- >Best Crypto Exchanges

- >bitFlyer Review: A Crypto Exchange Focused on Trades

bitFlyer Review 2025: Security, Fees, and Key Features

BitFlyer at a Glance

- Very low fees

- Heavy volume

- Works closely with regulators to remain compliant with all laws

- Different interfaces for beginners and advanced traders

- Highest trading volume for BTC/JPY trading pair

Pros

Fully regulated in the U.S., EU, and Japan

All crypto is stored in cold storage

Industry-leading security protocols

Low trading fees on Lightning Exchange

Free account with $1 minimum to start trading

Cons

Limited cryptocurrency selection

Spread-based fees can be volatile

Limited customer support

Lower trading volumes than major competitors

Limited educational resources and features

Supported cryptocurrencies

39 cryptocurrencies supported

Fiat currencies accepted

USD, JPY, and EUR

Trading volume and liquidity

$78 million 24-hour trading volume

Number of users

3 million registered users

Customer Support

Support forms, FAQs

Fees

Tiered fees based on trading volume

Highlights

bitFlyer was one of the first cryptocurrency exchanges to secure a BitLicense from the New York State Department of Financial Services in November 2017. Today, it operates as a fully regulated platform across the U.S., EU, and Japan.

They have 100% cold storage for customer assets and a track record of zero security breaches. Advanced traders can access Lightning Exchange, which offers margin trading, futures, and professional-grade tools with maker/taker fees as low as 0.03%.

Fees & Costs

The exchange charges spread fees for standard trades and uses a tiered pricing model specifically for Lightning users.

Spot trading fees

bitFlyer USA uses a spread-based fee structure for regular trades, with fees ranging from 0.1% to 6.0% depending on market conditions. This pricing model means fees fluctuate with market volatility and can cost more during downturns.

Lightning Exchange offers a tiered fee structure based on 30-day trading volume. Fees range from 0.10% for balances below $50,000 to 0.03% for balances above $500 million.

Instant buy/sell fees

The provider’s Buy/Sell marketplace charges no transaction fees. You will pay the spread between the buy and sell price, which ranges from 0.1% to 6.0% depending on market conditions. In the EU, instant purchases using credit cards or payment methods like iDeal, Sofort, or Giropay are charged a 1.95% convenience fee plus a flat €0.25 fee.

Deposit & withdrawal fees

bitFlyer crypto charges no fees for bank deposits, including wire transfers. Cryptocurrency withdrawal fees vary by asset. Account creation and maintenance are free.

Margin/futures dees

Margin trading is available through Lightning Exchange with standard borrowing costs and funding rates. Specific rates depend on the trading pair and market conditions.

Hidden costs & spreads

The spread-based pricing model means the actual cost per trade isn’t fixed and can increase during market volatility. You will need to monitor market conditions to avoid higher-than-expected costs.

Security & Regulation

The platform has a flawless security record; however, a compliance challenge led to a fine, which prompted the exchange to improve their protocols.

Storage & custody

100% of customer cryptocurrency is kept in cold storage, significantly reducing your exposure to online threats. They also use asset segregation to keep customer funds separate from company assets.

Account security

Multi-signature (multisig) technology is used for Bitcoin transactions and two-factor authentication (2FA) for all accounts. Other security measures include web application firewall (WAF), encryption of customer information, and continuous monitoring.

Audits & compliance

Anti-money laundering (AML) and Know Your Customer (KYC) standards are in place, with continuous monitoring and inspection checks. In 2023, bitFlyer USA was fined $1.2 million by the NYDFS for failing to meet cybersecurity requirements.

Regulatory licenses

The platform holds a BitLicense from the New York State Department of Financial Services, granted in November 2017. They are fully regulated as a payment institution in the European Union and licensed in Japan.

Past Incidents & Mitigation

The platform has never been hacked, earning them the reputation of being one of the safest cryptocurrency exchanges. The 2023 NYDFS fine prompted enhanced cybersecurity protocols.

Features & Tools

The exchange features a wide range of crypto trading tools and features aimed at providing a bespoke trading experience.

Trading features

Basic spot trading is available on the standard platform, and advanced order types are available through Lightning Exchange. Lightning provides limit orders, custom alerts, themes, and access to a professional trading chat room.

Staking & earnings

Staking services are available in Japan and Europe but not in the United States. In Japan, Ethereum staking launched in August 2025 with an annual reward rate of approximately 1.74% after a 30% service management fee. Rewards are distributed monthly. In Europe, Lisk (LSK) holders automatically receive staking rewards by holding LSK in their accounts, with no fees or special requirements.

Lightning Exchange & mobile app

Lightning Exchange is bitFlyer’s advanced trading platform available at no additional cost to all account holders. The platform features order books, real-time price charts, limit and stop-limit orders, margin trading with up to 15x leverage, Bitcoin futures, custom alerts, and access to a professional trading chat room.

