- >Best Crypto Exchanges

- >Guardarian Review

Guardarian Review 2026: Features, Fees, Security & Verdict

Guardarian at a Glance

A fiat-to-crypto on-ramp offering simple crypto purchases worldwide.

Pros

Wide cryptocurrency selection

No account registration required

Flat-fee structure

Multiple payment options

24/7 customer support

Cons

Reports of cancelled transactions, with delayed refunds

No spot trading, margin trading, or advanced order types

Must purchase crypto with fiat

Supported cryptocurrencies

1,000+ digital assets

Fiat currencies accepted

30+ currencies, including EUR, USD, GBP, and BRL

Trading volume and liquidity

Not publicly disclosed

Customer Support

24/7 customer support, live chat, FAQs

Fees

All-inclusive rate

Highlights

The Guardarian Exchange is a VASP (Virtual Asset Service Provider) with the State Enterprise Centre of Registers of Lithuania, operating under the supervision of the Financial Crime Investigation Service. The platform employs a non-custodial model, sending purchased cryptocurrency directly to user-provided crypto wallet addresses without storing assets.

Unique features include account-free operation requiring no registration, flat-fee pricing rather than percentage-based charges, and KYC verification designed to complete in seconds. Guardarian also provides API and widget integration for businesses seeking to embed fiat-to-crypto functionality into their platforms.

