- >News

- >In the Game of Crypto, Can There Be Only One?

In the Game of Crypto, Can There Be Only One?

There are currently 9,284 cryptocurrencies in existence, according to CoinMarketCap. This is a staggering, almost overwhelming number, yet it underlines just how large the cryptocurrency pie is right now, and just how many people and organizations believe they can carve a slice of it for themselves.

But as large as the cryptocurrency market has now become, there remains a contingent of ‘maximalists’ who essentially believe that only their favorite crypto has a permanent place at the table. This is particularly the case with so-called Bitcoin maximalists, who often refer to other cryptocurrencies as ‘shitcoins’, arguing that Bitcoin is the “only cryptocurrency that works” and that “nobody wants to manage dozens of different types of money.”

It may (arguably) be true that Bitcoin’s combination of first-mover advantage, network effects and careful development will combine to preserve it as the leading cryptocurrency for years to come, especially when you add its supply cap.

However, the hard fact remains that, at the present moment in time, the cryptocurrency market is primarily about speculation (rather than storing value in ‘digital gold’). As such, speculators will continue to be interested in smaller-cap coins which offer a higher probability of outsized, shorter term returns.

A Brief Outline of Crypto Maximalism

There’s no fixed definition of crypto maximalism, with ‘maximalists’ taking a position that can veer from moderate to extreme. Here’s one example of what altcoin supporters would regard as ‘extreme’ maximalism, from The Bitcoin Standard author Saifedean Ammous:

Source: Twitter

Such maximalists would certainly agree that crypto is a zero-sum game, at least in the sense that Bitcoin is “the only one with any chance of success,” and that as bitcoin rises in value, an increasing number of altcoins will most likely fade into obscurity.

It’s worth pointing out that Bitcoin maximalism has its roots in the Austrian School of economics, which has been a major influence for the work of Saifedean Ammous and other Bitcoin authors, analysts, holders, and/or developers. Here’s Kraken’s Bitcoin strategist — and Satoshi Nakamoto Institute co-founder — Pierre Rochard exemplifying the link a tweet:

Source: Twitter

Basically, Bitcoin is going to out-compete altcoins for adopters, and the more adopters it attracts, the fewer adopters go to its rivals. As a belief (or attitude), this is something you find less frequently with other cryptocurrencies or platforms, with more of a balanced attitude being taken.

Source: Twitter

As the above tweet suggests, not every prominent figure in the industry believes that crypto is a zero-sum game. While some do believe that only one cryptocurrency will gain any real significance, others expect a range of truly decentralized — and useful — cryptocurrencies to emerge as dominant.

Source: Twitter

Higher Returns

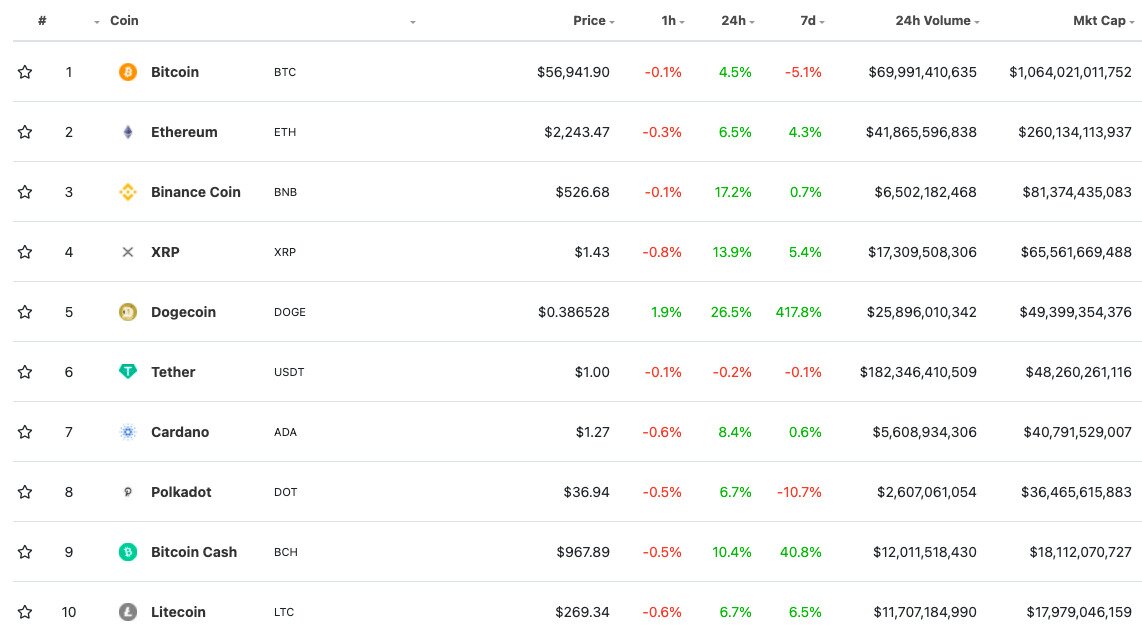

As far as things currently stand, the facts support those who take a more moderate, inclusive stance on what the future cryptocurrency market will look like. Because while Bitcoin obviously remains the most valuable crypto (in terms of market cap), several others also have high valuations that run into the tens of billions (or hundreds of billions, in the case of Ethereum).

