- >Best Crypto Credit Cards

- >Crypto.com Visa Card

- Up to 5% crypto cashback on all purchases

- Huge amount of available perks including free Netflix, Spotify, and Airport Lounge access

- Unique CRO staking model offers five different tiers of cards

- High-quality premium metal cards

A Comprehensive Look at the Pros & Cons

Pros

Available at 40 million point-of-sale locations around the world

Discounts on cash withdrawals from ATMs

Get up to 10% cashback on all purchases

Five different card tiers available

Get 100% cashback on common subscriptions like Netflix and Spotify (for up to six months)

Cons

CRO must be staked to gain access to the best rewards

Cashback rewards are denominated in CRO

There is a $50 fee if you close your account without spending all funds

Earning the best rewards requires a massive stake of CRO ($1,000,000)

How Does the Crypto.com Visa Card Work? All the Details You Need

The Crypto.com Visa Card is one part of the greater Crypto.com platform and ecosystem. In addition to the card, Crypto.com also offers the ability to buy Bitcoin and other cryptocurrencies via a credit or debit card, exchange 100+ different crypto assets on an exchange, and even borrow or lend out various cryptocurrencies. All of this functionality can be accessed via the Crypto.com mobile app on Android and iOS devices.

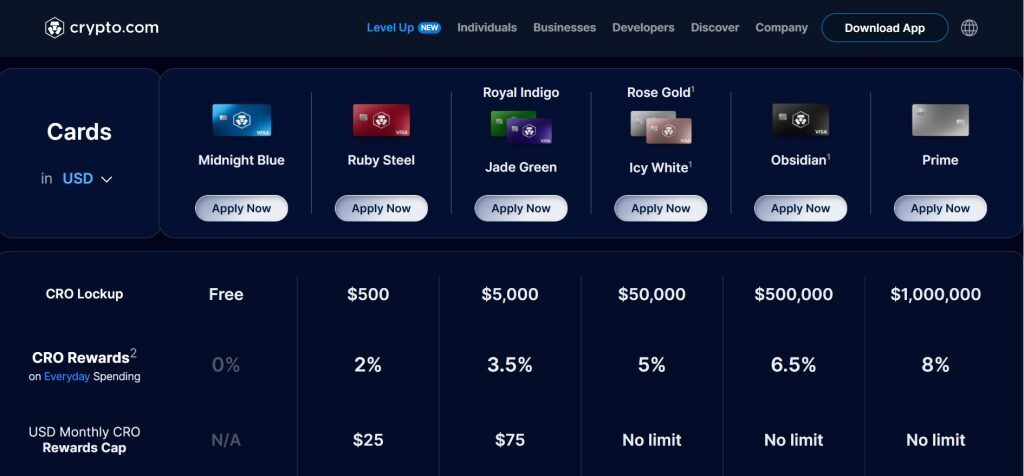

If you want to make the most of your Crypto.com Visa card and its many perks, you will need to pay close attention to the Cronos (CRO) crypto token. To gain access to the best rewards associated with this card, you will need to hold on to your CRO tokens for a period of at least six months. While there are rewards available for users who do not stake CRO, these rewards pale in comparison to what is given to CRO stakers. For example, someone staking $500,000 USD equivalent in CRO with an Obsidian level card receives 6.5% cashback, while a user with the same tier card who is not staking CRO receives no cashback (in addition to losing out on a number of other rewards).

What Are the Benefits of the Crypto.com Visa Card?

There are so many add-ons that come with owning a Crypto.com Visa Prepaid Card. The card is part of Crypto.com’s Level Up programme, giving users the following benefits for use on the move:

CRO rewards for everyday and travel spending

There are various Cronos rewards you can get just for spending with your Crypto.com card. Anyone from the Ruby Steel tier upwards is eligible for CRO rewards on everyday spending, with up to 8% available for “Prime” tier cardholders.

There’s no limit on how much you can earn in cashback either for Icy White, Obsidian, and Prime tier cardholders. This trio of tiers also earns 10% rebates on travel spending. Royal Indigo and Jade Green tier cardholders can earn 5% cashback on travel spending, and monthly rebates are capped at $75.

These rebates are attractive when you consider that conventional debit cards, like Axos Bank’s branded “CashBack” Card, offer just 0.50%-1% cashback. The Bank of America’s Debit Card offers variable cashback too, but there’s a monthly fee incurred for taking out this card.

Rebates on entertainment subscriptions

Get a 100% rebate on standard and basic subscription plans for Spotify and Netflix, giving you live-streamed music and entertainment on tap, without it costing you a cent. The rebates are the equivalent of up to $13.99 per plan, for the first six months.

Speaking of entertainment, the Crypto.com Visa Card has also become a popular payment option for Bitcoin bettors who enjoy playing casino games online. Since it acts like a prepaid card, it’s easy to budget how much BTC to deposit into your iGaming account. It’s also faster than every other conventional withdrawal method, returning winnings faster to your wallet than ever before.

Airport lounge access

If you stake enough CRO to land one of the premium metal Crypto.com Visa Cards, you’ll get access to over 1,300 airport lounges around the world. These tiers will give you Priority Pass access, with unlimited free visits to Obsidian, Icy White, and Frosted Rose Gold cardholders, as well as one guest. As a Jade Green or Royal Indigo cardholder, you’ll have four complimentary lounge visits permitted each year.

Invites to exclusive sporting events

Rose Gold, Icy White, Obsidian, and Prime tier members are also eligible for invites to exclusive live sporting experiences. The Crypto.com website suggests VIP tickets to events with Formula 1, UFC and UEFA, are all on the table.

