- >News

- >Will GameStop Traders Flock to Bitcoin? Not Necessarily

Will GameStop Traders Flock to Bitcoin? Not Necessarily

The financial world is aflutter with a new craze: anti-short-selling pumps. Originating in the wallstreetbets subreddit, individual traders are now banding together to buy certain stocks hedge funds are selling short. The trend stems from antipathy towards the kind of Big Finance that profits from failure and misery, and that in the process makes such failure more likely.

Whatever you make of this new and unusual social phenomenon, it seems almost tailor-made for Bitcoin. The people responsible for boosting stocks such as GameStop and AMC seemingly detest big, institutional short sellers, who are currently shorting bitcoin itself to the tune of over $1 billion. It therefore stands to reason that, once they’re done with GameStop, they’ll turn to bitcoin, which is arguably a more attractive proposition than ‘failing’ GameStop stocks, given its end to 2020 and deflationary economics.

However, while wallstreetbets collective behavior has given rise to similar behavior from more crypto-focused groups, a sober appraisal of available evidence suggests that the subreddit itself won’t turn to bitcoin, or other cryptocurrencies for that matter. Why? Because as a quick perusal of its Reddit page shows, it is (unfortunately) anti-crypto.

WallStreetBets Doesn’t Like Bitcoin or Crypto

Yes, Bitcoin and wallstreetbets might seem like a match made in Heaven, but apparently not to wallstreetbets itself.

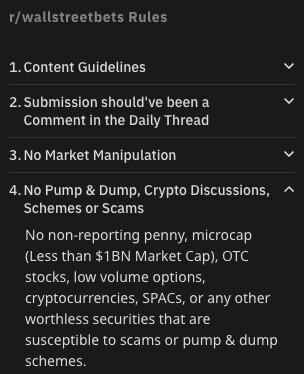

Exhibit A is wallstreetbets’ rules, which determine what can and cannot be posted within its subReddit:

Source: Reddit/wallstreetbets

Sadly, its fourth rule (out of nine) prohibits any discussions of crypto. “No … cryptocurrencies … or any other worthless securities that are susceptible to scams or pump & dump schemes.”

It’s interesting that the subReddit lumps Bitcoin in with “worthless securities,” particularly when there’s a case that the forum has been used to pump companies which a number of analysts have argued will inevitably fail. But there you go.

