- >News

- >The 5 Biggest Lessons from 2022 and Its Crypto Meltdown

The 5 Biggest Lessons from 2022 and Its Crypto Meltdown

2022 is almost done, and it’s a year that will go down in crypto’s history as one of the worst on record. Having begun in the glow of 2021’s roaring bull market, it ultimately saw prices decline by 62% (as of writing), dragged down by a struggling global economy, war in Ukraine, and fiscal tightening by most central banks and governments. And as cryptocurrency prices descended lower and lower, platforms and companies that depended on said prices for their stability found themselves in a fight for survival, which many of them lost.

Yes, 2022 is the year of collapse, with Terra, Three Arrows Capital, Celsius, Voyager Digital, FTX, BlockFi and Genesis all facing bankruptcy across its 12 months. While such collapses have obviously been terrible for the people directly involved and caught up in them, they have arguably provided the cryptocurrency industry with a number of important lessons. This article provides a rundown of the five biggest lessons from 2022 and the crypto meltdown, teasing out what the market can learn from them and what they tell us about 2023, and beyond.

1. Don’t Trust Exchanges and Platforms That Speculate Themselves

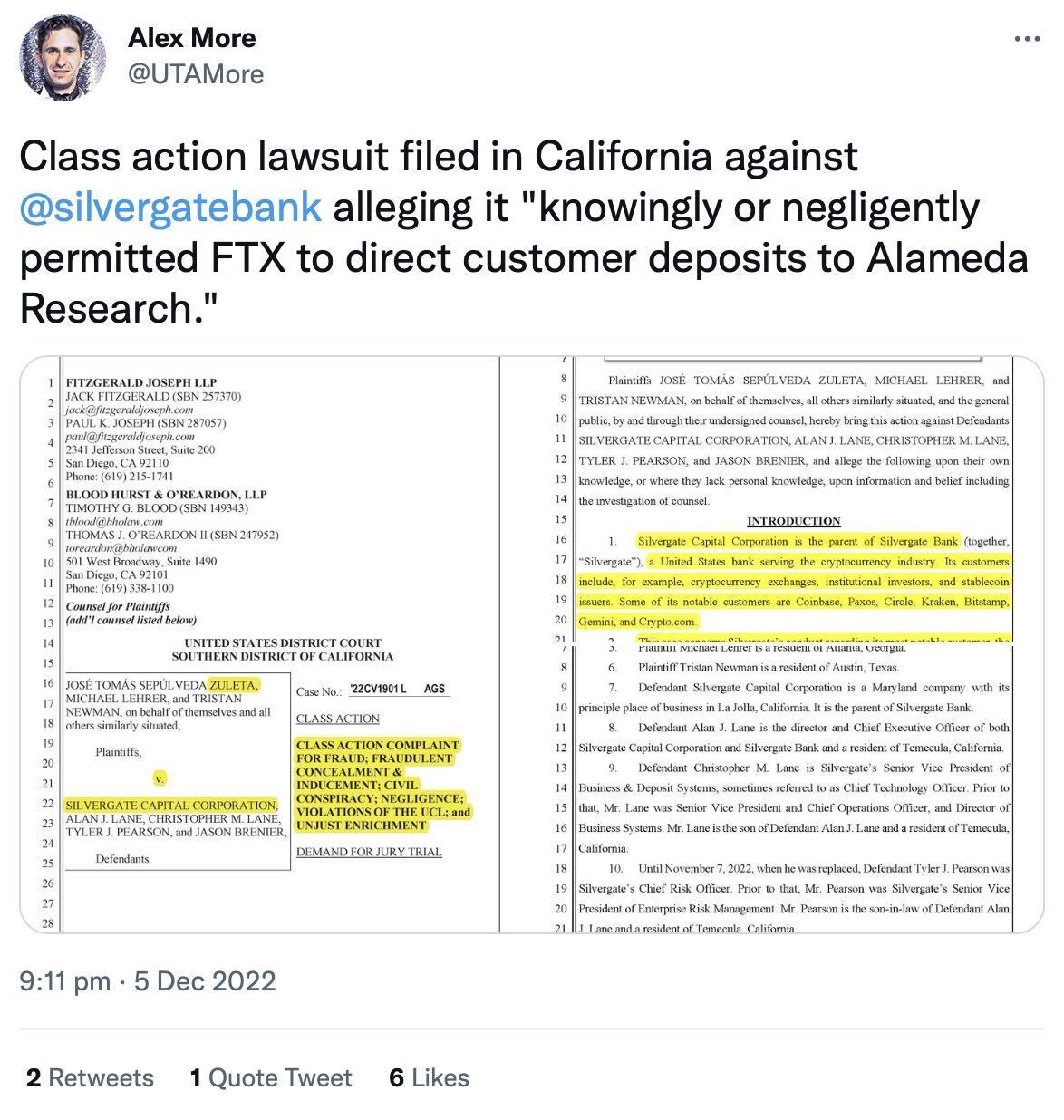

If there’s one lesson everyone in crypto needs to take from 2022, it’s that no self-respecting trader or investor should trust a cryptocurrency exchange that either invests in cryptocurrency itself, or is closely associated with a firm that invests. This is the number one takeaway of the FTX collapse and bankruptcy, which was ultimately caused by FTX’s parent company, Alameda Research.

Specifically, Alameda used FTX’s native utility token FTT as collateral for loans, which it used to make investments in the cryptocurrency market. When it emerged in November that most of Alameda and FTX’s ‘assets’ were in FTT (which had fallen in value by 70% since September 2021), customers began rushing to withdraw funds from FTX. It couldn’t fulfill these withdrawal requests, since it had used customer funds to support Alameda’s risky investments.

Source: Twitter

It’s a similar story with Celsius, for example. The cryptocurrency lender offered high interest/yield rates to customers who deposited funds with its platform, and it sought to make good on its offer by investing in the cryptocurrency market. As with FTX and Alameda, it appeared to use customer deposits to fund its investments, which increasingly turned sour during 2022’s bear market.

