- >News

- >The Rise of Polkadot: How DOT Became a Top 10 Crypto in a Month

The Rise of Polkadot: How DOT Became a Top 10 Crypto in a Month

The price of Polkadot’s native currency, DOT, rose by a massive 117% between August 21 and September 1. Beginning this period at a modest $2.90, it jumped to $6.30 in less than two weeks.

DOT was by far the best-performing crypto during this window, outperforming the likes of Bitcoin, Ethereum, and Chainlink (which all remained pretty much static). The main reason for its heady rise was the redenomination it underwent on August 21, when a single DOT token was split into 100.

As we explain below, this re-denomination had the effect of triggering a market pump on DOT, a process which was boosted by it being listed on big exchanges such as Kraken and Binance. Yet Polkadot’s surge was also helped by its promises of delivering one of the holy grails of crypto: interoperability between different blockchains.

Redenomination Fuels Polkadot to Top 10 of Crypto

Polkadot isn’t actually a particularly new cryptocurrency and blockchain. It had its ICO in October 2017, when it raised some $140m to fund its plans to build a ‘relay-chain’ capable of linking other blockchains with each other. Its mainnet eventually went live on May 26, 2020, at a time when DOT tokens were still locked up by its protocol.

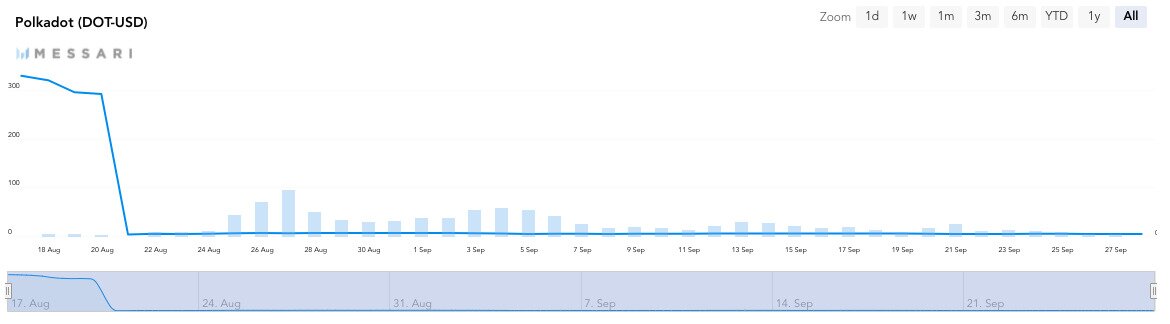

DOT tokens were finally transferred to their owners on August 17, three days before redenomination. On this date, they were priced at around $328, according to data from Messari.

Source: Messari

From the Polkadot price chart above, you’d think that the cryptocurrency has effectively crashed since August 21, when the redenomination took place. However, Messari is one of the few sources that retains the older denomination, meaning that its chart looks like Polkadot has suffered some kind of terrible calamity.

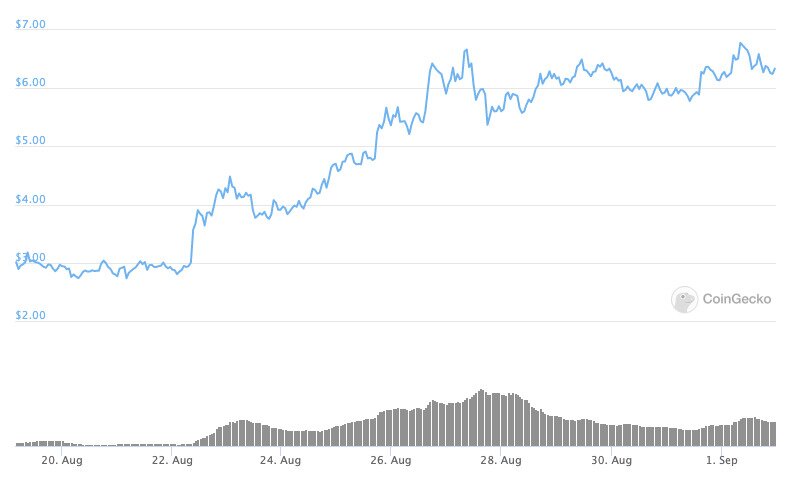

In fact, it’s quite the opposite. The chart below shows DOT’s price before August 21, yet according to its new denomination.

Source: CoinGecko

Before redenomination on August 21, polkadot hit a low of $2.74 (on August 20). It then rose to $6.78 on September 1.

Why would redenomination have this effect? Well, polkadot’s redenomination was effectively a 1:100 stock split. This means that for every single DOT token someone held prior to August 21, they would end up with 100 after the redenomination.

Likewise, the redenomination would multiply the supply of DOT by 100, while making each DOT token 100 times cheaper. At the same time, the overall market cap wouldn’t be affected.

As with splits in the stock market, the re-denomination has the effect of making each DOT token much cheaper — and much more accessible — for the ‘average’ trader. This creates a rush to buy up the tokens, since traders assume that this will be the cheapest they’ll ever be able to buy them, and that the price of DOT will rise consistently in the future.

