- >News

- >Will Binance Be the Next Big Crypto Exchange to Collapse?

Will Binance Be the Next Big Crypto Exchange to Collapse?

No one ever said crypto is boring. Of course, eventfulness can be negative as well as positive, and at the moment it seems that much of what’s happening in the cryptocurrency market is less-than encouraging, at least for people still going long. Not only have FTX and BlockFi declared bankruptcy in the past few weeks, but speculation continues to swirl about other major players. And perhaps none come more major than Binance, which despite offering to step in at one point to save FTX in early November, now looks like it’s potentially suffering issues of its own.

Binance’s drama began early last week, when it emerged that the US Department of Justice was (and still is) weighing up whether to file criminal charges against the exchange in relation to money laundering. This news caused two things to happen: 1) the BNB price fell from $285 on Monday December 12 to $262 the next day; and 2) Binance’s customers began withdrawing their funds from the exchange en masse, with $1.9 billion in deposits being withdrawn in the 24 hours following disclosure of the DoJ news.

In fact, withdrawals continued apace in the days that followed, with net outflows passing $6 billion by the end of last week. Even worse, last Friday brought the news that Mazars — the auditors Binance had hired to certify its proof-of-reserves — had “temporarily” suspended its work with the exchange, casting the state of Binance’s finances into further doubt.

However, despite an increase in fear over the past week or so, observers have affirmed that Binance’s ability to honor billions of withdrawals offers proof of the robustness of its finances. And with more than $50 billion of crypto still in its reserves, it will take many, many more withdrawals to put its existence in real jeopardy.

Binance Suffers a Bank Run

Binance has witnessed a substantial outflow of holdings in the past month. According to analytics firm Nansen, the exchange had more than $69.5 billion in its reserves a month ago, with this figure now standing at $54.7 billion.

Source: Twitter

This is still a big figure, but if withdrawals continue at the same rate over the next few weeks, Binance’s situation could become more unstable real soon, particularly if the market also continues to witness further price falls.

