- >News

- >Is $100,000 Bitcoin Still Possible for 2023? Or Did FTX Meltown Derail BTC?

Is $100,000 Bitcoin Still Possible for 2023? Or Did FTX Meltown Derail BTC?

A year is a very, very long time in crypto. Back in 2021, bitcoin was hitting record highs of $52,000, $63,729 and then $69,044, with a legion of analysts and industry figures predicting that it would quickly reach $100,000 or even higher. Now, the current BTC price is just over $17,000, with the cryptocurrency market as a whole having fallen by 70% since reaching a record total cap of $3 trillion in November 2021.

It actually gets worse for crypto, since not only have prices fallen substantially across the board, but the space has witnessed a number of spectacular collapses this year. From Terra, Celsius, Voyager and Three Arrows in the summer to FTX and BlockFi this winter, some big firms have been fatally tested by the decline in prices and profitability in recent months. This hasn’t been helped by the ongoing Ukraine-Russia war or by what seems to be a global recession, which have dampened investor sentiment to the point where markets have been at an apparent bottom for months.

Such news begs a question: do any of the experts and analysts who lined up in 2021 to predict a bitcoin price of $100,000 (or higher) still stand by their optimistic forecasts? Well, the picture is very much mixed, because while many have revised or abandoned dazzling near-term forecasts, others still suggest that bitcoin will reach new highs in the more distant future, rewarding patient holders.

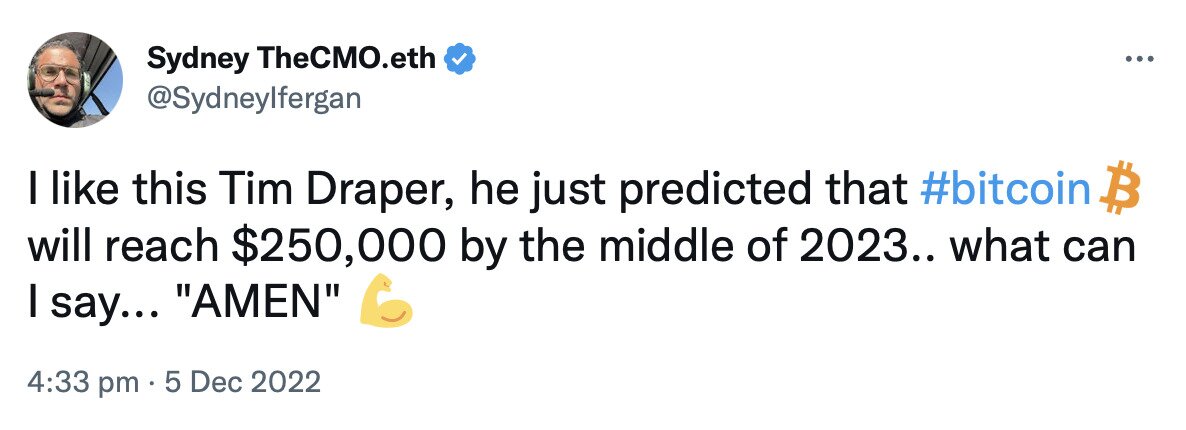

Billionaire Tim Draper: $250,000 by Mid-2023

Billionaire venture capitalist Tim Draper made his first bitcoin price prediction in 2018, when he set a target of $250,000 by 2022. He stood by this forecast and timeframe at least until the end of 2021, repeating it in June 2021.

Of course, 2022 itself brought a train of bad news, so Draper has understandably adjusted his prediction. He has stuck to the $250,000 price target, but in the middle of 2023, rather than at the end of this year.

Source: Twitter

“I have extended my prediction by six months. $250k is still my number. I expect a flight to quality and decentralized crypto like bitcoin, and for some of the weaker coins to become relics,” he told CNBC, which more than any other media outlet seems intent on extracting more or less arbitrary numbers from its interviewees.

