- >News

- >What’s the Best Way to Start Staking Crypto in 2023?

What’s the Best Way to Start Staking Crypto in 2023?

If you’re looking to earn free crypto, then look no further than staking. Whether you’re a beginner, or seasoned crypto veteran, staking your crypto assets is a great way to earn passive income over time. You can earn rates of return much higher than traditional options with many different crypto staking methods.

In this guide we’ll discuss what staking is, its various forms, and give you the best option for your cryptocurrency knowledge level. Let’s jump in.

What is Staking Crypto?

Staking is the process of taking your crypto assets and using them to help secure and validate transactions on a blockchain network. This can be done as a validator yourself or by delegating your stake to a stake pool operator or service provider such as a centralized exchange. When delegating, you’re not giving someone your assets, but rather allowing them access to their voting rights.

For example, Cardano (ADA), uses a proof of stake mechanism. Users can choose to be a stake pool operator (SPO), meaning they run a node and can receive other users’ Cardano through delegation. They can also be a delegator, meaning they turn their voting power over to someone else but still own their ADA. Cardano is also liquid staking, meaning you can still trade/sell ADA that is staked.

Centralized vs Decentralized Staking

When it comes to your options for staking, they fall into two general categories: centralized and decentralized.

Centralized staking is staking through a centralized service such as a cryptocurrency exchange like Binance, Kraken, or Coinbase. Within centralized staking options there are then two main categories, protocol staking, and earn programs. Note that Binance and Kraken staking services are not available in the USA.

Protocol staking is staking done directly to a blockchain, meaning you’re delegating your crypto to a validator (often the exchange itself). It’s often a stable, decent return, but could incur additional fees or commissions that you wouldn’t get if you staked yourself. You also have to keep your assets on the exchange rather than in a wallet you hold the keys to.

Earn programs are generally a higher return, but may not protect your principal. You’re usually loaning out your assets to a third-party which doesn’t offer the same guarantees as protocol staking.

Decentralized staking comes in three forms: liquidity pool staking, lending platform staking, and protocol staking.

Protocol staking is the same as with centralized services, but rather than the centralized exchange being the ones who stake your assets, you stake the assets yourself and keep them in an external wallet. You also get to choose the validator you use.

Lending platform staking is fairly simple, and is done on decentralized lending platforms like AAVE. You provide an asset (supply) and earn what is generally a modest return (but it’s based on how much supply and demand there is). There’s no real risk, and you can then borrow against your supplied assets.

Liquidity pool staking involves providing two assets in equivalent dollar amounts to a decentralized exchange such as Uniswap. You then receive trading fees in proportion to the liquidity you provided that depends on the volume of trading done using the pool. There is more risk in the form of impermanent loss, but the rewards can make up for that.

Best Way to Stake For Beginners

The best way to start staking for beginners is to use a centralized option like Coinbase Earn, or a similar service wherein the exchange is simply staking your assets to the blockchain protocol. There is no risk of losing assets (provided you trust the exchange), the returns are stable, and assuming you used the exchange to make your first crypto purchase, your assets are already there and ready to be staked. Depending on the asset, you can earn anywhere from 2-15%.

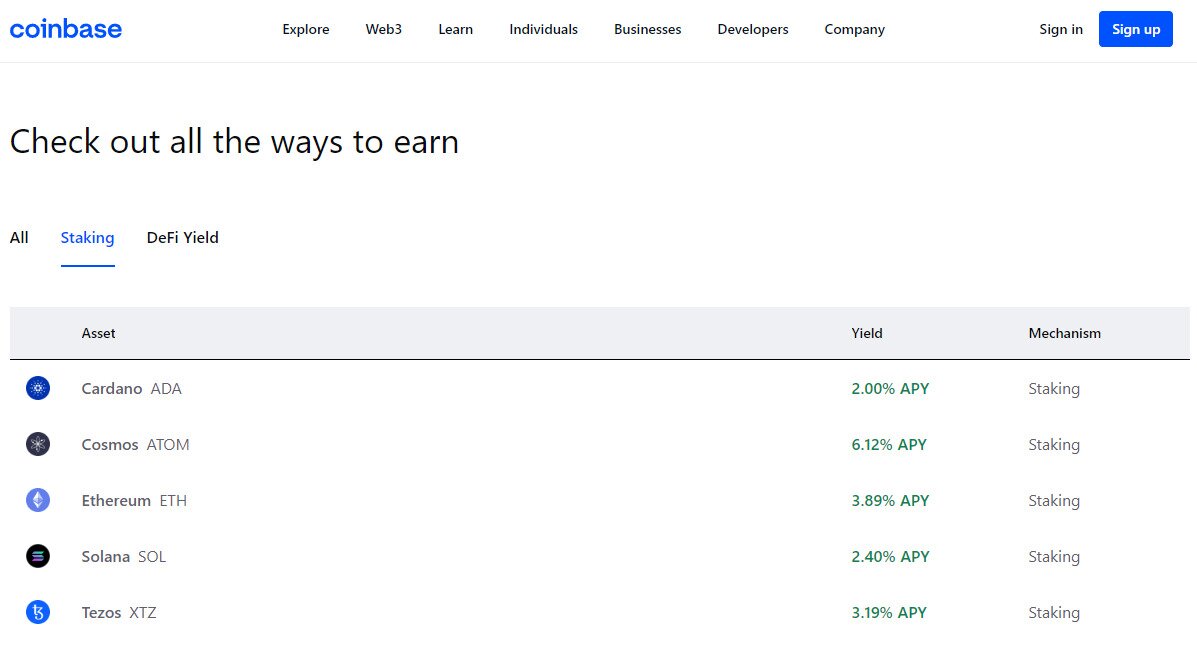

Here’s a look at staking on Coinbase:

As you can see in the above image, you can do Ethereum staking, without having to learn how to stake Ethereum. You simply make a few clicks and confirmations on Coinbase. Other centralized options for staking crypto are Binance, Kraken, KuCoin, and Crypto.com, with the processes being just as straightforward.

