- >News

- >What Are the Top 10 Greenest Cryptocurrencies? You Might Be Surprised

What Are the Top 10 Greenest Cryptocurrencies? You Might Be Surprised

Misinformed or not, a growing popular consensus is forming around the idea that Bitcoin is bad for the environment. Having emerged several years ago with work from the likes of Digiconomist Alex de Vries, this idea has now gained significant traction thanks largely to Tesla, which announced on May 12 it would no longer accept bitcoin as payment.

In its statement, Tesla declared it’s “concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions.” This promptly caused a market nosedive, with bitcoin plunging from around $57,700 on May 12 to a two-month low of $42,879 on May 17. In parallel, certain coins perceived to be friendlier to the environment — Cardano (ADA), Stellar (XLM) and Solana (SOL) — bucked the overall downward trend to post significant seven-day gains.

This leads to an important question: what are the most environmentally friendly cryptocurrencies, at least compared to Bitcoin? This article rounds up the top ten, providing data on how much energy each crypto and its blockchain consumes, as well as pertinent info on decentralization, security, and whether each cryptocurrency would remain ‘eco-friendly’ if it operated at a much bigger scale.

Ripple (XRP)

While XRP hasn’t been left untouched by the recent Tesla-inspired drop, it hasn’t quite suffered as much as its main rivals, dropping by 5.5% over the past seven days, compared to a 22% dive for BTC and a 10% fall for ETH. The relative mildness of its decline may be due in large part to its smaller energy needs, which in turn should have a smaller environmental impact.

According to an April report from server company TRG Datacenters, XRP was the least energy intensive of the seven major coins it reviewed (the others being dogecoin, cardano, litecoin, bitcoin cash, ethereum and bitcoin). It consumes 0.0079 kWh of electricity per transaction, which is only 0.00112% of the 707 kWh Bitcoin consumes per transaction. To put that differently, Bitcoin’s energy consumption per transaction represents a 8,949,267% increase over Ripple’s (according to TRG Datacenters).

Other available data supports this assessment. Ripple’s own data — from 2019 — indicated that it consumed 474,000 kWh per year, with Bitcoin consuming 57.09 billion kwH and Ethereum 2.57 billion kWh. Likewise, a July 2020 blog from Ripple estimated that its network could power 79,000 lightbulb hours for every million transactions, while a million Bitcoin transactions were equivalent to 4.51 billion lightbulb hours, making Ripple “57,000x more efficient.”

The secret to Ripple’s eco-friendliness is that it doesn’t use Bitcoin’s (or Ethereum’s) proof-of-work consensus mechanism. Instead, it uses a “distributed agreement protocol” that requires agreement among a super majority of nodes to confirm transactions. While critics have suggested that this makes Ripple much less decentralized and secure than Bitcoin, it means that Ripple could scale far beyond Bitcoin and still be less energy intensive.

In fact, Ripple pledged in February to reach net-zero carbon emissions by 2030. This obviously doesn’t mean it would consume no energy, only that what energy it does consume would be generated entirely by renewable sources.

EOS

EOS is also resource un-hungry compared to the likes of Bitcoin, given that it uses a proof-of-stake consensus mechanism (actually delegated-proof-of-stake, but we needn’t enter specifics). It’s also worth pointing out that, over the past seven days, it has fallen in price by only 7.9%, although it admittedly hadn’t fared as well during the recent bull market as other coins.

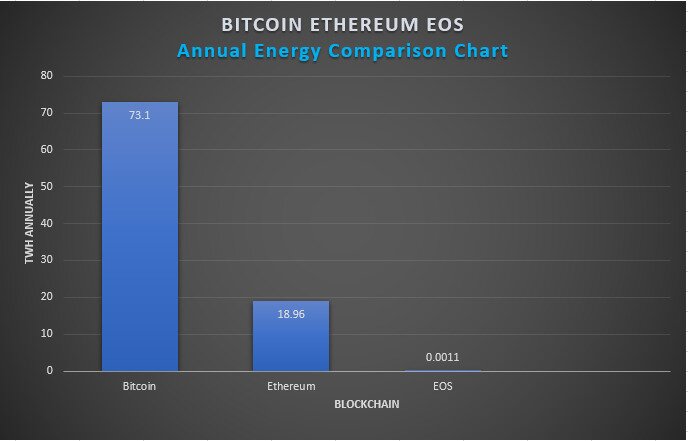

According to data from EOS itself, it’s 66,454 times more energy efficient than Bitcoin and 17,236 times more efficient than Ethereum. Its annual energy use is only 0.0011 tWh (based on 2018 data), compared to what was then an annual use of 73.1 tWh per year for Bitcoin.

