- >News

- >Why is Tether So Popular Outside of North America and Western Europe?

Why is Tether So Popular Outside of North America and Western Europe?

With a market capitalization of just over $15 billion, Tether (USDT) is a massive part of the cryptocurrency ecosystem. The US dollar-pegged stablecoin has been the third biggest cryptocurrency since May, and the reason why it’s so big is that it feeds the rest of the market.

There’s arguably nothing special about Tether in itself, not least because the stablecoin still hasn’t undergone a full audit. However, it has become a lifeline in parts of the world where trading crypto with fiat currencies is either prohibited or very difficult, whereas it remains marginal in markets such as the United States.

In this article, we take a deeper look into Tether’s usage around the world, and into what continues to drive traders towards it. As the following will show, it owes its position largely to the fact that crypto is still illegal or clandestine in many parts of the globe. Its position may also partly be a product of criminals using it to launder money.

Tether: Big in China and East Asia

Tether may be viewed with a mixture of suspicion and bemusement in the West, but in East Asia it is the biggest cryptocurrency after Bitcoin.

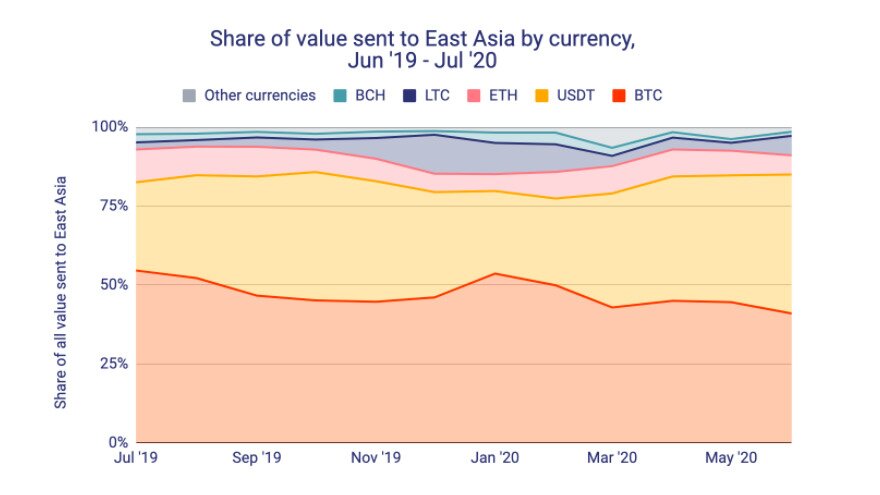

According to Chainalysis’ 2020 Geography of Cryptocurrency Report, stablecoins account for 33% of all value traded on-chain in East Asia, as opposed to 21% for Western Europe and 17% for North America. And of the stablecoins traded in East Asia, 93% of the traded value comes from Tether.

Source: Chainalysis

To put this in some perspective, $50 billion in cryptocurrency moved from East Asia to addresses located elsewhere in the world during the period from June 2019 to July 2020. Tether made up $18 billion — 36% — of this outflow.

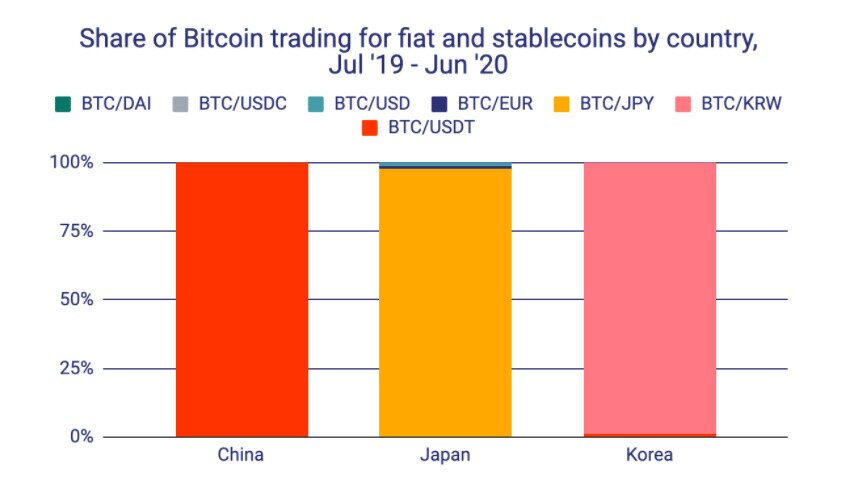

This is big, and pretty much all of this outflow comes from China. As the table below indicates, Chinese traders exclusively use Tether to trade with Bitcoin, while traders in Japan and South Korea predominantly use their respective national currencies.

Source: Chainalysis

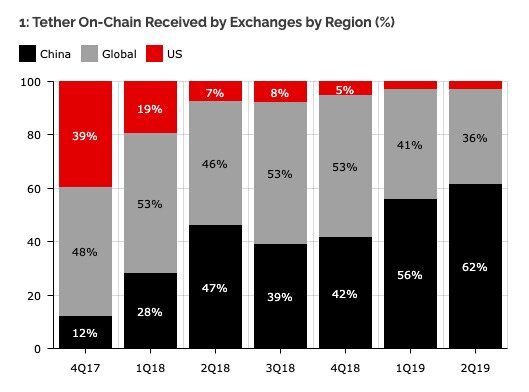

These figures fit with previous data on Tether usage. As of the second quarter of 2019, China accounted for 62% of all Tether usage worldwide. Given that the above Chainalysis study found an increase in Chinese Tether usage “over the last few months”, the percentage as of Q2 2020 is likely to be higher.

