- >Best Crypto Exchanges

- >dYdX Review

dYdX Review 2026: Features, Fees, Security & Verdict

dYdX at a Glance

A decentralized exchange specializing in perpetual futures trading.

Pros

True decentralization with self-custody

Zero gas fees for trading

Industry-leading perpetuals platform

Competitive fee structure

High leverage availability

Cons

No spot trading currently available

Limited fiat support

Steep learning curve

Not available in the U.S.

Supported cryptocurrencies

250+ assets supported

Fiat Currencies Accepted

None directly (USDC used as collateral)

Trading Volume and Liquidity

$270 billion in 2024, $1.46 trillion cumulative

Market Reach

53,000+ DYDX token holders, over 2 million transactions processed

Customer Support

Online ticketing and live chat

Highlights

The dYdX crypto exchange runs on a custom Layer 1 blockchain (dYdX Chain), built using Cosmos SDK for high-performance trading. The platform provides zero gas fees for traders, funded by protocol revenue.

Users retain full control of their assets by connecting a wallet. Over 60 active validators ensure decentralization and network security. They also offer permissionless market creation, enabling traders to launch new markets without centralized approval. Security audits by Informal Systems found zero critical issues. A bug bounty program pays out up to $5 million.

Fees & Costs

The DeFi exchange primarily uses a maker/taker fee structure, and fees vary based on the user’s trading volume over the previous 30 days and type of order placed.

Spot trading fees

The platform plans to add spot trading on Solana and other linked cryptocurrencies for the U.S. market by the end of 2025, but perpetual contracts are the core focus.

Instant buy/sell fees

You can use the integrated fiat onramp services (like MoonPay or Banxa) to purchase USDC with your bank card, Apple Pay, or Google Pay. However, these third-party providers will then charge their own fees separate from dYdX.

The fees are not controlled by the dYdX exchange, and can fluctuate based on payment method, transaction size, and your geographic location. The exact fee percentage is displayed before you confirm your purchase through the onramp provider.

Deposit & withdrawal fees

There are no fees for cryptocurrency deposits or withdrawals. You only pay the network fees required by the blockchain itself, which vary based on network congestion. Since the platform migrated to its own Cosmos-based chain, these network fees have become minimal. They have also removed deposit fees on instant transfers of $100 or more across major chains.

For fiat withdrawals, you need to convert your USDC to fiat through the third-party on-ramp services, which charge their own withdrawal and conversion fees.

Margin/futures fees

Standard perpetual trading fees for this provider are 0.05% for takers and 0.02% for makers, which is slightly below the industry average. They use a volume-based tier system where traders who achieve higher 30-day trading volumes receive progressively better rates. The lowest tier requires more than $200 million in 30-day volume and offers 0.06% taker fees with 0.00% maker fees.

On perpetual contracts, funding rates create periodic payments between long and short positions to keep contract prices aligned with spot markets. If you’re holding a long position when the funding rate is positive, you’ll pay shorts. If the rate is negative, shorts pay longs.

Hidden costs & spreads

The bid-ask spread varies by market and liquidity conditions. Major pairs like BTC-USD and ETH-USD usually have tight spreads thanks to deep liquidity. Smaller altcoin perpetuals may have wider spreads that increase your effective trading costs. Spreads aren’t fees but represent the difference between the best buy and sell prices available in the order book.

Network congestion can increase blockchain fees during periods of high activity, though the dYdX Chain’s dedicated infrastructure keeps these costs consistently low.

Security & Regulation

Several features and strategies make dYdX one of the safest crypto exchanges in the world.

Storage & Custody

The dYdX exchange is a non-custodial platform. You retain complete control of your assets at all times. Your funds remain in your connected, secure crypto wallet (MetaMask, Keplr, Ledger, Trust Wallet, etc) and are only committed to trades through smart contract interactions that you authorize.

The self-custody model minimizes the risks inherent to centralized exchanges where the platform holds your funds. You are responsible for your wallet security. It’s important to remember that if you lose your private keys or seed phrase, no customer support team can recover your assets.

That said, the platform has an insurance fund capitalized through a percentage of liquidation fees to handle potential contract losses and protect against cascading liquidations.

Account security

Security centers on your wallet’s protection rather than platform security. You’ll need to secure your wallet with a strong password and enable two-factor authentication through your wallet provider, not through the exchange itself.

The platform has a bug bounty program with payouts up to $5 million, depending on severity. The program incentivizes security researchers to identify and responsibly disclose vulnerabilities.

Additionally, they have a time-locked admin model to prevent malicious instant changes to the protocol. The admin account has a 14-day delay for Layer 2 perpetuals and a 3-day delay for margin, lending, and Layer 1 perpetual contracts.