Source: genereos.io

EOS has already declared itself the world’s first major carbon-neutral blockchain, having begun a scheme in 2018 to buy carbon offsets for its own energy use.

On the other hand, critics have again argued that delegated-proof-of-stake results in considerably more centralization than proof-of-work, so investment in EOS likely depends on your priorities.

Stellar (XLM)

Stellar has been one of a small handful of coins to actually rise in price during the recent selloff. Its value has jumped by as much as 20% over the past week or so, from $0.577 on May 9 to $0.695 on May 17.

Data from the non-profit Poseidon Foundation (with which Stellar partnered in 2018) reveals that the blockchain uses 0.03 Wh of energy per transaction (or 0.00003 kWh), compared to 634,000 Wh (or 634 kWh) for Bitcoin. This makes it more energy efficient than the Visa network, according to the Foundation.

Stellar uses neither proof-of-work nor proof-of-stake, instead harnessing a system of federated voting. This is why it can get away with using so little energy, although almost needless to say, researchers have suggested that its blockchain is “significantly centralized” and subject to “cascading failure” in the event of only two nodes failing.

Tezos (XTZ)

Tezos is another energy efficient blockchain, although it hasn’t escaped the recent downturn, falling by 23% over the past seven days.

Source: Tezos

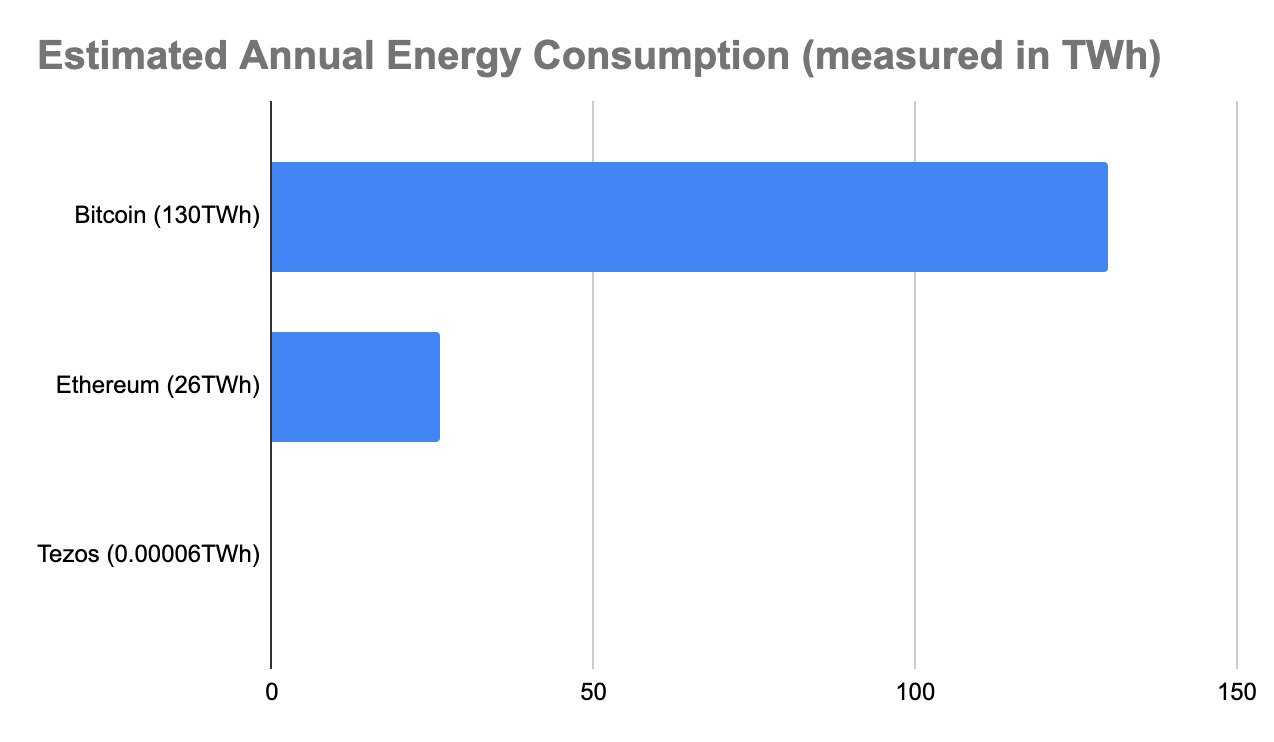

Still, it is many orders less energy intensive than Bitcoin or Ethereum. A Medium post from Tezos published this March put its annual energy consumption at only 0.00006 tWh, with the latest annual figures for Bitcoin and Ethereum having risen to 130 tWh and 26 tWh, respectively.