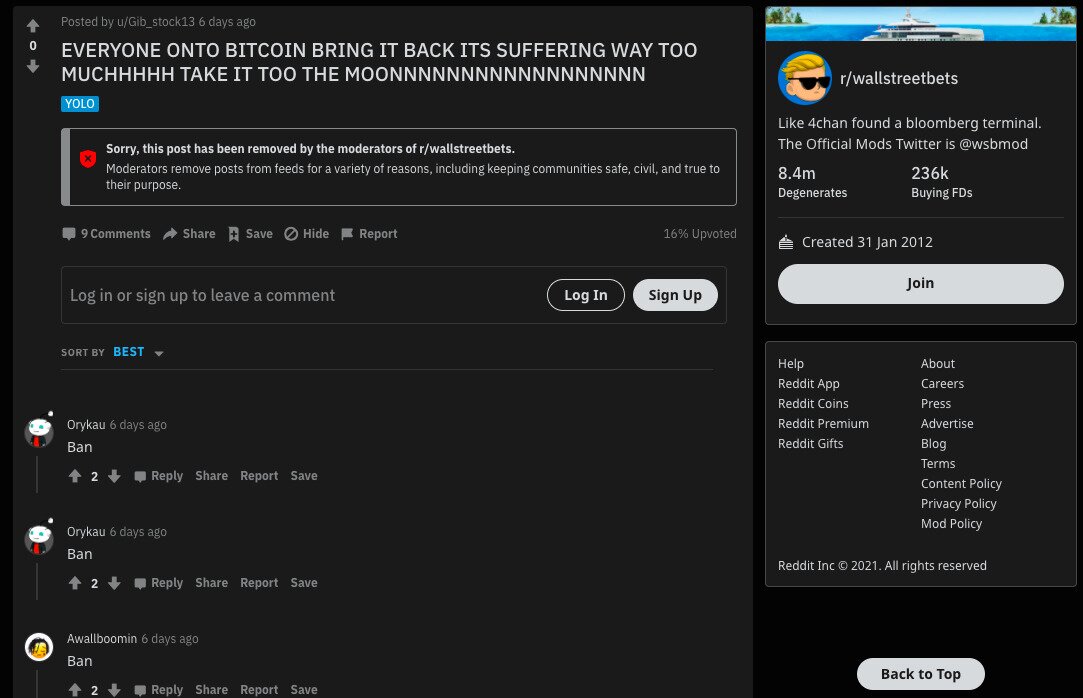

This no-crypto rule is one that the forum upholds with almost religious fervor, even to this day (in fact, particularly in recent days and weeks). This is attested by the number of Bitcoin posts which are instantaneously removed by moderators, complete with calls for posters to be banned.

Source: Reddit/wallstreetbets

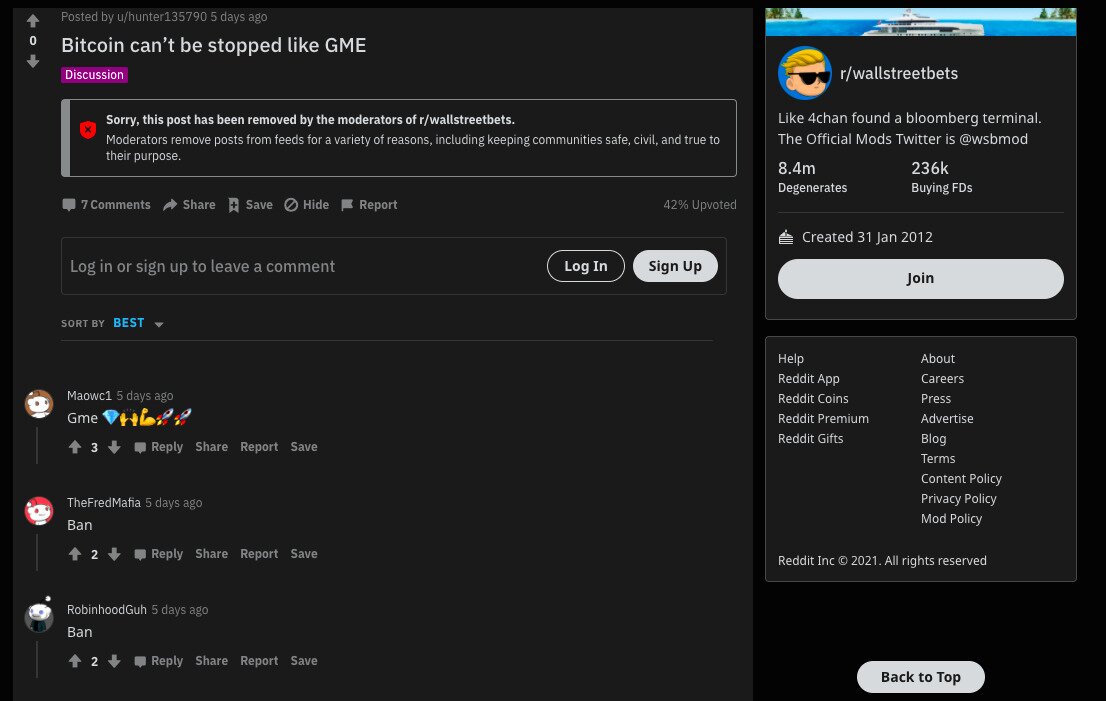

So while there are a number of people coming to the wallstreetbets subReddit to post about Bitcoin and urge others to buy, it seems the majority of members are almost zealously opposed to even a mention of crypto.

Source: Reddit/wallstreetbets

This anti-crypto stance is particularly discouraging when you bear in mind that the subreddit has 8.4 million members, most of whom share the kind of anti-Big Finance mentality of many bitcoin holders. Even worse, there are other affiliated subreddit that operate much like wallstreetbets, and that have a similar disdain for crypto.

