- >News

- >Bitcoin Halving Proves Price Crash Predictions Wrong… So Far

Bitcoin Halving Proves Price Crash Predictions Wrong… So Far

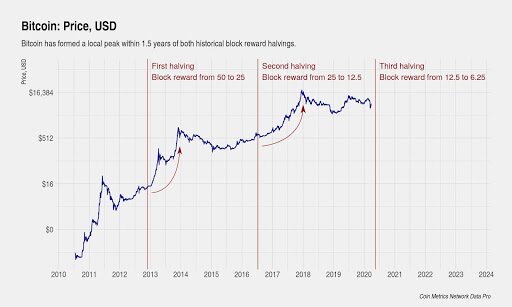

The third Bitcoin halving has finally happened, proving gloomy forecasts of short-term price crashes and sharp hashrate drops completely wrong. At 19:23 UTC on May 11, F2Pool mined the 630,000th Bitcoin block, causing the rewards dispensed by the Bitcoin Core protocol to halve from 12.5 BTC to 6.25 BTC.

In contrast to the earlier Bitcoin Cash and Bitcoin SV halvings, Bitcoin’s hashrate didn’t fall by over 50%, or even by more than 15%. Meanwhile, its price is basically unchanged compared to where it was at the time of halving, also in contrast to its two younger forks.

In other words, not only has the Bitcoin halving proven the doom mongers wrong, but it has shown just how fundamentally strong Bitcoin and its network is. Even with a halving of mining rewards (and therefore revenues), its blockchain and hashing power is largely the same as it was before.

Predictions And Pinches Of Salt

Prior to Monday’s Bitcoin halving, many commentators were predicting a massive drop in hashrate and a noticeable (if short-term) dive in bitcoin price.

For example, an April report from Coin Metrics suggested that the halving would increase “selling pressure” from miners, which would likely cause a short-term bitcoin price drop.

Source: Coin Metrics

Likewise, a Blockfolio survey suggested that at least 29% of bitcoin holders expected hashrate to drop in the short-term following the Bitcoin halving. Meanwhile, F2Pool told this author that it expects around 40% (or more) of mining machines to be switched off in the first two weeks after the halving.

Such fears were compounded by the Bitcoin Cash and Bitcoin SV halvings. In both cases, the hashrate of each respective network was hit very hard. Bitcoin Cash’s hashrate dropped by around 67% within one day after its halving, while Bitcoin SV’s hashrate plunged by just over 70%.

Fortunately, the real picture is nowhere near as bad as any of this suggested. Firstly, the bitcoin price has actually increased (at the time of writing, on May 13) since the Bitcoin halving. According to CoinGecko, the bitcoin price stood at around $8,512 at the time of the halving on May 11. However, it has since increased by 4.6%, to $8,905.

Source: CoinGecko

A 4.6% rise is hardly a disaster. In fact, given that expert opinion had predicted miners should be facing enormous financial pressure right now, it’s actually a very positive result.

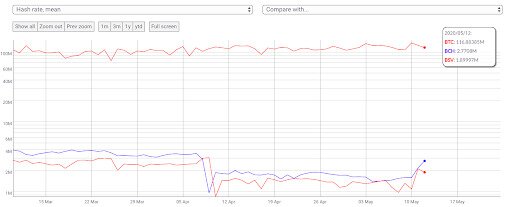

Something similar could be said for Bitcoin hashrate, even if there has been a slight decrease in this department since the Bitcoin halving.

As the chart below from Coin Metrics reveals, Bitcoin’s hashrate was around 136.09 million TH/s on the day of its halving. Two days later, it’s now approximately 116.88m TH/s, representing a fall of about 14.1%.

This fall is significant, but it hardly compares to the hashrate drops witnessed by Bitcoin Cash and Bitcoin SV.

Source: Coin Metrics

At the same time, data from Crypto51 – which records network hashrate and the cost of launching a 51% attack for one hour – shows that Bitcoin is still the most secure blockchain. It currently costs $330,775 to launch a 51% attack against Bitcoin for one hour, while it costs $113,116 to do the same to the next highest blockchain, Ethereum. By contrast, it costs only $9,474 to attack Bitcoin Cash.

Bitcoin Halving Will Result in Future Growth

Put simply, the halving hasn’t really dented Bitcoin, while hashrate will recover from the medium-term. And with the reduced supply inevitably bound to increase relative demand over the long run, the bitcoin price should, on average, gradually increase over the coming months and years. In theory anyways.

Indeed, even over the past week, there have been plenty of encouraging signs that demand for bitcoin will increase.

For one, crypto exchanges are witnessing increases in new user registrations. Binance CEO Changpeng Zhao revealed this week that the Malta-based exchange was seeing new signups spike in the run up to the halving, with the levels approaching those seen during the late-2017/early-2018 bull market.

Speaking at the recent Consensus event, he said:

The new user registrations are picking up very aggressively, like getting close to the sort of [new users] generated under 2018. All of those indications are very clear, the activity level is definitely much higher than even three or four months ago.

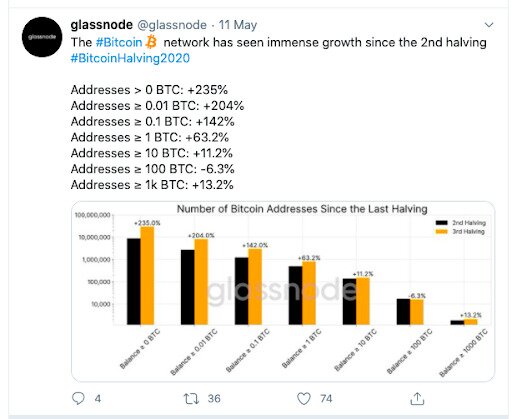

In parallel with this, Bitcoin wallet addresses also hit an all-time high in the weeks leading up to the Bitcoin halving. According to data from Glassnode, the number of addresses holding at least 0.1 BTC hit three million for the first time in history at the end of April.

Likewise, on the day of the Bitcoin halving, Glassnode noted a respective 204%, 142% and 63% increase in wallets holding at least 0.01 BTC, 0.1 BTC and 1BTC since the second halving in July 2016.

Source: Twitter

Simply put, interest in bitcoin is rising, and is set up nicely for another bull market in the not-too distant future. Meanwhile, the ongoing coronavirus recession is making bitcoin seem like an increasingly attractive investment, particularly with the likes of mainstream hedge fund manager Paul Tudor Jones revealing that around 2% of his assets are now in bitcoin.

So yes, the Bitcoin halving went off without any apparent hitch, and has paved the way for the cryptocurrency’s continuing ascent.