- >News

- >Here’s What a Joe Biden Presidency Means for Crypto and Bitcoin

Here’s What a Joe Biden Presidency Means for Crypto and Bitcoin

The result may not yet be final, but it seems that Joe Biden is the next President of the United States. The Associated Press, Reuters, CNN, Decision Desk and other agencies have declared him the winner of November 3’s election, and while Trump and his team will contest state results where legally possible, it’s doubtful they’ll be successful.

The question is: what does this mean for Bitcoin and cryptocurrency? A few months ago, analysts were warning investors that a Biden victory would be bad for the stock market, largely due to potential corporate tax rises and also fears over new financial regulation. The same could apply to crypto, if only because the bitcoin market has become increasingly correlated with the S&P 500 in recent months.

However, while Biden may have less of a ‘pro-business’ reputation as a Democrat, it’s unlikely that his presidency will be bad for Bitcoin or cryptocurrency. This is mostly for three reasons: 1) Biden’s proposed tax rises won’t directly hurt crypto, and may boost it; 2) the Republicans still have a majority in the Senate, so any new legislation will have to have bipartisan approval; and 3) the Democrats have shown themselves to be no less crypto-friendly as the Republicans, with House Democrats proposing a ‘Digital Dollar’ in stimulus legislation put forward in March.

Joe Biden = Good For The Cryptocurrency And Bitcoin Market?

Assuming Biden is confirmed as the next president, here’s what’s likely to happen in the stock, bitcoin and cryptocurrency markets.

First, the Biden administration will push through a new stimulus package. This will be good for markets, and by extension it will be good for crypto and Bitcoin. This is because it will provide investors with greater confidence and the economy with greater liquidity, something which we saw in March, when a market crash (in stocks and crypto) was followed by a stimulus-powered recovery.

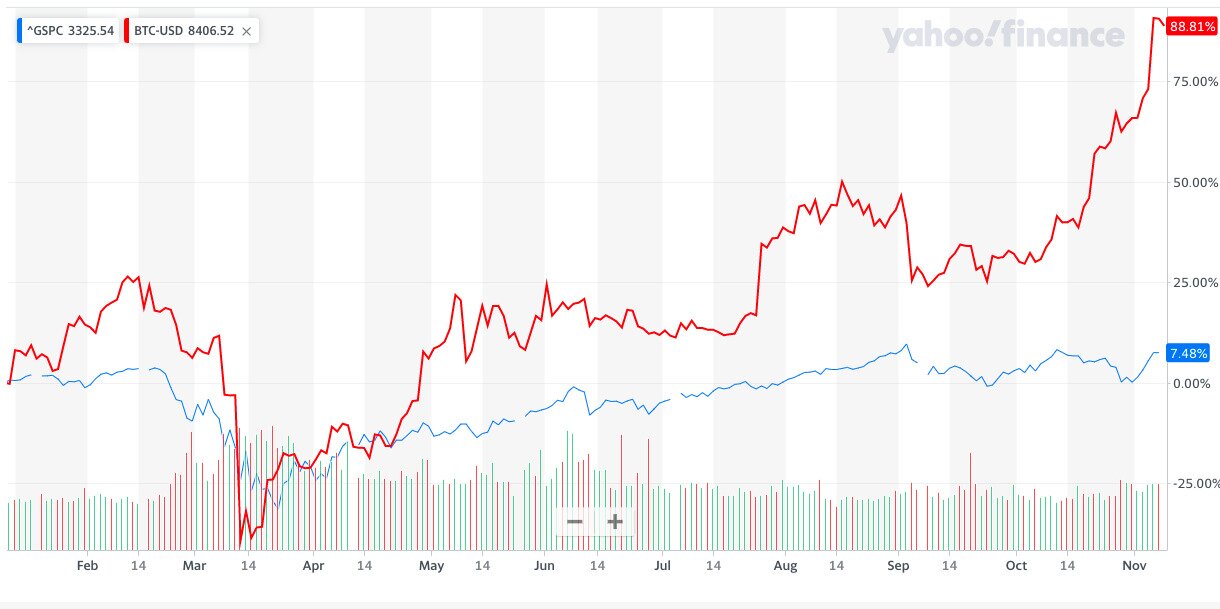

Bitcoin (red) and the S&P 500 (blue) crashed at roughly the same time in March, before climbing over the same timeframe. Source: Yahoo! Finance

Bitcoin and crypto will benefit from new stimulus, particularly in a low interest-rate environment in which much of the economy remains stalled. With fewer options than usual for investing money, and with the possibility of higher inflation, it’s likely that a second substantial stimulus package will boost the cryptocurrency market as well as financial markets.