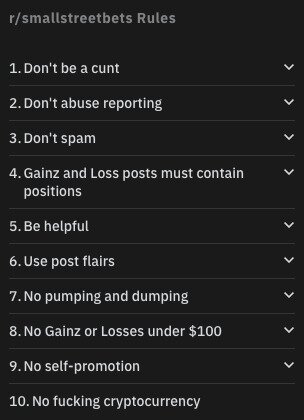

Take smallstreetbets, which is basically wallstreetbets but for people with less spare cash to throw around. Check out its tenth rule, and our apologies for the colorful language:

Source: Reddit/smallstreetbets

It’s also worth pointing out that the popular Stocks subreddit, with two million members, also bans discussion of crypto, while the similarly popular investing subreddit permits only “major cryptocurrency news.”

If there is going to be a continuation of collectivized anti-shorting pumps, and if it’s going to be generalized further among retail investors worldwide, it would seem (at this moment in time) that Bitcoin and crypto are going to be largely left out of the fun. Strange, but apparently true.

Crypto Follows WallStreetBets’ Example

That said, it’s already evident that significant portions of the crypto community have been inspired by the doings of wallstreetbets and its ilk.

The subreddit satoshistreetbets (created last February) was responsible for a very recent Dogecoin surge, which saw the price of the meme-based crypto rise by 833% in less than two days, from $0.0075 to $0.07.

Likewise, two associated Telegram groups (pumpxrp and pumpxrpofficial) with around 300,000 members coordinated a similar ‘buying attack’ on XRP. The cryptocurrency, which is currently being sued by the SEC, rose from $0.29 to $0.71, again in a couple of days.

As these two coordinated movements show, the emergence of collective trading within the legacy financial system has inspired at least some crypto traders to follow suit. It’s therefore a possibility that the trend may spread further through crypto, with social media being used to encourage traders to buy and hold, and to discourage them from selling.

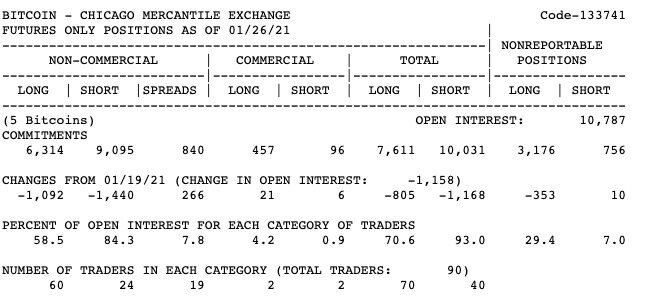

This possibility is given further weight by the fact that over $1 billion in shorts are currently opened against bitcoin on the Chicago Mercantile Exchange. As the table below shows, more traders on CME are short bitcoin than long.

Source: CFTC

With so many institutions shorting bitcoin, you’d think the time was ripe for a wave of retail traders to swoop in and pump bitcoin. Not only would this give a number of hedge funds a bloody nose, but with bitcoin having better long-term prospects than Dogecoin and XRP (not to mention GameStop), you’d think the traders involved in any coordinated action would have a better chance of profiting.

Numerous analysts think this is the case, with a reduction in circulating supply likely to create a short squeeze, where short-sellers are forced to buy bitcoin in order to close their positions before they lose too much money.

Source: Twitter

At the same time, posters within satoshistreetbets are urging other members to turn to bitcoin. This may suggest that a coordinated buying attack for bitcoin may be in the works, although such posts have received few upvotes.

However, at risk of being a killjoy yet again, a GameStop-style pump is much less likely for bitcoin than it is for other cryptocurrencies. This is because it represents a larger market with greater depth and liquidity than others, meaning that it’s considerably harder to move prices. By contrast, cryptos like dogecoin and XRP have lower prices, lower liquidity, and lower depth, so their prices can be manipulated more easily.

This is why recent buy attacks have focused on dogecoin and XRP (and not bitcoin, or ethereum), and both have in fact also witnessed coordinated rallies before. In other words, in the context of crypto, it’s likely that the motivation doesn’t relate to ‘sticking it to the man’ (à la GameStop), but mostly to pumping and dumping,

So while crypto may witness an appreciable increase in coordinated buying over the short-term, the GameStop mania is unlikely to be a game-changer for Bitcoin. Which means, your best bet is still to buy whatever bitcoin you can afford and simply sit tight.