- >Best Crypto Exchanges

- >Crypto.com Review

Crypto.com Review 2026: Pros, Cons and Tips

Crypto.com at a Glance

Full feature crypto exchange tied to the Crypto.com ecosystem (app, cards, staking).

Pros

Innovative Visa card with up to 5% cashback in crypto

Top-rated, beginner-friendly mobile app

Strong regulatory compliance with licenses in multiple jurisdictions

Multiple earning options through staking and Crypto Earn

400+ cryptocurrencies with extensive trading pairs

Cons

Relatively higher fees for low-volume traders

Complex fee/tier system

Certain card benefits require CRO staking with lock-up periods

Supported Cryptocurrencies

400+ cryptocurrencies supported

FIAT Currencies Accpeted

25+ fiat currencies supported

Trading Volume and Liquidity

$50 million

Number of users

Over 100 million global users

Customer support

24/7 in-app live chat support

Highlights

Crypto.com is known for its rigorous regulatory standards and strong focus on security. It operates globally and is recognized as one of the safest crypto exchanges due to its transparency and user-centric approach.

For the more advanced user, the platform offers a more sophisticated and modern experience. The exchange features a deep order book, more trading opportunities, and a whole host of progressive tools that cater to experienced traders.

Fees & Costs

Crypto.com operates as two distinct platforms—the App and the Exchange—with two distinct fee structures. Users are subjected to trading fees, spreads, and other costs associated with crypto trading.

Spot trading fees

Exchange users are subjected to a tiered Maker/Taker fee model. Tiers are based on trading volume, and higher-volume traders enjoy lower fees. In addition, users who hold and stake the platform’s native CRO token receive further discounts, which can be reduced to zero or even result in a rebate.

Instant buy/sell fees

App users can instantly purchase crypto using their chosen fiat currency. The fee for these purchases is incorporated into the spread. This final price of the transaction is transparent, and users can see it before executing the trade.

Deposit & withdrawal fees

Fiat and crypto deposits are mostly free on the platform. However, withdrawals come at a cost. Crypto withdrawals to external wallets are subject to a network charge. This fee varies depending on the coin and network required to complete the transaction.

Fiat withdrawal fees are dependent on the payment method used. Bank transfer withdrawals are typically free, but USD wire transfers have a fixed cost that depends on the users’ jurisdiction.

Margin futures fees

Margin and futures trading is available on the platform.

Futures contracts use a unique maker/taker fee schedule that is generally lower than the regular spot trading fees. Perpetual futures contracts have a periodic funding rate. This fee is not for the exchange, but rather to keep the contract price aligned with the spot price.

Margin traders pay an hourly interest rate on the borrowed amount. This rate is subject to change and can change based on the supply and demand of the asset.

Hidden costs and spreads

The app charges users a spread on instant transactions. Although users see the final trade cost at checkout, the app includes this spread or commission without showing its exact amount, making it effectively a hidden fee.

Processing fees are charged when users purchase crypto with credit and debit cards, while foreign exchange fees can also affect users’ profits.

Security & Regulation

This Crypto.com review determined that the exchange has robust security measures and maintains regulatory compliance across multiple jurisdictions. These measures form part of its goal of being considered one of the safest cryptocurrency exchanges available.

Storage and custody

The exchange stores the majority of user funds offline in cold storage wallets. These wallets are held offline in geographically distributed locations to minimize risks. An operations float is maintained in hot wallets to facilitate daily trading operations.

A significant insurance policy is maintained by the exchange to cover assets held in hot wallets against physical damage, destruction, or theft.

Account security

Mandatory two-factor authentication is required for all accounts. The mobile application also supports fingerprint and facial recognition for secure logins.

The exchange provides real-time monitoring and alerts for new device account logins and suspicious activity to safeguard accounts. They also use anti-uprising code and AI-powered machine learning systems for real-time fraud detection and prevention.

Audits & compliance

Regular proof-of-reserve audits are completed by the third parties to verify the exchange holds the assets backing its users’ deposits.

Regulatory licenses

The company holds licenses and registrations with financial and regulatory authorities in multiple jurisdictions globally, demonstrating a commitment to regulatory compliance. This includes a Money Transmitter License in the USA, a Class 2 Crypto-Asset Service Provider License in Europe, Money-Services Business registration in Canada, and many more.

Past incidents and mitigation

In 2022, the hackers bypassed the exchanges’ 2FA and stole funds from some user accounts. The exchange immediately reimbursed affected clients and began beefing up its security controls. This included requiring authenticator apps to be used for withdrawals, as it is considered safer than SMS- and email-based two-factor authentication.

Features & Tools

Millions of people who trade choose Crypto.com as their cryptocurrency exchange. Here are some crypto tools and features available to them.

Trading features

Spot trading, margin trading, and derivatives trading are available on the platform. Margin trading allows users to trade with borrowed funds, which can amplify potential profits (and losses).

Users can also customize and enhance their trading experience by setting up price alerts to stay up to date with market movement and automating crypto purchases at predetermined prices.

