- >News

- >Miners Leave Bitcoin Cash for Bitcoin. Will They Ever Go Back?

Miners Leave Bitcoin Cash for Bitcoin. Will They Ever Go Back?

The Bitcoin Cash halving has already happened, and one of its biggest consequences was that a flood of miners left the cryptocurrency to mine Bitcoin. Yes, that’s right, because Bitcoin Cash’s halving occurred a month before Bitcoin’s, miners realized that it was more profitable to mine the older cryptocurrency.

Given that it’s a fork of Bitcoin Cash, the same thing also happened to Bitcoin SV, when it halved two days later on April 10th. But the question is: will departed Bitcoin Cash and Bitcoin SV ever return to these cryptocurrencies, or will they mostly remain with Bitcoin?

Well, it’s likely that a significant portion could remain with Bitcoin for the foreseeable future, particularly if the two forks decline in value relative to Bitcoin, which is what has happened since their halvings. But at the same time, the Bitcoin halving on May 13th is also likely to send a portion of them back.

Bitcoin Cash, Bitcoin SV Miners Flee for Bitcoin

Bitcoin Cash and Bitcoin SV are both forks of the original Bitcoin. This means they use the same SHA-256 proof-of-work algorithm to validate transactions. It also means that anyone with the technology to mine one of the three cryptocurrencies, can also mine the other two.

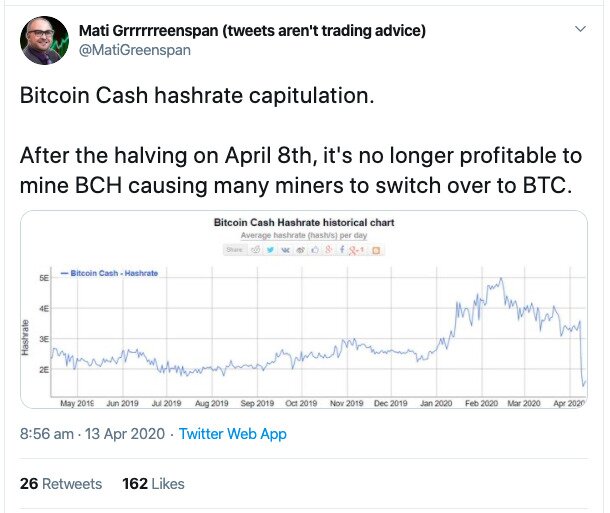

This is why Bitcoin Cash’s hashrate – the total computing power being used to confirm blocks – plummeted when it halved its block rewards on April 8th. All of sudden, miners received only 6.25 BCH as a reward for being the first to mine a block, literally halving their profits overnight. So what did they do? Well, they left to mine Bitcoin, which is keeping the same 12.5 BTC reward until May.

This switch is evident in data compiled by Coin Metrics. If you look at the two charts below, you’ll see that Bitcoin Cash’s mean daily hashrate was 2.94 million TH/s on April 8th (before the halving), before dropping to 960,000 TH/s on April 9th (after the halving).

Source: Coin Metrics

Source: Coin Metrics

Also note that Bitcoin’s hashrate rose by almost nine million TH/s after Bitcoin Cash’s dropped, while Bitcoin SV’s barely moved. And when Bitcoin SV’s halving occurred almost two days later, its hashrate fell by over two million TH/s, while Bitcoin’s rose by almost seven million TH/s.

In other words, hash power moved from Bitcoin Cash and Bitcoin SV to Bitcoin. And what’s bad about this from the perspective of the two Bitcoin forks isn’t only that it means mining BCH and BSV is now less profitable, but that their blockchains are less secure.

Source: Twitter

In fact, Bitcoin Cash’s hashrate dropped by over 70% in the day after its halving. And according to the Crypto51 resource, it cost only $11,665 to launch a devastating 51% attack on Bitcoin Cash on April 11th, having been almost double that a month before.

Some Miners Will Return, Some Won’t

This is bad news for Bitcoin Cash and Bitcoin SV. Even before their respective halvings had actually happened, certain analysts were predicting that the early reduction in their block rewards (relative to Bitcoin) could jeopardize their existence. Coin Metrics’ Benjamin Celermajer was one of them:

Source: Twitter

As Celermajer proceeds to explain, the premature Bitcoin Cash and Bitcoin SV halvings may have set off a dangerous chain reaction. First, miners see their profitability cut in half. Next, they stop mining Bitcoin Cash and Bitcoin SV, reducing the hashrates of each cryptocurrency. They may also sell their stores of Bitcoin Cash and SV, which would not only reduce the prices of both cryptos, but would cause more miners to leave for Bitcoin, and so on.

Fortunately, this nightmare scenario hasn’t quite played out. That said, both Bitcoin Cash and Bitcoin SV have witnessed greater price declines relative to Bitcoin.

For example, since its halving on April 8th, Bitcoin Cash’s price has fallen by about 16.7%, from $275 to $229 (as of April 23rd). Much the same applies to Bitcoin SV, which fell by roughly 11.2% between its halving on April 10th and April 23rd, according to data from CoinMarketCap.

By contrast, Bitcoin’s has basically remained stable, falling 1.3% from $7,199 on the morning of April 8th to $7,106 on April 23rd.

Difficult for Miners to Stick with BCH, BSV

Clearly, such significant declines in price will make it harder for miners to remain with either Bitcoin Cash and Bitcoin SV. And since the halvings of both coins, their hashrates have remained significantly reduced. As of the time of writing (April 23rd), Bitcoin Cash’ hashrate is roughly 1.55 million TH/s, a 56% decrease compared to where it was before the halving. Likewise, Bitcoin SV’s hashrate is only 50% of what it was before its halving.

As such, the question of whether the lost miners will return to these two cryptocurrencies depends on what happens before and after Bitcoin’s halving. If Bitcoin continues to maintain or increase its value before May 13th, while Bitcoin Cash and Bitcoin SV witness declines, then it’s likely that a portion of miners will remain with Bitcoin.

Yes, Bitcoin will suffer a 50% fall in block rewards, but it will also be 50% less profitable to mine Bitcoin SV and Bitcoin Cash, so miners may not necessarily return to these two coins. And the fact that the two forks halved a month early and suffered price drops as a result will put them at a relative disadvantage.

Source: Twitter

That said, there’s little doubt that a portion of Bitcoin mining capacity will switch off following its halving, so some of it may go back to Bitcoin Cash and Bitcoin SV. But it would seem that, ultimately, the pre-maturity of the two forks’ halvings will come back to haunt them in the long term, particularly when the same thing will happen again in four years.