This is also evident with the recent stock splits Apple and Tesla underwent. These both took place on August 31, and as you can see from the chart below, they both boosted the respective prices of each stock.

Tesla (red) and Apple (blue) both grew much more strongly than the S&P 500 (green) in the weeks leading up to their stocks splits on August 31. Source: Yahoo!

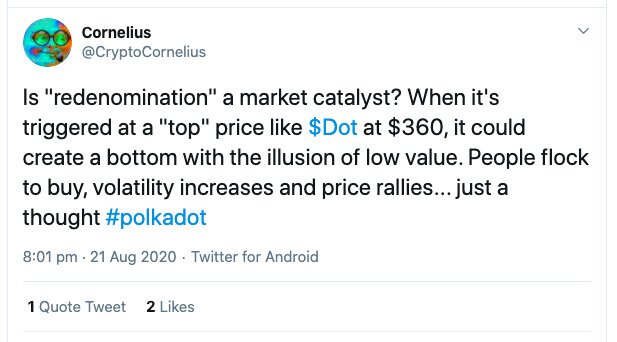

Many crypto traders also suspected that redenomination played a significant role in DOT’s rise.

Source: Twitter

As Three Arrows Capital CEO Su Zhu wrote in a blog post back in July, redenomination allows “users to afford whole units of DOT which would lead to broader participation and engagement.”

The result of this is that, having been outside the top 200 cryptocurrencies by market cap on August 21, Polkadot rose to become the sixth biggest by September 1.

Not Just Redenomination

Polkadot’s price and market cap wasn’t helped exclusively by redenomination, but also by the fact that it has only been tradeable for just over a month. Big exchanges such as Binance, Kraken, and Bitfinex have only recently listed it, so it’s only now that the vast majority of traders have been able to buy a stake in it.

Similarly, it may be over three years old in terms of its original inception, but its mainnet went live only four months ago, so it remains a relatively new — and promising — project.

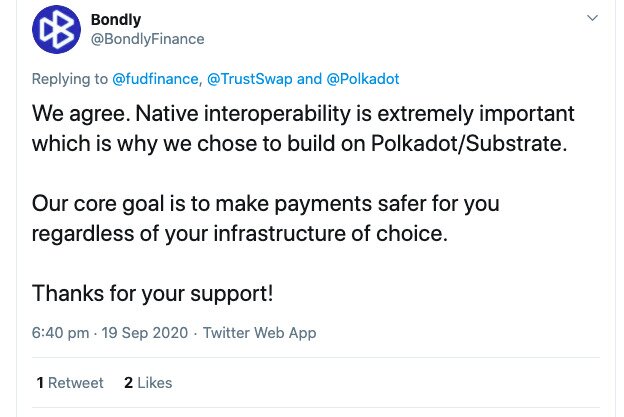

As such, it’s exciting people. It doesn’t simply promise to enable interoperability between blockchains, but it will also allow other teams and companies to build projects on top of it, which will then be interoperable with multiple other blockchains.

Source: Twitter

As such, Polkadot looks set to become an important platform within the crypto ecosystem. In this respect, it follows in the footsteps of Chainlink, which recently rose to become a top-ten cryptocurrency on the back of its promise to feed external data to other blockchains.

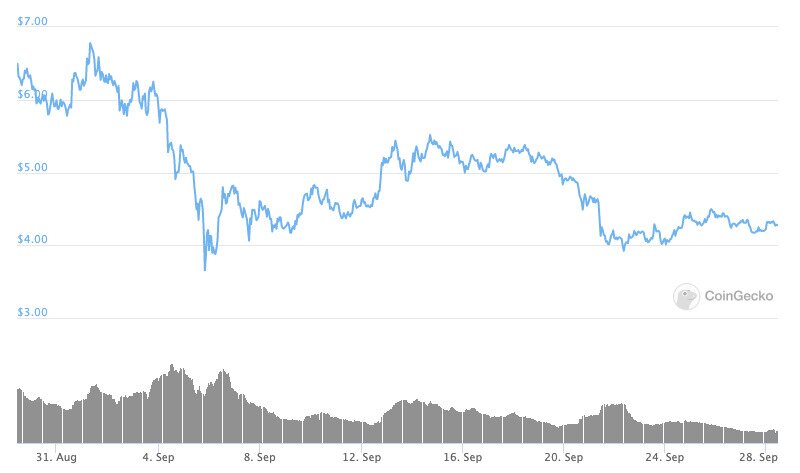

Traders seem to believe that Polkadot could become a fundamental part of the crypto ecosystem’s underlying infrastructure, like Ethereum, (arguably) Chainlink, and potentially certain others (e.g. IOTA). And so far, this belief appears to be holding out, with Polkadot still standing as the seventh most valuable cryptocurrency, despite falling to $4.35 (as of writing) from $6.78 on September 1.

Source: CoinGecko

It’s also worth pointing out that, while DOT has declined by 36% since September 1, much of the market has also fallen over this period. Bitcoin has declined by 9%, Ethereum by 25.9%, and Chainlink by 39%, according to data from CoinGecko.

In other words, DOT is largely holding its own as one of the big cryptocurrencies, even if it’s been tradeable for barely a month. And given its technological potential, it could continue holding its own for some time to come.