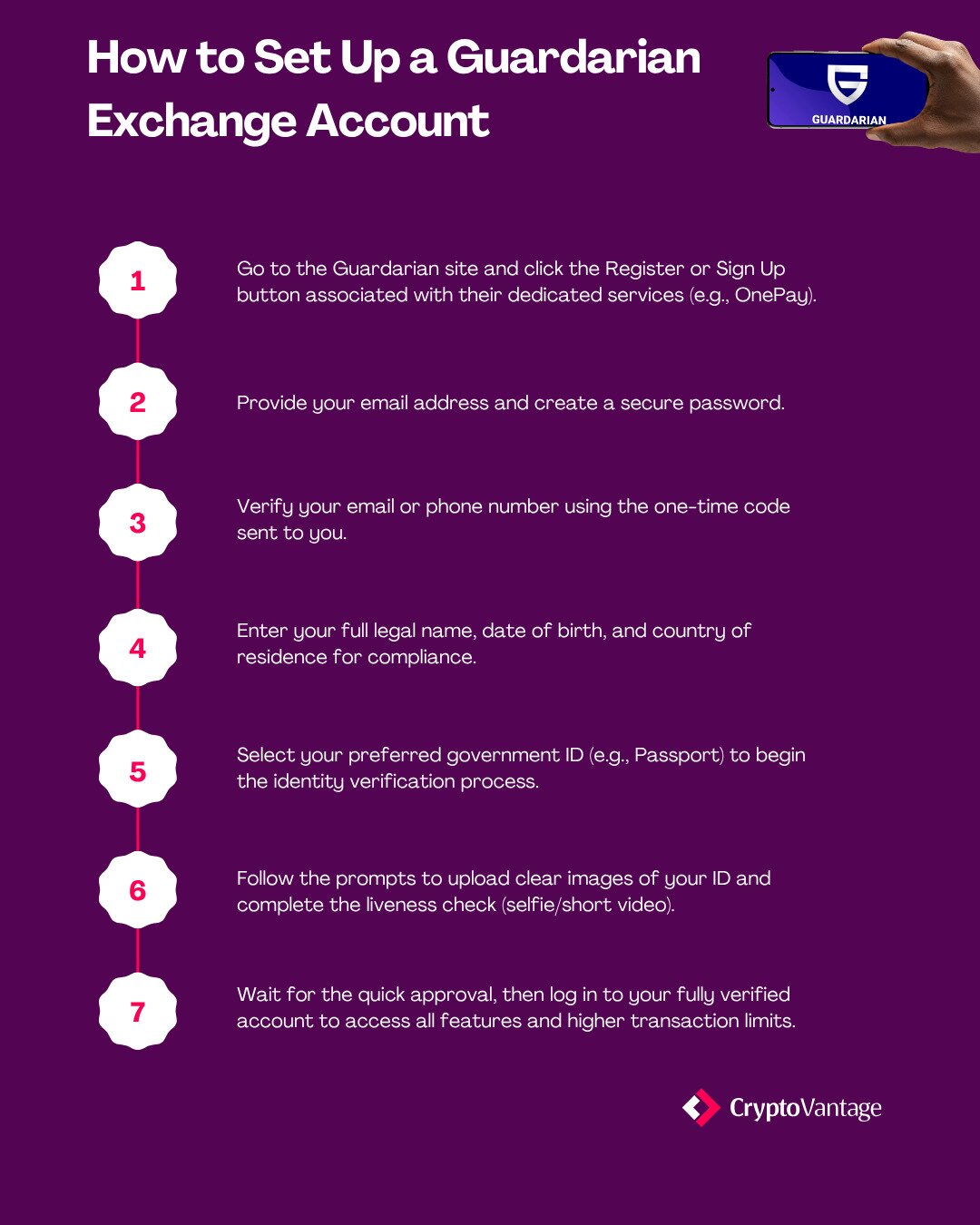

How to Set Up a Guardarian Exchange Account

Fees & Costs

Here’s a quick overview of what to expect in terms of fees and costs.

Instant buy/sell fees

The platform charges a flat fee of €2.49 for cryptocurrency purchases and €3.49 for sales, regardless of transaction amount. Their pricing model benefits people who make larger transactions, as these become proportionally cheaper. All exchange rate margins are incorporated into the displayed rate with no additional hidden charges.

Deposit & withdrawal fees

Payment method fees vary by provider, with credit/debit card transactions, bank transfers, and digital wallet options each carrying different costs determined by payment processors rather than platform directly. The only network fees you pay are the blockchain gas fees, built into the transaction itself, not a separate withdrawal fee.

Hidden costs & spreads

Exchange rate spreads are built into displayed conversion rates, with all fees incorporated transparently at the point of transaction. Payment method providers may charge additional processing fees outside Guardarian’s control. Currency conversion costs apply when using non-EUR fiat currencies, as the platform’s base pricing operates in euros.

Security & Regulation

The platform is an EU-licensed virtual asset service provider focusing on providing secure and compliant gateways for users to trader cryptocurrencies.

Storage & custody

Guardarian is fully non-custodial. They do not store your digital assets at any point. Purchased digital assets are transferred directly from liquidity providers to your wallet addresses, which means there is no custodial risk. The company does not disclose information regarding cold storage percentages, hot wallet balances, or insurance coverage for user funds, as these metrics primarily apply to custodial services.

Account security

The account-free service model means traditional security features like two-factor authentication (2FA), withdrawal whitelists, or account lockdown mechanisms do not apply. It’s your responsibility to provide accurate wallet addresses, as transactions cannot be reversed once blockchain confirmation occurs.

Identity verification is still required for each transaction to comply with Anti-Money Laundering (AML) regulations mandated by Lithuanian financial authorities. During checkout, you enter your email address to receive a one-time verification code, then complete KYC by uploading government-issued identification such as a passport, driver’s license, or national ID card.

Audits & compliance

According to the Guardarian website, the platform undergoes periodic third-party audits of internal controls and security procedures. However, specific audit reports, dates, or certifying organizations are not publicly disclosed. The company does not store sensitive user information beyond regulatory requirements.

Regulatory licenses

This provider holds VASP registration in Lithuania, with supervision by the Financial Crime Investigation Service. As of January 1, 2025, the EU’s Markets in Crypto-Assets Regulation (MiCA) came into effect, requiring companies to obtain CASP licenses. Guardarian operates under transitional provisions that allow pre-MiCA VASPs to continue operations until December 30, 2025, while working toward full MiCA compliance.

