- >News

- >The Dark Side of Crypto: 10 of the Worst Scams and Hacks in History

The Dark Side of Crypto: 10 of the Worst Scams and Hacks in History

Crypto remains a controversial area of human activity, despite its increasingly mainstream status. There’s probably one main reason for this: scandals. Yes, crypto barely seems to be able to go a few months without some kind of unflattering news making the headlines, be it an exchange bankruptcy, platform hack, Ponzi scam or SEC legal action. Such episodes all serve to reinforce the still-popular narrative that the cryptocurrency industry is mostly a playground for gamblers and crooks, even if multi-billion dollar institutions and corporations are increasingly exploring the space.

And while developments in the EU, the UK and elsewhere show that the industry is gradually becoming more regulated and legitimate, wrongdoing still persists, helping to perpetuate the image of crypto as a haven for scandals. Such wrongdoings have veered from the outrageous to the mysterious, and this article collects the worst/biggest of them in a list of the top 10 scandals in crypto. If they teach us anything, it’s that cryptocurrency investors really need to do their own research at all times, and that if something looks too good to be true, then it probably is.

Terra and TerraUSD: More than $56.7 Billion in Market Cap Wiped Out

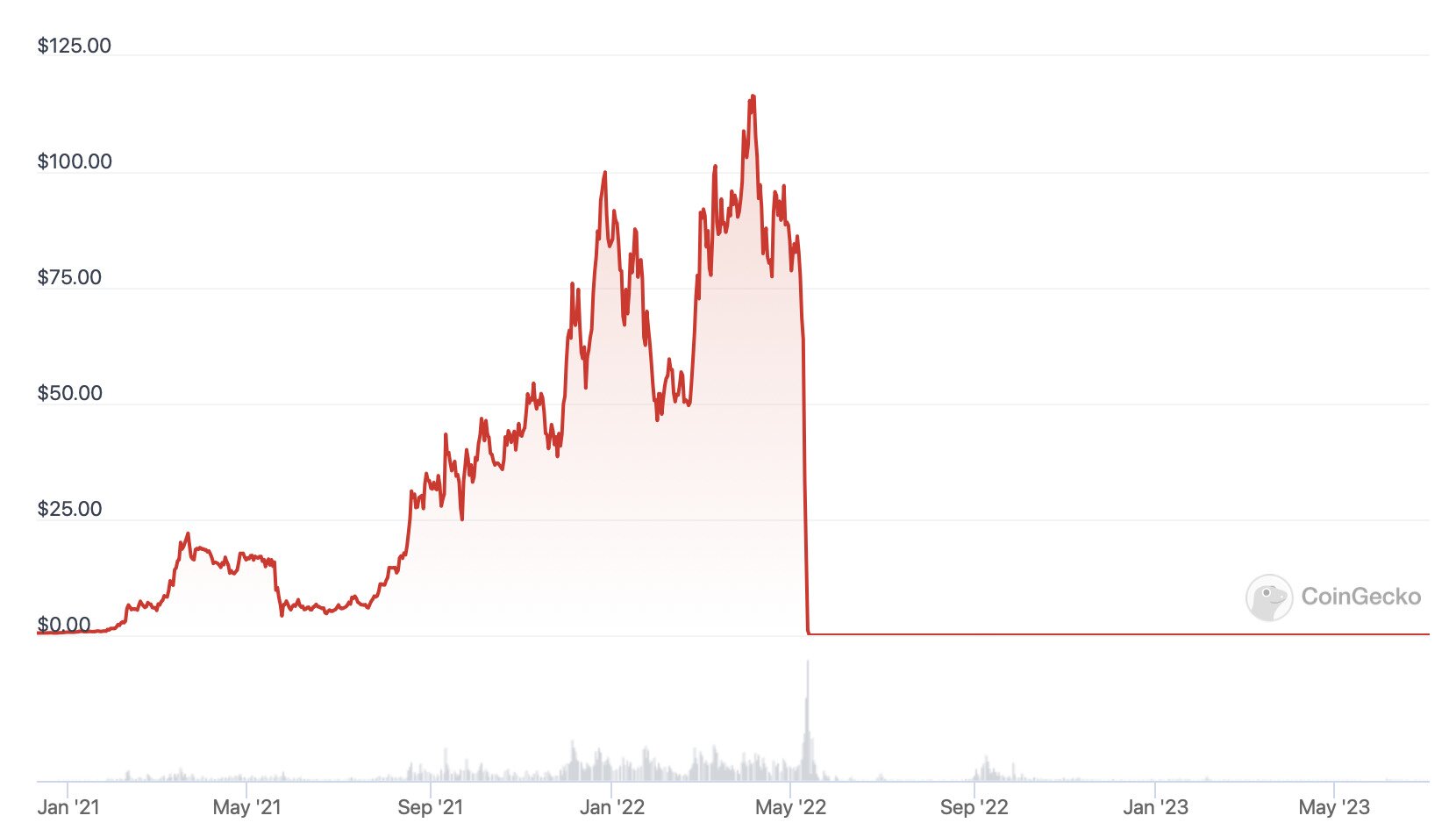

The monumental collapse of TerraUSD (UST) and Terra (LUNA) in May 2022 is the biggest scandal in crypto in terms of money lost. It was arguably also a major catalyst in making the current bear market more severe and prolonged than it perhaps had to be, bringing down many other platforms and cryptocurrency investors in its wake.

Back in April of that same year, the two cryptocurrencies – the stablecoin UST and its sister token LUNA – had a combined market cap of around $57.3 billion, making them two of the biggest and most important coins in the market. However, this value took a terminal nose dive in May when UST de-pegged from the US dollar, doing as a result of two big accounts withdrawing $500 million in crypto from Anchor, a Terra-based DeFi platform that was used for UST staking.