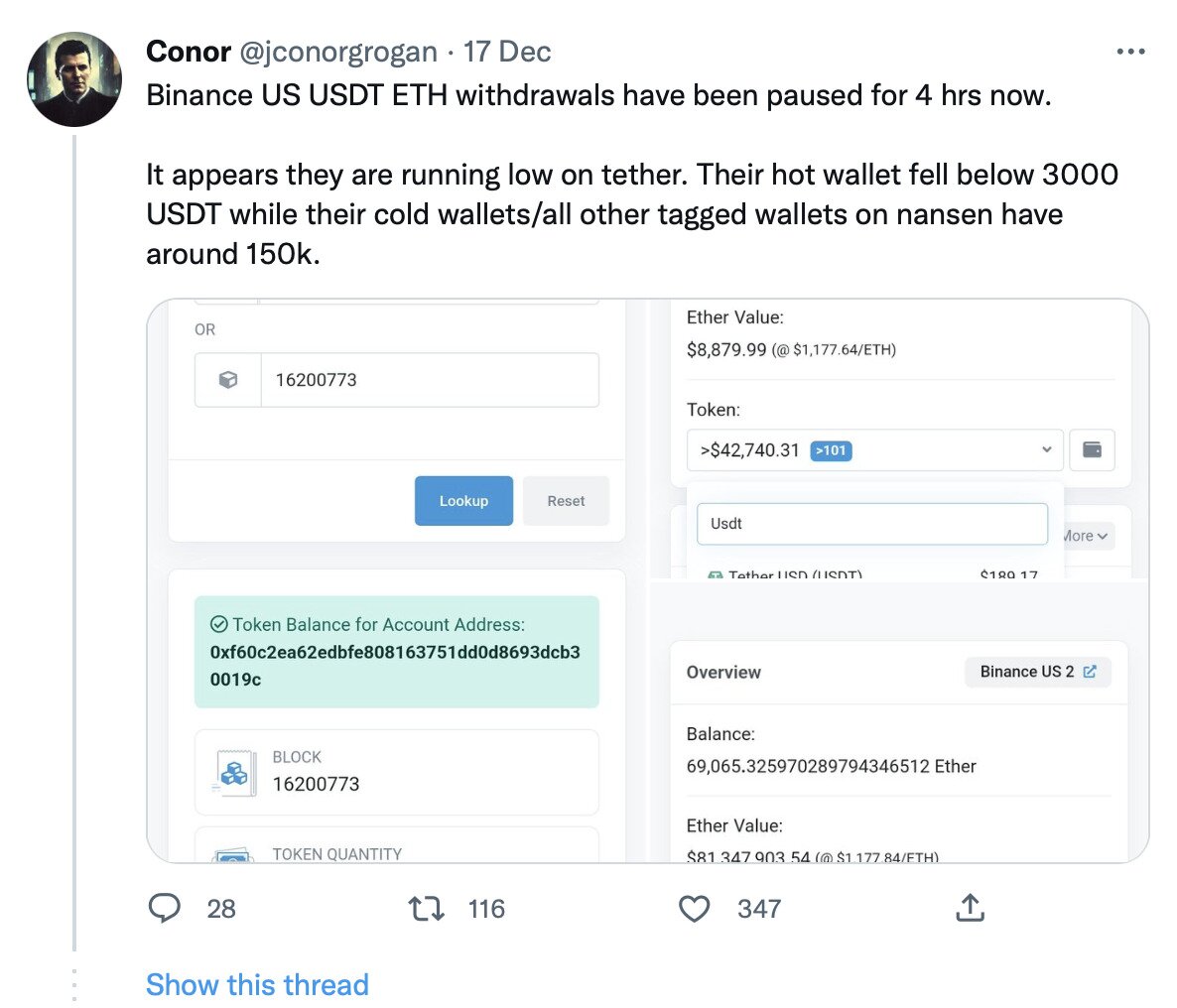

Indeed, commentators are suggesting that Binance is already in some trouble, insofar as it appears to have paused withdrawals for certain cryptocurrencies and assets. This includes withdrawals for stablecoins such as USDT and USDC, as well as for other cryptocurrencies such as cardano and monero.

