- >Buying Crypto

- >What is Cronos? Where to Buy CRO Coin?

What is Cronos? Where to Buy CRO Coin?

General Overview

Pros

High APY interest for staking on exchange

Discounts on exchange fees

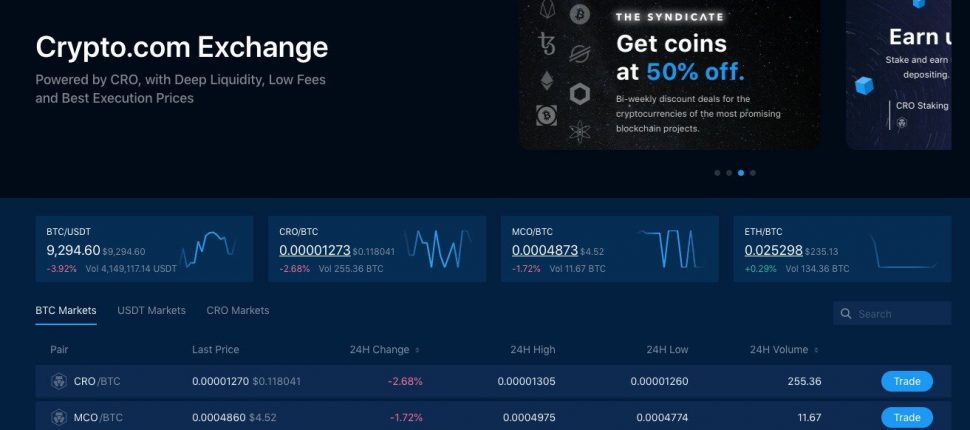

Opt-in to syndicate event where various cryptocurrencies can be bought at 50% off

Holding a certain number of CRO offers perks like higher interest rates for staking

Cons

High APY for staking has people questioning business model

Coin has little use case outside of the Crypto.com ecosystem

Best Exchange for Buying CRO

CRO Ratings

Supply

- Max: 100,000,000,000

Network Speed

- Rating: High (Aiming for 50,000 Tx/s)

Disbursement

- Rating: Medium

- Reason: The token supply for Crypto.com is capped at 30 billion tokens. This is a relatively high number for any cryptocurrency. The first CRO tokens were airdropped on MCO token holders. Since then, Crypto.com has been dispersing CRO tokens to stakers on the crypto.com exchange. Roughly 84% of CRO coins are already in circulation.

Developer Engagement

- Rating: Medium

- Reason: Crypto.com has been consistent with their roadmap. Crypto.com has delivered on incremental product releases since their inception in 2016. Crypto.com publishers API documentation for both their payment portal, and their exchange. Most of the documentation and end products are in their early stages which is why we give CRO a medium developer rating.

Liquidity

- Rating: Medium

- Reason: CRO will always be connected to the Crypto.com platform. Therefore the number of exchanges that offer a CRO trading pair is low. Furthermore, outside of staking, and using it for discounts on the crypto.com exchange, there is not much of a use case. Therefore we give CRO a medium liquidity rating.

History of CRO

Crypto.com started in 2016, and ran a successful ICO in 2017 where they launched their now discontinued MCO token. It now appears that Crypto.com has a broader goal of accelerating mass adoption of cryptocurrency. They are focusing on enabling cryptocurrency payments around the world. A large emphasis has been placed on the interaction between the customer and the merchants. Crypto.com gives the ability for both the customer and the merchant to choose the currency they pay and get paid in.

CRO formally got started in December of 2018 with an airdrop through the mobile application. The airdrop lasted 6 months, and was locked for an additional year after. CRO started becoming more open to the public with the launch of the crypto.com exchange. Suddenly owners of CRO were able to stake their coins at 20% APY within the exchange. Since the launch of the exchange in 2020, Crypto.com has piled on a range of different incentives for buying, staking, and spending CRO. The incentives range from access to their syndicate events, to discounts on the exchange.

On August 2nd 2020, Crypto.com discontinued the MCO token in favor of CRO. Holders of the MCO token were able to swap their MCO tokens for CRO tokens at a rate of 1:33. Although the swap caused some outrage amongst the Crypto.com user base, many argue that this was the right business decision moving forward. Any functionality that was previously attributed to the MCO token has since been wrapped into the CRO token. The Crypto.com ecosystem has been massively simplified and all features and perks are received by holding onto the single Crypto.com token: CRO.

In 2022 Crypto.org opted to re-brand the coin as “Cronos” although the CRO ticker remained the same.