These big withdrawals caused a panic among other Anchor users, who ran over themselves to withdraw UST from the platform. Because there was very little exit liquidity on Anchor (around $300 million), users could exit their positions only by selling UST way below its then-current market rate.

Needless to say, this violently severed UST from the US dollar. In a vain attempt to restore the supposedly algorithmic stablecoin, Terra minted around 6 trillion LUNA, which became nigh-on worthless in the process.

One of the scariest charts in crypto history: LUNA’s price since 2021. Source: CoinGecko

The repercussions of this downfall was that Terra founder Do Kwon ended up on Interpol’s most wanted list, with the entrepreneur eventually being arrested by the international agency in March 2023. The collapse also had knock-on effects on the price of bitcoin (down from nearly $40,000 at the beginning of May to $19,000 by mid-June), which Terra had bought and then sold in order to support the price of UST.

Even worse, it caused the knock-on collapses of a number of firms that had invested in Terra, including Three Arrows Capital, Voyager Digital and Celsius. As such, the amount of money lost because of the Terra collapse almost certainly exceeds the $56.7 billion wiped off the market caps of UST and LUNA.

Mt. Gox: 750,000 Bitcoins Stolen ($23.2 Billion at Present Value)

For a few years, Japan-based exchange Mt. Gox was the bitcoin market. Estimates suggest that it accounted for 70% of all BTC trades by 2013, yet it was only a year later that it suffered a catastrophic hack in which 750,000 bitcoins were stolen.

This theft resulted in Mt. Gox declaring bankruptcy that same year, with the exchange unable to honor withdrawal requests from its thousands of customers. Because of this, a class action lawsuit was filed against the exchange by its US and Canadian clients, while a plan to begin repaying creditors and customers (in bitcoin) is to come into effect from October 2023.

Details surrounding the circumstances and nature of the apparent hack remained unclear until June 2023, when the US Department of Justice charged two Russian nationals – Alexey Bilyuchenko and Aleksandr Verner – for attempting to launder around 647,000 bitcoins stolen in the attack.

