may also refuse to process transactions to and from exchanges and other platforms, making it very difficult for the average retail investor to find on-and-off ramps.

“The regulators are effectively building a wall between crypto trading and the banking and the securities markets to prevent the types of systemic vulnerabilities that led to the 2008 financial crisis,” said Columbia University’s Todd Baker, speaking recently to Bloomberg.

There does appear to be some kind of cooling effect going on right now between the traditional banking sector and crypto, with US banking regulators warning financial institutions away from cryptocurrency dealings. However, two things aren’t clear: 1) how extensive banking reluctance to deal with crypto will be, and 2) how long-term such reluctance will prove. For instance, regulated US exchanges such as Coinbase and Kraken still have little problem processing US dollars for their customers, and it’s likely to stay that way for the foreseeable future.

Will the US Cryptocurrency Industry Have to Move Overseas?

This all feeds into perhaps the fear concerning some people, which is that regulation will force much of the US crypto industry to relocate outside of the US. In other words, there could one day be no legitimate US cryptocurrency industry, with US-based customers having to do whatever trading they can with international exchanges and platforms.

While there’s no doubt that US regulators are seeking to restrict crypto in various ways at the moment, it would be a colossal mistake on the part of the US to kill off its cryptocurrency industry. Many lawmakers recognize this, calling for tailored regulation/legislation that accounts for the particularities and innovations of crypto.

For example, in a January speech at the Duke University Digital Assets Conference, SEC Commissioner Hester Peirce said, “The crypto industry encompasses a wide variety of experiments being conducted by many different people, so we must avoid painting them all with the same regulatory brush.” She also said that regulation “should foster an environment where good things flourish, and bad things perish, not the other way around,” indicating that reasonable lawmakers and regulators want to encourage the positive innovations coming out of crypto.

Such sentiments (which Peirce has repeated elsewhere) have also been echoed, for example, in the Responsible Financial Innovation Act, presented to Congress in June 2022. This bill seeks to create “a regulatory framework that spurs innovation,” while also affirming that it’s “critical that the United States play a leading role in developing policy to regulate new financial products.”

Put differently, the US political and regulatory establishment doesn’t want to choke off America’s crypto industry, even if it may seem that way sometimes. And while it may take more than a few months for the industry to secure the regulatory clarity it so desperately needs, such clarity will arrive, sooner or later.