The platform also operates as a fiat on/off-ramp, which allows users to withdraw fiat currency via bank transfers or card payments.

Large-volume traders can also benefit from the personalized over-the-counter services offered by the exchange.

Staking & earnings

Crypto.com users can earn passive income and rewards when using the platform.

Their syndicate offers users early access to new token launches and investment opportunities. They also offer a Supercharger service whereby liquidity miners can earn rewards in the form of new tokens.

Users can also stake crypto and earn rewards for securing the blockchain. They can also lend crypto to the exchange for a variable or fixed interest rate.

NFT marketplace & crypto services

The platform offers several services beyond simple crypto trading. The Crypto.com credit card allows users to borrow money against their crypto without having to sell their assets. The exchange’s debit and credit cards also allow users to spend their crypto holdings on everyday expenses.

A fully functional NFT marketplace serves as a platform for users to buy, sell, and trade non-fungible tokens, while their decentralized exchange allows users to interact with decentralized trading protocols.

Institutional & API tools

A suite of specialized and high-level tools is available for advanced traders and developers. This includes API access for algorithmic traders and crypto portfolio management.

High-volume traders can use sub-account functionalities to manage multiple trading strategies under one master account. The exchange also offers specialized secure storage and wallet services for institutional clients.

Standard App vs. Exchange App: Are they different?

The main app caters to everyday users, while the Exchange offers advanced crypto tools, margin, and derivatives trading. It supports multiple order types, deep liquidity, portfolio management, customizable dashboards, and trading bot support.

Platform

The App (Standard)

The Exchange (Advanced)

User Interface

Simple, intuitive, optimized for mobile use

Professional dashboard, customizable layouts

Fees

Standard spot fees; card purchases incur extra fees

Lower fees for high-volume traders; rewards for CRO staking

Order Types

Instant buy/sell, basic swaps

Standard offering plus limit, market, stop-loss, take-profit, derivatives

Charting Tools

Basic charts with price updates and portfolio analytics

Integrates TradingView for advanced analytics

Ideal Use Case

Everyday crypto purchases, earning, card rewards

Advanced and professional traders, institutions, margin, derivatives

Supported Assets & Markets

The platform supports over 400 cryptocurrencies and 500+ pairs across major cryptocurrencies, altcoins, DeFi tokens, and the native CRO token. In 2025, the platform launched stock and ETF trading in select regions with fractional shares and zero‑commission pricing.

Cryptocurrencies & tokens

Crypto.com supports the trading of the largest and most widely traded coins like Ethereum and Bitcoin. They also list stablecoins including Tether, USD Coin, and DIA in addition to several altcoins including Solana, XRP, Cardano, and more. Cronos (CRO) is the platform’s native token, while they also list Binance’s utility token, BNB.

Fiat pairs

The U.S. dollar is the most common fiat currency on the platform and is paired with nearly all major cryptocurrencies. However, many other fiat currencies are available, including the euro, Great British pound, Australian dollar, Canadian dollar, Japanese yen, and various others.

Geographic availability

The exchange has a global presence spanning across North America, South America, Europe, Asia, and Africa. However, services vary depending on local regulations.

Usability & User Experience

As mentioned earlier, there are two distinct platforms—the App and the Exchange. While the app is geared towards simple crypto trading and account management, the Exchange is meant for experienced traders.

Desktop & web interface

The desktop and website interfaces are clean and intuitive. However, the Exchange contains advanced trading tools, spot trading, and order books. The sheer number of features can overwhelm new users who are trying to grasp the platform.

Mobile app experience

Beginners should find the mobile app more inviting. It’s easy to buy, sell, stake, and trade cryptocurrency on the platform. The design is clean and emphasizes simplicity. Users can also manage their Crypto.com Visa Card on the app.

While maintaining beginner-friendliness, the app still contains all the features more experienced users are looking for. These include access to the platform’s many earning programs and advanced features.

Crypto.com app seen on the smartphone screen placed on top bitcoin coins pile. Concept. Stafford, United Kingdom, April 12, 2021.

Learning curve

The learning curve for the app is low, as it’s geared towards making buying and selling crypto easy. However, users wanting to take advantage of all the features offered by the Exchange may need to take time to understand more of the nuances of crypto trading.

The platform has an extensive help center along with a learning section on their website with education guides. These guides cover crypto basics, trading, security, and using the platform’s features.

Customer support

Users encountering challenges should check out the platform’s help center, which contains hundreds of articles that they can use to resolve common issues. The exchange also offers live chat support for users who require guidance in resolving challenges.