Audits & compliance

Informal Systems conducted a comprehensive multi-phase audit of the dYdX Chain code, and all findings have been addressed with zero critical issues remaining in the source code.

Regulatory licenses

Regulatory licenses are not held in any jurisdiction. The platform is a fully decentralized protocol without a central entity that could be licensed.

They geo-block users from the United States, Canada, the UK, and sanctioned countries to avoid regulatory enforcement. They also published a voluntary MiCA-compliant whitepaper for the European market, showing an effort to align with regulatory frameworks, but this is documentation, not licensing.

Past incidents & mitigation

No trader has lost funds on the exchange via malicious actions, and there have been no known successful hacks or security issues. The platform has maintained a strong security track record throughout its operation.

In October 2025, they did experience a chain outage, responding transparently by addressing the incident publicly and proposing user compensation from the protocol’s insurance fund. To prevent future downtime, three dedicated engineers were assigned to eliminate indexer instability, stale data, and throughput constraints.

Features & Tools

The platform provides leveraged perpetual trading with advanced order types, fast off-chain order matching secured on-chain, and cross-margin risk management tools. It also offers staking rewards, a full suite of programmatic and real-time data APIs, and a mobile experience designed for both beginners and advanced traders.

Trading features

Core offerings revolve around perpetual futures contracts—derivatives that track asset prices without expiration dates. You can take both long and short positions to trade in rising and falling markets, with leverage up to 50x to amplify your exposure.

Advanced order types include reduce-only limit orders, TWAP (time-weighted average price) orders, and scale orders. They additionally support conditional orders with price triggers, letting you set up sophisticated trading strategies that execute automatically when market conditions are met.

An off-chain order book is used with on-chain settlement, combining the speed and efficiency of centralized exchanges with blockchain security. Orders match in real-time through validators’ in-memory order books, with resulting trades committed on-chain each block.

Cross-margin functionality lets you use your entire account balance to support open positions, reducing liquidation risk compared to isolated margin. You can monitor positions through detailed risk indicators showing account balance, buying power, and liquidation prices.

Staking & earnings

Trading generates rewards distributed in DYDX tokens. The native token powers governance and provides utility throughout the ecosystem. The exchange community voted to launch a buyback program, allocating 25% of net protocol fees to purchase DYDX from the open market monthly.

Token holders can stake native tokens to validators, earning a share of trading fees and gas fees collected by the network after deducting the community tax and validator commission.

Mobile app & trading access

There is no charge for premium tiers or subscriptions. All features are available to everyone. The mobile app (iOS and Android) includes two interface modes that you can toggle between at any time. Default Mode offers simplified navigation for newcomers to perpetual trading. Pro Mode provides advanced crypto trading tools similar to the web platform for experienced traders.

Both modes support up to 50x buying power, long and short positions, and real-time risk indicators showing margin utilization, liquidation price, and collateral health. The app displays color-coded risk levels and provides early alerts when market conditions shift so you can adjust leverage or add collateral before liquidation. The mobile app integrates fiat on-ramps through MoonPay for direct crypto purchases.

Institutional & API tools

High-performance APIs are provided for programmatic trading and automated strategies. The platform offers WebSocket services for real-time market data. Comprehensive technical documentation covers REST endpoints, WebSocket channels, and integration examples. The dYdX Grants Program supports ecosystem development, including API improvements, indexing services, full node infrastructure, and client deployment.

Supported Assets & Markets

Popular cryptocurrencies, like Bitcoin and Ethereum, are available for trading, along with a wide range of altcoins.

Cryptocurrencies & tokens

As for crypto, the exchange covers all major cryptocurrencies, including Bitcoin, Ethereum, Solana, and a wide range of altcoins. There are perpetual trading options for over 35 popular cryptocurrencies, including Bitcoin (BTC), Ether (ETH), Dogecoin (DOGE) and Cardano (ADA).

Fiat pairs

The exchange doesn’t support traditional fiat currency deposits or trading pairs directly. All perpetual contracts are quoted in USD but settled in USDC stablecoin, which is the platform’s universal collateral asset.

They have also integrated fiat onramp services to make funding easier. The mobile app supports direct fiat deposits through MoonPay.

Derivatives market availability

Perpetual contracts are the exchange’s specialty, a type of derivative that lets traders speculate on the price of an asset without actually owning it, and unlike traditional futures, does not have an expiration date. Each market offers different leverage limits, with most major pairs supporting up to 20x-50x leverage depending on the asset and market conditions.

