- >News

- >Has Lightning Adoption Stalled? What Are the Best Bitcoin L2 Alternatives?

Has Lightning Adoption Stalled? What Are the Best Bitcoin L2 Alternatives?

Since bursting onto the scene in 2009, Bitcoin has remained the preferred digital asset for millions of people. Challengers have tried to supplant it as a means of exchange by focusing on scalability and increasing the volume of transactions per second (tps). In what is known as the Blockchain Trilemma, Bitcoin has remained an ardent defender on its approach of focusing on its level of decentralization and security, believing scaling would be achievable through Layer 2 solutions.

On January 14, 2016, the Bitcoin Lightning Network Whitepaper was published as one such Layer 2 solution. It introduced scalable off-chain instant payment channels without compromising the main channel’s degree of security or decentralization. After intensive review and testing, the Lightning Network mainnet launched in January 2018.

Has Lightning Adoption Stalled?

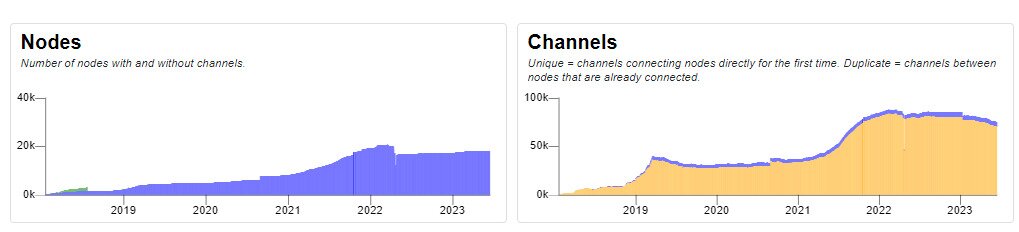

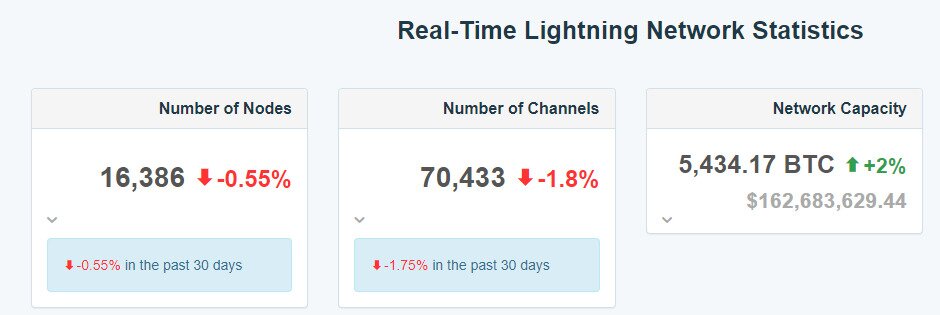

Evaluating the adoption rate of the Lightning Network can be a challenging task for a number of reasons. If you were to simply look at the number of channels and nodes on the Lightning Network, then yes, it would appear that there has been a degree of stagnation.

The number of nodes and channels peaked when Bitcoin reached its ATH at the end of 2021 and hasn’t really grown much further since. What is impressive is that despite Bitcoin losing almost 80% of its value over the next 18 months, the channels and nodes operating did not see a massive drop off.

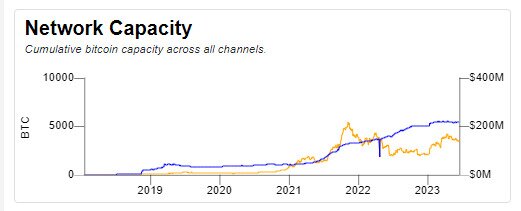

While these charts and figures would surely indicate that Lightning adoption has stalled, if you were to look at the Network Capacity, you would get a different story. During the same 18th-month period from when Bitcoin reached its ATH, the Lightning Network saw a 40% increase in Bitcoin added to the network. This would indicate that the channels on the LN remain active and engaged despite the massive price volatility of Bitcoin.

It is also too early to tell what, if any, correlation may be attributed to Bitcoin’s overall price in fiat. Launching in 2018 means the Lightning Network has only experienced one full market lifecycle.

In the past, Bitcoin’s valuation has been closely attributed to its halving event every four years. With the next halving occurring in less than a year and the renewed attention of Bitcoin ETFs, we may be able to see if this trend is accurate sooner rather than later.

It is not unreasonable to think that adoption would stall when the value of Bitcoin crashes. A similar impact to high inflation, where the same amount of BTC buys you fewer goods and services in comparison to when Bitcoin was trading at an ATH.

Unless you are operating in a closed-loop economy, it is more financially sound to use fiat currency in the short term as a means of exchange. Time will tell if Lightning’s adoption is impacted by the BTC price volatility or if this stalling is something more chronic.

What Are the Best Bitcoin L2 Alternatives?

It is important to remember that despite its popularity amongst the Bitcoin community, the Lightning Network is not the only Layer 2 solution. There are a number of active Layer 2 solutions that offer similar off-chain payments. They include, but are not limited to, the following:

Liquid Network

One of the earliest iterations of an L2 solution, the Liquid Network, was founded in 2014 by Adam Back, Erik Svenson, and Peter Wuille through Blockstream. Control has since been handed over to a federation of its member parties, and the network is run on the Elements open-sourced blockchain platform.

The Liquid Network operates through users locking up their Bitcoin through a process known as a “peg-in”. Users send their Bitcoin to a Liquid Network address and receive an equal amount in Liquid Bitcoin (L-BTC). Users can then use this L-BTC across the Liquid Network.

The main drawback is that L-BTC is not as ubiquitous as regular BTC and is only utilized for transactions with accounts already on the L-BTC. Similar to how wrapped Layer 1 coins and tokens operate in some DeFi protocols.

Stacks Protocol

Stacks is a Layer 2 project that utilizes self-executing smart contracts to increase the functionality of Bitcoin without the use of a hard fork. This allows Stacks to add features to Bitcoin like Dapps and smart contract functionality without altering the capabilities of Bitcoin itself.

Stacks was founded by Muneeb Ali and Ryan Shea under the name Blockstack in 2017.

Fedimint

Fedimint is one of the newer L2 solutions that has emerged. Focused on the issues of custody and security, Fedimint aims to create a communal way to custody and transact Bitcoin with strong privacy.

Fedimint has a novel solution to the issue of custody. Inspired by the fallout from the repeat collapses of centralized exchanges, Fedimint created a new model for distributing custodianship across millions of communities rather than unknown third-party intermediaries.

Enabling communities to bank themselves, as mentioned on their site “Fedimint allows bitcoiners to onboard new users, assisting them in their custody and payment model. Instead of referring a new bitcoiner to a third-party custodian, you can onboard them yourself as part of a Federation.

Put another way, it allows you to be your mum’s / friends / village’s bank.”

Conclusion: The Rising Tide

While the Lightning Network appears to have had adoption slowed with a reduction in new nodes and channels. Users can take strength in the fact that despite an 80% price collapse from its ATH, usage by the current user base remains high and is primed for another wave of adoption.

Moreover, alternative L2 solutions continue to grow alongside the Lightning Network. Often with unique and specific scaling solutions that will help with the overall adoption of Bitcoin. These alternatives strengthen BTC as a means of exchange and provide additional decentralization of L2 infrastructure.

Some users are looking for smart contract functionality to add DeFi to the network (Stacks), whereas others don’t feel comfortable taking self-custody of their BTC but don’t want to trust centralized exchanges (Fedimint).

Whatever their reasons, we should embrace these L2 solutions. They will inevitably end up spreading awareness and future adoption of Lighting and Bitcoin as whole as a result.