Access to the Crypto.com Private Program

Cardholders within the Rose Gold, Icy White, and Obsidian tiers are entitled to entry into the Crypto.com Private membership program. This includes access to leading crypto industry events, special priority tickets, as well as priority customer support for their cards and accounts.

Private members will even have the opportunity to trade CRO (Cronos) tokens over-the-counter (OTC) from Monday to Friday.

Can I Really Get Free Netflix and Spotify with the Crypto.com Visa?

The good news is: you do get free Netflix and Spotify with certain Crypto.com Visa Cards. However, it works a little differently than you might expect.

Essentially, you will have to set up your Crypto.com Visa Card to pay your monthly membership fees for Netflix and Spotify, and then Crypto.com will reimburse you the subscription fee in equivalent CRO tokens.

You could immediately cash in that CRO for a stablecoin, like USDC, and you’ve essentially received a rebate on your Netflix. Or, you could hold on to your CRO, in hopes that it will gain in value. In that sense, it’s a way of dollar cost averaging into CRO. Of course, your CRO could also lose value, which means that your Netflix subscription will not be entirely cancelled-out that month.

The higher tiers of the Crypto.com Visa Card also offer reimbursements for Amazon Prime subscriptions. Here’s a look at the latest cashback rates from the Crypto.com Website (with stake):

Battle of the Crypto Cards: A Quick Comparison of the Top Competitors

How does the Crypto.com Card compare to other similar cards aimed at crypto owners looking to convert their assets into fiat currency to pay for goods and services? Have a look at our comparison table below:

| Card Name | Supported Currencies | Transaction Fees | Rewards |

| Crypto.com Visa Card | 100+ cryptocurrencies (including Bitcoin and Ethereum) |

|

|

| Binance Visa Card | BNB, BUSD, USDT, BTC, SXP, ETH, EUR, ADA, DOT, XRP, AVAX, SHIB, LAZIO, PORTO, SANTOS |

|

|

| Coinbase Card | All available to buy and sell on the Coinbase exchange |

|

|

| Fold Visa Card | Bitcoin only |

|

|

Is the Crypto.com Visa Card Worth Adding to Your Wallet?

Here’s the deal, the Crypto.com card is an excellent choice for anyone seeking a versatile option with some great additional perks. Use it as you would your regular prepaid or debit cards, whether you are at the ATM or at the online casino.

However, these perks and benefits are incredibly reliant on the Cronos (CRO) token to enable all the wonderful rewards. As always with cryptocurrency, holding on to these CRO tokens comes with some risk, and you may just end up losing more than you make back in rewards. If you are risk-averse, or you just don’t feel like locking up your CRO tokens for six months — you may need to consider other options. One option worth considering is the so-called “free” tier. This will enable you to use your Crypto.com card like a debit or prepaid card, but without the added staking benefits. In the end, it all depends on the rewards you prioritize and the way you manage your wallet.

Is the Crypto.com Visa Debit Card Right for Me?

In most cases, your choice of crypto debit card is wholly unique to your preferences and situation.

If you have a Netflix and Spotify membership, the middle tier of cards might be right for you. If the risk of holding CRO is too much to bear, there is always the free tier of the Crypto.com Visa card that is available to everyone by default. Alternatively, if you’re a believer in the CRO project, then you stand to benefit most from the top Obsidian and Prime tiers. We suggest carefully studying each tier and its benefits, before you make your final decision.

Crypto.com Visa Card FAQ

If you’d like to apply for a Crypto.com Debit Card with Visa, you’ll need to download and install the Crypto.com app on your iOS or Android device. In the top right corner of the app’s navigation menu, hit the “Card” tab. Choose your ideal card tier based on the necessary CRO staking or lockup amounts you’re happy with.

Once you’ve accepted the terms and conditions and supplied the delivery address for your card, the Crypto.com Visa will be mailed to you imminently.

You’ll receive a virtual version of the card to use before the physical debit card arrives, once you pass all the relevant ID and address verification checks.

Yes, there is the small matter of 40,000,000 compatible points of sale globally for the Crypto.com Visa Card. All you need to do is seek the Visa logo at any retail store or business, and you’ll be able to make transactions. Some places may have a Visa Plus logo instead of the classic Visa logo. If either are visible, you should be fine.

The Crypto.com Visa Card is also compatible with an abundance of e-commerce platforms too. Basically, anywhere that accepts Visa cards as a payment method should enable you to pay for goods and services using your Crypto.com Debit Card from Visa.

This Crypto.com debit card is distributed by the Crypto.com crypto exchange, but it’s powered by Visa, to bridge the gap between the fiat-currency and cryptocurrency worlds. Visa is one of the most trusted leaders in digital payments worldwide.

In fact, it’s now the world’s second-largest card payment firm across credit and debit cards, lagging somewhat behind China UnionPay in first place. Nevertheless, Visa is said to command a 50% market share for all card payments globally. Visa’s latest trading figures from 2023 showed that its revenue was up to $32.7 billion, with the company holding over $90 billion in total assets. All of which suggests this is a payment company with rock-solid foundations.

The beauty of the Crypto.com Visa Card is that there’s no monthly or annual fees to pay. You don’t even pay a cent in setup fees.

There are some alternative fees incorporated in the service. This includes the 1% fee charged on all debit or credit card top-ups, as well as the 2% fee for withdrawing cash over the monthly free ATM limit.