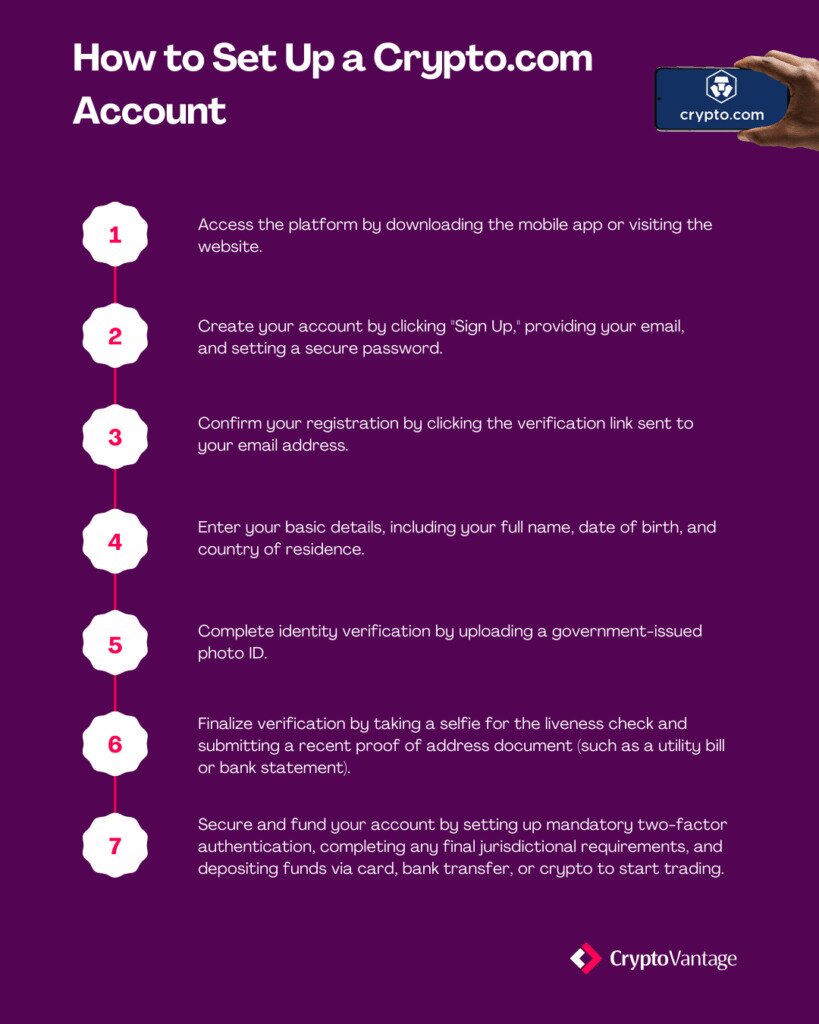

How to Set Up a Crypto.com Exchange Account

The process of setting up a crypto exchange account is easy for the platform. If you want to try out the platform for yourself, here’s what you need to do:

Identity verification can take minutes or hours, depending on document quality and regional requirements.

History & Background

The platform was established in 2016 in Hong Kong under the name Monaco. Led by CEO Kris Marszalek, the team acquired the Crypto.com domain and gradually began increasing their financial service offerings.

Milestones & growth

More than 5000 people are employed by the Singapore-based company. The platform experienced significant growth over the last five years when its user base surpassed 10 million in 2021, 50 million in 2022, and exceeded 100 million global users in 2024.

The period of growth coincided with the exchange achieving several regulatory licenses, offering increased financial products, and major marketing events.

Reputation & public events

A significant effort was made by the exchange to improve its security following the 2022 security breach. Arguably, their response to the breach has positively affected their reputation.

The company is known for its aggressive marketing, which has penetrated various spheres. This includes signing Matt Damon as a brand ambassador, acquiring naming rights of the Staples Center in Los Angeles, which primarily hosts LA Lakers games, and securing high-profile sponsorships with Formula 1, UFC, and Paris Saint-Germain football club. The company also sponsored the 2022 FIFA World Cup.

Crypto.com Alternatives

While Crypto.com makes a strong case for being one of the best cryptocurrency exchanges, it may not cater to all your needs. Check out our detailed reviews on established exchanges.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Security

Crypto.com

Rewards-driven users

Spread

Full fund reimbursement

Globally licensed

Final Thoughts and Verdict

Crypto.com is a great option for users seeking a comprehensive mobile-first ecosystem that effectively bridges the gap between traditional finance and crypto. It is particularly suitable for beginners who want easy access to crypto and intermediate traders looking to leverage a wide range of products tied to real-world spending.

While advanced traders can use the dedicated Crypto.com Exchange for spot, margin, and perpetual futures trading, the platform’s true strength lies in its expansive offerings centered around its native coin, CRO, and its card program.

FAQs

You can withdraw money by selling your crypto for fiat currency within the app or exchange, and then transferring the funds to a linked bank account via ACH or wire transfer. Withdrawals are processed through clearly labeled options in the Accounts section.

The platform prioritizes safety with robust security protocols, including two-factor authentication, cold storage, and insurance on digital assets. The platform undergoes regular third-party audits and holds globally recognized security certifications.

No, it remains fully operational in 2025 and continues to expand through new features, service rollouts, and strategic partnerships that broaden its offerings.

Yes, the platform is available to users in the US, but some features, coins, and services may be restricted or limited depending on state-specific regulations. All US users are required to complete identity verification (KYC) and comply with applicable federal and state laws before trading or using platform services.