FTX: $8.9 Billion in Customer Funds Lost

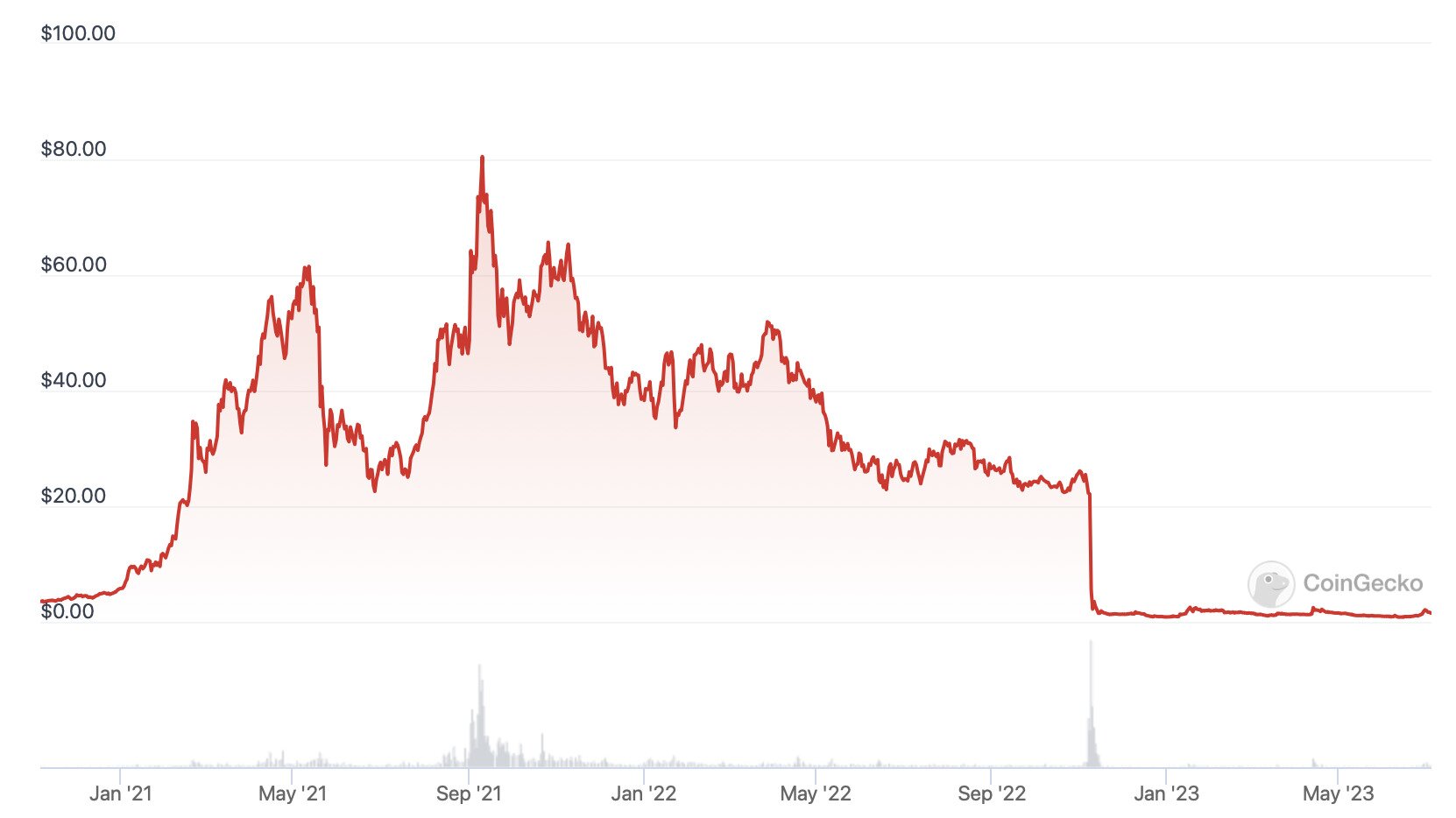

Founded in 2019, FTX quickly rose up the ranks to become one of the biggest crypto-exchanges in the market, with a 24-hour trading volume of $1.5 billion on November 1, 2022. However, it would collapse spectacularly by the end of that same month, leaving thousands of its customers out of pocket.