To put this in some context, Bitcoin’s current energy consumption is now equivalent to the entire nation of the Netherlands, which as the world’s 18th biggest economy, is hardly a shantytown.

As with most other environmentally friendly blockchains, Tezos runs a proof-of-stake consensus mechanism, with token holders able to delegate their XTZ to validators who then use their funds to confirm transactions.

Cardano (ADA)

Cardano has been perhaps the biggest beneficiary of the recent bear market, rising by 24% in seven days, from $1.76 to $2.19. This is almost certainly a result of its apparent green credentials.

According to the same TRG Datacenters report cited above, Cardano consumes only 0.5479 kWh per transaction, compared to 707 kWh for Bitcoin. This makes it around 1,290.38 times more energy efficient than Bitcoin, with proof-of-stake once again the main reason for this superiority.

Solana (SOL)

Solana has been another gainer, rising by around 13.7% over the past seven days, to $50.71 (as of writing).

While there’s no hard data on Solana’s energy consumption, community members have estimated the latter at a very modest 1,200 kWh per year (although we have to stress the highly informal and biased nature of such figures).

While we can’t entirely vouch for such estimates, Solana’s use of a novel proof-of-history protocol — which involves synchronizing time across all nodes — allows blocks to be confirmed even more quickly than with proof-of-stake mechanisms. As such, it’s likely to be very energy efficient, and should be much less intensive than Bitcoin and other proof-of-work cryptocurrencies.

Polkadot (DOT)

Polkadot uses its own proof-of-stake consensus mechanism, known as nominated proof-of-stake, whereby token holders stake their DOT with validators who secure the Polkadot blockchain.

Use of the nPoS mechanism almost certainly makes Polkadot less energy intensive than Bitcoin, although neither Polkadot nor any other organization has produced data confirming this.

That said, Polkadot’s green credentials have been supported to some extent by the fact that it hasn’t fallen as badly as PoW cryptocurrencies over the past seven days. It has dropped by less than 1%, from $39.74 to $39.65.

Nano (NANO)

Having increased in price by around 10% over the past seven days, Nano is another big winner from the recent fallout. Originally a coin which used delegated-proof-of-stake, it now uses a similar mechanism known as Open Representative Voting, whereby each transaction is voted on by validators.

Either way, it’s another energy efficient chain. One estimate from 2018 puts its consumption at a tiny 0.000112 kWh per transaction, making it even more efficient than XRP (although obviously the data comes from different sources at different times).

Dogecoin (DOGE)

TRG Datacenters report suggests that Dogecoin is one of the most environmentally friendly cryptocurrencies out there. Its research suggests that the cryptocurrency consumes only 0.12 kWh of energy per transaction, compared to 707 for Bitcoin.

This seems impressive, although Dogecoin has also fallen by 12% over the past week. Not only that, but Dogecoin is also a proof-of-work cryptocurrency, much like Bitcoin. In fact, Dogecoin is largely based around the core code of Bitcoin, so it works in much the same way.

So what accounts for its smaller footprint per transaction? Well, given that it’s used much less widely and frequently than Bitcoin, and has a smaller community of miners, its network difficulty is much lower. This basically means it takes much less computing power to process and validate transactions, which explains why it consumes much less energy.

More precisely, BitInfoCharts puts Bitcoin’s difficulty at roughly 25 TH/s, while Dogecoin’s is 4.7 MH/s. In other words, Bitcoin is more than five million times more difficult than Dogecoin. This makes Dogecoin’s supposed energy efficiency (5,891.6 times greater) seem a little trivial, since this would disappear if Dogecoin scaled to the size of Bitcoin.