Best Way to Stake for Intermediate Users

The best way to start staking for intermediate users is to do direct protocol staking. This simply means rather than having the cryptocurrency exchange hold and stake your assets, you keep them in an external wallet and delegate them yourself. This can be quite easily done through most external browser extension wallets like MetaMask or Coinbase Wallet, and through hardware wallet applications like Ledger Live.

You simply pick the asset you wish to stake, which validator you want to stake with, how much you’re going to stake, then start earning after you confirm. Applications like Ledger Live provide step by step guidance when you’re ready to stake, along with an easy to find “Stake” button.

The advantage to doing protocol staking yourself is that you control your assets, can choose a validator with a commission you like, and you have more freedom to move them.

Keep in mind that some cryptos, such as Cardano and Cosmos, are much easier to stake on the protocol level with very little investment. Meanwhile Ethereum requires a considerably bigger investment (there is a 32 ETH minimum and technical requirements) so many people use liquid staking tokens such as Lido (STETH) or Rocket Pool (RETH) to stake smaller amounts of ETH.

Best Way to Stake for Advanced Users

For advanced crypto users, the safest and perhaps best way to stake would still be protocol staking. It’s a steady return with no real risks. However, advanced users are likely motivated to leverage both their knowledge and their holdings by using things like liquidity pools and lending platforms. Liquidity pools are the best way to stake for advanced users looking to potentially maximize their returns, whereas lending platforms give them a way to leverage their holdings through staking.

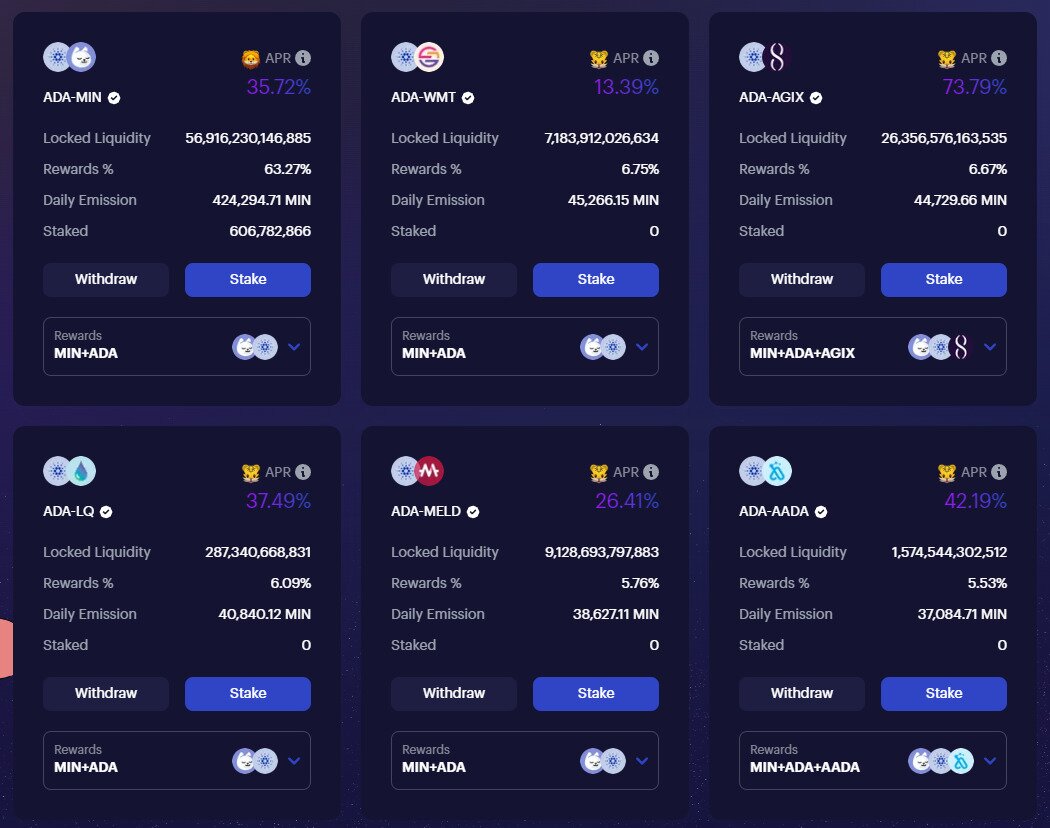

Cardano Liquidity Pools on Minswap Exchange

With liquidity pool staking, users can often earn a rate of return over 30%, but they face the risk of impermanent loss. Whereas with lending platform staking, they earn a much lower rate of return but can leverage their holdings in order to take out loans. These are both riskier and more complex ways to stake crypto.

Closing Thoughts: Staking Should Be for Everyone

Though there are many ways to stake crypto, the best, safest way is just basic protocol staking.

Whether you do it yourself or through an exchange is up to you. If you’re more of a risk taker, then do some due diligence and research liquidity pools and lending platforms to see if they’re something you want to try out.