- >News

- >Could a Flash Sale in Real Estate Set New Lows in Crypto?

Could a Flash Sale in Real Estate Set New Lows in Crypto?

While most macroeconomic reporting has focused on the rapid rise of inflation over the last year and a half, people should be equally concerned about the continuing increase of federal interest rates. To understand how they are related, it is essential to understand how central banks operate.

At their very core, the Federal Reserve and central banks have a dual mandate. To maximize employment and keep prices stable. They target a modest amount of inflation (2-3%) to incentivize people to spend money today rather than save it for tomorrow. It is achieved through the printing of additional money to stimulate the economy. This devalues the current supply and causes inflation. This is manageable and tolerated if it is done in moderation. Still, when too much new money enters the system too quickly, inflation will accelerate beyond what the market can absorb. The Fed can combat this by increasing the federal interest rates. This makes it more expensive to borrow money and slows down the economy.

What Does This Have to Do With Real Estate?

Real estate is a unique investment class. While it remains a preferred method of storing wealth over the long term for many, it also provides an essential function for society. Its functionality and utility mean that it will always be in demand in some capacity. This constant demand makes it a reliable long-term investment.

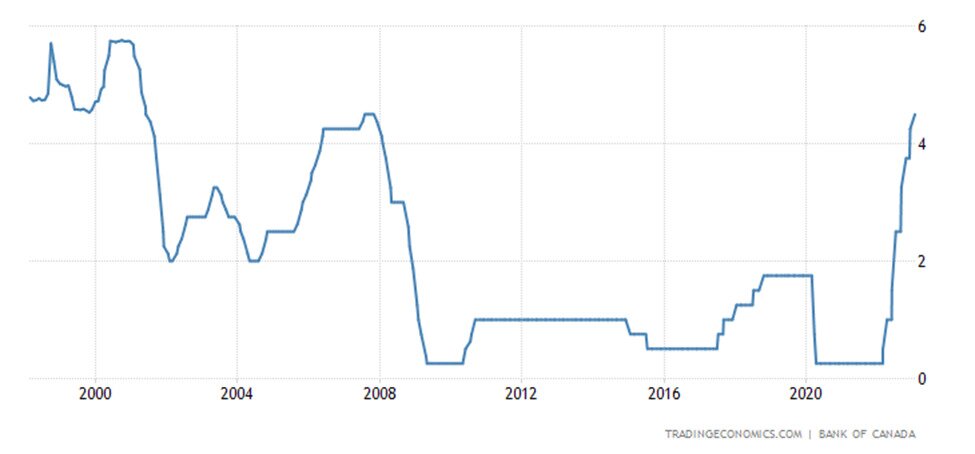

When the Federal Reserve introduced large volumes of new currency to the market in 2020, many savvy investors began applying it to real estate investments. Combined with record-low federal interest rates of 0.25%, the market exploded in popularity. Moreover, low-interest rates allowed people to maximize and leverage their borrowing.

This run-up in demand for real estate preceded the soaring inflation rates we saw in the latter half of 2021 and all of 2022. As a result, there was a tonne of liquidity sloshing around in the economy, and it ended up settling into investments in stocks, cryptocurrencies, and real estate. With the massive increase in demand but a stagnant supply of available real estate to purchase, housing prices began to explode.

Housing prices within Canada saw an average increase of 60% from 2020 to 2022, with its second-largest province Ontario surging by 111% during the same period.

Why is This a Problem?

While the housing market exploded during this period, federal interest rates lagged. This delay allowed for the demand in real estate to reach its fever pitch. It often left people increasing their risk tolerance levels and maximizing their leverage just to field a competitive offer. As a result, people began overextending themselves financially.

This is problematic for the wider economic impact it will have. When people start maximizing their borrowing potential, they start using up their disposable income that could be used to stimulate the rest of the economy. People have less money to spend on luxuries like eating out or entertainment. This minor alteration in behavior can have a significant impact on these industries. Reduced sales results in fewer jobs and fewer taxes collected.

Many of the real estate investors from this cycle are also first-time buyers. While this may not seem important, it is crucial to understand that this class of buyers would not have been exposed during the 08′ housing crash. The last time prime interest rates were this high. This also explains their willingness to overleverage themselves.

The Impact of Federal Interest Rates

When interest rates rise, there is less incentive to borrow. Not only does it cost more to borrow, but institutions become less willing to lend. As a result, it becomes harder for individuals to access large loans or mortgages. These conditions intensify the real estate market in the short term. People rush in before they are closed out by lenders. However, once the rates hit a certain point, there reaches an equilibrium in the market, and a cooling effect starts. Less competition and demand for the same supply.

When these market conditions are met, real estate prices begin to slow and come back down. People who bought at the top watch in horror as they are now paying more for a house than it’s worth. Investors who received a flexible mortgage see their payments swell to unsustainable levels. An average 1% flexible mortgage on a $300,000 house has increased by $700/month in less than a year. People locked into fixed-rate mortgages and now up for renewal are facing the same headwinds.

What seemed like a relatively safe investment strategy has become a living nightmare for many investors.

How Does This Impact Crypto?

The explosion in real estate prices was never going to be sustainable. Similar to the recent bull runs in the crypto and stock markets, it was artificially inflated by the introduction of massive amounts of additional currency by central banks.

Real estate investors have a choice. They can absorb the higher interest payments on their real estate investments. This certainly isn’t an option for everyone, and as previously discussed, many are already overextended from entering the market. They can sell off their real estate before the contraction starts. Few would be willing to do so, but many will be forced into this option. This will put downward pressure on the rest of the real estate market and cause prices to drop. Increasing the supply and reducing the demand.

Alternatively, people could start to believe that real estate is no longer a reliable store of long-term value and look to alternatives. Despite its volatility, Bitcoin has remained the best-performing asset of the last ten years. If investors were solely involved in real estate for this reason, they could be convinced to transfer their value to Bitcoin. However, it is much more likely that the opposite is true, and people holding Bitcoin would be willing to sell it to subsidize their real estate investments. Theoretically this could lead to the forced selling of crypto and put downward pressure on their valuations, causing lower lows.