Ethereum (ETH)

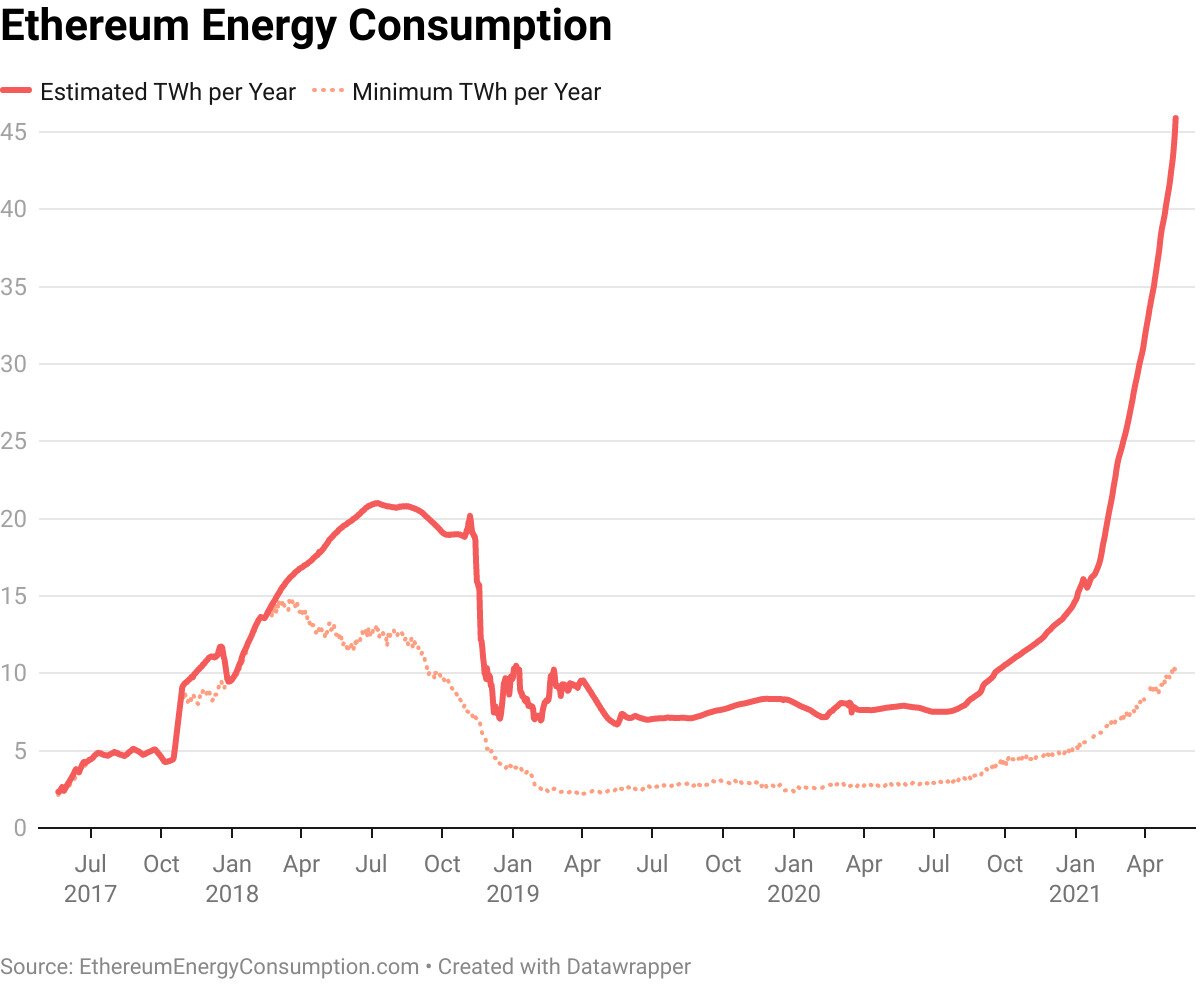

While Ethereum is still currently a proof-of-work cryptocurrency, it’s planning an eventual transition to proof-of-stake, due to come at some point towards the end of the year. This would make it considerably more environmentally friendly, putting it in the same league as chains such as Cardano and Tezos.

For now, however, it’s actually the second most environmentally unfriendly crypto. Digiconomist puts its annual consumption at around 49.16 tWh, between Portugal and Peru. This may explain why it has risen along with cryptocurrencies that are already using a PoS mechanism.