As such, investors really should do their research when picking a trading platform, ensuring that said platform doesn’t itself engage in investing and speculation.

2. If Something Sounds Too Good to Be True, It Usually Is

And speaking of Celsius, its downfall in June offered a very salient reminder that crypto isn’t immune to an old adage: if something sounds too good to be true, it usually is, especially in crypto.

Celsius offered yields of up to 18%. Such a rate isn’t sustainable, particularly during bear markets and downturns. The same applies to the Anchor Protocol, which was a lending protocol tied to the Terra ecosystem, offering yields of 20% for UST deposits.

Given that interest rates were historically very low during the period in which all of this happened, investors should have taken the rates above as a BIG red flag. Basically, the implication is that the platform or system concerned needs to be doing something highly speculative and risky to honor its rates, and that a sudden change in conditions can mean it all comes crashing down.

3. CeFi is Dead, Long Live DeFi

Within the decentralized finance (DeFi) ecosystem, there were a number of platforms and companies that dominated market share. For the most part, these were centralized finance (CeFi) entities, such as Celsius, Voyager Digital and BlockFi, all of which have collapsed. Surviving CeFi companies, such as Nexo, remain in a precarious position.

The main issue with CeFi now is that centralization can only breed mistrust. As private companies, CeFi players such as Celsius and BlockFi were able to keep their finances a secret. More importantly, they could do things with customer funds without being detected, leading to dangerous business and investment practices.

Now, the cryptocurrency market and its investors are likely to turn more to real DeFi in the coming months and years. ‘Real’ DeFi means that the platforms concerned actually put as much as possible on blockchains, including customer deposits and liquidity. That way, the health and stability of any given DeFi platform can be monitored.

4. Building is Back, Look for Fundamentals

As with every other bear market in crypto’s history, the current bearish cycle has brought little opportunity to enjoy massive profits from simply holding cryptocurrencies. Instead, platforms and projects have increasingly focused on actually developing and evolving themselves, preparing for the next expansionary phase.