Source: CoinGecko

More significantly, bitcoin’s dominance of the market’s overall capitalization has declined by nearly 10% in the past month. In fact, it has declined by 20% since the beginning of the year, having stood at 71.86% on January 3, and now standing at 51.25% (as of writing).

This is important, because it suggests that Bitcoin’s rising fortunes have actually benefited the wider cryptocurrency market and industry. This is the opposite of what Bitcoin maximalists would ordinarily predict.

It’s likely that, as institutional and retail investors have plowed into bitcoin, existing bitcoin holders have sold some of their holdings for profit and funneled this profit into altcoins. This would explain why most of the top-100 altcoins have risen so strongly in recent months.

And as institutions have entered the bitcoin market, traders have increasingly felt the need to turn to lower cap altcoins. Bitcoin is now pretty expensive, while it also isn’t quite as volatile as it used to be in previous years, so smaller cryptos seem to be where the action is if you don’t have enough patience to wait a few years for big profits.

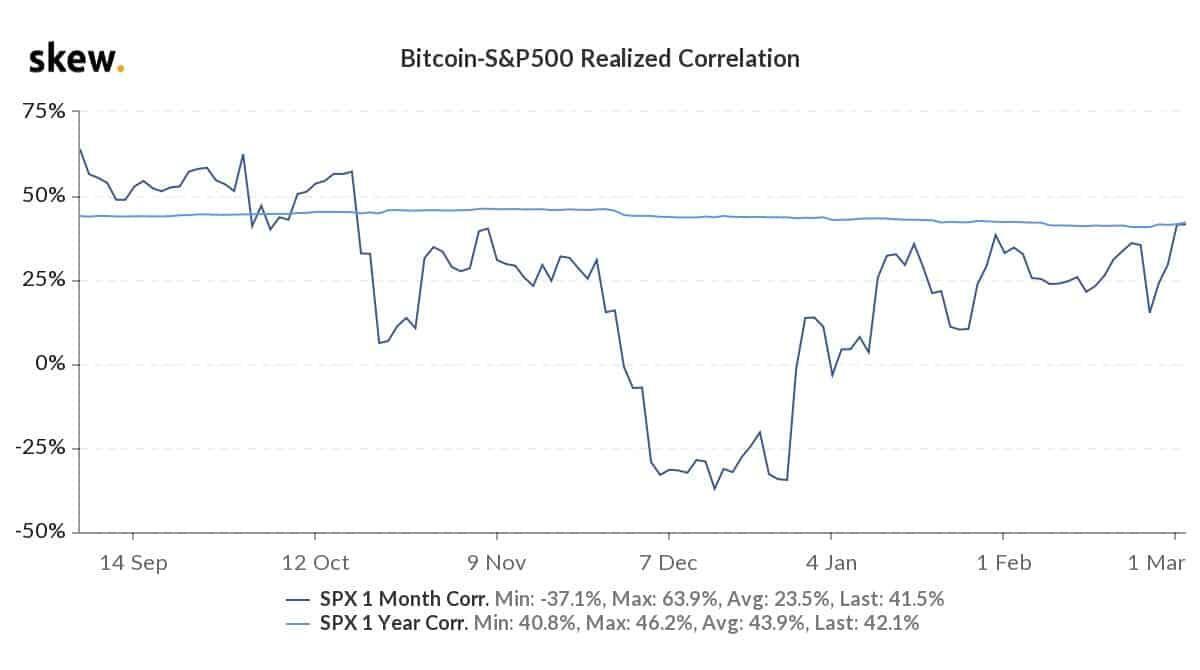

And this is what many Bitcoin maximalists seem to neglect. Yes, bitcoin is increasingly described as ‘digital gold,’ but its behavior as a financial asset is more correlated with stocks than it is with gold itself. This has especially become the case since the beginning of the current bull market, with bitcoin’s correlation with gold actually entering negative territory in December.

Source: skew

The point of all this is that, at the moment, the cryptocurrency market is very much about financial speculation. It’s not so much the desire for ‘sound money’ or a store of value that has driven investors towards bitcoin, but rather a desire for higher returns in a low-interest rate environment.

As other commentators have noted, “interest rates are in the toilet” right now, so traders, investors and savers have been looking for newer sources of easy profit.

Bitcoin has provided such profit. But now that it has reached a relatively high level of saturation, traders have increasingly turned to altcoins, something which explains why bitcoin’s market dominance has declined by nearly 20% since January.

And for as long as rock-bottom interest rates prevail, speculation will remain a big factor pushing people towards crypto. This means that other cryptocurrencies besides bitcoin will also enjoy investment, which by extension also means that crypto will not be a zero-sum game.

Such a situation may change if and when the macroeconomic picture improves. It may also hypothetically change if regulations somehow restrict the speculative aspect of crypto, forcing investors towards safer or more legitimate cryptocurrencies such as bitcoin. But it’s hard to see how regulations (or an improved global economy) could hamper most other cryptocurrencies without hampering bitcoin.

In other words, expect altcoins to be around for as long as Bitcoin, even if the latter will continue to attract most of the attention from investors.