The short-term cause of FTX’s downfall was the revelation that its parent company, Alameda Research, had most of its assets in FTX’s very own native token, FTT. When the latter was taken out of the equation, it became apparent that Alameda had around $9 billion in liabilities and only $900 million in liquid assets.

FTT’s price chart since 2021. Source: CoinGecko

Cue a massive run on FTX, with customers quickly rushing to withdraw their funds from the insolvent exchange, which reportedly processed around $6 billion in withdrawals in 72 hours. It wasn’t long before the exchange filed for chapter 11 bankruptcy protection, after a mooted bailout offer from Binance fell through.

This was only the tip of the iceberg, however, with the fallout of FTX’s collapse revealing a whole underworld of shady practices. Most notably, it emerged that Alameda had been ‘borrowing’ FTX customer deposits in order to make risky investments, which became increasingly worthless as the 2021 bull market turned into a bear. On top of this, founder Sam Bankman-Fried was later indicted in the US on eight criminal charges, including money laundering, wire fraud, and campaign finance violations.

Underlining the sheer scale of FTX’s collapse, it eventually came to light that $8.9 billion in customer funds were unaccounted for as a result of the collapse. Fortunately, $7.3 billion in assets has been recovered as part of the bankruptcy proceedings, with the new administration planning to reboot the exchange at some point in the not-too distant future.

OneCoin: Investors Defrauded of Over $5 Billion

Aside from BitConnect, OneCoin is probably the most notorious Ponzi scheme in crypto’s short history. It was founded in 2014 and billed itself as as a Bitcoin killer, yet it operated on pure pyramid scheme-based principles, with OneCoin’s founder – Karl Sebastian Greenwood and Ruja ‘The CryptoQueen’ Ignatova – urging buyers of the cryptocurrency to recruit additional buyers from among their friends and family.

According to OneCoin’s own records and promotional materials, more than three million people bought its token. More staggeringly, it generated €4.037 billion in sales revenue and earned profits of €2.735 billion between Q4 2014 and Q4 2016.

Unfortunately for its founders, things began to fall apart from late 2016, with various regulators around the world issuing warnings about the token and even taking legal action. The next year, co-founder Ignatova flew from Bulgaria to Greece and has not been seen publicly since, with the FBI adding her to its Top Ten Most Wanted List in June 2022.

Bitcoin Savings and Trust: 146,000 BTC (Now Worth $4.5 Billion) Lost to Fraud

Launched way back in 2011, Bitcoin Savings and Trust has the distinction of being one of the first-ever bitcoin/crypto Ponzi schemes. It promised investors a 7% return per week on deposited BTC, with the trust’s operator – Trendon T. Shavers – claiming that it would make money by selling its BTC high and then buying it back at a lower price.

However, the reality was that Shavers used much of the deposited funds to finance his own lavish lifestyle, while incompetently speculating with the rest. When he began losing too much money, he lowered the promise interest rate, yet this caused a rush of withdrawals among investors. Inevitably, this caused the pyramid to collapse in on itself, with Shavers sentenced to 18 months in prison and order to pay about $2.5 million in forfeiture and restitution.

