- >News

- >Has the Ethereum Shanghai Upgrade Kicked Off Alt Season? There’s Still One Nagging Issue

Has the Ethereum Shanghai Upgrade Kicked Off Alt Season? There’s Still One Nagging Issue

Ethereum’s Shanghai upgrade is finally live, with the ability to withdraw staked ETH not causing a massive selloff, as some feared. In fact, Shanghai caused something like the opposite, with the price of ETH jumping to an almost one-year high of $2,134 on Friday April 14, the day after the upgrade’s deployment. And with ethereum came most major altcoins, with the likes of cardano (ADA), solana (SOL) and avalanche (AVAX) currently sitting on gains of 13%, 24% and 17% in the past week.

Given that such cryptocurrencies outperformed bitcoin (BTC), their rallies have caused commentators and analysts to suggest that the market has just entered an alt season, which is basically when major altcoins post higher gains than BTC. There’s no doubt that alts performed better than the original cryptocurrency over the weekend, and there’s also no doubt that bitcoin’s dominance over the past few weeks has increasingly set the stage for an alt season. However, the declaration of such a season is arguably premature, and for two main reasons.

Firstly, bitcoin’s rally had come at a time when a weak banking system and global economy had pushed some investors towards the cryptocurrency as a relative safe haven, with the ongoing economic fragility meaning that altcoins remain less attractive. And secondly, the arrival of a negative outcome in the soon-to-be-finished Ripple-SEC case could easily wipe out altcoin gains, with bitcoin’s status as not a security (according to SEC Chairman Gary Gensler) protecting it from regulatory blowback.

Ethereum and Shanghai: New Altcoin Season?

There had been a concern that Shanghai would invite a mass withdrawal of staked ETH, yet the numbers show that this clearly isn’t the case. Data gathered by TokenUnlocks shows that around 1.04 million ETH has been queued for withdrawal since Shanghai went live, while 385,000 ETH has been deposited, making for a net withdrawal rate of roughly 658,000 ETH.

This latter figure equates to 4% of the 16.3 million ETH currently staked on the Ethereum blockchain. It also equates to 0.55% of the total circulating ETH supply, meaning that the enabling of withdrawals is hardly going to make a dent on ETH’s price, especially when such withdrawals are queued.

It seems that the market quickly woke up to this fact. Indeed, it also seemed that investors also realized that Shanghai’s completion of Ethereum’s transition to a proof-of-stake mechanism is, on the whole, a big plus for the platform and its native token. That’s because the price of ETH rose by about 12% in the 24 hours following Shanghai’s rollout, with the coin now up by just over 67% since the start of the year.