Trading pairs include BTC/USD, ETH/USD, BTC/JPY, and ETH/BTC, with maker/taker fees ranging from 0.03% to 0.10% based on 30-day volume. Lightning Exchange is accessible via a web browser or directly through the bitFlyer mobile app.

Institutional & API tools

Institutional services and API access are available for developers through Lightning Exchange. These features are, however, less comprehensive than the best crypto tools, those offered by larger exchanges.

Supported Assets & Markets

The exchange features a boutique selection of established cryptocurrencies.

Cryptocurrencies & tokens

Around 39 cryptocurrencies are currently supported, including Bitcoin, Ethereum, Ethereum Classic, Bitcoin Cash, Litecoin, and Polkadot. Their selection is limited compared to competitors who offer hundreds of assets.

Fiat pairs

Supported fiat currencies include USD, Japanese Yen (JPY), and EUR. Popular trading pairs include BTC/JPY, ETH/JPY, BTC/EUR, XRP/JPY, and BTC/USD.

Derivatives/futures

Bitcoin futures and margin trading are available through Lightning Exchange. The platform offers leverage trading for experienced users seeking advanced strategies.

Geographic availability

This exchange operates in over 40 European countries, including the U.K., Germany, France, Spain, and Italy. It’s also available in the United States and Japan.

Usability & User Experience

The platform aims to make trading accessible and delivers an exchange that makes trading quick and easy across platforms.

Desktop & web interface

The standard interface is streamlined and beginner-friendly, focusing on simplicity over advanced features. Lightning Exchange offers a more complex dashboard with real-time charts and professional trading tools.

Mobile app experience

The mobile app provides basic trading functionality with a clean interface. The iOS app has a 4.2/5 rating, while the Android version scores 3.6/5, indicating decent usability but room for improvement.

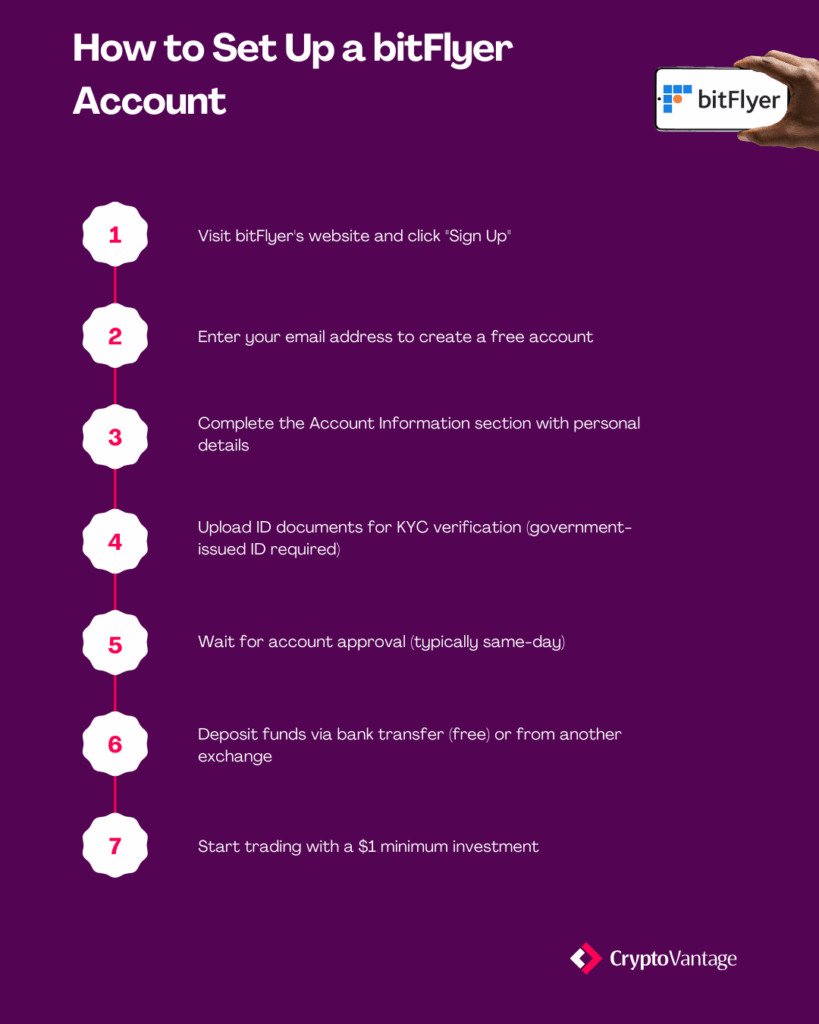

Learning curve

New users can start trading within minutes after providing an email address and completing KYC verification. Educational resources are limited, which may mean a steeper learning curve than other exchanges. Experienced traders will likely outgrow the platform quickly because of the limited features.

Customer support & resources

Customer support varies by region. USA customers can call 1-888-676-2035 for voicemail support during business hours (Monday-Friday, 9 AM-5 PM PT) or submit inquiries via contact form.

