- >News

- >Analysts Predict Bitcoin Price to Pass $20,000 This Year

Analysts Predict Bitcoin Price to Pass $20,000 This Year

The bitcoin price is heading to $20,000, according to a growing number of analysts. If you take the views of analysts working in the cryptocurrency industry and even beyond, the vast majority believe the price of bitcoin will hit and perhaps pass $20,000 by the end of this year.

This was brought home most recently by forecasts produced by Bloomberg, which in its latest Bloomberg Crypto Outlook wrote that “Bitcoin will approach the record high of about $20,000 this year.” However, pretty much every crypto analyst or expert you speak is also saying that previous Bitcoin history indicates a push towards $20,000.

Hitting $20,000 again this year would obviously be a significant achievement, particularly for those who already hold the cryptocurrency. Yet even more significantly, analysts also predict that if the bitcoin price really does pass $20,000, it will cross an important psychological barrier that will cause institutional investors to flood into its market, raising prices even higher.

Bitcoin Price Predictions: Most Are Looking at $20,000 by Year’s End

Recently, Bitcoin has been enjoying a gradual increase in enthusiasm from the wider financial industry. There was hedge fund manager Paul Tudor Jones’ admission last month that around 2% of his assets are in bitcoin, as well as JPMorgan taking on its first crypto-exchange customers. And now, there’s Bloomberg predicting a bitcoin price of $20,000 in 2020.

In the June 2020 edition of its Bloomberg Crypto Outlook, its analysts declared that “History Indicates Bitcoin Toward $20,000 in 2020.”

In particular, the report noted that the bitcoin price is currently following the same patterns it produced before and after its 2016 halving, which helped the cryptocurrency recover from falls in 2014 and climb towards its famous 2017 bull market.

Its authors wrote, “Fast forward four years and the second year after the almost 75% decline in 2018, Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend.”

It would seem most other analysts working within crypto agree that the bitcoin price is likely to hit $20,000 by around the close of 2020. One notable example of this is Wall Street trader and Galaxy Digital CEO/founder Michael Novogratz, who told CNBC in May that the bitcoin price “will go to $20,000 by the end of the year. I feel real confident about it.”

Similar predictions have been made by Danny Scott, the CEO of crypto-exchange Coin Corner, who predicted a climb to $20,000 in the wake of the Bitcoin halving. They’ve also been made crypto podcaster and Ivan “IvanOnTech” Liljeqvist, who predicted that the rise to $20,000 could be quicker than expected.

Source: Twitter

There are too many examples of other analysts predicting $20,000 to mention (some even predict higher than $20,000). However, one other related set of predictions worth mentioning are those which look at fractals. Increasingly, analysts have been pointing out that bitcoin price movements over the past few years exhibit similar patterns to the past movements of big tech stocks and also the stock market.

For instance, crypto analyst “Ethereum Jack” pointed out earlier this year that the bitcoin price is moving much like the Nasdaq did around the time of the 2007-8 financial crisis.

Nasdaq (between 1998 and 2016) on the left, bitcoin price (up to the present) on the right. Source: Twitter

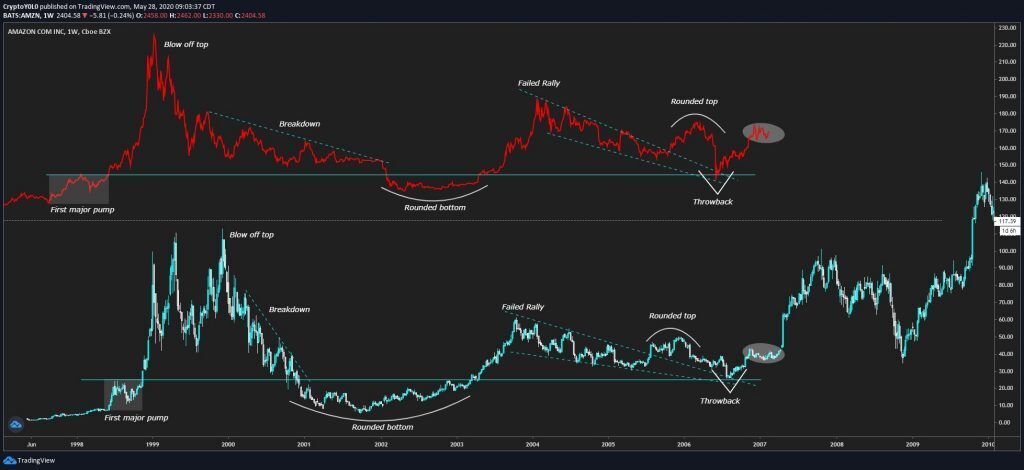

Likewise, trader “Mr Chief” observed in May that the bitcoin price is uncannily behaving like Amazon stock.

Bitcoin price (up to the present) in red, Amazon stock (from 1998 to 2010) in light blue. Source: Twitter

In both cases, fractals suggests a strong climb for the bitcoin price, potentially to the $20,000 level.

Doing The Math

Of course, past patterns do not necessarily recur in the future, particularly when looking at two very different things (i.e. bitcoin and Amazon stock) and at different times.

Still, because it uses previous bitcoin price movements to suggest future bitcoin price movements, it’s worth looking at Bloomberg’s predictions more closely. Specifically, it’s worth examining the periods they examine and seeing just how similar they are.

Looking at the numbers, the bitcoin price fell from a then-high of about $1,149 on December 5, 2013, to a bottom of about $171 on January 14, 2015, according to data from CoinMarketCap. After that low, it gradually began rising, hitting about $750 in the runup to the July 2016 halving, and then peaking at close to $20,000 on December 17, 2017.

In other words, there was a fall of around 85% between December 2013 and January 2015, then a rise of 338% between January 2015 and June 2016, and finally a rise of 2,566% from June 2016 to December 2017.

In comparison, there was a fall of roughly 84% from December 17, 2017 to December 15, 2018 (the bitcoin price having hit $3,191). Then a rise of 328% to the high of $12,685 on June 26, 2019.

Bitcoin Hitting $20,000 Could Be a Tipping Point

All the aforementioned numbers are remarkably similar to the trends observed across the 2013-17 period. Of course, it would be quite a leap to conclude that the bitcoin price will rise by 2,566% from June 26, 2019 to December 2020, or thereabouts. If it did, the price of bitcoin would hit roughly $364,900.

Nonetheless, even if it rose by only 46% compared to its June 2019 high, it would reach $20,000 by the end of 2020. And with its price holding up well after its halving, and with signs of a more bullish market, $20,000 may not be an unrealistic target.

Even more encouragingly, if it does hit $20,000, analysts expect this to be a tipping point, leading to a large influx of retail and institutional investment. Put simply, if it reaches $20,000, Bitcoin may never look back.