- >News

- >PayPal Now Lets Customers Shop with Bitcoin, What Does it Mean for BTC Price?

PayPal Now Lets Customers Shop with Bitcoin, What Does it Mean for BTC Price?

The price of bitcoin jumped by as much as 4.5% on Tuesday, after PayPal announced it had begun letting US customers shop with over 29 million merchants using cryptocurrency. One bitcoin was worth around $57,168 at the start of the day and hit a peak of $59,749 early on Wednesday morning, as the market took PayPal’s news as further confirmation that Bitcoin and crypto are firmly entering the mainstream.

Combined with Visa’s own announcement that it’s allowing the use of the USDC stablecoin to settle transactions on its network, PayPal’s news is the kind of thing many within crypto have been waiting for for years. However, while it may be exciting to hear that the average layperson can now pay for sneakers or Snickers using bitcoin and ethereum, PayPal’s move may not provide crypto with quite the short or medium-term boost some would expect.

Not only will PayPal’s policy of converting crypto into fiat reduce adoption (insofar as merchants will be receiving only fiat), it may also add selling pressure to the bitcoin market. Because with millions of customers effectively having to sell their bitcoin for fiat in order to pay for goods, there could be an increase in supply that sends the price of bitcoin (and other PayPal-supported coins) downwards.

PayPal Launches ‘Checkout with Crypto’

PayPal’s news this week is basically a confirmation of what it announced in October, when it revealed it would be letting customers buy and sell bitcoin, ethereum, bitcoin cash, and litecoin. It also announced the ability to pay for goods using these four cryptocurrencies, yet it’s only now that it has begun actually rolling out the feature to its users in the US.

The service will be rolled out to all of the 29 million merchants on its platform over “the coming months,” with PayPal — and numerous commentators and media outlets — selling the move as a big step towards widespread adoption of cryptocurrencies.

“As the use of digital payments and digital currencies accelerates, the introduction of Checkout with Crypto continues our focus on driving mainstream adoption of cryptocurrencies,,” said PayPal CEO Dan Schulman in an accompanying press release. “Enabling cryptocurrencies to make purchases at businesses around the world is the next chapter in driving the ubiquity and mass acceptance of digital currencies.”

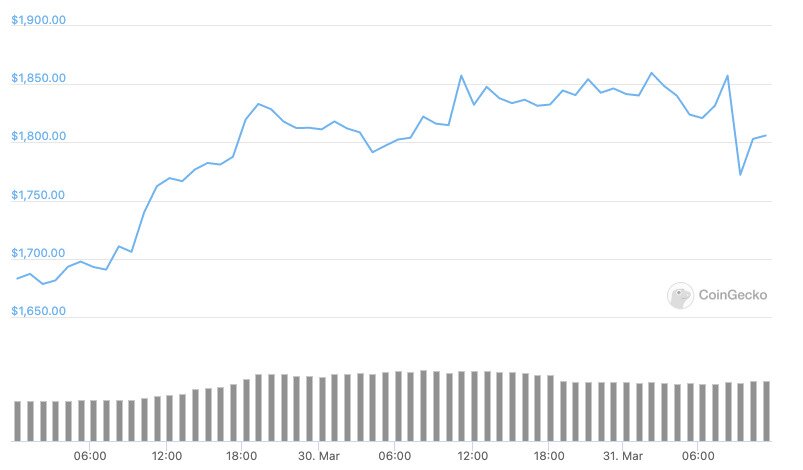

Again, the market appeared to agree that PayPal’s rollout is a big endorsement for bitcoin and other cryptocurrencies, at least if price action is any indicator. Here’s bitcoin’s price between March 29 and early on March 31:

Source: CoinGecko

And here’s ethereum, which rose by as much as 10% in the wake of PayPal’s release:

Source: CoinGecko

This 24-hour upswing added to momentum generated by Visa, which announced on Monday that it would support settlements on its payment network using USDC (which runs on Ethereum). The payments giant will be piloting the new capability with Crypto.com, and sold the move in terms of “bridging the worlds of digital and traditional fiat currencies:”

“The announcement today marks a major milestone in our ability to address the needs of fintechs managing their business in a stablecoin or cryptocurrency, and it’s really an extension of what we do every day, securely facilitating payments in all different currencies all across the world,” said executive VP Jack Forestell.

Selling Pressure

Visa’s move is potentially a very big step forward, although for now it remains a pilot its conducting only with Crypto.com, which will use USDC to settle payments on Visa’s network.

Much the same applies to PayPal’s move, since in some respects its news may not be quite as momentous as some would have you believe. This is largely because the 29 million merchants using its network will not be receiving any crypto when a PayPal customer chooses to ‘pay’ in bitcoin or ethereum.

Strictly speaking, not a single PayPal customer will actually be paying with cryptocurrency. Instead, those who choose the ‘Checkout with Crypto’ option when paying for stuff will simply be selling a portion of their crypto holdings to cover the relevant cost. PayPal will then pass on the (fiat-based) proceeds of this sale to the corresponding merchant.

In other words, PayPal’s ‘Checkout with Crypto’ is essentially inviting people to dump their cryptocurrency holdings to pay for goods in fiat. It’s a service focused on getting people to sell their bitcoin.

To put this even more plainly, the overarching aim of ‘Checkout with Crypto’ is to increase PayPal’s business by tapping into the growing cryptocurrency holdings of millions of Americans. It’s not primarily about boosting adoption of crypto, but rather about transferring capital from the cryptocurrency market to PayPal.

It’s arguable that most bitcoin holders have more sense than to offload some of their BTC in order to buy a hat or some nice cutlery, implying that few will actually use the Checkout with Crypto option. However, even a small percentage of PayPal’s 360-million-plus customers may be enough to make a dent on the price of bitcoin or other cryptocurrencies.

Assuming that, say, ten million PayPal customers spend $100 per month in crypto, this works out at $1 billion in crypto sales per month. Given that whales moving around $100m in bitcoin can help spark big corrections, such activity could add volatility to bitcoin markets.

Source: Twitter

Some may of course argue that, even if it encourages thousands if not millions of people to sell bitcoin, PayPal is also encouraging these same number of people to buy bitcoin for the first time, boosting the cryptocurrency’s price.

However, with plenty of exchanges and wallets offering a similarly easy and effortless process of buying crypto, it would be better for bitcoin’s price if new entrants bought BTC and held it, rather than selling a portion of it to buy stuff in fiat.

Patience

These criticisms aside, anything that switches the general public on to crypto is arguably a good thing. You could argue that, even without letting them withdraw bitcoin to their own wallets, PayPal has begun educating people about crypto. After taking those initial steps with PayPal, many new buyers may realize that it’s actually better to buy crypto via a dedicated exchange and then withdraw to a secure hardware or software wallet.

Similarly, merchants may soon enough begin asking PayPal to let them actually receive crypto as payment (rather than fiat), something which would really boost adoption. And as Visa’s entrance into the arena shows (not to mention BNY Mellon’s or Morgan Stanley’s), it’s now clear that the direction of travel is only towards greater adoption, and not less. So it may only be a matter of time before people and merchants are paying for everything in crypto, and disregarding fiat currencies altogether.