Voyager Digital: $3.8 Billion Lost in Customer Deposits

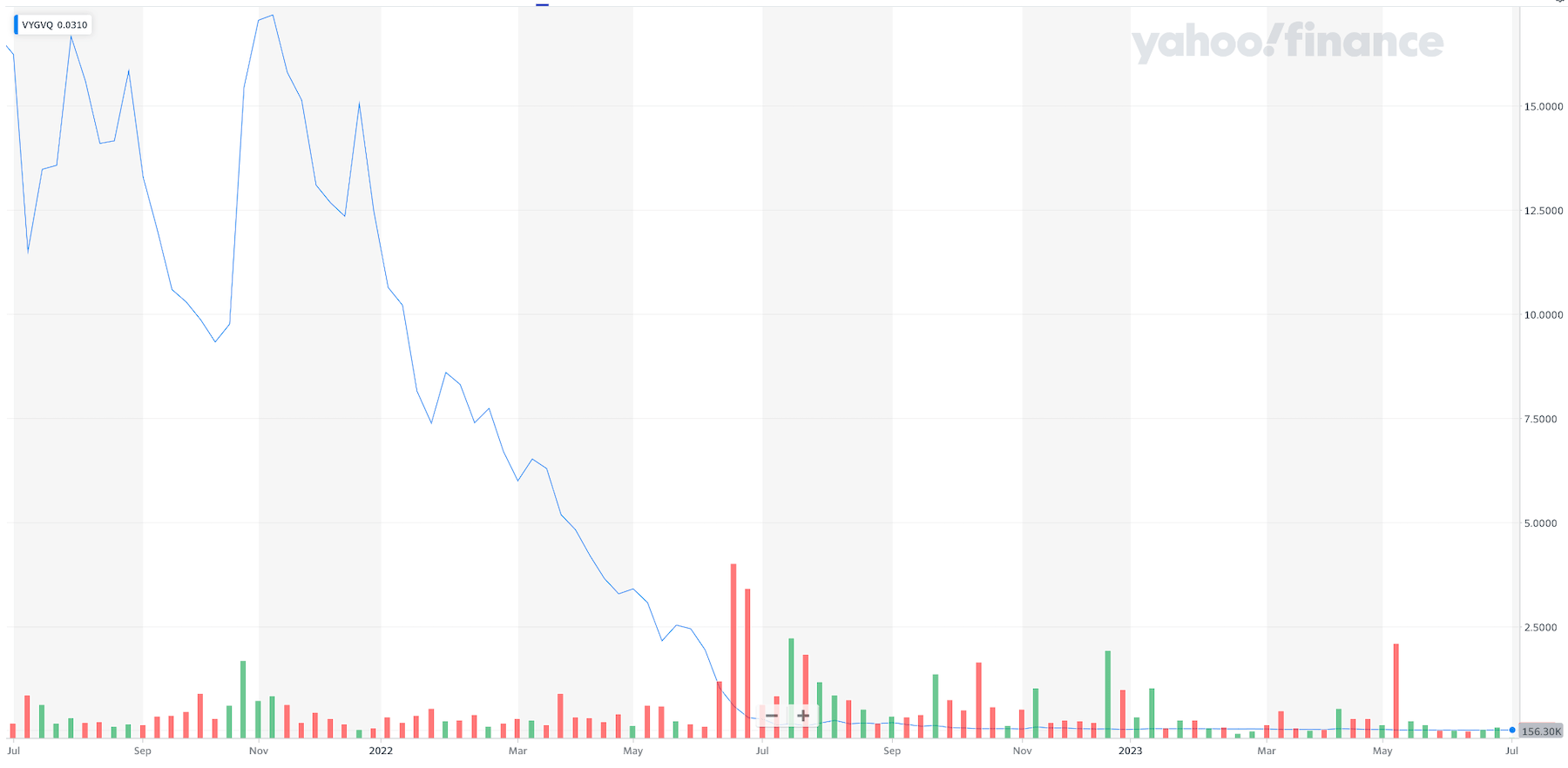

On the face of it, Voyager Digital’s scandal isn’t quite as shocking as those listed above. The cryptocurrency lender filed for bankruptcy in July 2022, barely two months after the collapse of Terra and barely a week after the bankruptcy of hedge fund Three Arrows Capital, which had been heavily exposed to Terra.

In turn, Voyager Digital had been heavily exposed to Three Arrows, via a $650 million loan it had made to the hedge fund. Yet what made Voyager’s crash particularly egregious is that the lender had claimed that deposits made with it were protected under the Federal Deposit Insurance Corporation (FDIC).