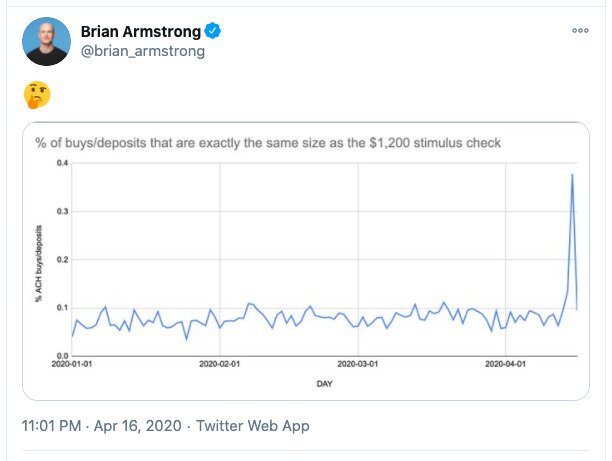

A second stimulus package is likely to include another round of checks for individuals. A portion of these may be diverted towards crypto, particularly with PayPal now providing Americans with an extremely frictionless way of buying bitcoin, ethereum, bitcoin cash and litecoin.

Source: Twitter

So far, so good for Bitcoin and crypto. However, let’s now suppose that Biden is also successful in pushing through his proposed tax rises, including raising the corporation tax rate from 21% to 28%.

Some might assume this is bad for crypto. They’d be wrong. Yes, Biden’s tax rises would most probably hurt stocks, given that companies would become less profitable as a result. But bitcoin and most other cryptocurrencies aren’t corporations, but rather decentralized networks that escape the reach of the Inland Revenue Service.

In fact, combined with the quantitative easing pursued by the Federal Reserve (and also the federal government’s second stimulus), a corporation tax hike would likely be bullish for bitcoin and crypto. Stocks would become less profitable, so we would likely see more investors migrating over to crypto, especially when Biden’s proposed 2.6% capital gains tax rise applies only to people with annual incomes above $1 million.

What About Crypto Regulation?

While Biden’s economic and fiscal policies may be indirectly beneficial for Bitcoin, some people within the cryptocurrency industry believe his administration would attempt to pass restrictive crypto legislation.

Explaining the likely short-term consequences of a Biden victory, Guardian Circle founder Mark Jeffrey recently told me, “Biden meddles, Bitcoin price plunges, but then long-term, as it resists meddling, it goes up and surges. Biden has no choice but to capitulate in the end: Bitcoin is bigger than he is.”

Bloomberg recently published a crypto outlook which predicted something similar, albeit with a pro-Bitcoin twist. Bloomberg’s analysts asserted that the Biden administration would seek to pass general cryptocurrency legislation which, while potentially restricting the growth of DeFi and the wider crypto ecosystem, will largely serve to concentrate attention and investment on bitcoin.

Such analysis is largely speculation, however, because as CoinFlip’s Ben Weiss recently told Business Insider, Biden and his team have been silent on the subject of crypto.

“I haven’t heard any specific plans from Biden, or anyone, on Bitcoin regulation but there needs to be sensible regulation,” he said.

Some commentators have also speculated that Biden will seek to challenge Big Tech in various ways, representing an ‘anti-disruption’ attitude that may spill over onto crypto. Again, this is certainly not a given, particularly when the major Big Tech corporations have monopolistic power in various sectors, while crypto has a monopoly over nothing (besides decentralized payments).

The Republicans And Digital Dollars

Lastly, it needs to be remembered that the Republicans could very easily retain the Senate, pending the result of a runoff election to be held in Georgia in January. This would make life very difficult for Biden, and would also likely result in any Democratic legislation being watered down, if passed at all.

On the other hand, the Democrats don’t necessarily deserve an anti-crypto reputation. Not only were House Democrats responsible for floating the idea of a ‘Digital Dollar’ in March, but a Super Political Action Committee campaigning on Biden’s behalf in 2016 even accepted donations via bitcoin. “This is in keeping with Vice President Biden’s strong support of technology and innovation throughout his career,” Joseph Schweitzer, the group’s director, said in a statement at the time.

Not only that, but the second-largest donor to Biden’s campaign this time around was Sam Bankman-Fried, the CEO of Hong Kong-based cryptocurrency exchange FTX.

It’s therefore hard to conclude that Biden will be anti-crypto, unless he wants to upset his donors. And compared to the overtly Bitcoin-hostile Donald Trump, he may be just what the crypto industry needs right now.