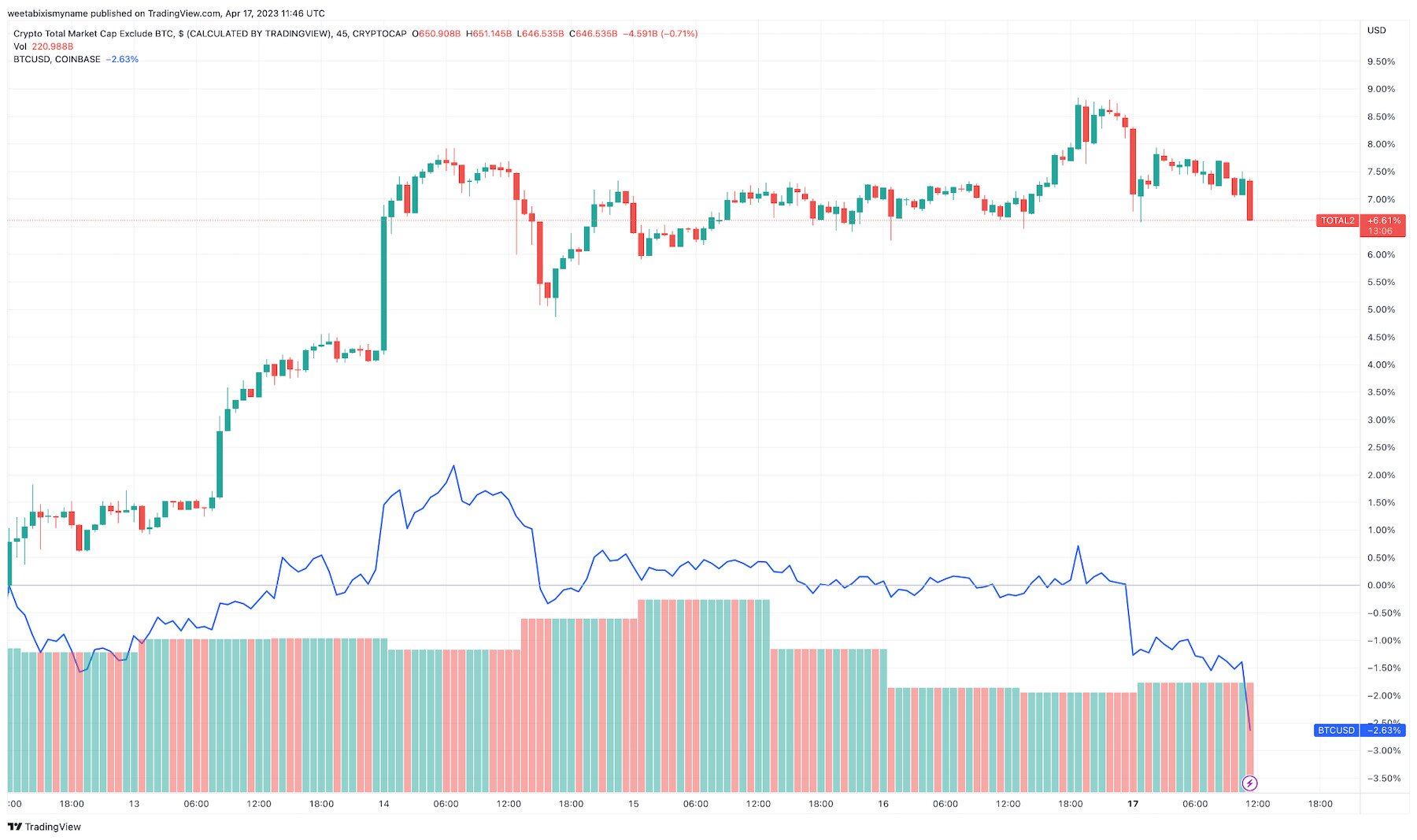

Clearly, Shanghai stood as confirmation that Ethereum’s development and growth is completely on track, serving to instill investor confidence in the layer-one platform. And by extension, it also indirectly served to instill confidence in other layer-one platforms and altcoins. This is evident in the fact that the total market cap of all cryptocurrencies — minus bitcoin — has risen by over 5% since Shangahi’s rollout (and at one point was 7% up), while BTC has actually dropped by 1%.

Altcoin market cap (green and red candles) versus bitcoin pride (blue) since Thursday. Source: TradingView

It’s also evident in the seven-day gains witnessed by the biggest altcoins, with ETH, ADA, DOGE, MATIC, SOL, AVAX, LINK, ATOM, APT, ARB, NEAR and ICP (as well as several others) all enjoying double-digit percentage increases. For this reason, numerous analysts have already jumped the gun and called an alt season.

