- >News

- >Are Decentralized Exchanges the Big Winners of the FTX Collapse?

Are Decentralized Exchanges the Big Winners of the FTX Collapse?

Uniswap is now the second-biggest exchange in the cryptocurrency ecosystem for ethereum (ETH) trading. Yes, according to recent on-chain data, it is processing a higher volume of ETH trades than Coinbase, with only Binance exceeding it. In fact, if you look at its total volumes, the market’s biggest decentralized exchange currently surpasses its third-biggest centralized counterpart, Kraken.

This is a development that has taken hold of the market in the past week or so, with the FTX collapse and bankruptcy having the inadvertent (but entirely predictable) result of pushing traders and investors away from centralized exchanges (CEXes). Now, they’re increasingly turning to DEXes, with DappRadar finding that such exchanges have processed around $31 billion in trades in the week to November 15, representing an increase of 178% compared to the previous seven days.

It’s therefore reasonable to assert that a major shift is underway in the cryptocurrency market and ecosystem, with FTX’s demise serving to highlight the dangers that comes with having opaque centralized businesses (ruled over by a single executive) look after your money. However, while a move to DEXes is potentially a big win for crypto and its nominally decentralized ethos, it doesn’t come without its own dangers, as has been highlighted by the ongoing spate of hacks the DeFi sector has seen in recent years.

Decentralized Exchanges Grow Following FTX Collapse

The available data shows a significant increase in trading volumes for all major DEXes since the FTX collapse. For example, a version of the CoinMarketCap website indexed on October 23 (the latest available date prior to the FTX crisis) shows much smaller 24-hour volumes for the top decentralized trading platforms. Meanwhile, its current page shows big increases for pretty much all of them, as outlined below:

- 1. Uniswap: $130.6 million (Oct 23) – $886 million (now): 578.4% increase

- 2. dYdx: $149.5 million (Oct 23) – $686.7 million (now): 359.3% increase

- 3. Curve Finance: $33.6 million (Oct 23) – $195.3 million (now): 481.25% increase

- 4. PancakeSwap: $31.2 million (Oct 23) – $174.9 million (now): 460.6% increase

- 5. ApollxDEX: $29.4 million (Oct 23) – $97.6 million (now): 232% increase

With only a few exceptions (e.g. Kine Protocol), every DEX tracked on aggregators such as CoinMarketCap show an increase between pre-FTX collapse and now. By contrast, centralized exchanges witnessed either modest increases or pretty much no changes over the same period (with the exception of FTX, which went from over $1 billion in reported daily volumes to pretty much nothing). And depending on the dates you check, you will also see big declines for CEXes, with daily volumes on October 26 much higher than they are now.

