- >News

- >With Rates This High Will The Next Crypto Bull Run Have to Wait?

With Rates This High Will The Next Crypto Bull Run Have to Wait?

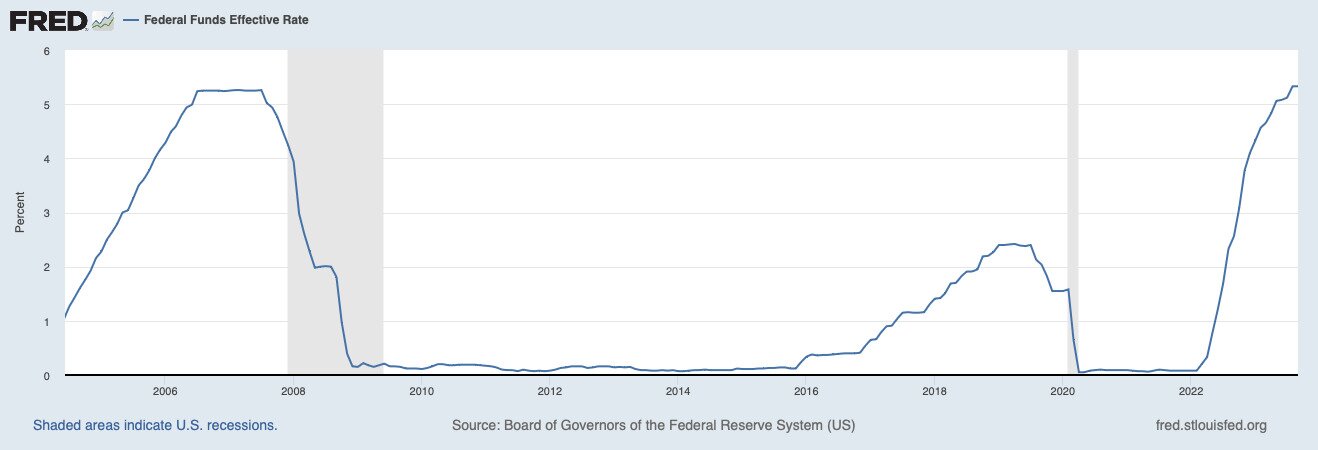

The Federal Reserve continues to hold fast to high interest rates, with its benchmark funds rate remaining unchanged after its latest FOMC meeting in September. It currently sits within the 5.25%-5.50% range, putting it at its highest level since the 2007 financial crisis. This has had a substantial effect on financial markets, with yields on government bonds having to rise to compete with interest rates, and with stocks and other speculative assets suffering as a result.

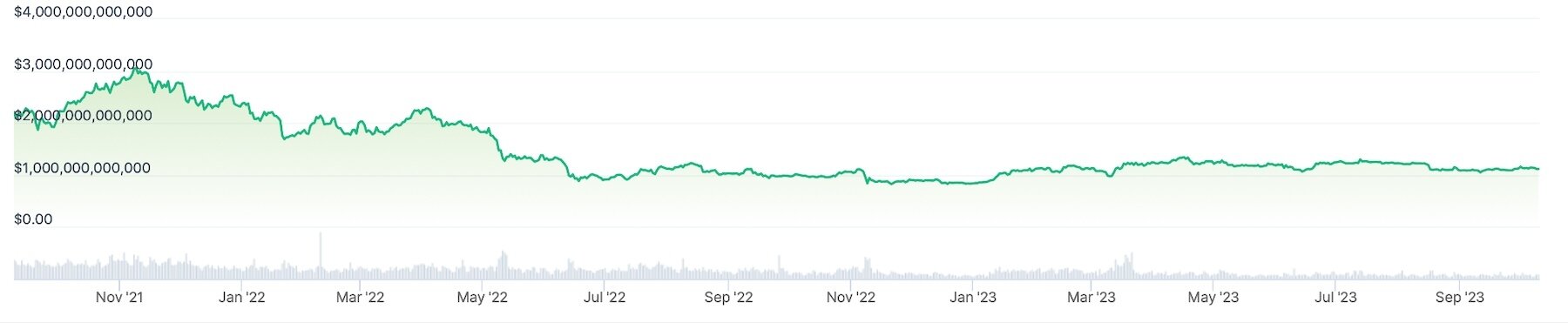

Such speculative assets include cryptocurrencies, which have fallen in value over the course of 2022 (and 2023) in a loosely inverse correlation with rates. And with the cryptocurrency market’s total cap remaining 63% below its all-time peak of $3 trillion (set back in November 2021), it’s clear that the persistence of historically high rates has prevented this market from staging a significant recovery.