Geographic availability

Geographic availability is in 180+ global countries, including regions often restricted on other platforms such as China, Russia, South Korea, Japan, and Vietnam. The platform currently blocks access in the USA, Canada, the UK, Iran, Cuba, North Korea, Syria, Myanmar, Crimea, Donetsk, and Luhansk to comply with AML, CTF protocols, and sanctions enforcement.

Geographic restrictions are implemented through the centralized frontend managed by the dYdX Foundation. VPNs can technically bypass blocks, but the exchange prohibits VPN usage in its terms and has suspended accounts for violations. They plan to enter the US market by the end of 2025.

Usability & User Experience

The platform provides a flexible web and mobile interface with simplified and advanced modes, making trading accessible while still supporting professional workflows.

Desktop & web interface

The web platform features a modular, responsive interface optimized for quick execution. The layout groups information based on similarity and importance, with customizable sections that can be minimized to create more room for market data and charts. The interface works across ultra-wide monitors, laptops, and tablets while balancing power user requirements with accessibility for first-time traders.

Mobile app experience

The latest app update brings a faster, more intuitive trading experience with a simplified interface designed to onboard the next generation of perpetual traders. The mobile app experience has been streamlined to reduce friction while maintaining access to essential trading functions.

Two-mode operation lets beginners stick with simplified controls while advanced traders can access the full feature set. The app handles wallet connections smoothly and processes deposits/withdrawals with significantly improved speed compared to earlier versions.

Learning curve

There is a steep learning curve for beginners new to derivatives. You must understand concepts like leverage, liquidation prices, funding rates, margin requirements, and automatic liquidations.

The Default Mode in the mobile app and configurable web interface helps reduce initial complexity by presenting information progressively. Advanced traders familiar with derivatives will find the interface intuitive and comparable to professional platforms.

Customer support & resources

Support is available on the website via an online ticketing system and live chat. Technical support is available via in-app help chat, and the help center contains extensive documentation.

The dYdX Foundation partnered with ACX, a leading service provider, to deliver user support comparable to centralized exchanges. Self-help resources include FAQs, user guides, and educational videos available at the help center and dYdX Academy.

Community support is available on Discord and Telegram, where traders discuss strategies and help each other navigate platform features. Official channels provide announcements about upgrades, new markets, and governance proposals.

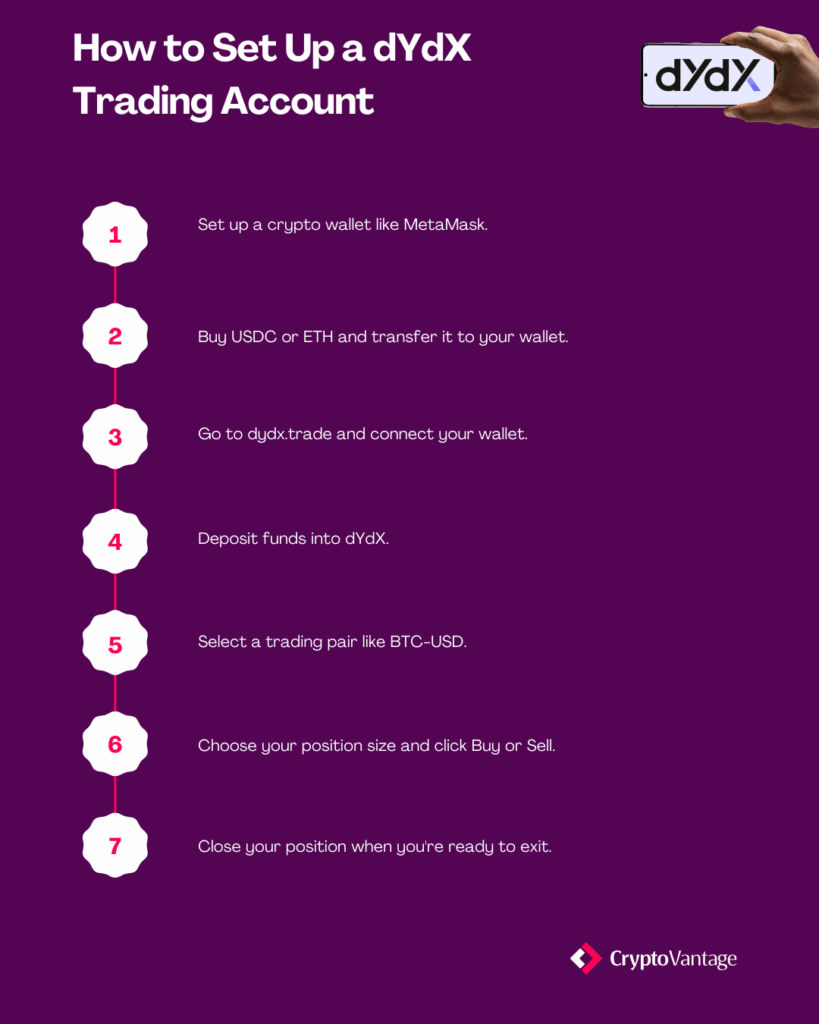

How to Get Started with dYdx

Here’s a quick guide for setting up a crypto exchange account on the platform.