Fundstrat’s Tom Lee: From $200,000 to No Prediction

The managing partner and head of research at analytical firm Fundstrat, Tom Lee predicted as recently as February that bitcoin would reach $200,000 in 2022. This means either bitcoin is set to rise by about 100,000% in three weeks, or he’s wrong.

Unsurprisingly, Lee has recently backtracked on his exuberant prediction, telling CNBC towards the end of November that “nobody’s made money in crypto in 2022,” which has been a “horrific year” for the market and investors. He also suggested that “if there’s more fraud” in the market (i.e. more blowups), then 2023 will likely be a horrid year as well.

However, while this sounds fairly bleak, Lee also suggests that this year’s bear market is an “important moment for the industry” and may help with “cleansing a lot of bad players” out of it.

He also stands by his confidence in bitcoin. Even though he now shies away from setting an ambitious near-term price target for the cryptocurrency, he self-adulatingly said, “we recommended people put 1% of their funds into Bitcoin [in 2017 …] Bitcoin was under $1,000 — that holding today would be 40% of their portfolio without rebalance. So, does Bitcoin still make sense for someone who wants to sort of have some sort of ballast? Yes.”

Cathie Wood and ARK Invest: Still $1 Million in 2030

ARK Invest fund manager Cathie Wood predicted in January that bitcoin will reach $1 million by 2030, representing a 5,700% return from its current price. A devout Christian who reportedly reads the bible every morning, Wood and her fund stand by this bullish prediction, reiterating in late November that it will be worth one million US dollars by the start of the next decade.

Echoing Lee’s remarks on the tough year bitcoin and crypto are having, Wood said, “Sometimes you need to battle test, you need to go through crises […] to see the survivors. We think bitcoin is coming out of this smelling like a rose.”

It’s worth pointing out that ARK Invest’s fund (the ARK Innovation ETF) is down by around 62% this year, with its biggest holdings being in Tesla (10.2%), Zoom (8.38%) and Roku (6.79%), all of which have suffered noticeable declines. Traders have made around $2.3 billion by short selling the fund this year.