Source: Diar/Chainalysis

The question is: why is Tether gigantic in China? The most important reason for this is that the Chinese government banned direct exchanges of the yuan for cryptocurrency in late 2017. Chinese individuals can still trade cryptocurrencies for cryptocurrencies, however, so they now use Tether as a substitute for the yuan.

It’s also possible that Tether is increasingly being used to evade Chinese capital controls on the US dollar. In China, you can transfer a maximum of $50,000 out of the country each year.

Chainalysis believes that Tether is being used to get around this law, and that the demand for Tether has increased as a result of China’s economy — and currency — taking a hit from trade wars (and the coronavirus pandemic). The analyst company supports its view by noting that spikes in Tether outflows closely follow cryptocurrency-related news coming out of China, such as President Xi Jinping’s October 2019 speech on a Chinese national currency.

Solving Problems Caused By Restrictions, Inflation and Capital Controls

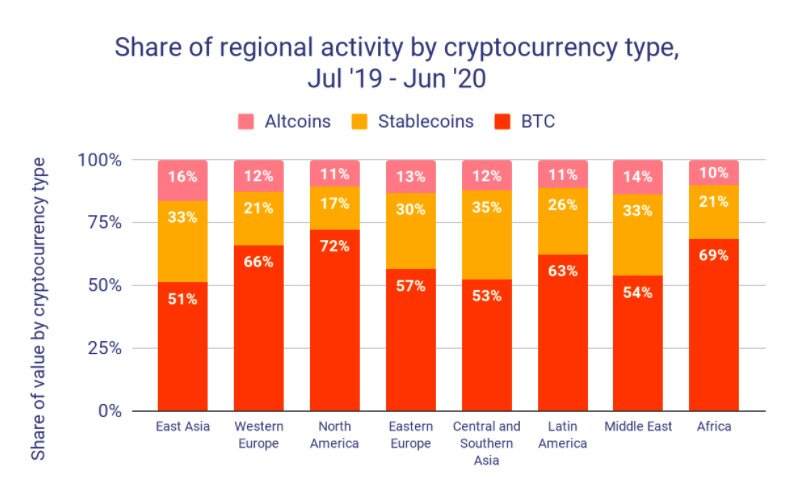

While China certainly leads the way in terms of absolute volume, Tether makes up a sizable portion of cryptocurrency trades in other regions.

Source: Chainalysis

Eastern Europe, Central and Southern Asia, Latin America, and the Middle East also witness a proportionally high level of stablecoin usage. Again, it’s highly likely that Tether occupies the lion’s share of the stablecoin market in all four of these regions.

And again, Tether is used in these regions for very similar reasons. In the Middle East, numerous countries — such as Saudi Arabia, Jordan, Iran — have imposed banking bans, meaning that banks are prohibited from accepting or sending fiat currency to or from crypto-exchanges. Some Middle Eastern nations, such as Lebanon, have also imposed capital controls, so this again may heighten demand for Tether.

You find a very similar picture in Latin America, Central/Southern Asia, and Eastern Europe. In Argentina, capital controls and hyperinflation are likely pushing people towards Bitcoin as well as Tether, while there are currently capital controls in place Ukraine, Kazakhstan, and Turkmenistan.

“Anecdotally, it appears that users in many regions use stablecoins to access US dollars for cross-border payroll, remittance, and capital flight from local currencies,” said Grayscale Director of Research Philip Bonello, speaking to Chainalysis for the purposes of its report.

Crime and Money Laundering

The rise of Tether isn’t only the product of restrictive cryptocurrency laws and the combination of capital controls with inflation. It’s also likely that a small portion of demand for Tether comes from criminals, who use Tether as part of their money laundering processes.

Chainalysis’ 2020 Crypto Crime Report found that at least $2.8 billion in bitcoin moved from criminals to crypto exchanges, with over 50% of this going to Binance and Huobi. According to Chainalysis, this process is helped largely by over-the-counter (OTC) traders, who take bitcoin from criminals and often exchange it for Tether on crypto-exchanges.

“Many of them take advantage of this laxity and help criminals launder and cash out funds, usually first by exchanging Bitcoin and other cryptocurrencies into Tether as a stable intermediary currency before they presumably cash out into fiat.”

You might suppose that money laundering via OTC traders makes up only a tiny percentage of overall trading volume. However, previous research from data provider Kaiko has suggested that “OTC desks may facilitate a majority of all cryptocurrency transactions.”

In other words, Tether’s use in money laundering may actually be pretty substantial, and could even be worth several billion dollars.

Either way, it’s clear that Tether’s growing importance within crypto is less a reflection of its own strengths, and more a reflection of the legal status of cryptocurrency trading in various countries, as well as of the economic circumstances of countries where Tether is popular.

As such, we should expect it to remain popular for as long as crypto trading is prohibited in certain countries, and for as long people within these countries want to transfer their wealth away from weakening national currencies.