History & Background

Antonio Juliano founded dYdX in 2017 after working as a software engineer at Coinbase, where he helped launch services in Canada and Singapore and built core banking infrastructure.

After seeing that trading was crypto’s primary use case and watching the first decentralized exchanges emerge, he identified decentralized derivatives as the next logical product. Despite being based in California, the company geo-blocked U.S. users from launch to avoid aggressive SEC and CFTC enforcement against unregistered derivatives platforms. He stepped down as CEO in May 2024 before returning in October 2024.

Milestones & growth

The exchange launched in July 2017, initially offering crypto margin trading, lending, and borrowing services over Ethereum Layer 1. In April 2020, they introduced their first perpetual contract for BTC-USD, becoming the first platform to offer decentralized perpetual futures.

In August 2021, they started offering cross-margin perpetual trading. The platform’s Layer 2 launch on StarkEx in 2021 dramatically improved speed and reduced costs, driving explosive growth.

In October 2023, dYdX Chain launched as the platform shifted from operating as a Layer 2 network on Ethereum to becoming an independent blockchain within the Cosmos ecosystem.

Reputation & public events

The company has earned a reputation as a trusted DeFi builder over eight years, achieving over $1.5 trillion in lifetime trading volume. In October 2025, they experienced a brief chain halt but quickly restored service and compensated affected users. In July 2024, the older v3 website was compromised in a DNS hijacking attack, though smart contracts and user funds remained secure.

dYdX Alternatives

dYdX is a great option if you want a derivatives platform, but it may not suit everyone’s trading needs or preferences. Other centralized and decentralized exchanges offer different feature sets that might better match your requirements.

If you’re weighing your options, consider some of the best cryptocurrency exchanges, like Binance for high-volume traders wanting both spot and derivatives with deep global liquidity, Bybit for derivatives traders who want competitive fees and advanced charting tools, or Kraken for U.S. traders needing regulated access with strong security.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Compliance

dYdX

Decentralized derivatives traders

Maker/taker: 0.02%/0.05

Self-custody security

Not available in U.S.

High-volume multimarket traders

Maker/taker: 0.10%/0.10%

SAFU fund protection

Globally licensed

Regulatory-conscious traders

Maker/taker: 0.16%/0.26%

Proof-of-reserves

U.S. regulated

Final Thoughts & Verdict

dYdX is great for experienced derivatives traders who value self-custody and want perpetual futures without trusting centralized platforms with their funds. They suit algorithmic traders and market makers needing API access with low latency. It’s not ideal for beginners, casual traders wanting spot markets, or anyone uncomfortable with derivatives’ complexity.

The exchange successfully delivers decentralized derivatives trading at scale, processing massive volumes while maintaining self-custody and competitive fees. Technical improvements in 2025—faster deposits, mobile enhancements, and instant market listings—address previous limitations. Weaknesses include specialization: no spot trading, the learning curve discourages beginners, and geographic restrictions limit market reach.

Overall, this provider delivers professional derivatives trading with decentralized infrastructure remarkably well. It’s a solid option for perpetual futures trading. If derivatives trading aligns with your strategy and you’re comfortable with DeFi infrastructure, they deserve serious consideration. For everyone else, platforms offering spot trading provide better starting points.

FAQs

This decentralized exchange specializes in perpetual futures contracts with up to 20-50x leverage across 235 trading pairs. It eliminates intermediaries, letting you trade directly on the blockchain and maintain self-custody of your funds.

They are safer than centralized exchanges because you control your own funds. The platform never holds your assets.

No, they don’t require KYC or identity verification. You simply connect a Web3 wallet like MetaMask to start trading immediately. This provides privacy but also means you’re fully responsible for your account security.

They suit experienced derivatives traders comfortable with leverage, funding rates, and liquidation risks. It’s ideal for algorithmic traders and market makers needing API access.

Liquidity on dYdX is provided by the users, much like on Uniswap, PancakeSwap, or SushiSwap. Users deposit liquidity in exchange for rewards in the form of fees, and this is where the liquidity comes from. dYdX provides none of their own liquidity, as it is decentralized.

A Stark Key is a public key that links a user’s Ethereum key with dYdX’s smart contracts. This Stark Key is used to identify a user’s account on dYdX’s Layer-2 infrastructure and is saved locally on the user’s browser.