- >News

- >Crypto Owners Rise to 425m Worldwide As Ethereum Ownership Explodes By 263%

Crypto Owners Rise to 425m Worldwide As Ethereum Ownership Explodes By 263%

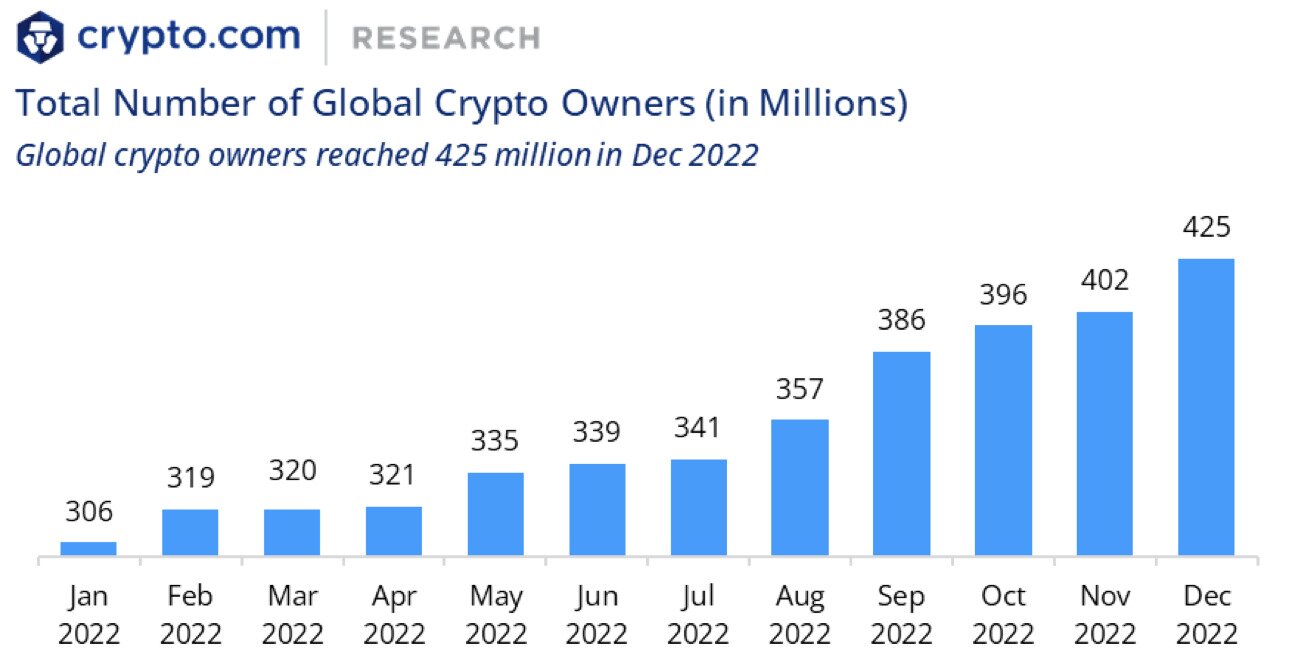

The number of cryptocurrency owners worldwide increased to 425 million people last year, according to Crypto.com’s Crypto Market Sizing Report 2022. This figure represents a 39% increase compared to 2021, a rise that came amid one of the worst downturns in the cryptocurrency market’s short history. That ownership rose despite substantial price falls should offer some hope that, even in a bear market, the cryptocurrency industry remains in strong health, insofar as much of the global public retains a growing interest in virtual currencies such as Bitcoin, Ethereum and the rest.

Speaking of Ethereum, Crypto.com’s report found that it had a better 2022 than most major cryptocurrencies, with ethereum ownership rising by 263% in the last 12 months, from 24 million to 87 million. By contrast, bitcoin ownership increased by 20%, from 183 million in January to 219 million.

Along with other recent cryptocurrency ownership reports that corroborate the same basic trend, what Crypto.com’s research underlines is that Ethereum may end up expanding much more rapidly than Bitcoin during the next bull market. This may particularly be the case in view of Ethereum’s shift to proof-of-stake and its becoming deflationary, not to mention the fact that most dapps within the cryptocurrency ecosystem already build on it.

Crypto Owners Rise to 425 Million Worldwide in 2022, Trend Continuing

Published late last month, Crypto.com’s report offers a further dose of hope amid what remains a bear market (despite recent recoveries). What’s particularly encouraging is that, without exception, every month witnessed growth in ownership numbers, even after the Terra collapse in May and the FTX bankruptcy in November.

Source: Crypto.com

There are likely a variety of reasons for this.

To begin with, even with price falls, rampant inflation in much of the world meant that people in some nations still turned to Bitcoin (and other coins) at various points of the year to preserve at least some of their fragile wealth. This is particularly the case in economically struggling nations such as Turkey, where the official inflation rate passed 70% and where more than 5.5 million people have bought cryptocurrency of some kind. It was also evident in Argentina, where not only did cryptocurrency ownership increase in 2022, but where 53% of residents who owned crypto owned stablecoins in particular.

Much the same thing applies to countries such as Nigeria, Lebanon and Iran, while Ukraine and Russia saw a surge in bitcoin and cryptocurrency trading after their conflict began back in February 2022. Yet trying to avoid inflation and other economic ills wasn’t the only driver of cryptocurrency ownership last year. Also important was growing use, something highlighted by the aforementioned fact that ethereum witnessed such a spike in ownership.