Source: Twitter

Most notable is Ethereum’s long-awaited Merge, which put it on the road towards sharding and scalability, while also drastically reducing its energy consumption. Yet other platforms have also witnessed significant development this year, with the likes of Cardano, Internet Computer, Solana and Bitcoin, all witnessing encouragingly high GitHub commit numbers.

Such activity is what investors need to pay attention to now, focusing on what cryptocurrencies and platforms might actually offer to real users. This is the only reliable way of increasing their chances of scoring during the next bull market.

5. Diversification and Dollar-Cost Averaging for Surviving Bear Markets

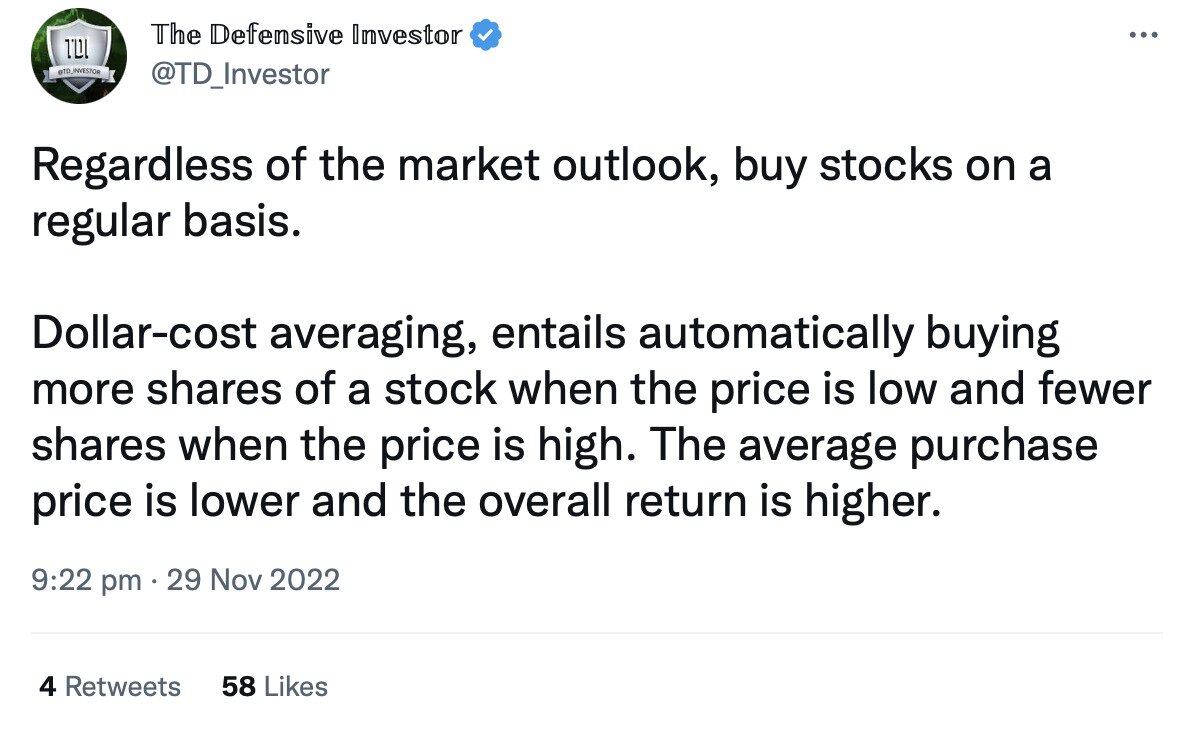

Bear markets are never much fun (unless you’re a short seller), but there are ways of surviving them and setting yourself up for the next bull run. This is something that 2022’s bear market has taught cryptocurrency investors more than any other, since it seems as though prices have been near their bottom for several months now.

Source: Twitter

First of all, dollar-cost averaging is one way of compensating for the fact that traders can never tell when the absolute, final bottom of a market is in. So instead of guessing, they can buy a little bit of a given cryptocurrency each month. This is better than buying a lump sum in one fell swoop, since it tends to ‘average out’ peaks and troughs in an asset’s price.