Yet while many observers may conclude that crypto won’t see a new bull market until rates return to lower levels, it’s likely that a strong reversal is not necessary for the next expansionary cycle to begin. Instead, all the Fed needs to do is signal that its recent course of rate hikes has come to end, something which it’s likely to do after its next FOMC meeting at the end of October. And when added to an improvement in the wider economic picture, such a cessation is likely to make investors a little more optimistic over time, benefiting the crypto market.

Accelerating Rates = Bad, Stable Rates = Not So Bad

As an indicator of the relationship between rates and cryptocurrency prices, it’s worth recalling that the effective federal funds rate (the Fed’s base rate) was at 0.08% in November 2021. This was basically a record low, and it also happened to be when the crypto market hit an all-time high, with the abundance of cheap money making speculative assets more attractive to the average investor.

The effective federal funds rate since 2005. Source: Federal Reserve Bank of St. Louis

It’s no coincidence that the cryptocurrency market began falling once rates started rising from early 2022 onwards. Indeed, the market’s total cap hit a two–year low of around $820 million in late December 2022, just around the time the federal funds rate climbed to 4.33%.

The cryptocurrency market’s total cap since October 2021. Source: CoinGecko

Yet the key thing to remember is that it’s not simply higher rates in themselves that causes price declines, but also expectations of higher rates. It’s such negative expectations which have the biggest impact on price declines, and which also explain why the market fell faster during the main period of rate hikes, rather than when such rates actually hit their highest levels.

“What the market doesn’t like is rapid changes in the monetary landscape,” said JP Morgan Private Bank’s David Stubbs, speaking in January 2022.

Stubb’s remarks help to explain why a sudden ramping up of rates had such an outsized effect on crypto (and stocks) at the beginning of the Fed’s program of ‘quantitative tightening.’ Yet the higher rates have had less of an effect now, even though they remain at their highest levels in decades.

Another key to understanding the dynamic between asset prices and rates is that rising interest rates do not simply occur in a vacuum. In fact, such rates are likely to have an impact on consumers and business and, in turn, economies, with any potential decline in GDP likely to make investors even more negative.

For example, writing in a note to investors in May of this year, credit rating agency Moody’s forecast that the continuing increase in interest rates would likely push numerous developed economies towards recession.

“We expect very weak growth in key advanced economies in particular, including mild recessions in the US, UK and Germany, and stagnant economic activity in France and Italy,” its analysts declared.

This kind of forecast helps us to understand why the acceleration in rate hikes had a disproportionate impact on the cryptocurrency market. That is, the market likely interpreted such hikes as a sign of an incoming recession.

And understandably enough, anyone expecting a recession isn’t likely going to be too eager to buy speculative assets such as stocks and cryptocurrencies. Yet the key thing to consider here is that the global economic picture may not be as bad as many initially believed, and that markets may soon recover as a result, even if rates remain comparatively high.

For instance, many economists are increasingly beginning to expect a ‘soft landing’ from the course of rate hikes that the Federal Reserve and many other central banks have imposed on developed economies. Writing in an October 10 blog post, IMF Chief Economist Pierre-Olivier Gourinchas reported that “projections are increasingly consistent with a soft landing scenario, bringing inflation down without a major downturn in activity, especially in the United States.”

And with GDP growth in the US coming in at 2.4% in Q2 2023, such positive forecasts are likely to have a reassuring effect on markets and investors. In other words, a steady improvement in GDP growth and employment figures – as well as a decline in inflation – is likely to be enough on its own to begin boosting the cryptocurrency market, without interest rates necessarily having to come down immediately.

Other Factors in Ongoing Bear Market

One other thing worth remarking on is that the S&P 500 (the benchmark US stock index) has had a pretty good 2023, with its overall level only 10% below its December 2021 all-time high. It and other stock markets have recovered to a large extent this year, largely on the basis of the expectation that the Fed will soon come to the end of its rake hike program, and that economic recovery is on its way.

Unfortunately, the same can’t exactly be said for the cryptocurrency market, which remains down by 63% compared to its record high. And the reason for this disparity is that it’s perhaps not only high interest rates (and poor macroeconomic conditions) that have been weighing down crypto prices.

Another big factor – perhaps the major factor – is regulatory uncertainty. While Ripple secured a largely positive ruling in July in its case with the SEC, the securities regulator is also in the process of suing Coinbase and Binance, two of the biggest exchanges in the world.

Such aggressive actions have likely had a freezing effect on wider interest in crypto, with the market perhaps having to wait for the resolution of such actions before new money will arrive. What’s funny is that interest rates will have lowered by then, meaning that the rally resulting from the end of regulatory ambiguity could end up being huge.