Source: Twitter

Binance Counters the FUD

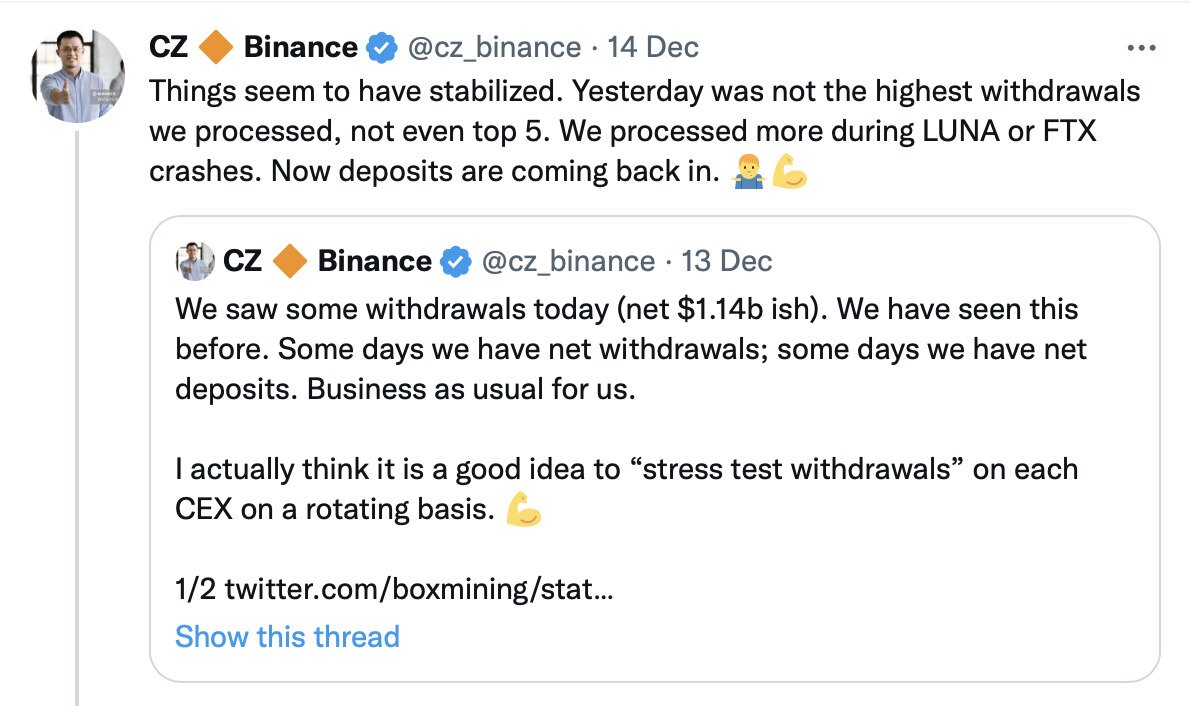

There’s no doubt that Binance is experiencing a noticeable surge in withdrawals requests, with CEO Changpeng Zhao acknowledging this in a number of tweets. However, he also noted that the level of outflows wasn’t unprecedented, claiming that the exchange processed more withdrawals during this year’s FTX and Terra collapses.

Source: Twitter

More than a few commentators and experts agree with Zhao that the recent spate of withdrawals are, while high, nothing to be alarmed about. It may be an overused counterargument in crypto, but ‘FUD’ seems to apply in this particular case, and for various reasons.