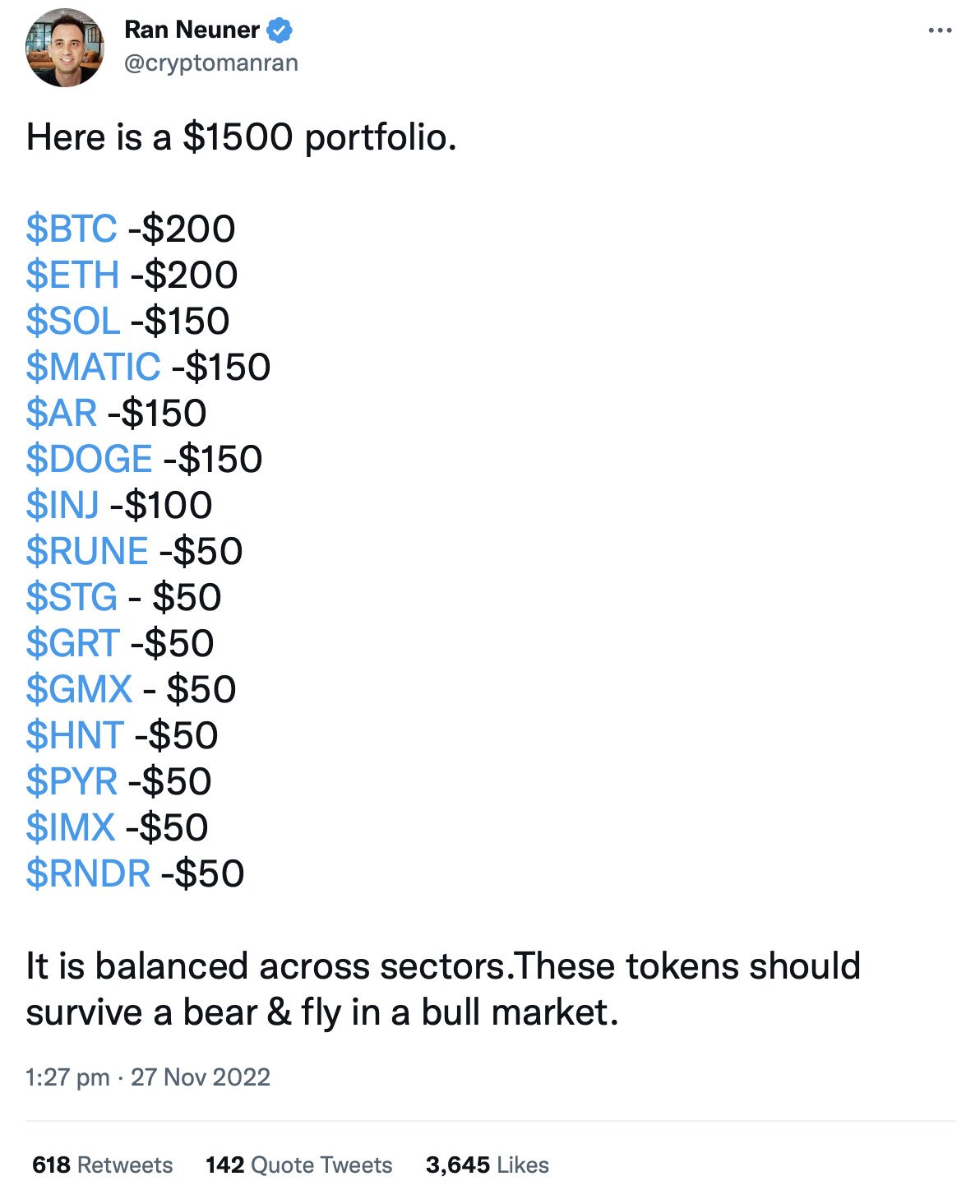

Source: Twitter

Another good strategy for spreading potential risk and reward is to diversify. It’s not certain which cryptocurrencies will benefit the most from the next bull market, so more careful traders may prefer to invest in a basket of fundamentally sound cryptocurrencies, from bitcoin and monero to ethereum and cardano. That way, they increase their exposure to potential upswings in the future.