Voyager Digital stock since July 2021. Source: Yahoo! Finance

This claim resulted in FDIC itself issuing Voyager with a cease and desist notice on July 28 2022, with the governmental corporation noting that only an account Voyager itself held with Metropolitan Commercial Bank was covered. Ultimately, this meant that its customers lost around $3.8 billion as a result of its failure, although it’s hoping to repay about 35% of this ($1.33 billion) as part of its liquidation plan.

Of course many of the claims about Voyager could also be made about fellow bankrupt lender Celsius Network, which allegedly had a $1.2 billion hole in its balance sheet.

Bitfinex: 119,756 BTC (Now Worth $3.7 Billion) Stolen in Hack

In August 2016, major crypto-exchange Bitfinex suffered a hack in which 119,756 BTC – then worth around $72 million – was stolen by hackers. Controversially, Bitfinex responded to this breach of its systems by depleting the account balances of all its customers by 36%, with the exchange issuing BFX and RRT tokens as digital IOUs for the confiscated funds.

LEO Token’s price since launch. Notice the spike in February 2022. Source: CoinGecko

This kind of socialization of losses remains unprecedented within the crypto industry, and while many holders of the BFX and RRT tokens have sold off their compensation, many are now hoping to receive a portion of the 119,754 BTC recovered by the US DoJ in February 2022. However, it’s not clear that Bitfinex will directly compensate any of its customers, with the exchange planning to use 80% of the recovered BTC to buy up and destroy its native LEO Token.

BitConnect: $2.4 Billion Defrauded from Customers in Ponzi

Launched in 2016, BitConnect was a cryptocurrency connected to its own native trading platform, through which users could earn high yields by lending BitConnect Coin (BCC) to the exchange.

BitConnect would supposedly earn the interest it paid to users by directing the loaned BCC towards speculative investments, with the exchange claiming at the time that it would use trading bots to take advantage of the arbitrage opportunities presented by multiple exchanges. Users had to spend actual bitcoin in order to buy BCC from BitConnect, which promised annualized returns of up to 100% or more.

However, January 2018 saw the Texas State Securities Board issue BitConnect with a cease and desist notice, with the regulator describing the company as “fraudulent” and insinuating that it was running a Ponzi scheme (which it was).

BitConnect’s response to this legal action was to immediately shut down, leaving its BCC token to collapse in price, and leaving its users/investors collectively worse off to the tune of $2.4 billion. Fortunately, the US Department of Justice was in November 2021 able to retrieve around $56 million from BitConnect’s main promoter, Glenn Arcaro, with victims being awarded a total of $17 million in January 2023.

MyCoin: $375 Million in Customer Funds Lost to Ponzi

Based in Hong Kong, MyCoin was a bitcoin exchange that promised its customers a HK$1 million return within four months after investing BTC worth HK$400,000 with the company. Customers were also promised ‘prizes’ – such as luxury cars and cash – for recruiting more users to the platform.

If this sounds like a classic Ponzi scheme, you’d be right, because MyCoin abruptly shuttered its website in February 2015, one month after closing its physical HQ in Tsim Sha Tsui for ‘renovations.’ Around 3,000 customers reportedly lost HK$3 billion (c. $375 million) to the scam, with many investing in excess of HK$1 million.

Sadly, no trace of MyCoin’s operators could be found, with no customer funds being recovered to date.

QuadrigaCX: $169 Million in Customer Funds Lost

At one point Canada’s largest cryptocurrency exchange, QuadrigaCX suffered a strange demise in December 2018, when founder Gerald Cotten unexpectedly died while holidaying in India.

In a very blunt example of ‘not your keys, not your bitcoin,’ it quickly became apparent after Cotten’s death that only he held the private keys to Quadriga’s wallets, which at the time supposedly contained around $169 million in crypto. However, a later investigation by Ontario Securities Commission found that most of this money had already been lost by Cotten prior to his untimely passing.

In fact, some $115 million had been lost as a result of Cotten’s fraudulent trading on Quadriga, while another $28 million in losses came from the founder using customer assets to trade on external platforms. As bad as such losses were, the administrators in charge of Quadriga’s bankruptcy announced in May 2023 that its former customers will receive 13% of the funds they originally lost.