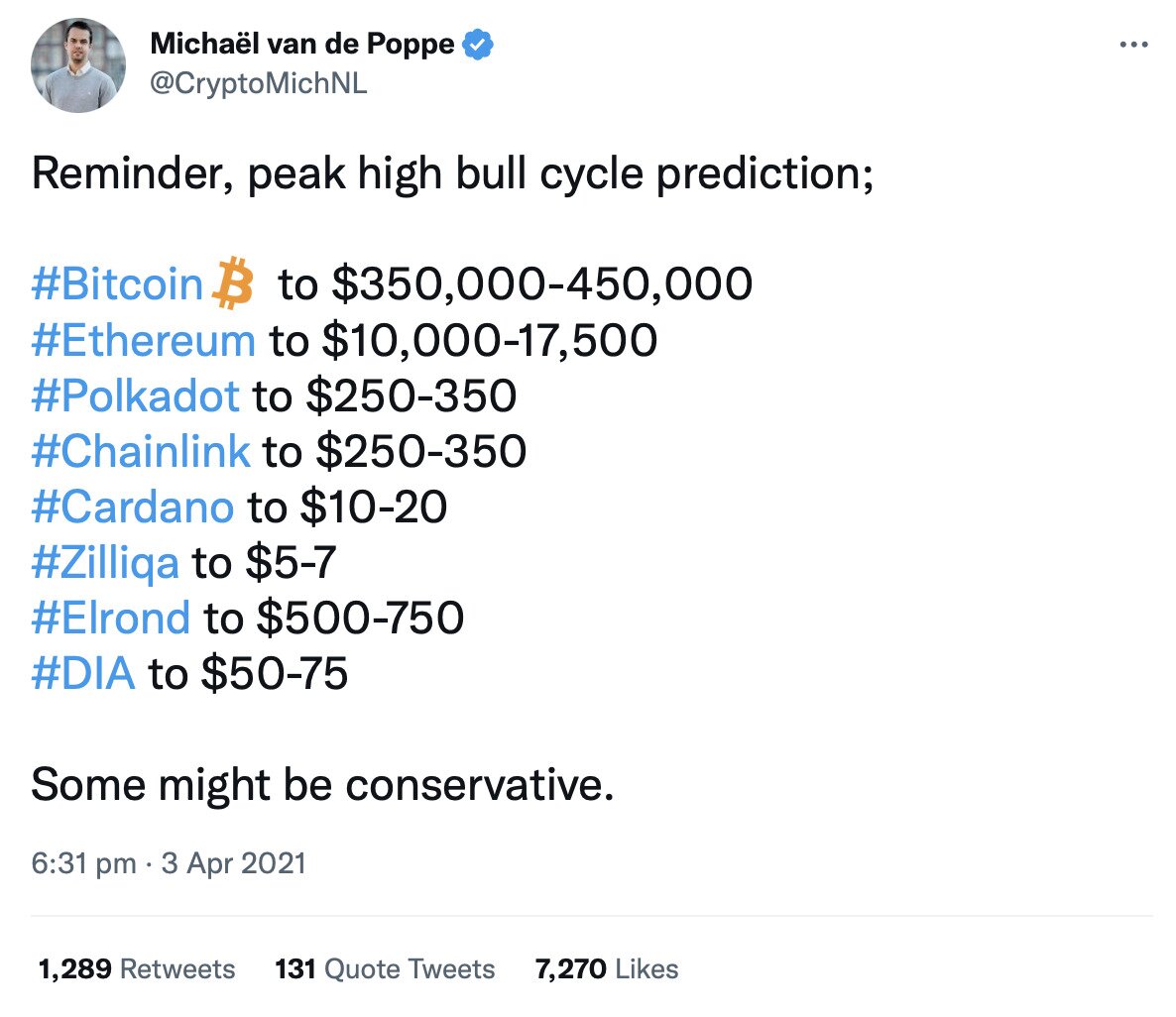

Michaël van de Poppe: From $350,000-$450,000 to $50,000 in Q2 2023

In April 2021, analyst, trader and Eight Global founder Michaël van de Poppe went so far as predicting a peak of between $350,000 and $450,000 for bitcoin during the then-current bull market. He repeated this prediction as recently as December 2021, which also included predictions of between $10,000 and $17,000 for ethereum, noting that some of his predictions “might be conservative.”

Source: Twitter

Fast forward to December 2022, and van de Poppe most recently set an upper-bound target of $50,000 for a relief rally that will occur by the end of Q2 2023.

The Big Financial Institutions, Surveys and Realism

Back in 2021, even some of the world’s big financial institutions were guilty of announcing mouth-watering bitcoin price targets. Standard Chartered, for instance, saw bitcoin reaching $100,000 by early 2022, while in January 2021 JPMorgan set a longer term target of $146,000, before bumping this up to $150,000 in February 2022.

Now, JPMorgan suggested that bitcoin could fall as low as $13,000 in the near term, while it hasn’t commented on what its long-term targets are for the cryptocurrency. This reflects the extent to which the current macroeconomic climate has dragged down market expectations, with no obvious end in sight.

Looking at the bigger picture, a panel of just over 50 experts arrived this year at an average prediction of bitcoin at $79,193 by 2025 and at $270,722 by 2030. It also suggested that the BTC price will rise to $21,344, which now arguably seems a little optimistic.

Indeed, now that BlockFi collapsed after FTX and that other firms seem unstable, only a pathological optimistic (or snake oil salesman) would suggest that bitcoin or any other major cryptocurrency is going to hit a new all-time high in the next few months. That said, it’s likely that BTC and its peers are close to their respective bottoms, meaning that long-term investors who buy now and show an admirable degree of patience could end up being rewarded in the more distant future.