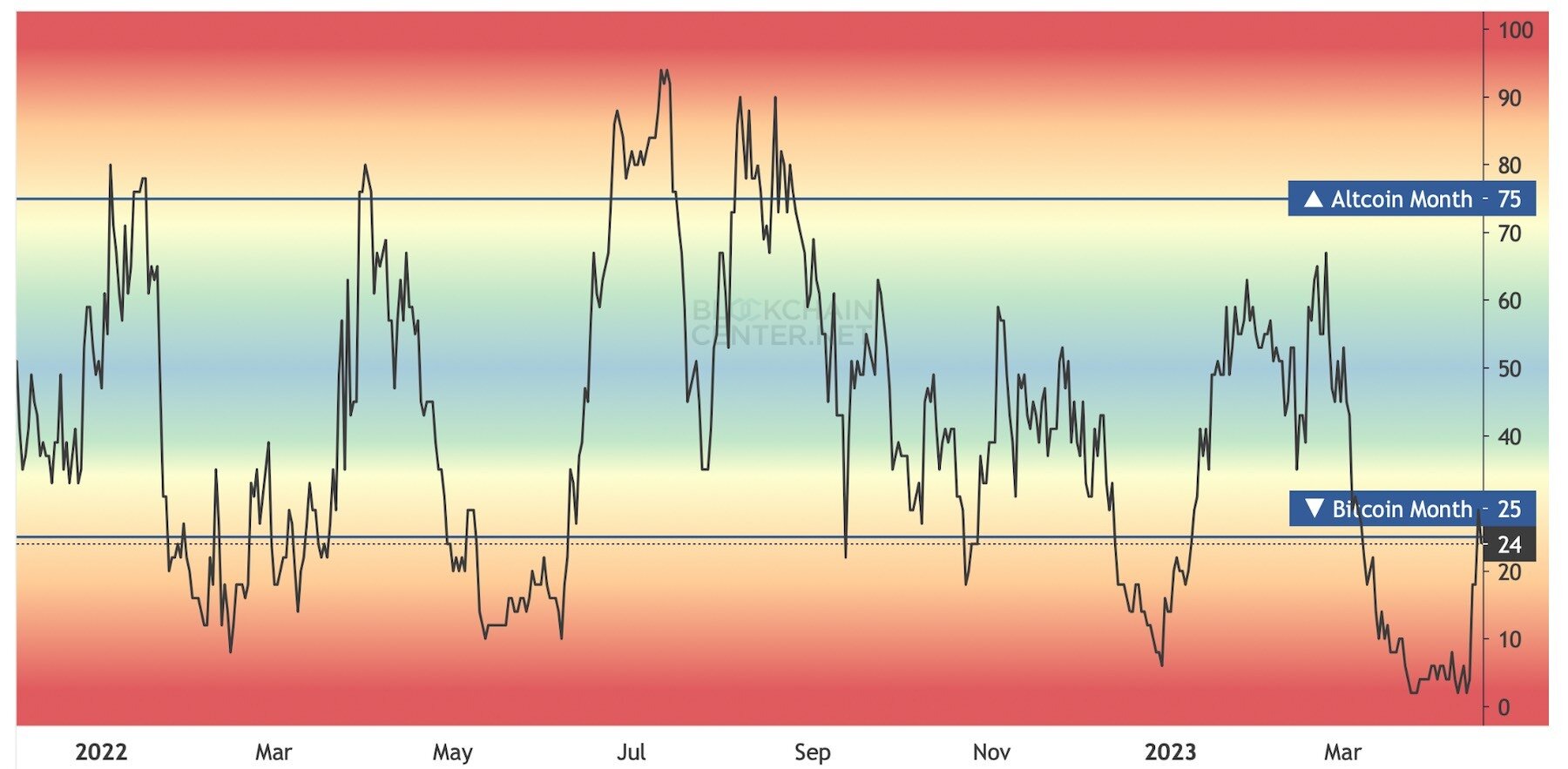

To be fair, past history alone would suggest that an altcoin season is due sooner or later. That’s because alt seasons generally follow a period where bitcoin has been in the ascendancy and has outperformed the market, as could be seen during the 2017-18 and 2021 bull markets. And at the moment, data from season-tracking website Blockchaincenter.net suggests that the market has been going through a bitcoin season since March.

Source: Blockchaincenter.net

As the chart above reveals, the market had very much been in bitcoin territory over the past few weeks, yet it has begun to change in the past few days. However, it still remains quite far from entering a fully fledged altcoin month or season, which is what occurs when at least 75% of the top-50 cryptocurrencies (excluding stablecoins) outperform bitcoin over the course of 30 or 90 days.

Why Traders Still Need to Wait for Alt Season

And it’s likely that the market won’t witness an alt season for a while yet, at least not until two important challenges are cleared.

As mentioned above, the market still remains way off its all-time high, with bitcoin still 57% down from its record price of $69,044, and with the stock market (i.e. the S&P 500) still 13% down from its own record. Around the world, financial markets remain subdued by a combination of still-high inflation, rising interest rates and ongoing conflict in Ukraine, and not to mention fragility in the banking system.

This is something that’s also undermining the recovery of the cryptocurrency market, meaning that we’re not going to see a proper bull market — including a proper altcoin season — until the global economy exhibits some meaningful and sustained improvement. Yes, bitcoin and altcoins may witness see-sawing periods in the meantime when one or the other enjoys more gains, but these aren’t going to be on the scale of previous bitcoin or altcoin seasons.