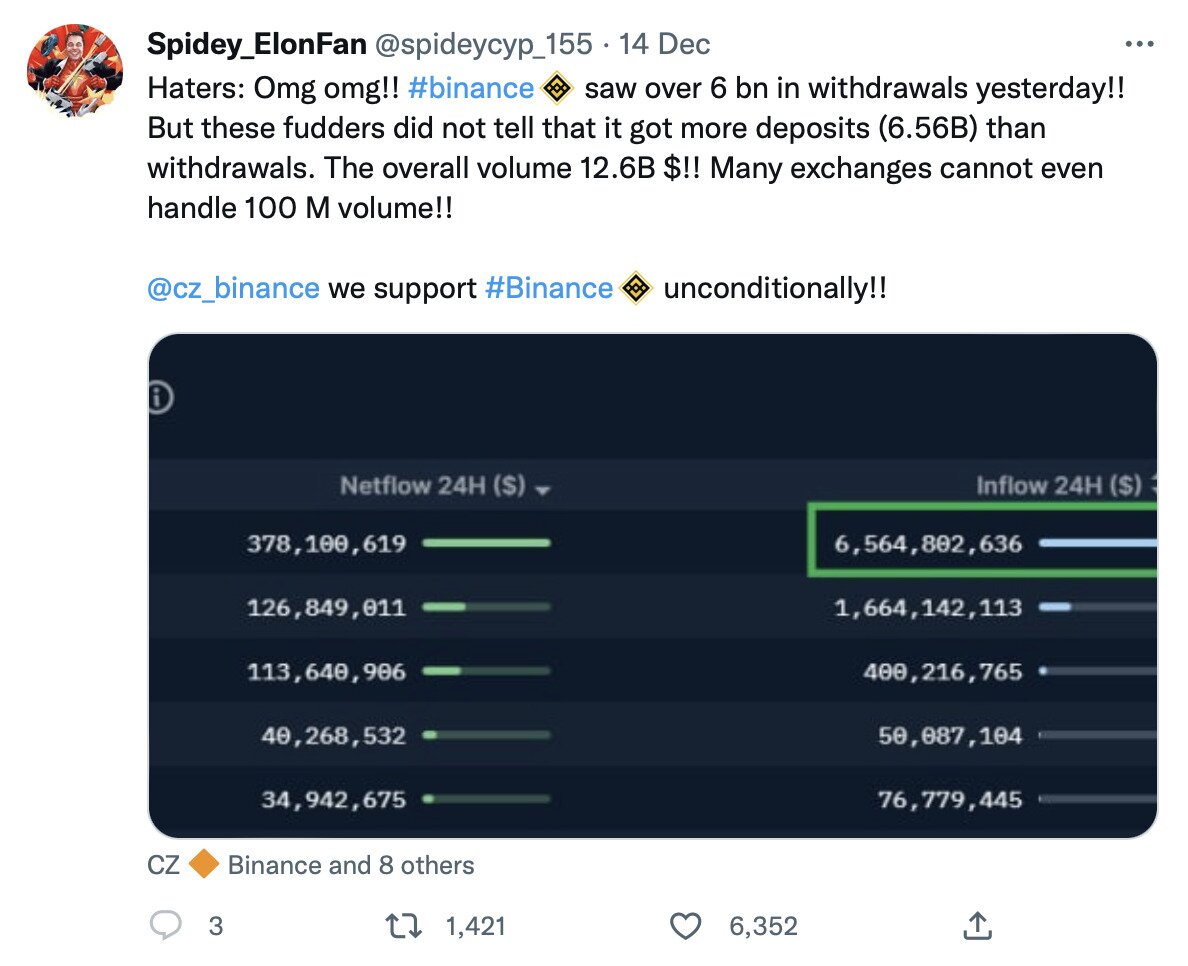

Firstly, Binance has also witnessed inflows as well as outflows in the past week or so, with some days of its ‘bank run’ actually witnessing net deposits. Observers have also noted that, over time, Binance has witnessed a steadily growing exchange balance with steady inflows, whereas FTX had a balance that fluctuated wildly.

Source: Twitter

Secondly, analytical firms have studied Binance’s on-chain behavior in recent weeks, with CryptoQuant declaring on December 15 that “our data suggest Binance’s ETH and Stablecoin reserves are not showing “FTX-like” behavior at this point.”

CryptoQuant also pointed out that, unlike with FTX, its reserves are mostly not in its own native token. In fact, BNB represents at most only 10% of its reserves, putting it in a much better position to weather financial stress than FTX.

Other sources of potential concern can also be dismissed, such as Mazars aforementioned suspension of work on Binance’s proof-of-reserves. This came amid the firm ceasing work with all of the crypto-exchanges it had worked with up until that point, with the auditor stating that it had an issue with how ‘proof-of-reserves’ had been presented and perceived in certain quarters.

As such, Mazars exit is not really a comment on Binance. It’s not as if the French auditing company had found a massive hole in the exchange’s reserves, and therefore wanted to remove itself from any association with Binance, so as not to be blamed for anything bad that might happen.

What Happens Next?

While the above should go some way to assuaging fears that it might be the next major exchange to take a tumble, Binance is not entirely out of trouble.

For instance, it seems that the market, or at least part of the market, seems to believe that it really is in trouble. Open interest in BNB has climbed very quickly, with more than $100 million in shorts against the coin opened in the past couple of weeks. Based on the (disputed) efficient-market hypothesis, this would imply that there’s some substance to concerns.

Either way, it’s certainly true that the US Department of Justice is investigating Binance, and it also seems credible that it may be close to charging the exchange with anti-money laundering violations. If it does, this would almost certainly knock faith in the exchange, causing another spate of withdrawals.

Of course, it’s questionable as to whether such a spate of outflows would be enough to seriously endanger Binance. Given that it has over $50 billion in crypto in its reserves, it would presumably take a seriously large market crash to cause it real trouble. And while 2022 has been a terrible year for crypto, it’s arguable that the market has hit its bottom, with few major price falls in store for investors.

Indeed, with the cryptocurrency market witnessing increased involvement from big financial institutions even during its current downturn, it remains well-placed to grow once the global economy turns a corner. And with Binance’s reserves remaining strong, the world’s biggest exchange will likely be leading such growth.