Don’t Forget Bitcoin (BTC)

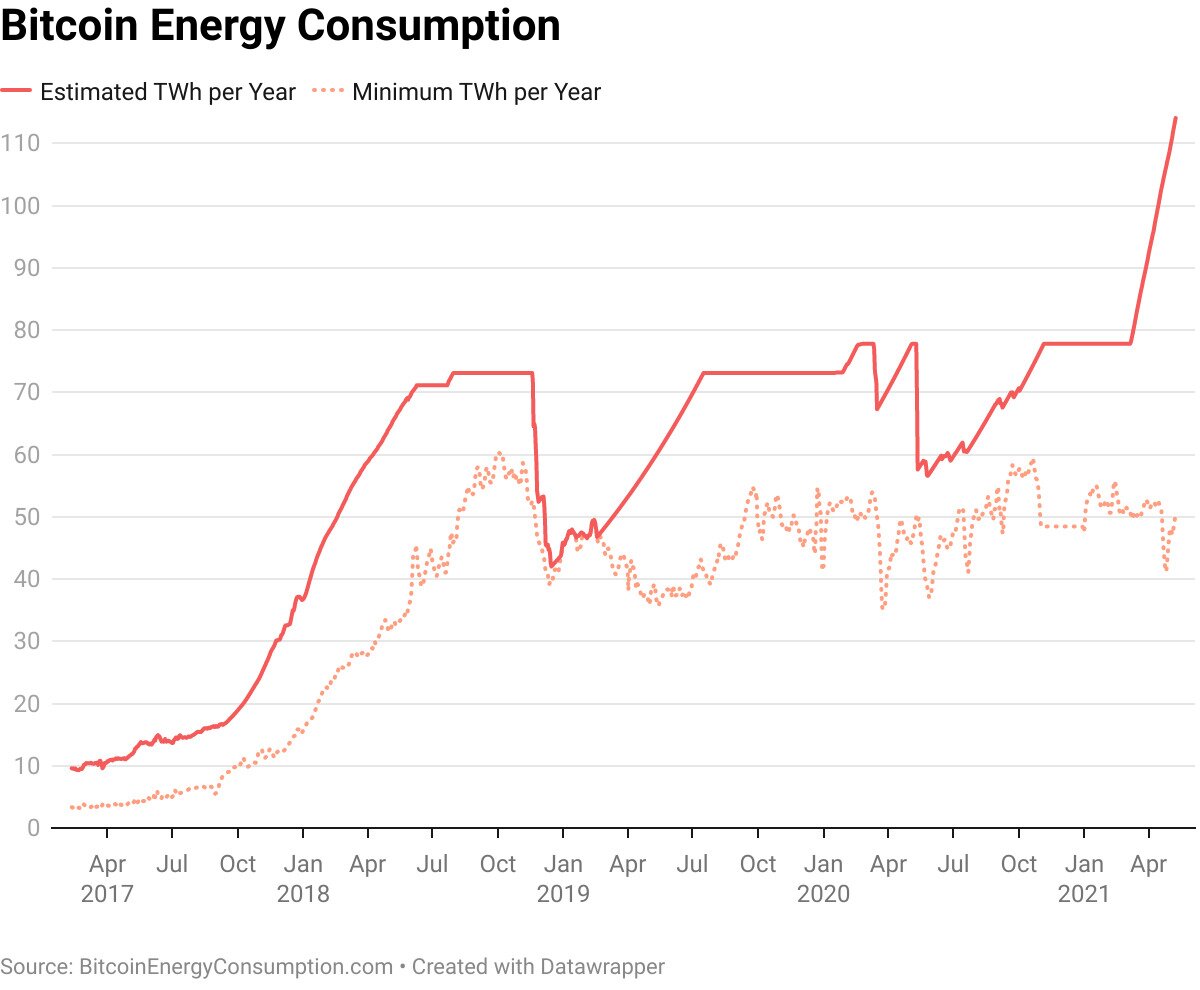

Yes, Bitcoin is crypto’s worst coin in terms of energy consumption, but its advocates would strongly argue that its potential damage to the environment is being overstated.

Digiconomist currently calculates its annual energy use at 118 tWh (although as noted above, it may be as high as 130 tWh). However, Bitcoin supporters have long claimed that it uses 73% renewable energy sources.

This figure is based on a 2019 report from CoinShares, which claimed that Bitcoin mining is “more renewables-driven than almost every other large-scale industry in the world.”

That said, more recent research from Cambridge University — arguably a more reliable and disinterested source of info than CoinShares — states that only “39% of proof-of-work mining is powered by renewable energy, primarily hydroelectric energy.” The important distinction the Cambridge researchers make is that, while 76% of miners use renewables at least intermittently, green sources make up only 39% of proof-of-work mining overall.

Nonetheless, many Bitcoiners maintain that Bitcoin is helping to drive expansion in renewables, an argument made to Business Insider in March by mining company Foundry. And with Tesla seriously denting Bitcoin’s reputation via its de-acceptance of the cryptocurrency, its push for renewable energy sources may only accelerate in the near future.