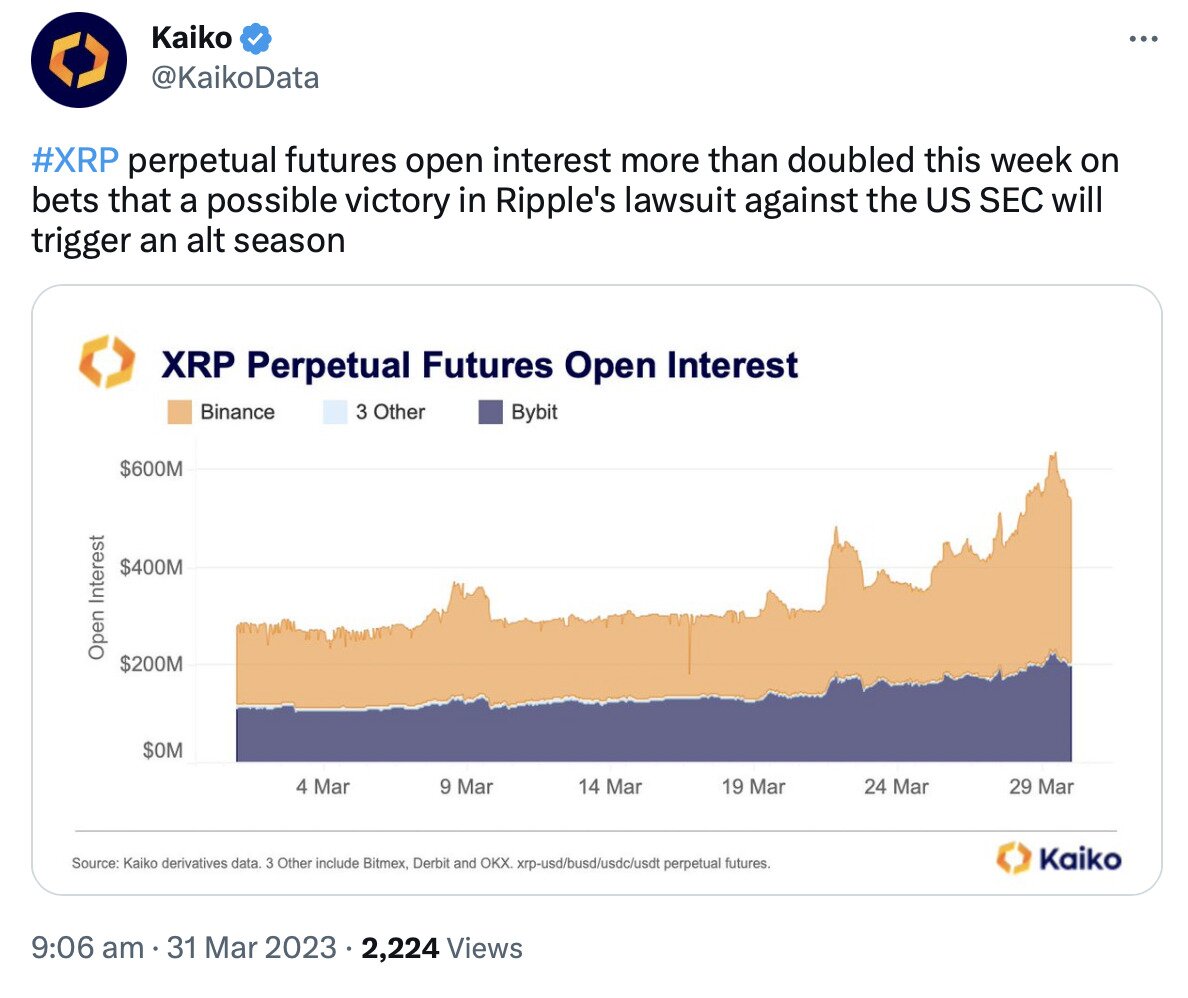

And perhaps more importantly, altcoins probably won’t manage even a relative outperformance of bitcoin until after the Ripple-SEC case is settled. It’s entirely arguably that investors may be holding back until this case reaches its conclusion, given that it could end up with the presiding judge issuing a summary judgment which upholds the SEC’s position (which is that Ripple sold unregistered securities to investors).

Investors are beginning to expect a positive result for Ripple. Source: Twitter

If the court does find entirely in favor of the SEC, this would be a massive blow to altcoins, one which would most likely stop any potential alt season before it ever got going. SEC Chairman Gary Gensler is on record as saying that pretty much all cryptocurrencies except for bitcoin are securities, meaning that a judgment against Ripple would also potentially be a judgment against most alts.

As such, more or less the entire cryptocurrency market needs to wait for an outcome in the Ripple-SEC case before a true altcoin season can ever really begin. Fortunately, much of the cryptocurrency community — including several prominent lawyers — have increasingly begun expecting a positive result for Ripple, which in combination with Ethereum’s ongoing development could make the next alt season a very big one.