- >News

- >Ask CryptoVantage: How Long Should I Hold My Bitcoin?

Ask CryptoVantage: How Long Should I Hold My Bitcoin?

By holding bitcoin for the long term rather than short term trading, you reduce the risk of losing value to short term price fluctuations while still having the opportunity to benefit from long term price appreciation.

Buying and selling bitcoin over short time periods significantly increases the chance of your bitcoin losing value. Throughout bitcoin’s lifetime, we have seen that a much safer way to store value in bitcoin is to buy it and hold it for the long term. This article shows that if you are buying bitcoin, you should be holding it for the long term rather than trying to trade it to make a fast profit.

Trading Bitcoin is Riskier

Many people think of bitcoin as an investment because the price has increased so much through time and quite a few people have become rich as a result. Bitcoin’s history of price appreciation and volatility reinforces the idea that to make a profit from bitcoin, you should buy and sell (trade) bitcoin.

However, the reality is that most people who attempt to trade bitcoin end up losing money. For a more detailed explanation on why we recommend most people do not try to trade bitcoin, read our article on bitcoin investment strategies.

Bitcoin is for Saving and Spending

The properties of bitcoin (which we’ll discuss a bit later) make it very well suited for saving and spending. History has shown us that the safest and most reliable way to make a profit with bitcoin is by buying and holding for a long period of time.

Bitcoin was originally created as an electronic cash system and can be used to make payments in ways that are impossible with traditional payment systems. For example, it takes days to send money across international borders, but bitcoin can be transferred globally within minutes.

Some of the properties that make bitcoin good for saving include:

- There will only ever be 21 million bitcoin, and over 18 million of them are already circulating.

- Your bitcoin holdings cannot be diluted by money printing.

- Basic economics states that a constant supply and an increasing demand ought to lead to price increases through time. Bitcoin’s consistent supply is very predictable because of the transparent design of the system. Demand for bitcoin is expected to gradually increase through time because we are still early in bitcoin’s life.

- Bitcoin is easy to secure with a bit of knowledge. You can securely store a large value in bitcoin quite easily – especially when compared to saving in gold or cash.

- Bitcoin cannot be easily confiscated in the same way gold or cash can be.

Some of the properties that make bitcoin good for spending include:

- Bitcoin is purely digital. In the same way that we can send information over the internet extremely quickly, we can send value over bitcoin much faster than sending it using traditional methods.

- Another benefit of bitcoin’s digital nature is that we can also divide it into much smaller units than traditional money (such as gold or dollars). This means bitcoin can be used for a wider range of applications than traditional money.

- Bitcoin’s decentralized peer-to-peer design means you can make bitcoin payments 24/7, 365 days a year, without needing to rely on banks or other payment providers.

Bitcoin Price Trends

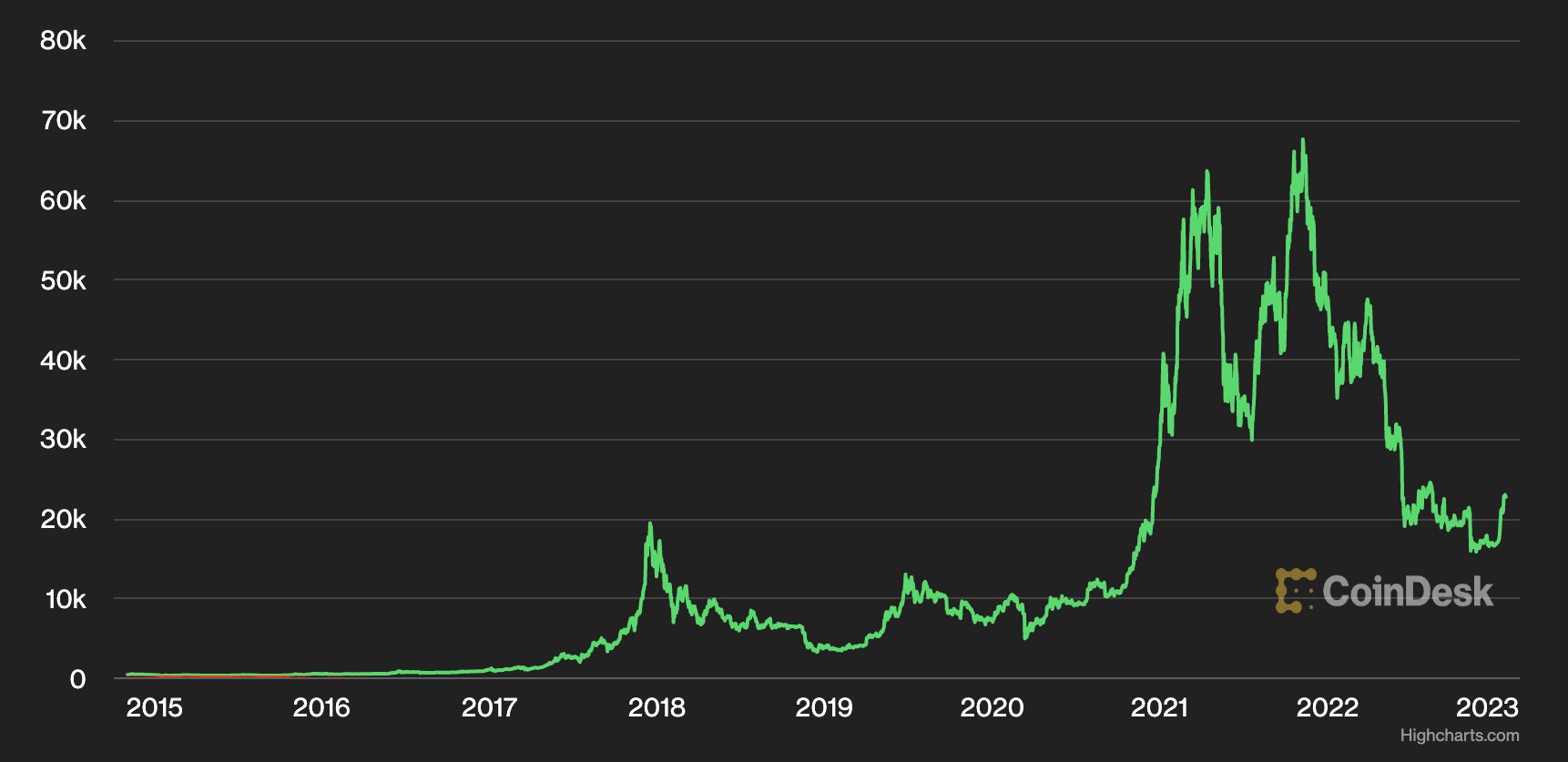

Here is a chart of bitcoin’s price history, which supports most of this article’s claims:

Bitcoin all-time price. Credit to CoinDesk.

In the chart above, you can see that bitcoin’s price has risen dramatically through time. Other than a few exceptions, if you had bought bitcoin and held it for more than a year or two you would have seen the value of your bitcoin increase. Conversely, you can see that there were many times when trying to time the market would have resulted in a sudden drop in value, such as at the start of 2018 and the start of 2022.

There are some really rough 1-2 year periods but if you pull back to a 5-year outlook than things become much more positive for Bitcoin holders.

History shows that if you were to buy and hold bitcoin for the long term, you would not be subject to these types of sudden losses. Instead, you would see the value of your bitcoin increase steadily through time.