Advantages of CRO

The first advantage is the 7% APY that users receive for staking the CRO token on the Crypto.com Exchange. The second advantage is by staking your CRO (and earning 7% APY) you also gain access to the Crypto.com syndicate events.

The syndicate is a weekly event where Crypto.com offers users the ability to purchase cryptocurrencies at a discounted price, usually 50% off. The third advantage is the tiered discounts on trading fees within the exchange. By staking more CRO, you pay less fees.

Crypto.com VISA Debit Card

The Crypto.com VISA debit card is perhaps the most appealing aspect of the entire Crypto.com ecosystem. The VISA debit card was in fact the platform on which Crypto.com first launched their ICO. There are five tiers of cards available to the public. Users can unlock higher and higher tiers of the VISA debit card by staking more CRO tokens within the Crypto.com mobile application. The bottom tier is free for all users, and offers the users the smallest number of perks. The highest tier requires users to stake an eye-popping $400,000 USD in CRO tokens. All of the benefits of the higher tiers include all the benefits that the lower tiers have, and more.

Free Card

Crypto.com offers a free card to anyone wishing to spend their cryptocurrency. The free card is perfect for anyone wishing to try out the Crypto.com services, and you can easily top it up from inside the app..

Ruby Steel Card

The real benefits start to build up once you stake some CRO tokens. In order to unlock the Ruby red card, you need to stake $400 in CRO tokens. After staking the tokens, you get a 100% Spotify membership rebate for sixth months. This rebate is paid in CRO. Lastly, you get double the amount of cashback you get from the free card, 1% cashback on everything.

Jade Green / Indigo Card

The Jade Green / Indigo cards tier starts to be for the more serious investors. In order to unlock this tier, you need to stake $4,000 in CRO. You get to keep the Spotify rebate from the Ruby Red tier. Additionally, you will get a 100% rebate on your Netflix subscription. Both are good for sixth months. By holding this tier of cards, you will also get free access to an airport lounge located at all major airports. Finally, you get 3% cashback on all your purchases.

Icy White / Rose Gold Card

The Icy White and Rose Gold card is where the benefits are taken to a whole other level. This tier of card comes will all of the benefits explained in earlier cards and more but it requires a stake of $40,000 in CRO. Continuing with the rebates, the Icy White / Rose Gold card will give you a 100% rebate on Amazon Prime. Furthermore, you will get 10% cashback on all Expedia purchases. Crypto.com will award anyone in this tier with a merchandise welcome pack, a bonus 2% interest through Crypto.com Earn, and exclusive access to Crypto.com Private. Crypto.com Private is a service where you may purchase large amounts of cryptocurrency at once, as well as gain access to industry events and research reports. With this tier of card, you may take a friend into the airport lounge, and earn 3% on all your purchases.

Obsidian Black Card

The Obsidian Black card is the highest tier offered by Crypto.com and requires an astronomical stake of $400,000 in CRO. The main differences between the Obsidian Black card and the Icy White card is a couple of travel perks, and an additional 1% cashback (bringing it up to 5%) on all purchases. You get 10% cashback on AirBnB purchases, and you’ll be flying in style. Obsidian Black users get access to a private jet.

Pay with CRO

Crypto.com has an entire service dedicated to helping you spend your CRO. They have signed on a number of various companies to their Pay Program. More than 300 brands, and 300k shops, in 30 countries have been integrated with the Crypto.com Pay program. Each shop or brand offers slightly different cashback options ranging from 1 – 10%. If you will be spending your money anyway, you may as well earn crypto cashback while you’re at it.

Disadvantages of CRO

The disadvantages of CRO have everything to do with its infancy as a project. New projects tend to have low liquidity, limited use case, and incomplete technology. CRO fits these categories. It is too early to tell whether or not CRO will carve out its niche within the broader cryptocurrency market. The biggest disadvantage of CRO is that only one fifth of the total supply is currently in circulation. This creates a lot of uncertainty in the direction of the overall project, and the price of CRO.

CRO Frequently Asked Questions

Cronos (CRO) is a cryptocurrency created by Hong Kong company Crypto.com. The coin is mostly used within the cryptocurrency exchange offered by Crypto.com.

CRO is available on multiple exchanges including Huobi, and KuCoin, although the best place to buy CRO, is straight from the source. You can buy CRO on the crypto.com exchange.

Crypto.com offers a wide range of cryptocurrency related products mostly centered around payments. Crypto.com makes money by charging transaction fees.

You can lock up CRO in either Crypto Earn, or the crypto.com exchange in order to earn as much as 12% APY on your investment.