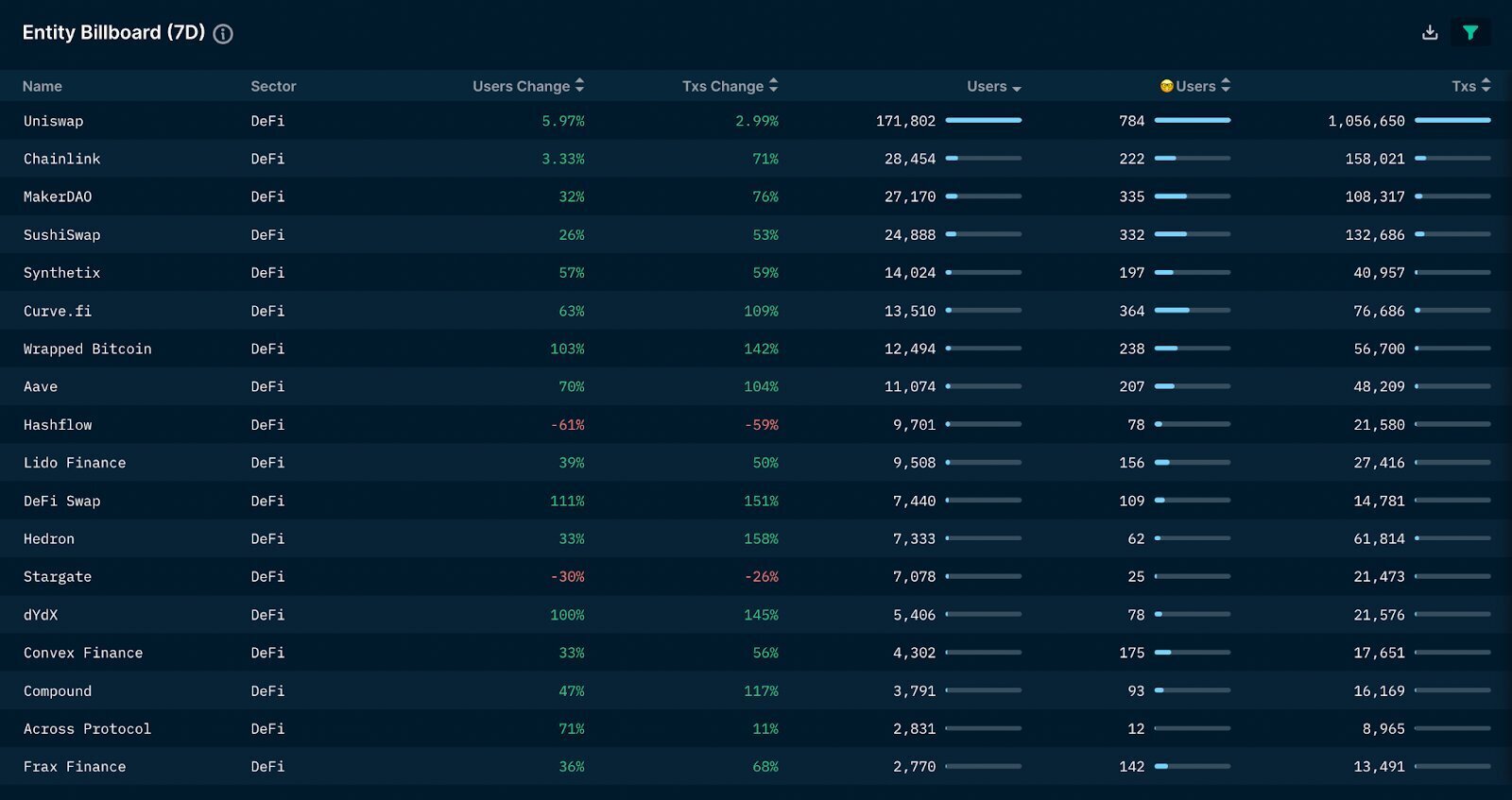

Transactions and users on DeFi platforms in the seven days to November 15. Source: Andrew Thurman/Twitter

As such, it’s tempting to conclude that something fundamental is currently changing within the cryptocurrency ecosystem. Indeed, social media is currently crammed with commentators predicting the demise of CEXes, in parallel with the rise of DEXes.

Source: Twitter

Testifying to this loss of trust in CEXes is data which shows that many DEXes have witnessed big spikes in revenues in the wake of the crisis. And with FTX not actually the first major centralized exchange to collapse and deprive its users of their funds (e.g. Mt. Gox in 2014), its downfall has encouraged more than a few people to repeat the age-old mantra, ‘Not your keys, not your bitcoin.’

DeFi Has Downsides

However, while FTX’s collapse has truly underlined the importance of self-custody, there are a number of obstacles which DEXes and DeFi in general will have to surmount if the ongoing crisis will result in a sustained and deep shift.

First up, decentralized exchanges have a less-than positive reputation when it comes to user experience and ease-of-use. Even in the wake of the FTX collapse, when support for DEXes has increased, many industry figures have taken to social media to criticize DeFi trading platforms, arguing that poor UX has long turned off potential customers and may continue to do so unless something is done.