European customers can email info.eu@bitflyer.com or use the online contact form, with support available Monday-Friday, 9 AM-6 PM CET.

Japanese customers have access to phone support and a contact page for inquiries. All regions provide FAQ sections on the website for self-service support.

Get started

History & Background

bitFlyer was founded in January 2014 by Yuzo Kano, a former Goldman Sachs derivatives and bonds trader.

Kano holds a master’s degree in engineering from the University of Tokyo and worked at Goldman Sachs, developing settlement systems before transitioning to equity derivatives and convertible bonds trading. He recognized the potential of cryptocurrencies after the Mt. Gox collapse and launched bitFlyer’s exchange in April 2014 to provide a secure, regulated alternative.

Kano served as CEO until 2019, overseeing expansion into the U.S. and Europe, and currently serves as Representative Director & CEO of bitFlyer Holdings and Chairman of the Japan Blockchain Association.

Milestones & growth

bitFlyer launched its cryptocurrency exchange in April 2014. By February 2016, the platform had reached 100,000 users and was processing approximately $64 million in monthly transactions, making it Japan’s largest Bitcoin exchange. In September 2017, it became one of the first eleven exchanges to receive a license from the Japanese Financial Services Agency.

The company expanded to the United States in November 2017 after securing a BitLicense, followed by European operations in January 2018. By 2018, it was processing 80% of Bitcoin transactions in Japan with 150 employees. The company raised approximately $36 million in venture capital, with the largest round securing $27 million in April 2016.

In July 2024, the company completed its acquisition of FTX Japan for several billion yen, rebranding it as “New Custody Company” to offer institutional crypto custody services. Today, bitFlyer maintains 38% market share in Japan and handles over $250 billion in annual trading volume.

Reputation & public events

The provider’s no-hack streak has established it as one of the safest cryptocurrency exchanges in the industry.

However, in May 2023, the NYDFS fined bitFlyer USA $1.2 million for cybersecurity violations, including failure to conduct required risk assessments, relying on generic IT audits from its Japanese parent company, and using template policies containing placeholder text like “ABC Company.”

bitFlyer agreed to a remediation plan and achieved full compliance by December 31, 2023. No actual security breach occurred during this period.

bitFlyer Alternatives

This platform offers strong security and regulatory compliance but may not meet every trader’s needs. If you’re weighing your options, explore how the best crypto exchanges compare in terms of features, fees, and coin selection.

Exchange

Ideal For

Fees & Pricing

Security

Regulation

bitFlyer

Security-focused beginners

Spread fees

100% cold storage

BitLicense, EU, Japan licensed

Beginners and U.S. traders

Spread + transaction fee

FDIC-insured USD, SOC 2 certified

U.S.-regulated, publicly traded

Advanced traders

Maker/taker fees

Proof-of-reserves, cold storage

U.S. regulated, global licenses

Reward seekers

Maker/taker fees

CCSS certified, insurance

Global licenses, Visa partnership

Final Thoughts & Verdict

bitFlyer is ideal for security-conscious beginners who want a safe and regulated crypto exchange to trade major cryptocurrencies. It’s suitable for investors in Japan, Europe, or the U.S. who prioritize regulatory compliance over coin variety.

It’s a solid option for crypto beginners prioritizing security, but experienced traders who want diverse assets and advanced tools should consider alternatives. The platform works best as a starting point before graduating to more feature-rich exchanges.

FAQs

bitFlyer is a cryptocurrency exchange founded in January 2014 in Japan by Yuzo Kano. The company operates globally with platforms in Japan, the United States (47 states and territories, including New York), and the European Union.

There is support for 39 cryptocurrencies, including Bitcoin, Ethereum, Ethereum Classic, Bitcoin Cash, Litecoin, Polkadot, and Lisk. The selection focuses on major, established cryptocurrencies rather than newer altcoins. Available trading pairs include BTC/USD, ETH/USD, BTC/JPY, ETH/JPY, BTC/EUR, and XRP/JPY.

Yes, it is highly secure and regulated. The platform holds a BitLicense in New York, operates under the Japanese Financial Services Agency, and is licensed as a payment institution in the EU. It maintains 100% cold storage for customer assets and has achieved a 7-year streak with no security breaches. It also uses multi-signature wallets, 2FA, and asset segregation.

Government-issued photo ID is required for verification. USA customers need a valid state ID, driver’s license, or passport. European customers can use a national ID card, driver’s license, residence permit, or passport through Quick ID verification, which requires a live photo. Japanese customers can verify using a driver’s license or Individual Number Card. The process typically completes within 24 hours.

Yes, advanced trading is available through Lightning Exchange, free to all account holders. The platform provides margin trading with up to 15x leverage (in Japan), Bitcoin futures, limit and stop-limit orders, and professional trading tools. Fees range from 0.03% to 0.10% based on 30-day trading volume. Lightning Exchange is accessible via a web browser or the mobile app.