Past Incidents & mitigation

No major security breaches or hacking incidents have been publicly reported. There have been complaints about operational issues, including charged credit cards followed by cancelled transactions, missing cryptocurrency deliveries attributed to incorrect wallet addresses, and prolonged refund processing times. In November 2022, BestChange removed the provider from their listings and recommended users stay away due to reliability issues.

Features & Tools

The trading features and tools offered by Guardarian Exchange aim to simplify the process of converting fiat currency/traditional currency into crypto and vice versa. Here’s some things you need to know.

Trading features

Guardarian crypto services does not provide trading features such as margin trading, futures contracts, perpetual swaps, or advanced order types. They only offer instant buy/sell execution at displayed rates and crypto-to-crypto swap functionality.

Mobile app

There is no dedicated mobile application; all transactions occur through the web-based platform accessible via mobile browsers. The mobile web interface provides the same functionality as desktop access, including cryptocurrency selection, payment method choice, wallet address entry, and KYC verification.

Institutional & API tools

Guardarian provides API integration and embeddable widgets, enabling businesses to incorporate fiat-to-crypto functionality into their platforms. The API supports over 1,000 cryptocurrencies and 50+ fiat currencies with transparent fee structures and bank-level security. Institutional custody solutions are available for businesses that require secure asset management services.

Supported Assets & Markets

A broad range of cryptocurrencies and fiat markets are supported, offering users multiple ways to trade both well-known coins and emerging projects.

Cryptocurrencies & tokens

The platform supports over 1,000 cryptocurrencies, including major assets like Bitcoin, Ethereum, and stablecoins, alongside obscure altcoins and meme tokens.

Fiat pairs

The exchange accepts 30+ fiat currencies, including major options such as EUR, USD, GBP, and regional currencies like Brazilian Real (BRL) for PIX payments.

Payment methods vary by currency and region, with SEPA bank transfers available for European currencies, card payments for most jurisdictions, and specialized options like Open Banking in supported territories. Each cryptocurrency can be purchased with any supported fiat currency, providing flexible pairing options without traditional trading pair limitations.

Geographic availability

No Guardarian crypto review would be complete without discussing where it is available. The exchange operates across 170+ countries, though specific restrictions and availability vary by jurisdiction. Their Lithuanian VASP license provides regulatory coverage within the European Union.

Supported payment methods differ significantly by region, with SEPA transfers available in Europe, PIX in Brazil, and card payments globally where banking partnerships permit. Users should verify availability for their specific location through the interface before initiating transactions.

Usability & User Experience

The platform is engineered for high usability, delivering a user experience centered on providing a simple, fast, and non-custodial fiat-to-crypto gateway.

Desktop & web interface

The web version keeps things simple with three basic steps: pick your cryptocurrency, enter your wallet address, and make your payment. You’ll use dropdown menus to select which crypto and fiat currency you want, type in where you want your coins sent, and then complete your payment.

Design aspects prioritize transaction speed over extensive features. The exchange rate updates in real-time, so you can see exactly what you’re paying before you commit to the transaction.

Learning curve

Their straightforward approach works well for crypto beginners who aren’t familiar with complicated platforms. The three-step process doesn’t require much technical knowledge beyond knowing how to use a crypto wallet.

You do need to understand how to manage an external wallet since the platform sends crypto directly to the address you provide, and you can’t recover funds sent to an incorrect address.

If you’re an experienced trader looking for sophisticated tools, technical analysis features, or portfolio management capabilities, you may find Guardarian’s offering limited.

Customer support & resources

There is 24/7 customer support via email with response times within 24 hours. They also have a blog section covering cryptocurrency topics, market analysis, and educational content.

FAQ sections answer common questions about KYC requirements, transaction times, and refund processes. Some user reviews praise rapid support resolution, while others report long communication gaps during transaction disputes.

History & Background

Guardarian (operating as Guardance UAB) was founded in 2017 and is registered in Lithuania under number 306353686, with headquarters in Vilnius. The company also maintains an Estonian entity (Guardarian OÜ) registered in Tallinn.