Source: Twitter

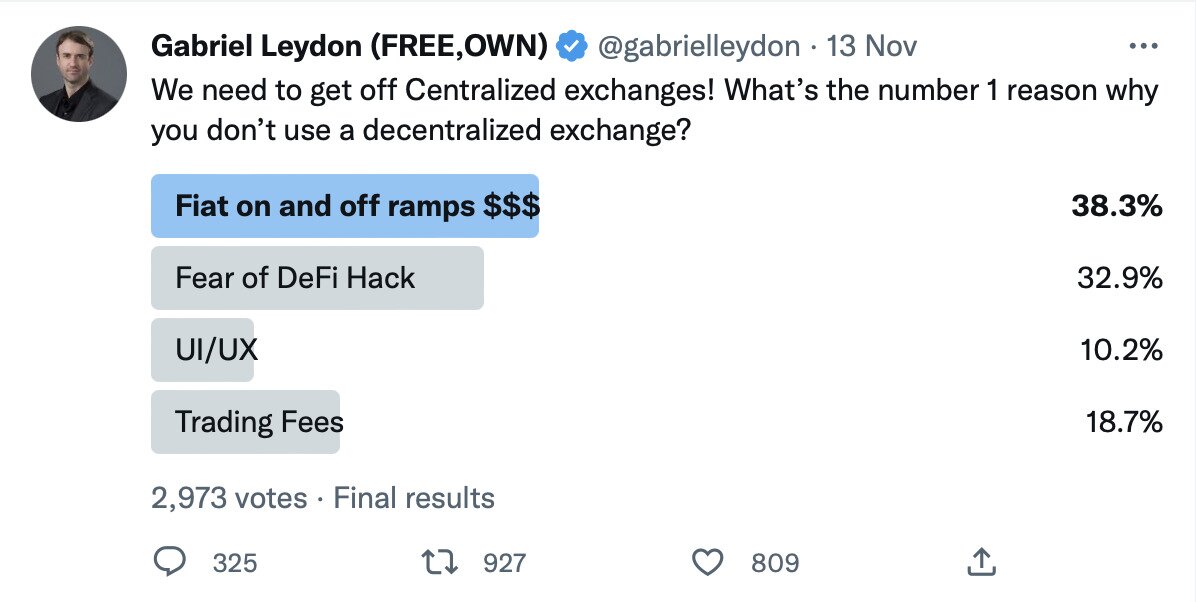

According to a Twitter poll conducted by developer Gabriel Leydon, the most popular reason for not using a decentralized exchange is the lack of fiat on-off ramps, meaning the average trader is put off by already having to have crypto in order to trade on Uniswap and the like.

Source: Twitter

Leydon’s poll also highlights another big challenge DEXes and DeFi face: hacks. For example, estimates suggest that DeFi-related exploits have passed $3 billion in nominal value so far in 2022, with protocols such as Ronin, Wormhole and the Poly Network being breached for hundreds of millions of dollars each in the past year or so.

Clearly, the average cryptocurrency investor doesn’t want to take their funds from a centralized exchange only to have them stolen in a DeFi hack. As such, the industry really needs to do something to improve the quality of its cybersecurity programming, and in this respect it’s pleasing to note that many have launched bug bounty programs in the wake of hacks. At the same time, startups such as Immunefi have raised millions of dollars to support the development of bug bounty platforms focused on DeFi and Web3.

This raises hope that the major technical challenges faced by DEXes will eventually be solved, yet there’s one more big hurdle that also needs to be cleared if decentralized trading platforms are to take advantage of the FTX collapse. Namely, they and the DeFi sector need to face regulatory challenges that are fast approaching, with the US Congress preparing to debate new legislation that could have a cooling effect on the evolution of DeFi. Likewise, the European Union has also set DeFi in its sights, with a policy paper authored on behalf of the European Commission in October recommending that new rules are introduced in order reduce the “severe threat” DeFi poses to the consumers.

Most notably, senators Debbie Stabenow and John Boozman have now re-committed to pushing forwards with the Digital Commodities Consumer Protection Act of 2022, a bill that critics have claimed might end up “killing DeFi and other novel crypto use cases.” What’s interesting about this is that this legislation had previously been supported and lobbied for by none other than Sam Bankman-Fried, the very person whose shenanigans so clearly underline the need for some form of DeFi.

It’s hard to say whether this bill will ultimately be passed, with other comprehensive pieces of crypto-related legislation also going through Congress as we speak. Either way, it shows that the rise of decentralized exchange in the wake of the FTX collapse is far from guaranteed.