That is, 2022 also witnessed a large growth in the use of NFTs, with Web3 and ‘the metaverse’ becoming very fashionable among various brands, fashion houses and companies. It seemed that everyone from Nike to Starbucks launched their own non-fungible tokens last year, with the vast majority using either Ethereum or one of its layer-two sidechains (e.g. Polygon). As such, demand for ethereum itself — as a means of acquiring or selling NFTs — reflected this growth.

Other Trends, Other Reports

Other recent reports reinforce Crypto.com’s research, finding that cryptocurrency ownership increased last year, defying all the skeptics who partook in schadenfreude in declaring that ‘crypto is dead’ (yet again).

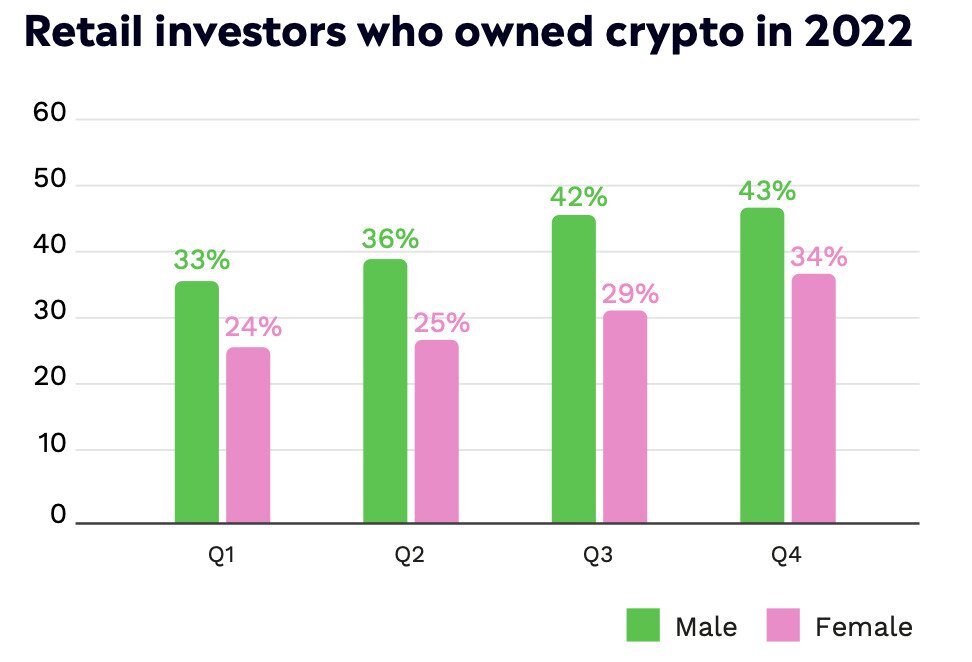

For instance, rival trading platform eToro published its own Retail Investors Beat report in January of this year. Based on a survey of 10,000 investors across 13 countries and three continents, one of its main conclusions was that cryptocurrency ownership increased during every quarter of 2022.

The bright green bar represents cryptocurrency ownership among retail investors. Source: eToro

While the chart above shows that owning stocks remained more common than owning crypto (and that holding cash became more common as the year progressed), it nonetheless finds a steady increase in the percentage of investors who keep some crypto. It rose from 36% to 39% over the course of the year, with eToro suggesting that this was “driven by a slightly older cohort of investors seemingly looking to buy the dip.”

Yes, eToro’s report found that ownership among older sections of the public increased more than it did with younger generations, who already have a well-documented openness to cryptocurrencies. Specifically, there was a 5% increase in cryptocurrency ownership among investors aged 35-44 and 45-54, rising to 53% and 36% respectively.

Perhaps even more significantly, eToro’s report found that crypto ownership among women increased quite noticeably in 2022, becoming the second-most widely held asset by females after cash. It rose from 24% of female investors holding cryptocurrency in the first quarter of last year, to 34% by the final quarter. For the report’s authors, this indicates that crypto “is succeeding where traditional financial markets have sometimes failed in bringing more women to the table.”

Source: eToro

This should be taken as highly encouraging news: despite claims from some quarters of the mainstream media and from well-meaning critics that crypto is suffering a slow death, quite the opposite appears to be happening.

Indeed, a survey of 5,000 American adults by the Federal Reserve Bank of Philadelphia was published in December 2022, finding that 24.6% of US residents report that they or someone in their family owns cryptocurrency. This is a quarter of the population, signaling that crypto is hardly some marginal phenomenon any more.

The Next Bull Market

And given that such figures have been published during a downturn, they also suggest that crypto ownership is now set to really take off during the next bull market. The latter will indeed arrive sooner or later (possibly when Bitcoin undergoes another halving in 2024), and with it future surveys will find that ownership of virtual currencies has really become mainstream.

But as Crypto.com’s report makes clear, it may be Ethereum rather than Bitcoin that enjoys the lion’s share of gains in the next bull run. As we’ve covered before, it successfully completed a shift to a proof-of-stake consensus mechanism in September 2022, a shift which will provide the technological basis for it to become not only less energy intensive, but also more scalable and efficient.

Combined with the fact that it’s already the biggest layer-one smart contract-enabled blockchain by quite some margin, the next bull market could see it grow massively. And when combined with the fact that recent upgrades (involving transaction fee burning) can make it deflationary during periods of higher use, its price could really see some upwards pressure.

Still, judging the research covered above, the next bull market will be beneficial for pretty much every major cryptocurrency of genuine value, and not just Ethereum. Of course, we just need to be a little more patient in waiting for it to arrive.