The company’s founders (names not publicly disclosed) saw an opportunity to create a simpler alternative to complex cryptocurrency exchanges by focusing exclusively on instant buy/sell services. They registered Guardarian (operating as Guardance UAB) under number 306353686 with Lithuanian authorities and pursued VASP licensing from the start.

Milestones & Growth

The company’s early years coincided with Lithuania’s 2019 regulatory framework for cryptocurrency businesses. All crypto exchanges were required to implement KYC procedures and AML compliance. They expanded their cryptocurrency offerings from around 200 assets initially to over 1,000 by 2025.

In 2024, they partnered with Sumsub for streamlined KYC verification. In 2025, the exchange secured a partnership with Ivy to provide instant payment infrastructure for other platforms. The business model has also changed from direct consumer services to include B2B offerings through API and widget integrations.

Reputation & Public Events

Is Guardarian considered a safe exchange? So far, security breaches or regulatory sanctions have been avoided, but Guardarian has faced credibility challenges. BestChange cites reliability concerns and TradersUnion assigned a 3.8 out of 5 trust score, noting mixed reviews but no systemic fraud indicators.

Their 4.3-star Trustpilot rating shows divided user experiences, with operational inconsistencies rather than security failures driving negative feedback.

Guardarian Alternatives

If you’re looking for a simple platform to buy, swap, and sell crypto without creating an account, Guardarian exchange delivers exactly that.

If you are looking for more advanced features like spot trading, margin trading, staking, or portfolio management, Kraken, Coinbase, or Gemini are great choices. Guardarian specializes in quick fiat-to-crypto conversions. Kraken, Coinbase, and Gemini are some of the best cryptocurrency exchanges offering full-service trading platforms with custodial wallets, advanced crypto tools, and comprehensive crypto services.

Exchange

Ideal For

Fees & Pricing

Security Features

Regulation & Security

Guardarian

Altcoin traders

Flat buy/sell fees

Non-custodial, KYC required

Lithuania VASP license

Active traders

Tiered maker/taker fees

Proof of Reserves, Cold Storage

FinCEN registered.

Beginner traders

Spread + transaction fees

FDIC insurance (USD),

SEC registered

Final Thoughts & Verdict

Guardarian delivers instant fiat-to-crypto conversions with no account creation, making it ideal for one-time or beginner purchases. Its non-custodial model sends crypto straight to your wallet, ensuring privacy and asset control. Users benefit from flat-fee pricing on larger transactions and access to over 1,000 cryptocurrencies, including obscure altcoins.

If you need quick access to altcoins or prefer non-custodial transactions where crypto goes straight to your wallet, it’s a solid option.

FAQs

They support over 1,000 cryptocurrencies including Bitcoin, Ethereum, stablecoins, and obscure altcoins. They also accept 30+ fiat currencies including EUR, USD, GBP, and BRL.

They hold VASP registration in Lithuania under the supervision of the Financial Crime Investigation Service. The have also avoided security breaches since 2017, but have received mixed user reviews regarding operational reliability.

It operates in 170+ countries worldwide. Specific payment methods and availability vary by region. Check the platform during transaction setup for your location’s restrictions.

Pros: No account required, access to 1,000+ cryptocurrencies, including obscure coins, flat-fee pricing benefits large transactions, non-custodial model.

Cons: No advanced trading features (spot, margin, futures), no staking or portfolio tools, some users report transaction cancellations and refund delays.

Guardarian is available is all countries but the following: China, Vietnam, Bolivia, Colombia, Ecuador, Algeria, Bangladesh, Indonesia, Jordan, Kyrgyzstan, Morocco, Nepal, Saudi Arabia, Iran, Pakistan, Taiwan, Cambodia.

It is also not available for residents of these US States: Alabama (AL), Alaska (AK), New Mexico (NM), Hawaii (HI), Nevada (NV), Washington (WA), and Vermont (VT).